PRO Market & Mining Dashboards + SPECIAL OFFER

Each week, Bitcoin Magazine PRO shares a Market and a Mining Dashboard with our premium subscribers. We are releasing today's post for free subscribers along with a special discount offer.

Thank you for being a free subscriber to Bitcoin Magazine PRO.

Below are the PRO Market and Mining Dashboards that go out to paid subscribers on a weekly basis.

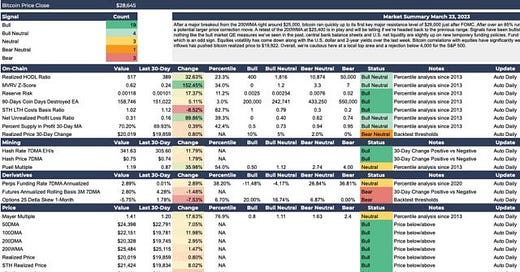

The Market Dashboard actively tracks 30-plus major market indicators and provide readers with a data-driven view of the market. It covers metrics across on-chain, derivatives, mining, price, fund flows, macroeconomic and correlation data. These are several of the key indicators we track on an ongoing basis and find them useful to assess the current state of the bitcoin market.

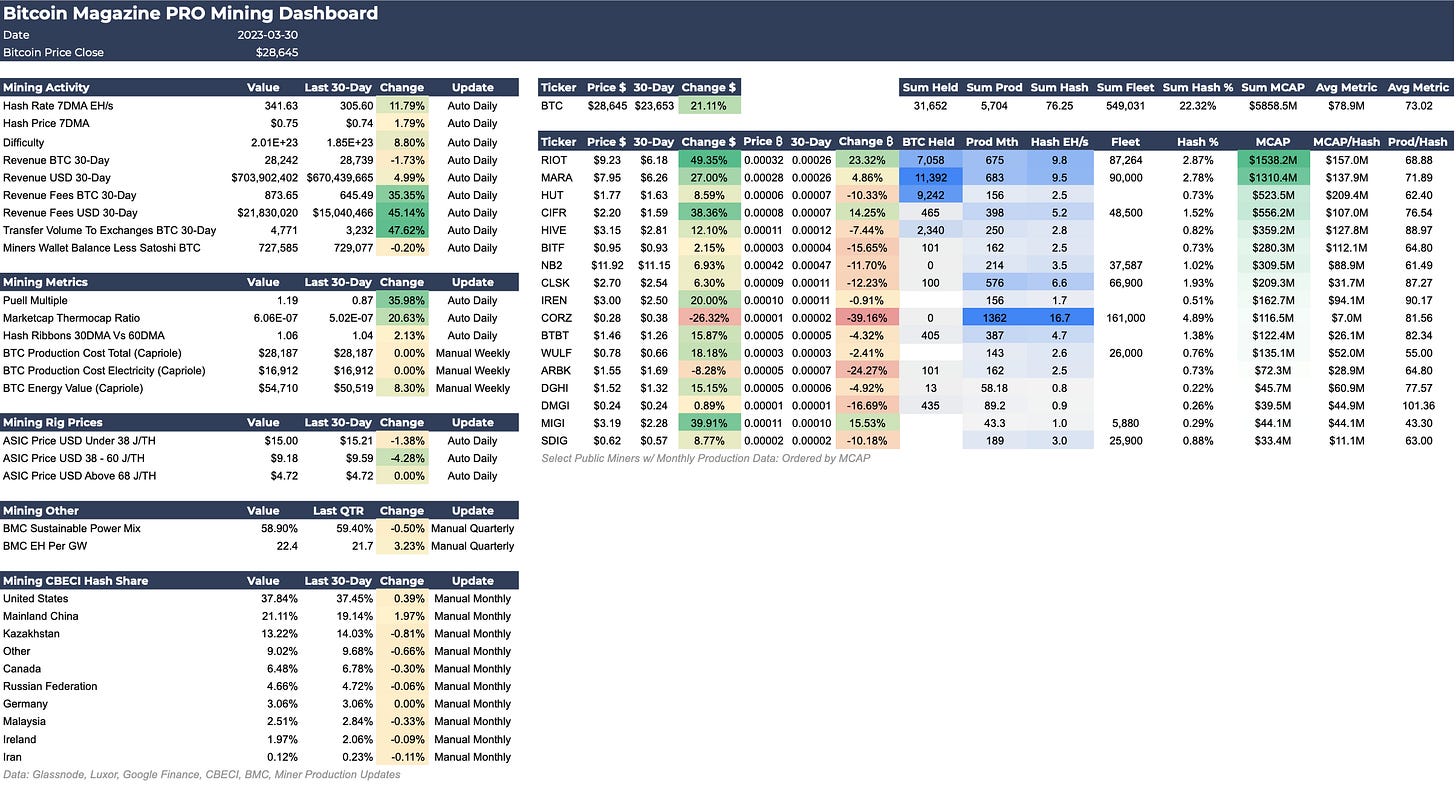

The Mining Dashboard tracks additional metrics specific to bitcoin mining and publicly trading mining companies. It covers data across hash rate, revenue, mining rigs, geographical hash share and mining-related equities. These are several of the key metrics we track on an ongoing basis and find them useful to assess the current state of bitcoin mining.

Paid subscribers also get access to a password protected website with a live view of these dashboards. When looking at market conditions, these dashboards offer a comprehensive view of the bitcoin and mining market.

We are offering the annual plan of Bitcoin Magazine PRO at a 25% discount for a limited time! Consider upgrading your subscription to receive these dashboards in your inbox every week.

In addition to the Market and Mining Dashboards, our paid tier subscribers receive:

Industry-leading market research 3x/week.

Coverage of the bitcoin market, macroeconomics, bitcoin mining equities and important market events.

Full access to our LIVE Market Dashboards (markets and bitcoin mining).

Early access to all Bitcoin Magazine PRO quarterly research reports.

Standing 15% off ALL products in the Bitcoin Magazine Store (magazines, conference tickets, art, merchandise + more).

Upgrade today to take full advantage of everything Bitcoin Magazine PRO has to offer. This deal will expire on April 6!

Market Dashboard

Market Summary

Over the last week, there’s been little change to our short-term view of a potential local top and our cautiousness on the bitcoin price at these levels. Current key areas for price are breakouts above $29,200 or below $26,500 as we’ve seen two weeks of ranging in between. After several weeks of significant negative outflows, fund inflows were positive to the tune of $127.5 million last week while the GBTC discount fell back toward 40%. S&P 500 has broken back above 4,000 even though bitcoin correlations to traditional risk assets have fallen off over the last two months. Realized price is now over $20,000 while the 200-WMA is at $25,484. Largely, macro measures of liquidity have been bullish relative to their last 30-day values as Q1 comes to a close. The market continues to bounce from concerns of systematic risk to pricing in more rate hikes in an uncertain, ping-pong fashion. So far, U.S. dollar strength is holding support while the VIX has been crushed to lows again during this latest rally.