SEC Hearings, Court Battles Call Agency’s Bitcoin Stances into Question

Despite January’s Bitcoin ETF approval, Caroline Crenshaw’s Senate confirmation shows SEC's ongoing hostility toward Bitcoin. CFTC Chair seeks more authority as two members depart.

As the Senate Banking Committee gave a confirmation hearing to a SEC member seeking a second term, the Commission’s long-term plans for Bitcoin and the digital asset industry seem murkier than ever.

Caroline A. Crenshaw, an attorney by trade, has been one of the Securities and Exchange Commission’s five members since her appointment in 2020. Each member’s term is set to expire on June 5th, staggered one year apart from each other member, with the caveat that they may continue holding their post for up to 18 months after their expiration date. Crenshaw’s tenure technically expired this June, but he has sought re-appointment for a second term.

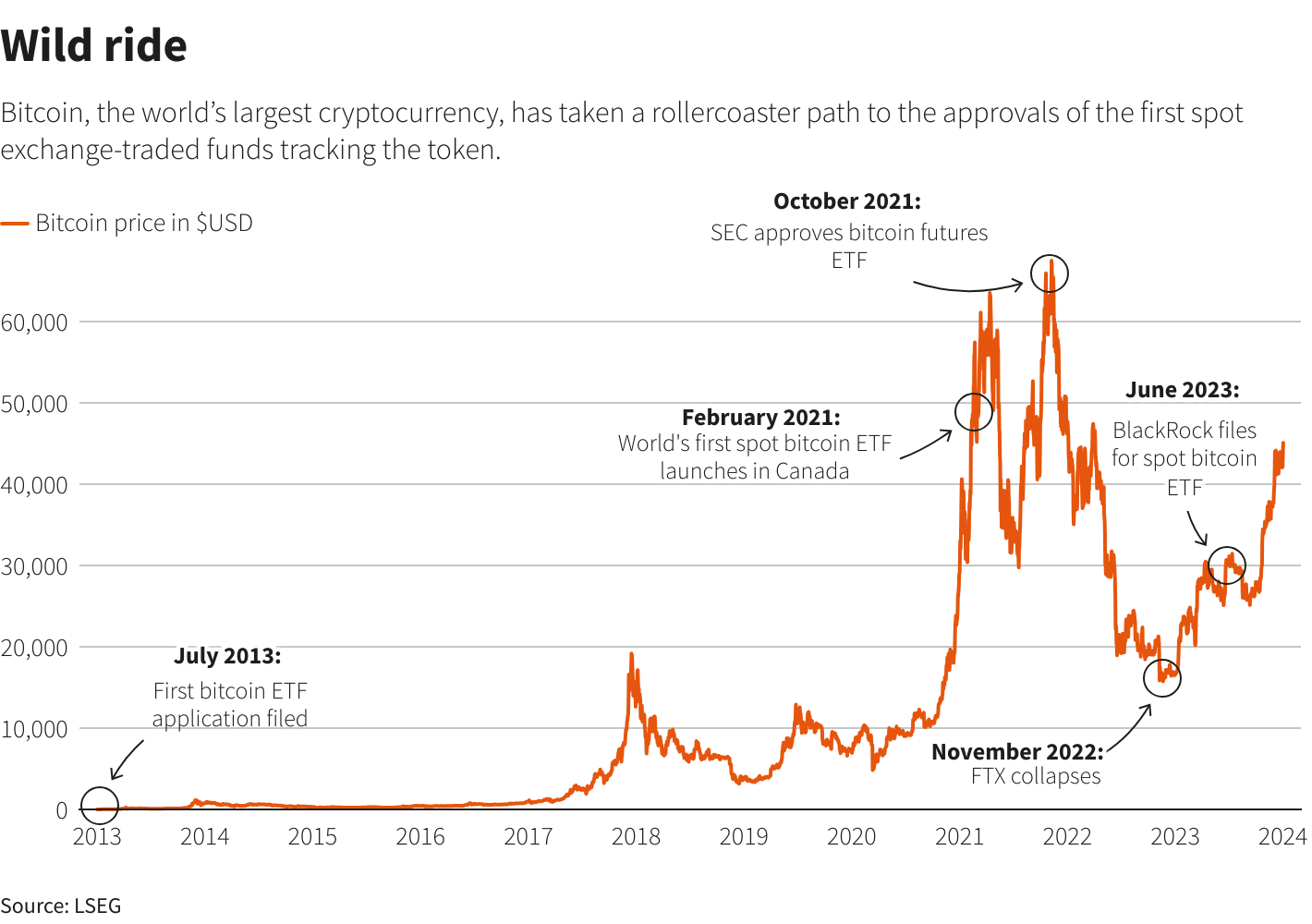

Crenshaw’s time on the SEC has taken place at a particularly pivotal moment for the Commission’s relationship with Bitcoin, specifically in that Bitcoin’s rapid and sustained profits in the 2020s have ushered in an unprecedented era of new establishment acceptance. Since the earliest years, Bitcoin has suffered no small amounts of condescension from financial regulators like the SEC, but Bitcoin’s meteoric rise in the last few years crested with the approval of a Bitcoin ETF. Several of the biggest milestones on the long ETF journey took place under her watch, such as the approval of the futures ETF and the establishment of spot ETFs abroad. In other words, her stances on the matter are, if nothing else, well-informed.

