Miners More Stable Than They Appear During Price Dip

Despite declining Bitcoin prices, public miners perform strongly with diversified strategies, stable revenues, and resilient network activity, providing valuable insights for investors.

Introduction

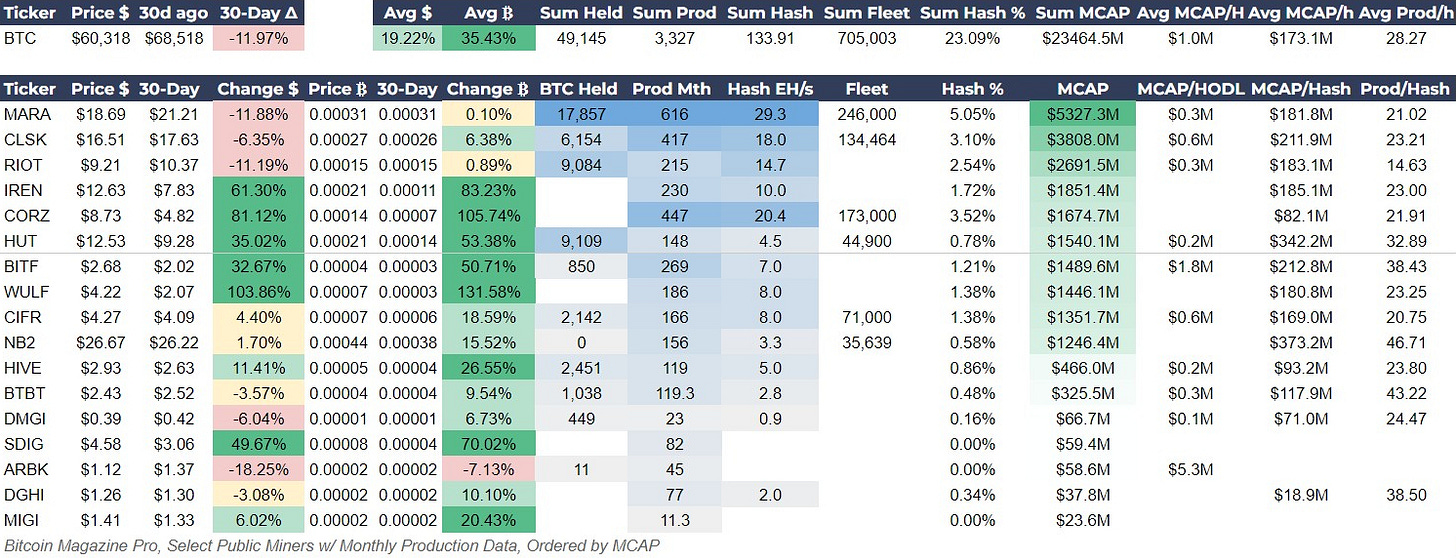

With market sentiment about the spot Bitcoin price at a multi-month low, public miners are actually performing quite well, posting an average 30-day gain of 19% in USD terms and 35% in BTC terms. In this post, we will dissect the strategies helping Bitcoin miners outperform, analyze general mining activity stats that point to stable miner revenue despite the drop in hash rate, and examine network stats such as mempool and fees to see if they match this bearish market sentiment.

Please check out my personal content on bitcoinandmarkets.com for more holistic analysis like this!

Public Bitcoin Miners

The Bitcoin dip is the topic de jour, down 11% in the past 30 days, hitting $58,456 yesterday before bouncing to close at $60,252. This downturn aligns with broader market trends, such as Nvidia (NVDA), which is in the midst of a 3-day sell off, down 16% at Monday’s close.

The average performance of miners is in stark contrast to the spot price of bitcoin, with an average increase of 19.22% in dollar terms and 35.43% in Bitcoin terms over the last 30 days. This performance of public miners coincides with a significant consolidation. Hash rate is dropping as marginal miners turn off their unprofitable machines at this price level.

The performance of publicly traded miners has varied significantly. Miners like Core Scientific (CORZ) and Terawulf (WULF) have shown remarkable gains of 81.12% and 103.86% respectively, largely due to the recent foray into hosting GPUs for AI computing. This is really a match made in heaven for bitcoin miners because it diversifies their revenue streams and allows them to expand their facilities and energy production. This relationship might cause some volatility in the future for bitcoin hash rate as well as AI compute. The energy used for the AI GPUs is energy not used for Bitcoin mining. When the spot price is low, it makes sense to diversify energy uses toward AI GPUs. However, when the spot price surges throughout this bull market, it will become increasingly profitable to put that energy toward bitcoin mining.

The three largest miners by Market Cap (MCAP), Marathon (MARA), RIOT and Cleanspark (CLSK) all have negative stock performance over the last 30 days. This isn’t surprising given that their bitcoin reserves have been losing value. However, this will rapidly change as bitcoin’s price starts going up again.

Investor Insight

Miner Strategies and Market Phase: Investors should consider how miners have set up their business model to take advantage of the phases of the Bitcoin market cycle. Miners who have diversified into AI hosting specifically, might be well positioned during periods of bull market corrections and pre-recessionary pumps in the traditional stock market. However, during periods of price expansion for bitcoin, when it rallies 50-100% in a month or two, those miners' high bitcoin reserves stand to benefit much more.

