New ATH for Bitcoin is Here as Spot ETF Inflows Surge

Bitcoin hits an ATH against the Japanese Yen, and is closer in Euro to that mark than in USD. Plus, the great bond bear trap of 2024.

Bitcoin Hits ATH in Japanese Yen

Bitcoin is a Veblen good, meaning the demand goes up as price goes up. That is the inverse of a typical good where demand falls as price rises. But which price are we talking about? Bitcoin has a price in many currencies. Its Veblen good status applies to each of them, with the effect on demand proportional to the size of that currency.

Sometimes we see charts of bitcoin in Turkish Lira (bottom right) or Argentine pesos, because those currencies are quite inflationary. But those currencies are relatively small compared to the big four (USD, EUR, JPY, GBP). When bitcoin breaks an ATH in those currencies we should expect that to have a noticeable effect on demand, and that is what we saw today with bitcoin priced in Japanese yen breaking its previous ATH.

Interestingly, the Nikkei 225 is also hitting a new ATH, along with bitcoin.

But not all is well in Japan. It was recently reported that they entered an official recession in Q4 last year. GDP for Q4 was -0.4% compared to Q4 in 2022, following a -3.3% Q3. Quarter-over-quarter growth was also negative, with the economy shrinking 0.1% from Q3 and Q3 shrinking 0.8% from Q2.

You wouldn’t know they were in recession by looking at their stock market. However, this is exactly what I’ve been preaching about here on Bitcoin Magazine Pro. Bitcoin and stocks should benefit from deteriorating economic conditions, contrary to what mainstream analysts say. As we progress toward recession, money is diverted from profitable private sector uses into investments and savings, boosting both stocks and bitcoin. Add this to the rising demand due to being a Veblen good, and this could create a significant boost in demand from Japan.

An ATH in the Euro is not far behind, currently only 18% away, while still 24% away in dollar terms. Each time bitcoin passes an ATH in one of these currencies, a new round of headlines will be published, and a number of doubters will be converted. These prices can also act as support in any future dip. BTC/USD was ~$52,000 when the ATH in JPY was broken. Therefore, the support that BTC/JPY receives from the previous ATH will translate to support in USD as well at this level.

Bitcoin Spot ETF Flows

Flows into the new bitcoin ETFs have increased dramatically in the last week. Net inflows are now $4.1 billion in 24 trading days. Excluding GBTC outflows, the total becomes a whooping $10 billion. Most of the GBTC selling was likely recycled into the other ETFs, but we know some was not, like the FTX selling. We can confidently say that the ETF flows were not priced in.

Below, we can see the next important level for bitcoin, or Schelling point, is around $56,000. That lines up with the 1.61 Fib and the next volume peak. It is the last focal point for price prior to the ATH, as well.

The Great Bond Bear Trap of 2024

The developments this week have set a massive trap. Keep in mind, nothing goes up or down in a straight line. Just because a few indicators, which are wrongly interpreted by consensus macro analysts anyway, have seemingly reversed trend, it does not mean we are in danger of inflation reaccelerating. Let me show you.

Since this trap came into shape with the CPI report this week, below is the US headline CPI month-over-month. Since COVID hit, I’ve been expecting a return to “post-GFC normal” after a transitory period of higher than average CPI. This is due to the fact that productive credit creation in the private sector is needed to sustain higher prices and that is simply impossible with this high of a debt load in the global economy. In fact, the pattern we observe today, of higher stocks, slightly falling bond yields, and appreciating hard assets fits the same scenario we always see in periods prior to recession.

This week is dangerous because many factors are apparently aligning in agreement. January CPI came in above expectations in the US, market pricing for Fed rate cuts has been pushed back to June, and the long end of the Treasury yield curve has risen through some technical resistance. The mainstream logic goes: these factors point toward higher inflation, and thus the Fed will not cut rates as soon and the economy will suffer from higher policy rates.

I wrote about this contradiction back in Paradox in Economic Headwinds: Recession or Inflation. Most people believe that we can have a recession and inflation at the same time, like the 1970’s. However, in the modern economy, those things are mutually exclusive. If the economy can produce enough expansion in private credit to cause sustained inflation, it means the economy is doing well. The 1970’s had high inflation, but it also had very high REAL GDP growth.

While it is true that higher inflation leads to higher Treasury yields, it does not follow that the economy must deteriorate from higher inflation. Indeed, the whole reason inflation would go up is because private sector credit is expanding due to real growth. Inflation is not a cause, it is an effect.

