Signs of Renewed Trader Activity and Price Growth in Bitcoin

Analyzing Stabilizing On-Chain Metrics, Resurging Derivative Markets, and Key Macroeconomic Shifts Set to Influence Bitcoin's Price

Introduction

Today, we're diving into the latest Bitcoin market trends and their implications for investors. We'll examine the current state of Bitcoin's on-chain metrics, which are showing signs of stabilization and potential reversal out of consolidation. We'll also explore price metrics and derivative markets, noting a potential resurgence of trader activity after a post-halving lull. Lastly, we'll discuss crucial macroeconomic indicators that impact Bitcoin. Surprisingly, these indicators are signaling recessionary trends in monetary aggregates, alongside the first positive Bitcoin Fund Flow in five weeks. Let's dive in.

On-chain metrics

Bitcoin appears to be finding a little foothold, according to on-chain metrics. They are still falling in a consolidation phase, but the rate of decline is slowing noticeably. They suggest a marked decline in speculative behavior and a strengthening of long-term holding strategies.

The Realized HODL Ratio continues a significant pull back week-over-week (WoW), meaning that the ratio between realized price for 1-week old UTXOs vs 1-2 year old UTXOs is dropping. In other words, a decline in this metric means that the spread or advantage for longer term hodlers is declining. However, it is still inline with expectations for a mid-cycle consolidation, not a bear market.

Coin Days Destroyed is affected most by old UTXOs moving, and it has consistently gone down WoW. This is indicative of a slowing distribution of supply from older to newer holders. With ongoing sources of demand, and new sources popping up every day, this slowing distribution can materialize quickly into a supply shortage.

The MVRV Z-Score, last week increased WoW, and is still relatively stable this week. MVRV is the ratio between market price and realized price used to identify cycle tops and bottoms. We can also use it to help us identify the bottom of a consolidation within a bull market, which appears to be what is happening right now.

Reserve Risk continues to decline, meaning market confidence at this steady price is rising, and it is becoming a more attractive risk/reward for new investors.

The LTH:STH Cost Basis Ratio has again remained very steady this week, indicating that gains or losses to STH and LTH are roughly equal, because price being flat has allowed both cost bases to also flatten out. However, since the LTH cost basis doesn’t move very much in explosive bull markets, it is the STH cost basis that rises rapidly, this metric should fall as the bull market resumes.

Investor Insights

Accumulation Strategy: The current data suggest that Bitcoin is in a phase where strategic accumulation is advantageous. With indicators pointing towards a stabilizing and improving risk/reward, this is a great time for investors to add to, or open, a position, especially if they are planning for long-term holdings.

What to Watch for Specifically: Realized HODL Ratio has been the lagging indicator over the last couple of weeks. A noted bullish week, accompanied by the RHODL Ratio rising significantly, will tick the one major on-chain box left to check off before the next leg.

Price Metrics

Little has changed for the price metrics WoW. Longer term moving averages are still bullishly sloped with price above, though it is testing the 100 DMA. The 50 DMA is still the level of concern with the 50 EMA (on chart below) providing resistance as well. EMAs are faster moving averages since they weigh recent prices more heavily, and they tend to be used by more short-term traders for that reason. This could be indicative of traders opening positions after a post-halving pause, which we can also see below in the derivative market numbers.

In terms of market sentiment indicators, the Daily and Weekly RSI values are within neutral ranges, which suggests that the market is neither overbought nor oversold, and ready for a move in either direction. Moreover, the metric we’ve been watching closely, the STH Realized price has provided support, but is still in danger of being broken to the downside.

