MSTR: A Turning Point For Outperformance

Strategy's massive Bitcoin accumulation and favorable risk/reward profile position it for potential outperformance vs. BTC, as key indicators suggest a critical inflection point.

As Bitcoin continues to show signs of sustained strength, it’s worth zooming in on one of the most highly leveraged plays on BTC’s long-term thesis: MicroStrategy, recently rebranded as “Strategy.” In this article, we’ll assess the scale of Strategy’s accumulation, examine its risk/reward profile, and explore whether this equity proxy could be primed for a period of outperformance versus Bitcoin itself. With multiple indicators converging and capital rotation possibly underway, this may be a critical inflection point for investors.

Strategy’s Treasury Swells

It is clear from our Treasury Company Analytics data that the pace of Bitcoin accumulation by Strategy over recent months has been nothing short of remarkable. Starting the year with approximately 386,700 BTC, the company now holds over 550,000 BTC, a staggering increase that suggests a clear and deliberate strategy to front-run a potential breakout event.

Figure 1: Strategy’s Acquisitions, P&L, and Average BTC Cost Basis charts are a selection of the metrics available on Bitcoin Magazine Pro for this company.

Led by Michael Saylor, this acquisition campaign has been methodical, with regular weekly purchases that now total billions of dollars in dollar-cost-averaged BTC. The company’s average acquisition cost sits near $68,500, translating to a current mark-to-market profit of close to $15 billion. With their total spend now around $37.9 billion, Strategy has become the largest corporate holder of Bitcoin by a wide margin, positioning themselves not just as a participant in this cycle, but as a defining player.

BTC Priced In Strategy

Instead of only comparing both assets against the U.S. dollar, a more revealing analysis comes from pricing BTC directly in Strategy stock. This ratio provides insight into which of the two assets is relatively outperforming or lagging.