That is the essence of the trap. Most people are stuck thinking that recession will be the result of inflation and the Fed keeping rates higher. Therefore, they expect inflation and rates to go up from here. In other words, they are bearish bond prices. They will be trapped when bonds rally (yields fall) leading into recession as they always do.

Market often sets these kinds of traps and gets everyone to one side of the boat. Why is it likely yields fall from here? Cracks in the banking sector are starting to appear. Last week, Barron’s published an article, Small Banks Are Teetering. Expect More Failures:

“Already this year, Deutsche Bank, Aozora Bank , and other publicly traded banks have had to dramatically increase their loan-loss provisions related to U.S. commercial real estate exposure. Commercial real estate write-offs have the potential to destabilize the banking sector.”

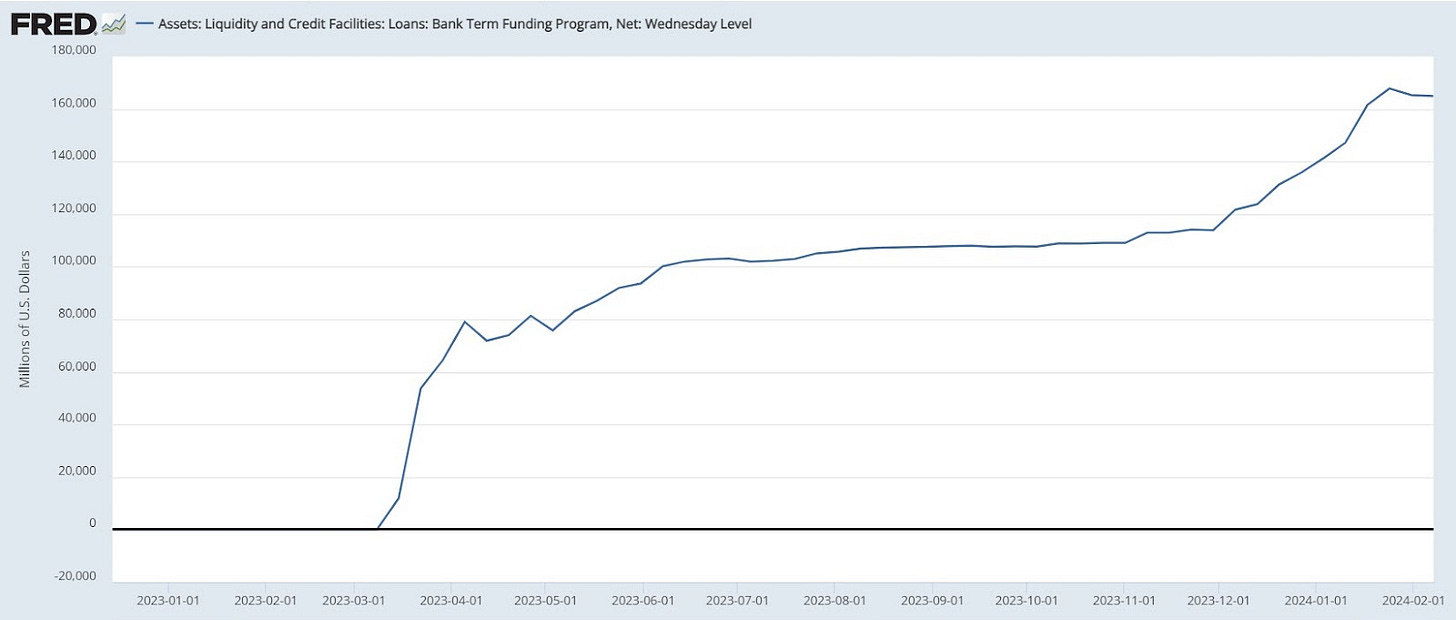

The Federal Reserve has also confirmed the end of the Bank Term Funding Program (BTFP) on March 11. That is the program set up last March to bailout the banks affected by the failure of Signature and Silicon Valley banks. That program is still providing $164 billion to troubled small banks, with no sign that banks are preparing for it to end.

Source: FRED

The more acute the crisis, the faster yields will fall, or the faster the trap snaps closed. With banks already “teetering” and the BTFP ending, PMI and other economic indicators showing economic slowdown, along with the historical pinch point at the end of Q1 every year, the trap could close quickly. The breakout fakeout in yields has lured in more bears making the crisis potential that much worse.

This is bullish for bitcoin in the medium term. Just like in Japan above, where bitcoin is rising while they are in an official recession, bitcoin should continue to rally as people view bitcoin more and more as a safe haven asset.

If you found value in this post, please like and share! Thank you!