Source: LookIntoBitcoin

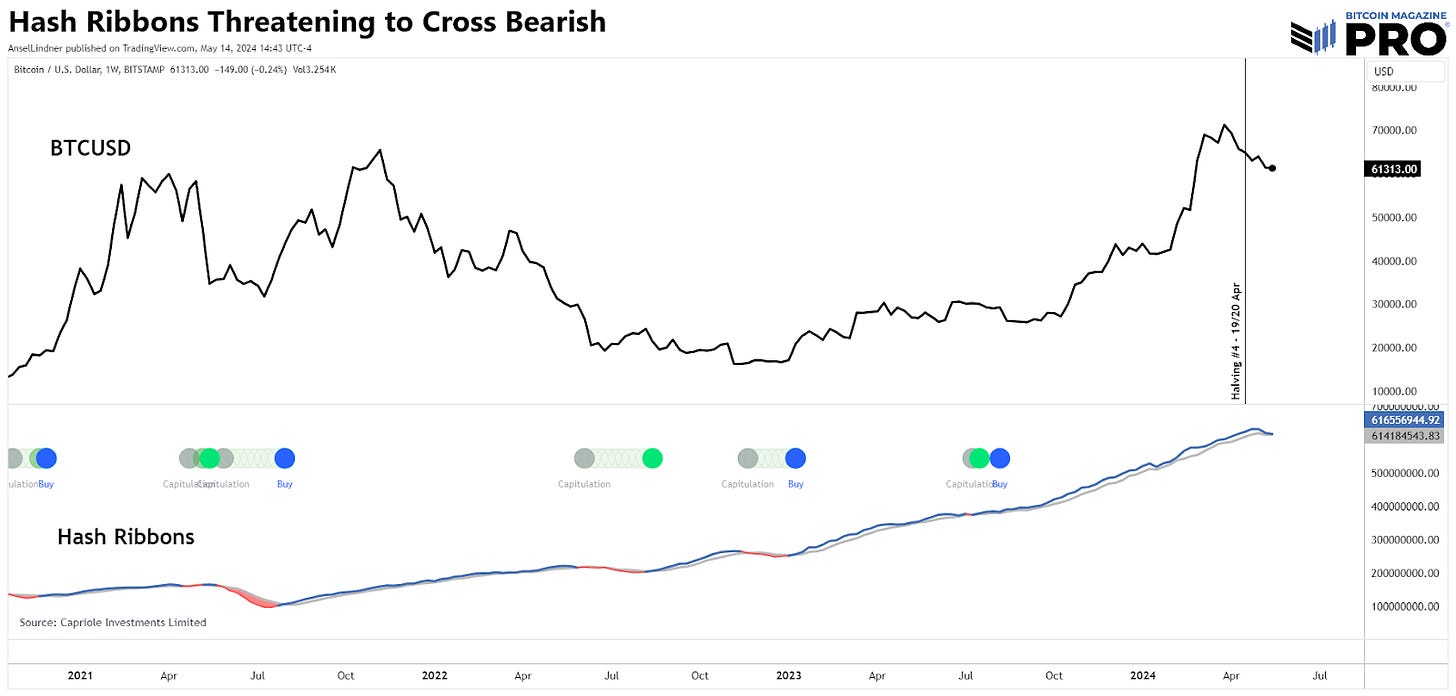

The newly added metrics last week, Hash Ribbons and B-bands mid-line, suggest a tightening in the market toward a significant move. The weekly Bollinger bands mid-line, also the 20-week MA is providing support under the price. The BBands themselves are tightening as well indicating the chance of a volatile move has increased.

The Hash Ribbons, which consist of a long and short term moving averages for hash rate are very close to crossing, typical of a bearish move. Do not be surprised by a cross of the ribbons, because the halving plus price consolidation are combining to make it very tough on the miners. Also, the last two halvings were followed by a brief cross and recross. This does not mean there is an imminent sell-off coming either, because most bearish crosses of hash ribbons happen after the main part of the dip has occurred, they are not a leading indicator.

Investor Insight

Support Levels as Entry Points: Pay attention to the 100 DMA and BBand mid-line as entry points to use with a tight stop loss for better risk/reward in a short term trade. Investors might consider these as strategic entry points for adding to their positions, particularly if they are trying to get the most out of their dollar-cost averaging.

Derivatives

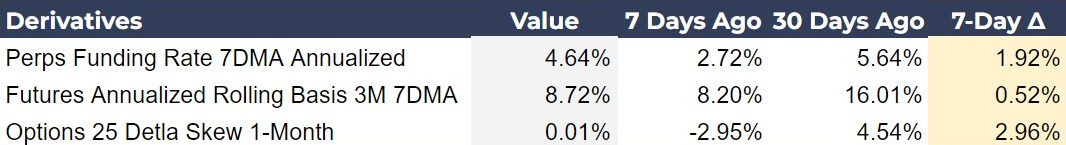

The derivatives market for Bitcoin is showing the first signs of increased bullishness in weeks. Over that time the Perps Funding Rate and Futures 3M Basis were continually declining, but have posted gains this week.