Considering her proximity to these radical changes in Bitcoin’s relationship with the establishment, her presence in this nomination hearing could certainly reveal some of the attitudes within this regulatory body as it stands today. Several candidates for regulatory agencies totally unrelated to the SEC and Bitcoin were also present, so her own remarks were comparatively brief, but some of Crenshaw’s stances on the ETF industry were quite surprising. Specifically, Crenshaw made a dissenting statement against the ETF approval when it first went through and has doubled down on her position in the intervening months.

Crenshaw persistently referred to the Bitcoin ETFs as “exchange-traded products” (ETPs), as their structure and regulations differ from average non-Bitcoin ETFs, and claimed that the SEC’s approval of these products “put us on a wayward path that could further sacrifice investor protection.” She went on to claim that she had to oppose the Bitcoin ETF for the sake of public interest “given the significant fraud in the underlying spot markets globally, given the opacity." In other words, at least one of the SEC’s five members is a committed opponent to the Bitcoin ETF, and she may very well be set to serve five more years after this.

However, although Crenshaw was the only candidate in this hearing set to serve on the SEC, she was not the only candidate relevant to the world of bitcoin. Two current members of the Commodity Futures Trading Commission (CFTC), whose five members have staggered term limits in a similar fashion to the SEC, were actually there to leave the CFTC for new assignments in the world of federal financial regulation. In other words, if these members gain Senate approval, two of the CFTC’s five seats will be open at a time when the CFTC chair wishes to take over the SEC’s Bitcoin responsibilities.

Rostin Benham, the CFTC Chair whose term will not expire for nearly two entire years, gave a passionate speech on July 9th to an unrelated Senate Committee about his belief that Bitcoin and Ethereum should be considered commodities. In other words, his jurisdiction, not the SEC’s. Railing against sluggishness from American regulators to clearly define Bitcoin-centric policy, Benham told the Committee that “in short, our current trajectory is not sustainable. Federal legislation is urgently needed to create a pathway for a regulatory framework that will protect American investors and possibly the financial system from future risk.” He went on to claim that the CFTC is ready for the challenge of regulating Bitcoin and listed several areas he wishes to improve upon before adding that “the SEC and CFTC have a longstanding partnership that facilitates strong, robust regulation of securities and derivatives markets. I am confident that the two agencies will continue working closely, ensuring a reliable, fair, and efficient system for listing and trading digital assets on regulated exchanges.”

So, the SEC is set to have one member who’s a real holdout for opposition to the Bitcoin ETF, and the CFTC wants to take on more responsibilities at a time when it may have multiple open seats. This could present a real opportunity for positive regulation in the United States, provided that the CFTC’s new members have a similar drive to re-invigorate Bitcoin policy. Indeed, although some speculated that the SEC’s ETF approval had ushered in a new era of government friendliness, the same old hostility is clearly present. The SEC lost or abandoned several of its lawsuits and investigations against crypto-related firms in July, but further legal battles in Gensler’s “crypto crackdown” continue unabated. If these fights and Crenshaw’s comments are anything to go by, some of the innate skepticism of Bitcoin runs deep at the SEC.

However, who’s to say that the CFTC will be any better in this regard? Bitcoiners have previously made attempts to argue that this agency should have authority over the space for the simple reason that its standards are typically far looser than the SEC’s, but these attempts ended in failure when the SEC was given regulatory supremacy in the matter. Would a new and energized CFTC be able to reverse these changes, and if they did, would their policies be less harsh than the SEC’s? Ultimately, it’s difficult to say. Two of the five seats on this commission will likely be open soon, and any number of potential regulators could be asked to fill them. Indeed, if two pro-Bitcoiners join forces with Benham, they could carry votes through with ease. Provided, of course, that their vote is consulted.

Ultimately, there is too much in the air at the moment to lay out an ironclad path from these proceedings to a friendlier Bitcoin policy. The important thing to consider, however, is that the ETF approval certainly has not broken down all barriers to institutional adoption. It’s true that since the ETF was finally approved in January, traditional finance has been assimilating the world of Bitcoin into its ranks on an unimaginable scale. This doesn’t mean the fight is over. As Bitcoiners, it’s of paramount importance that we keep an eye on proceedings like this, identifying friends and foes before the moment is critical. Anything can happen in chaotic moments, but with information and a plan, Bitcoin’s fortunes could indeed rise very quickly.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!