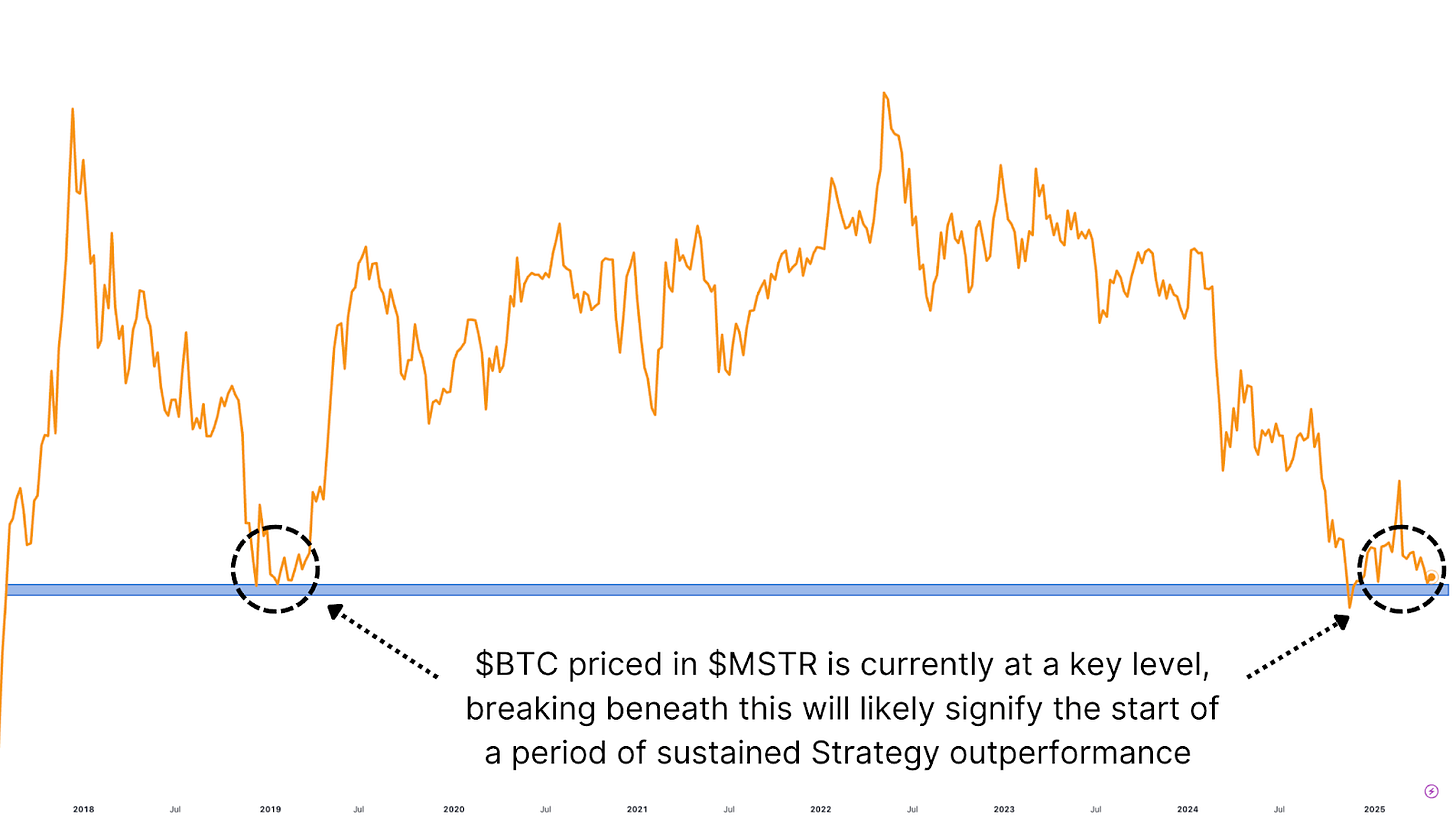

Figure 2: If the BTC/MSTR ratio breaks beneath this key level it may signify a sustained period of Strategy outperformance.

Right now, the BTC/MSTR ratio is sitting at a key historical support level, matching the lows set during the 2018–2019 bear market bottom. If this level breaks, it may indicate that Strategy is on the verge of a sustained period of relative strength versus BTC itself. Conversely, a bounce from this support would suggest Bitcoin could resume dominance and offer the better short- to mid-term risk/reward.

This chart alone is worth watching closely over the coming weeks. If the ratio confirms a breakdown, we may see significant capital rotation toward Strategy, particularly from institutional allocators seeking exposure to a high-beta BTC proxy with public market access.