The Perps Funding Rate rose by a significant degree meaning traders are back after a post-halving pause. As they open positions, the funding rate is assessed every 8 hours to incentivize the other side of the trade. As the funding rate increases, longs are having to pay shorts more to take the other side. In other words, bulls are dipping their toes back in.

The Futures 3M Basis also ticked higher after multiple weeks of decline. This is the 7-day average of the spread between the spot price and the 3M futures contract. A rise indicates a market expectation of higher prices in the near future.

The Options 25 Delta Skew is back to zero, indicating options traders are still on the fence, with no obvious bias in the market for hedge protection. When this number is negative, options traders are pessimistic and pricing downside protection more, and vice versa, when the skew is positive they are hedging upside moves.

Investor Insights

Identifying Returning Bullish Sentiment: It seems traders are coming back into the market after a post-halving pause. Identifying the first signs of this returning bullish leverage could allow investors to set positions sooner and not chase any market moves. This can also be used along with support levels discussed above, to add confidence when buying dips.

Cash-and-Carry: Given a premium reflected in the Futures Annualized Rolling Basis for 3 months, investors have an attractive opportunity to engage in cash-and-carry arbitrage. In this strategy, an investor buys Bitcoin in the spot market and simultaneously sells a futures contract for the same amount, locking in the basis as profit. This trade is market-neutral, meaning it is unaffected by subsequent price movements in Bitcoin—profits are realized from the premium at the outset of the trade. As the basis rises, this cash-and-carry trade becomes more attractive, effectively adding present spot demand and future supply.

Macro and Other Metrics

Our Macro section highlights metrics that affect the monetary and economic conditions in which we place Bitcoin adoption. April CPI comes out tomorrow with a consensus forecast of 0.4%. I believe it has a significant chance to be a miss and surprise the market.

Monetary Aggregates: Our three main measures of money supply are all in contraction WoW, Global M2, Central Bank Assets, and Other Deposits (more detail on why we are using ODL on last week’s post). These measures are definitely sending recessionary signals. The start to a recession is typically thought of as when risk assets begin to crash, however, an early sign of recession can be seen in demand for money. If the demand for money, and hence the supply of credit declines, these monetary aggregates will also decline. It is not until the reaction to the recession by the government and the central bank that they will expand again.

US Net Liquidity YoY: US liquidity is also down over 1% YoY, but has had a slight bump up in the last week. Net liquidity is defined as the Federal Reserve Balance Sheet less the sum of both the Treasury General Account (TGA) and Reserve Repo facility (RRP). It makes sense for this liquidity to be draining while the Fed is still doing QT, however, it has not seemed to affect the broader US markets or Bitcoin. The Fed has announced that it will be reducing their QT operations starting next month, therefore, any indirect effect we cannot necessarily see at this time, may become apparent then.

Investor Insight

Monetary Aggregates and Inflation: As our measures of money supply continue to decline, we should expect it to be reflected in the CPI and PCE. This is the main reason I have recently been expecting misses to the downside on CPI. Tomorrow, the chance for market volatility is elevated with the release of April’s CPI. If there is a miss of 0.2% instead of 0.4%, risk assets including bitcoin should take off higher.

Other Metrics

I don’t often include this section in this write up, but it is always on the tracker posted below. I’ve done a little rearranging, putting Dollar Index (DXY) into this section. These other metrics are important this week because the rate of change for the DXY has slowed and BTC Fund Flows have flipped back positive after four weeks of being negative. None of these things are definitive on their own, but take as a whole, all of our metrics are primed for a new leg higher and for that move to be relatively soon.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

Once again, I felt i had to mention twice: This weekly dashboard/conjecture provides a ton of value.

Thanks Ansel! You are my go to for market insights. Always reading all of the content you put out.