PRO Market Keys Of The Week: 4/10/2023

What to watch for in the week ahead as bitcoin pushes to 2023 highs!

Economic Calendar

April 12th:

8:30 am EST, Consumer Price Index release, forecast: 5.2%, previous: 6.0%

8:30 am EST, Core Consumer Price Index release, forecast: 5.6%, previous: 5.5%

2:00 pm EST, FOMC Minutes

April 13th:

8:30 am EST, Producer Price Inflation release (MoM), forecast: 0.1%, previous: -0.1%

Apr 14th:

U.S. Core Retail Sales (MoM), forecast: -0.3%, previous: -0.1%,

U.S. Export Price Index (MoM), forecast: -0.2%, previous: 0.2%,

U.S. Import Price Index (MoM), forecast: -0.2%, previous: -0.1%

U.S. Retail Sales (MoM), forecast: -0.4%, previous: -0.4%

USD Industrial Production (MoM), forecast: 0.2%, previous: 0.3%

USD Michigan Consumer Sentiment (Apr) data, forecast: 62.7, previous: 62.0

Bitcoin Realized Price At $19,8000

Bitcoin rarely exists below its realized price, network cost basis, for long with the current realized price at $19,779. What can be a more interesting sign though is the overall change in the cost basis as it increases or decreases over time. Realized price growth acts as a proxy for capital flows coming into the network. Generally as more capital comes in, realized price rises and vice versa. Briefly, we saw realized price reach over $20,000 with growth fairly stagnant or neutral over the last few months.

U.S. CPI On Wednesday

With markets all over the place changing expectations of rate hikes and rate cuts at every new data point, this week’s CPI print is yet another key one to watch. Core CPI forecast expectations are currently 5.6% YoY and 0.4% MoM. A key contributor to higher inflation is the services sector alongside the trend of higher median wage growth. With prices of oil and cars back on the rise short-term, jobs and wage growth must come down a lot more to ease inflationary pressures.

Source: Atlanta Fed

Source: Yardeni

In regards to the flurry of economic data that will be released this week, Core CPI is one of the most important to watch for macro investors. Given that core inflation, which

The Glimpse of A Bitcoin Gold Correlation

Since the turn of the year, bitcoin's correlation with traditional risk benchmarks has been much weaker. As those correlations have waned, a stronger correlation with gold has emerged throughout March. Although it's even stronger compared to spot bitcoin, the chart below shows the rolling 30-day correlations between BTC CME futures relative to gold and the Russell 2000 index.

Anomaly or a new trend? We're starting to see some small signs of a new trend forming, but it's still pretty early to tell considering bitcoin's strong relationship with risk over the last year.

