Mining Dashboard Summary 12/14/23

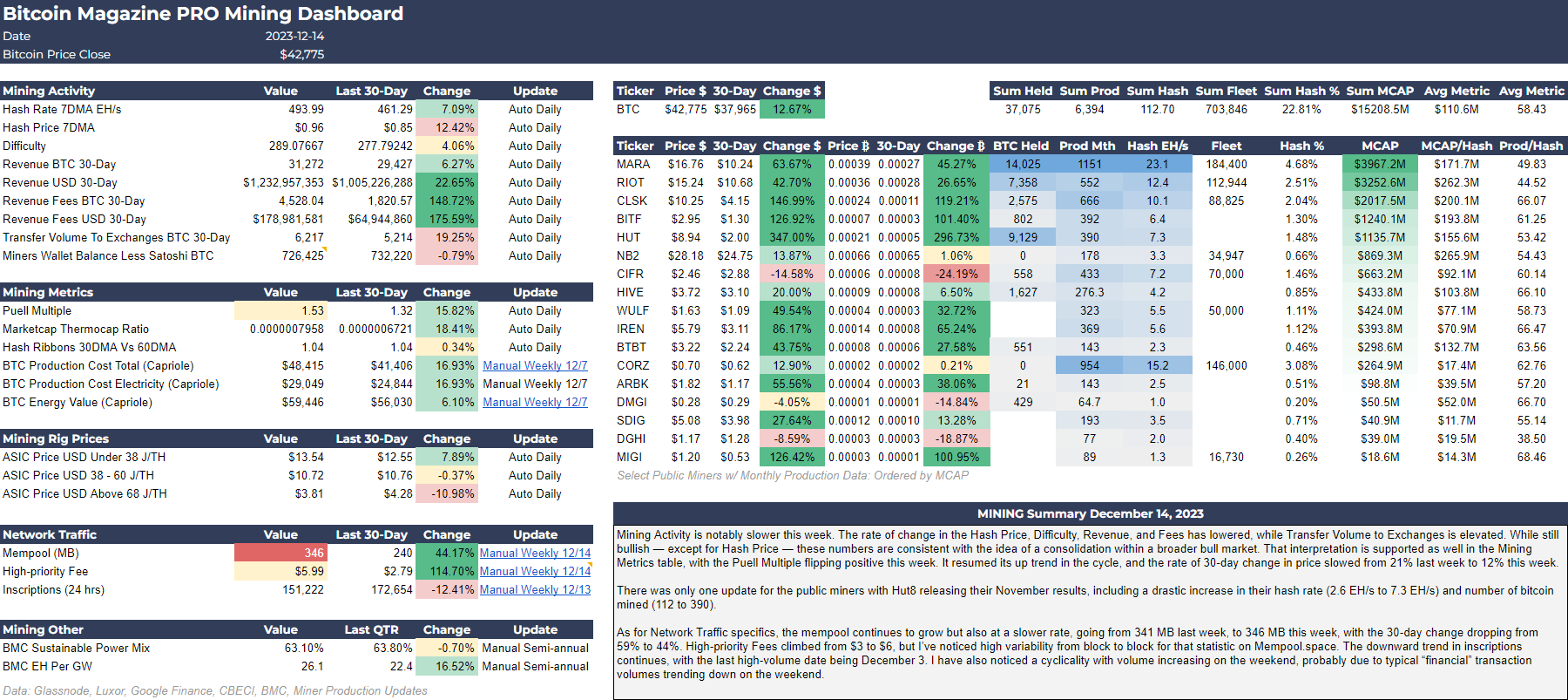

Mining Activity is notably slower this week. The rate of change in the Hash Price, Difficulty, Revenue, and Fees has lowered, while Transfer Volume to Exchanges is elevated. While still bullish — except for Hash Price — these numbers are consistent with the idea of a consolidation within a broader bull market. That interpretation is supported as well in the Mining Metrics table, with the Puell Multiple flipping positive this week. It resumed its up trend in the cycle, and the rate of 30-day change in price slowed from 21% last week to 12% this week.

There was only one update for the public miners with Hut8 releasing their November results, including a drastic increase in their hash rate (2.6 EH/s to 7.3 EH/s) and number of bitcoin mined (112 to 390).

As for Network Traffic specifics, the mempool continues to grow but also at a slower rate, going from 341 MB last week, to 346 MB this week, with the 30-day change dropping from 59% to 44%. High-priority Fees climbed from $3 to $6, but I’ve noticed high variability from block to block for that statistic on Mempool.space. The downward trend in inscriptions continues, with the last high-volume date being December 3. I have also noticed a cyclicality with volume increasing on the weekend, probably due to typical “financial” transaction volumes trending down on the weekend.

Mining Dashboard

Download Mining Dashboard PDF