Mapping Price Targets

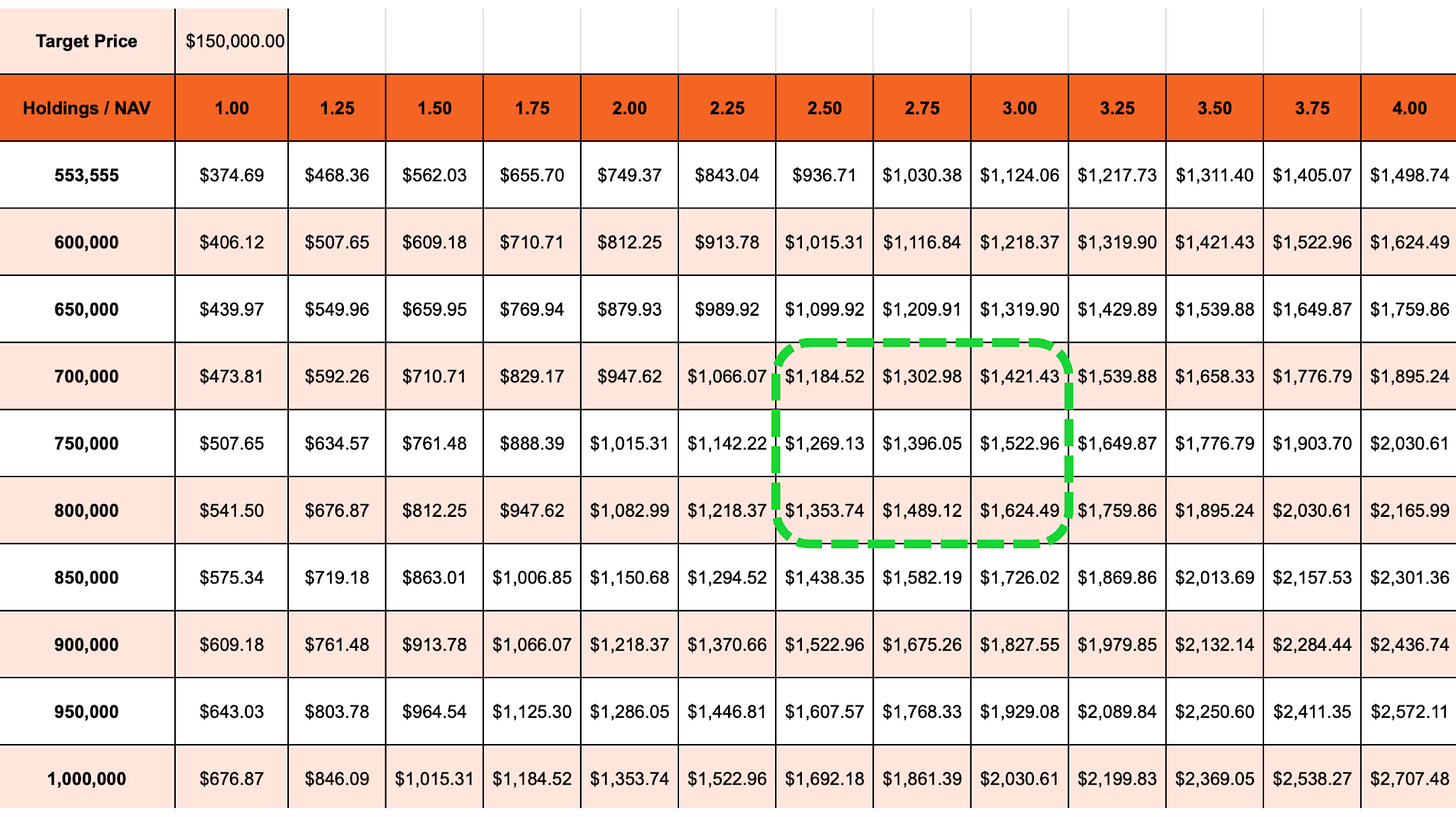

Although predicting exact outcomes is impossible, we can extrapolate forward from Strategy’s current trajectory and apply plausible Bitcoin cycle assumptions. At their current rate of acquisition, Strategy is on track to end 2025 with between 700,000 and 800,000 BTC. If Bitcoin rallies to $150,000, a commonly projected peak for this cycle, and we apply a net asset value premium of 2.5x to 3x (consistent with historical precedents that reached as high as 3.4x), this would yield a projected share price between $1,200 and $1,600.

Figure 3: Projecting potential Strategy share prices.

These figures point to a very favorable asymmetric setup, especially compared to Bitcoin itself. Of course, this projection assumes sustained bullish conditions. But even under more conservative scenarios, the math supports the idea that Strategy has a meaningful upside advantage, albeit with more volatility.

Strategy As A Bitcoin Proxy

To strengthen this case further, we can compare historical dollar-cost averaging performance between BTC and Strategy. Using the Dollar Cost Average Strategies tool, you can see that if you had invested $10 daily into Bitcoin over the past five years, you’d have contributed a total of $18,260, now worth over $61,000. That’s an impressive result, outperforming nearly every other asset class, including Gold, which itself has surged to new all-time highs recently.

Figure 4: Through investing $10 each day over the past 5 years, BTC outperforms other key asset classes.

