Rapid Acceptance of Bitcoin as Safe Haven, and the Death of Yield Curve Control

Bitcoin’s investment thesis is spreading like wildfire to large pools of capital as central bankers are walking into recession

Topics for today:

Bitcoin’s 3 investment theses

BOJ’s yield curve control failure

Quick note on FOMC today

The Investment Theses

Bitcoin has several concurrent investment theses. The first is, of course, being a hedge against inflation. Its limited supply and digital censorship resistance transactions means for the first time in human history, a perfectly fixed supply asset, with great monetary characteristics, is transferable anywhere in the world and settled on average every10 minutes. Even facing internal industry problems in 2022, bitcoin came through the high-CPI COVID era up roughly 250% while the CPI basket increased 20%.

If you can believe it, there is some controversy from bitcoin doubters about this fact. However, it is indisputable that, ceteris paribus, the value of a fixed supply asset must increase with an increase in the supply of money.

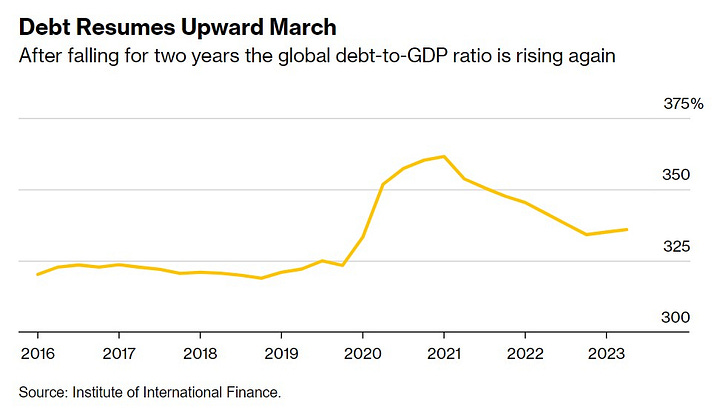

Another investment thesis for bitcoin, that I personally think is the most important at the moment, is bitcoin as a deflation hedge. In today’s current global system, “fiat” money is really debt-backed money. A lot is made about the US debt to GDP hitting 130% foretelling eventual US government default, but global debt is a MUCH bigger problem at 336%! We are coming to the end of a giant 75-year experiment in global debt, and when it ends, money is going to be in short supply. Defaulting in a debt-based system means money is destroyed and is not available for others in the economy to earn to service their debt. It is a classic Austrian Economics credit bust, but on a global scale and with no official backing to the currency to fall back on.

Source: Bloomberg

The chief insight for Bitcoin in this investment thesis is that in the bad times of a global credit bust, our human instincts will guide us to an inelastic money immune from default. Bitcoin, like its predecessor gold, doesn’t have a negative feedback loop of supply like “fiat” does. As credit stress spreads, people will search for alternative monies with low elasticity of supply. The natural side-effect of this will be a rising value of that alternative asset.

The third investment thesis for bitcoin is a combination of the two previous, and is, perhaps surprisingly, the one latched onto by notable influential investors and CEOs — namely that bitcoin is a safe haven asset. This thesis involves aspects of both an inflation hedge for a stagflationary recession and a deflation hedge for a credit crisis recession.

It was not on my bingo card for this year that influential investors, the likes of Paul Tudor Jones, Larry Fink and, most recently Mohammad El-Erian, would be recognizing bitcoin as a safe haven, even the premier safe haven asset. El-Erian is the President of Queens' College, Cambridge, and chief economic adviser at Allianz, the corporate parent of PIMCO ($2 trillion AUM). In an interview with CNBC this week, he stated that bitcoin is counterintuitively being seen as a safe haven instead of US Treasuries.

Japanese Yield Curve Control Failed

This week, the Bank of Japan (BOJ) released their newest monetary policy statement, removing the hard upper-limit on the 10-year Japanese Government Bond (JGB), replacing it with a “reference” rate of 1%. I wrote a post back in 2021 predicting the eventual failure of yield curve control (YCC), and it seems that day has come.

The BOJ is between a rock and a hard place. The yen continues to crash against the dollar, breaking 150 yen per dollar, but their economy has never regained its footing. The yen is pushed lower by the infamous Japanese carry trade, where market participants take out low-interest debt in Japan, swap for dollars, then make investments which yield over the Japanese interest rate. With US rates sky high for the time being, this carry trade is more attractive than ever and putting significant pressure on the yen. By letting long-term rates overshoot 1%, the BOJ is giving up on YCC.

All the BOJ has to do is get out of the way and JGB rates will naturally rise. The rationale behind YCC is now being outweighed by the concern for the yen. I’m reminded of the Plaza and Louvre Accords in 1985 and 1987 respectively. They were international agreements to first weaken the US dollar to yen, then to halt the decline. A similar agreement is possible today, but much less likely due to the extreme levels of debt in the world.

Some analysts are predicting that by putting the brakes on the carry trade, it will adversely affect demand for US Treasuries, and in doing so, rates in the US will continue to rise. In a linear world this would be the case, but we must put things in context of why the BOJ is doing this. Things are deteriorating, not just in Japan but in China, too, where Japanese banks are heavily involved in that credit crisis. The deterioration of those markets will naturally increase the demand for US Treasuries.

In addition, the relaxation of the 10-year peg was paired with a continuation of a -0.1% target on their short-term rate. That enables the carry-traders to still borrow short in Japan and lend long in the US to continue.

I have been expecting the US 10-year yield to put in a top as we head toward a recession next year. As we can see, the 10Y is currently breaking support and looking as if it wants to go lower. This in turn, signals a top in USDJPY since they are highly correlated.

As for the BOJ’s effect on Bitcoin, I think it is minimal. It doesn’t change the overwhelming tide moving us into global recession, or the growing recognition of bitcoin as a safe haven asset.

Note on November 1’s FOMC Meeting

At time of writing, the Fed Funds (FF) futures market is pricing no rate hike from the Fed as a 99% probability. I see no reason to expect the Fed will surprise markets by raising the FF rate this meeting. However, I do expect Chairman Powell to begin the process of becoming more dovish during the press conference and Q&A. If they hold policy stable, but shift more dovish in tone, it will result in putting in a bottom in stocks, and a top in Treasury rates.