A Push for $30,000

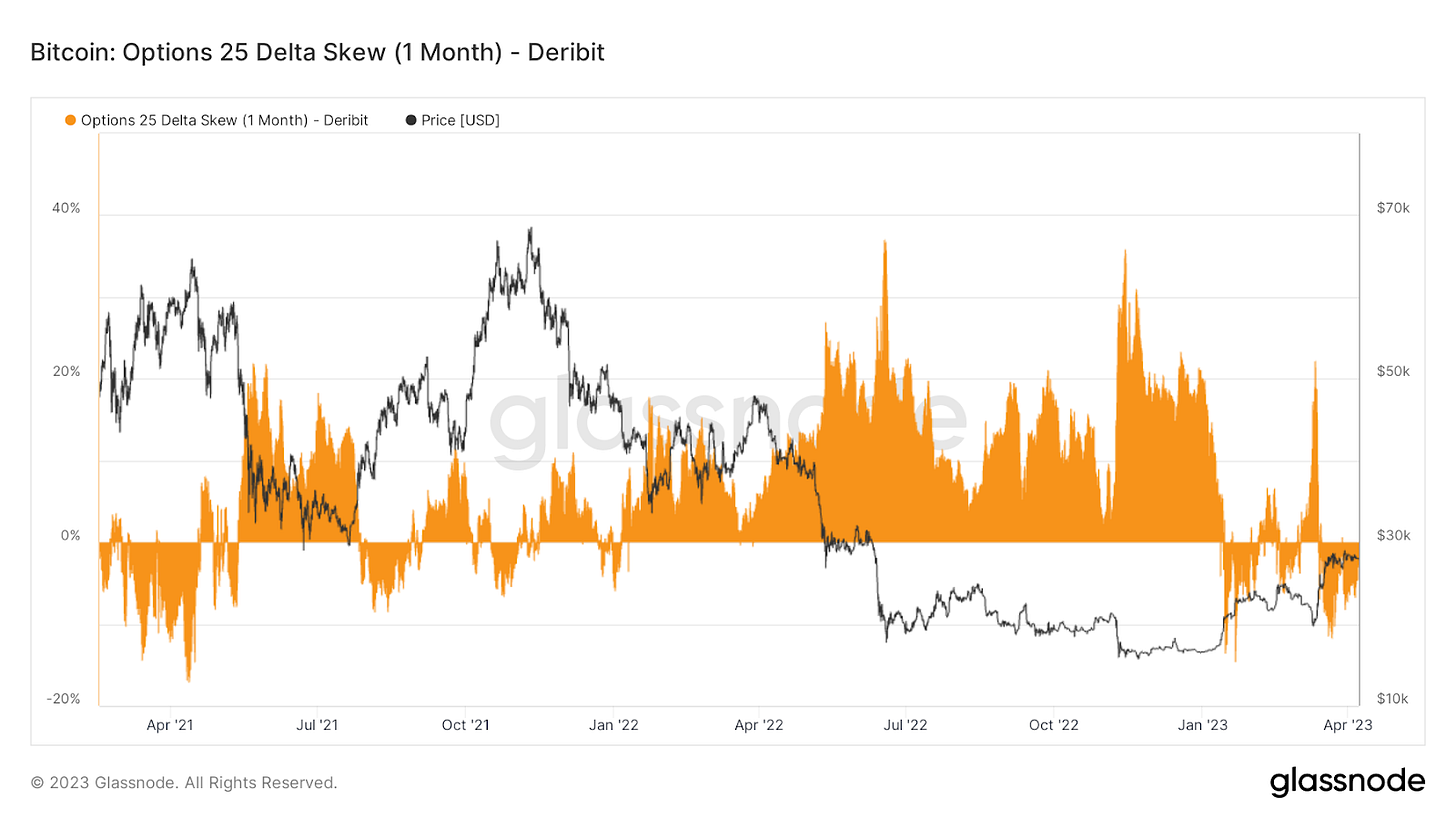

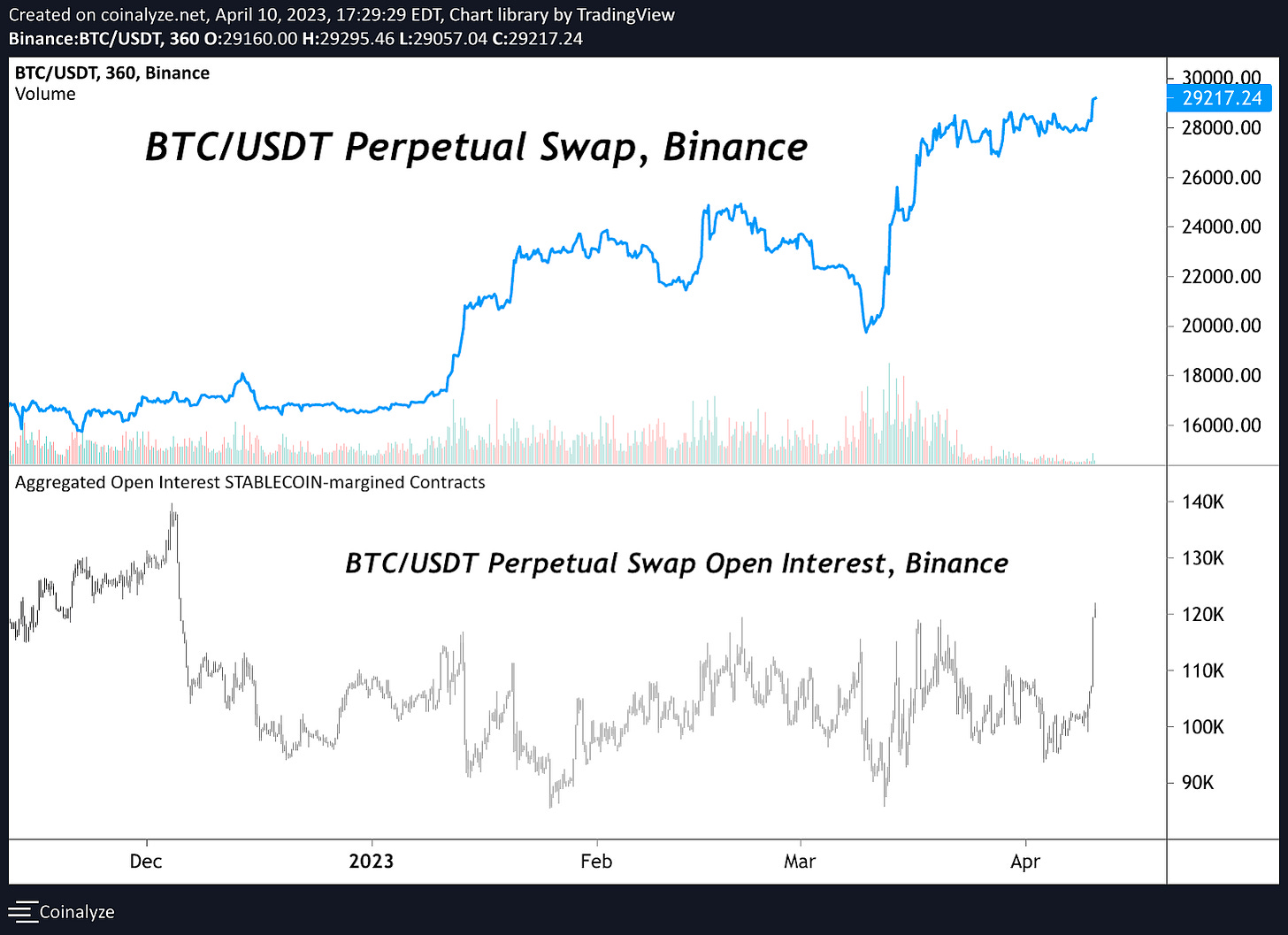

At the time of writing, as bitcoin has broken above $29,000 to make year-to-date highs, and on a long-time frame, bitcoin remains incredibly cheap in our view. The recent move to new highs has come with some support from the derivatives market, with declining levels of delta skew (increasing premium for call options relative to put options) in the options market and increasing open interest in tandem with the rise in exchange rate on the world's predominant crypto derivatives contract, Binance BTC/USDT perpetual futures.

For historical context, we can observe the history of 25 delta skew for one-month options. While correlation isn't necessarily causation, we can see that there was a much more bearish options market in the later months of 2022.

While it doesn't exactly mean that the market is guaranteed to be overbought, we can say that 1-month put protection hasn't been this cheap in a while, and overall market liquidity still isn't great.

Below, we show BTC/USDT perpetual futures open interest during the pump past $29,000.

However, it is important to note that much of this increase could be the same market participants that were recently in the BTC/USDT spot market that had limited time promotion 0% fees for market orders, whom are simply using the perpetual futures market as a way to synthetically but spot by going 1x long on futures.

Final Note:

Market liquidity remains low in bitcoin in terms of volume and spreads, the exchange rate (at least for the time being) doesn't seem to care, the direction is up. In terms of the relative amount of crypto collateralized leverage, it is still at extremely suppressed levels, a far different story then the last time bitcoin was trading near $30,000.

The fact that open interest is so heavily denominated in stablecoins rather than with bitcoin itself is a healthier profile for bulls, generally speaking.

When the supply of an asset is so tightly held, with this many price agnostic accumulators, it’s a mere matter of time before stacking flows lead to a higher exchange rate.

An all time high 53% of bitcoin have not moved on-chain in over two years. Two years ago on April 10th, 2021, the price of bitcoin was $61,000. A majority of HODLers simply remain largely unphased by upside and downside volatility.