General Mining Stats More Resilient Than Thought

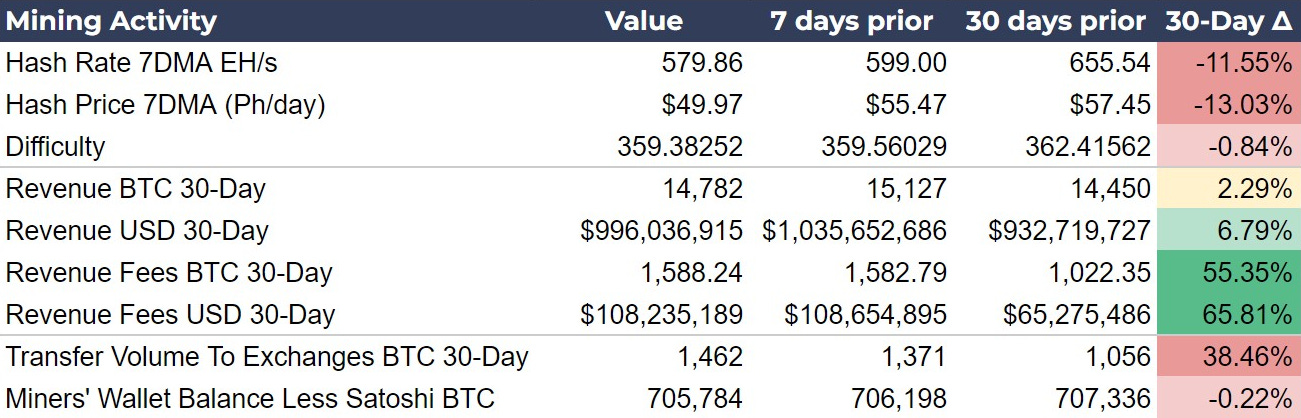

Despite the downturn in Bitcoin’s price, general mining activity shows signs of resilience. The 7 DMA hash rate has dropped by 11.55% over the last 30 days, indicating that less efficient miners are exiting the market. Hash price has also decreased by 13.03%, reflecting the lower Bitcoin price. However, difficulty remains relatively stable, showing only a minor decrease of 0.84%. Currently, the next difficulty adjustment in 9 days is estimated to be approximately -4%.

Interestingly, revenue in BTC terms has increased by 2.29%, and in USD terms by 6.79%, thanks to higher transaction fees, which have seen a significant rise of 55.35% in BTC terms and 65.81% in USD terms. These are all 30-day averages.

The transfer volume to exchanges over the last 30 days has increased by 38.46%, suggesting that many miners are selling to maintain profitability during this market phase. Miners’ wallet balances are also showing signs of selling, down 1552 btc from 30 days ago. Miners’ Reserves, which have been declining since before the FTX bottom, are starting to slow their decline. It is important to understand that bitcoin has rallied this whole bull market while Miner Reserves have been declining, there is no direct correlation to price.

Source: CryptoQuant

Investor Insight

Revenue Resilience Amidst Price Declines: From the June high to low, bitcoin has sold off 18.8%, but miner revenue has remained relatively constant. Miners are going to through a consolidation as the hash rate and even Hash Ribbons show us, but the industry as a whole is not showing signs of breaking.

Network Traffic Stats

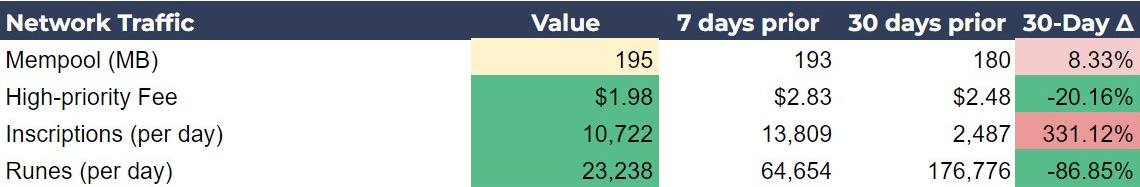

Network traffic stats have remained remarkably stable over the last 30 days, painting a picture of consistent usage despite the recent price volatility. The mempool size has seen a modest increase of 8.33%, from 180 MB to 195 MB, and transaction fees have actually decreased by 20.16%, from $2.48 to $1.98. This stability is surprising given the recent price decline, as we would typically expect a significant rise in both the mempool and transaction fees during a sell-off, driven by urgent transactions to exchanges. The subdued response this time suggests that market participants may be holding their positions rather than rushing to sell.

Inscriptions have increased dramatically by 331.12%, from 2,487 to 10,722 per day, though still far below the peak levels of 200,000 to 400,000 seen in 2023. The new Runes protocol has seen a significant decline in activity, dropping 86.85% from 176,776 to 23,238 per day. These factors together suggest a period of consolidation and stability in the Bitcoin network. The lower-than-expected transaction activity during a period of price decline could imply that holders are not panicking, and the network remains healthy and resilient.

Investor Insight

Stability into EOQ: The lack of a significant rise in network traffic before the volatility, could very well presage a strong bounce off the lows. However, with this week being the end of the second quarter for futures and derivatives contracts, watching these traffic stats though this week may give us some forewarning of what will happen with price on this week’s huge expiration.

Conclusion

Despite a challenging month for Bitcoin prices, the broader ecosystem of Bitcoin mining and network activity has demonstrated notable resilience. Public Bitcoin miners have not only weathered the storm but, in many cases, thrived by diversifying their operations and strategically managing their resources. General mining activity remains robust, with stable revenue figures and a manageable hash rate decline, underscoring the sector's adaptability. Meanwhile, network traffic metrics reveal a stable and healthy usage pattern, suggesting a calm and measured response from market participants rather than panic selling.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!