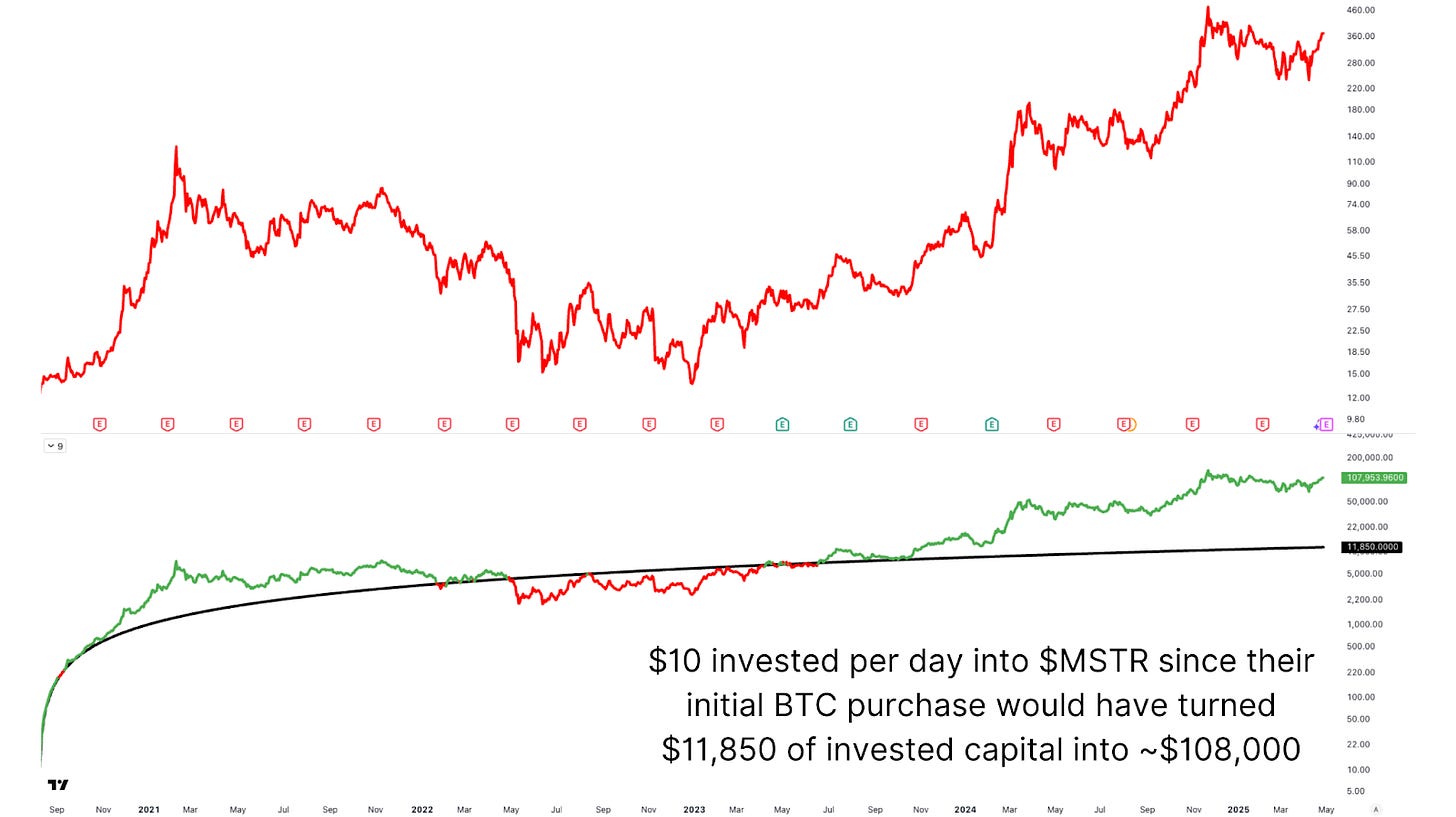

The same $10/day strategy applied to Strategy stock since its first BTC purchase in August 2020 would have resulted in an investment of $11,850. That position would now be worth approximately $108,000, significantly outperforming Bitcoin over the same window. This shows that while BTC remains the foundational thesis, Strategy has offered even more upside for investors willing to stomach the volatility.

Figure 5: A $10 daily investment in MSTR since August 2020 outperforms BTC over the same period.

It’s important to recognize that Strategy is effectively a high-beta instrument tied to Bitcoin. This correlation amplifies gains, but it also amplifies losses. If Bitcoin were to enter a prolonged retracement, say, a 50% to 60% correction, MicroStrategy’s stock could drop by significantly more. This is not simply hypothetical. In prior cycles, MSTR has exhibited extreme swings, both to the upside and the downside. Investors considering it as part of their allocation must be comfortable with higher volatility and the potential for deeper drawdowns during periods of broader BTC weakness.

Conclusion

So, is Strategy worth considering as part of a diversified crypto-forward investment portfolio? The answer is yes, but with caveats. Given its tightly wound relationship with Bitcoin, Strategy offers enhanced upside potential through leverage, as well as a historically validated return profile that has outpaced BTC itself in recent years. But that comes with the trade-off of greater risk, especially in turbulent markets.

The current BTC/MSTR ratio is sitting at a technical pivot. A breakdown would signal incoming outperformance from Strategy. A bounce, however, may reaffirm Bitcoin as the more favorable asset in the near term. Either way, both assets remain essential to watch. If this cycle enters a renewed phase of strength, expect significant institutional capital to flow into both BTC and its most prominent proxy, Strategy. The rotation could be fast, aggressive, and rewarding for those positioned early.

Matt Crosby

Lead Analyst - Bitcoin Magazine Pro

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

MSTR is an interesting stock. It generates strong emotions on both sides. I am biased. I own it, next to Bitcoin, Gold, Silver, and so on. That aside, great article about the potential upside for $MSTR this year. I see a similar upside, and even more if Bitcoin performs better. I look at $MSTR as a leveraged play on Bitcoin. But as you pointed out, leverage works both ways. Great if Bitcoin goes up. Bad if Bitcoin goes down. I believe that we are in a bull cycle for Bitcoin. Just looking at the record low OTC balance (where the whales go shopping) makes me very optimistic about BTC's performance this year. But I could be wrong.