Property Price in Bitcoin at All Time Lows

Currency devaluation's impact: Learn how decades of devaluation have turned U.S. real estate into a more accessible investment for Bitcoin holders.

Today’s headlines:

$BTC continues to range just below $100k.

CalSTRS pension fund reports holding $83 million in MSTR shares.

Abu Dhabi Discloses $437M Stake in BlackRock Spot Bitcoin ETF.

Bitcoin’s price is currently in a range that has been forming since December last year.

Here, we update the range, highlighting the key levels $BTC needs to break through to climb higher. The key resistance levels are $100,000 and $106,000.

Daily closes above those levels will rekindle retail interest and excitement, which have waned somewhat in recent weeks.

Figure 1: $BTC has been lackluster during February so far.

Over the past 3 months, Bitcoin is up just 4.12%.

Figure 2: Past 3 months' price action.

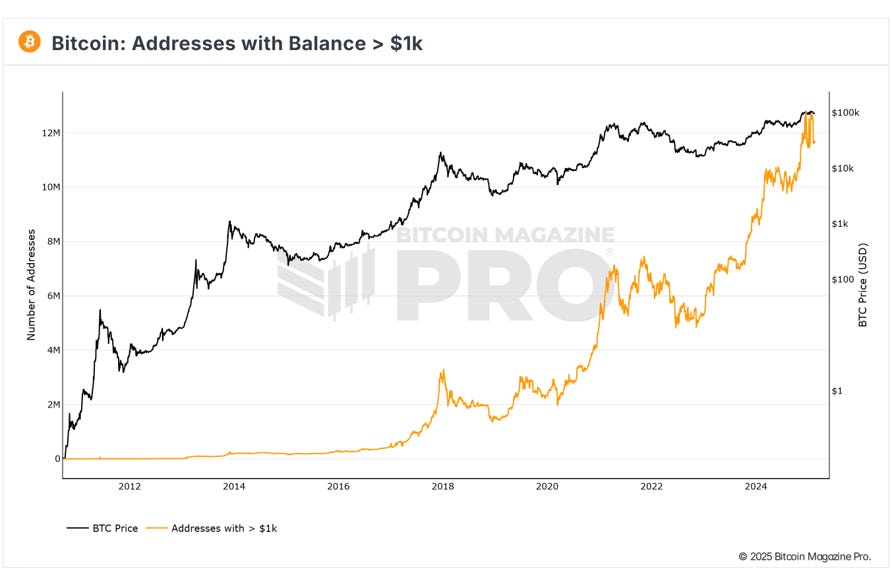

Once the BTC price breaks out above $100,000, retail interest will return, likely sending metrics like active addresses holding at least $1,000 worth of Bitcoin to new highs.

Currently, there are around 12 million addresses that each hold +$1,000 of bitcoin.

Figure 3: Active addresses holding at least $1,000

As price trends higher, this will draw more attention to the space, which in turn will drive adoption. Addresses holding at least $1,000 is a good proxy metric to track adoption over time.

The Big Story

US Property Priced in BTC at Lows

The latest data released on Bitcoin Magazine Pro shows how the value of house prices in the U.S. has continued to plummet over time relative to Bitcoin.

With currency devaluation so rampant over the past 15 years, it is no surprise that many assets, such as Property and Bitcoin, have increased in value. Why? Investors look to protect their dollars by moving from cash to assets with a better chance of holding their value as governments debase their currencies.

The first chart below shows that general increase over time, with $BTC in black and US Median House Sales price in blue.

However, while both have increased over time, the scale for each asset is VERY different.

Figure 4: Bitcoin and US Housing Median Sales Price.

This difference in scale can be brought to life when looking at median US House Prices shown not in US dollars…but in Bitcoin terms.

Figure 5: US Median House Prices priced in Bitcoin.

This results in a ‘down-only’ line (blue line) highlighting property depreciation relative to Bitcoin over time.

To visualize the impact of this for an investor, we can use the following infographic, which shows how many bitcoins would be needed to purchase a house in the US based on the median house price.

Figure 6: Number of bitcoin needed to purchase a US property.

In 2017, an investor would have needed 24 bitcoins to purchase a US property with a median house price of $337,900.

That dropped down to 9 bitcoin in 2021.

Today, an investor would need just 4 bitcoin to purchase a US property with a median house price of $419,200.

While property value has increased in US dollar terms, it has crashed relative to bitcoin.

Something worth remembering next time you here that Bitcoin is not a good investment.

These charts can be found in the Portfolio Tools section of the platform here.

The Bitcoin Magazine Pro Team.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Why would you consider buying property if you are in crypto?