MicroStrategy Ups the Ante with 3,000 Bitcoin Purchase, Fueling Bullish Market Sentiment

MicroStrategy purchases huge Bitcoin sums at near-record price highs in stunning display of confidence. This act, alongside a booming ETF market, propels Bitcoin prosperity towards next halving.

Michael Saylor, co-founder and executive chairman at MicroStrategy, has led his company to once again double down on the world’s leading crypto asset with a $155M Bitcoin purchase.

Bitcoin has been doing incredibly well lately. The currency had already been on a steady and extended period of growth for several months, in the latter half of 2023, but the ETF approval in January has changed everything. Although the market stumbled briefly after this major landmark, the data is clear: Bitcoin is doing better than it has at any point since 2021. Not only is the current valuation on par with the year that Bitcoin exploded more than ever, but we are also less than $10k away from Bitcoin’s highest all-time record, at the time of writing. In fact, when measuring the sheer rate of growth, Bitcoin has even been performing better than gold this year.

Although there are a number of factors that have created this undeniable bull market, one in particular stands out: Michael Saylor’s resolute commitment to Bitcoin maximalism. Bloomberg specifically calls attention to MicroStrategy as a determining factor in the more dramatic spikes taking place in the Bitcoin market, even as other tremendous developments have also pushed the market along. Specifically, Saylor announced on February 26 that the company was making an amazing commitment to the strength of Bitcoin, by purchasing 3k of them at a price higher than $50k. In other words, he’s unconvinced that Bitcoin is anywhere near its peak, even as we’re approaching the all-time highest valuation. And he’s so committed to this belief that he’s willing to stake $150M on it.

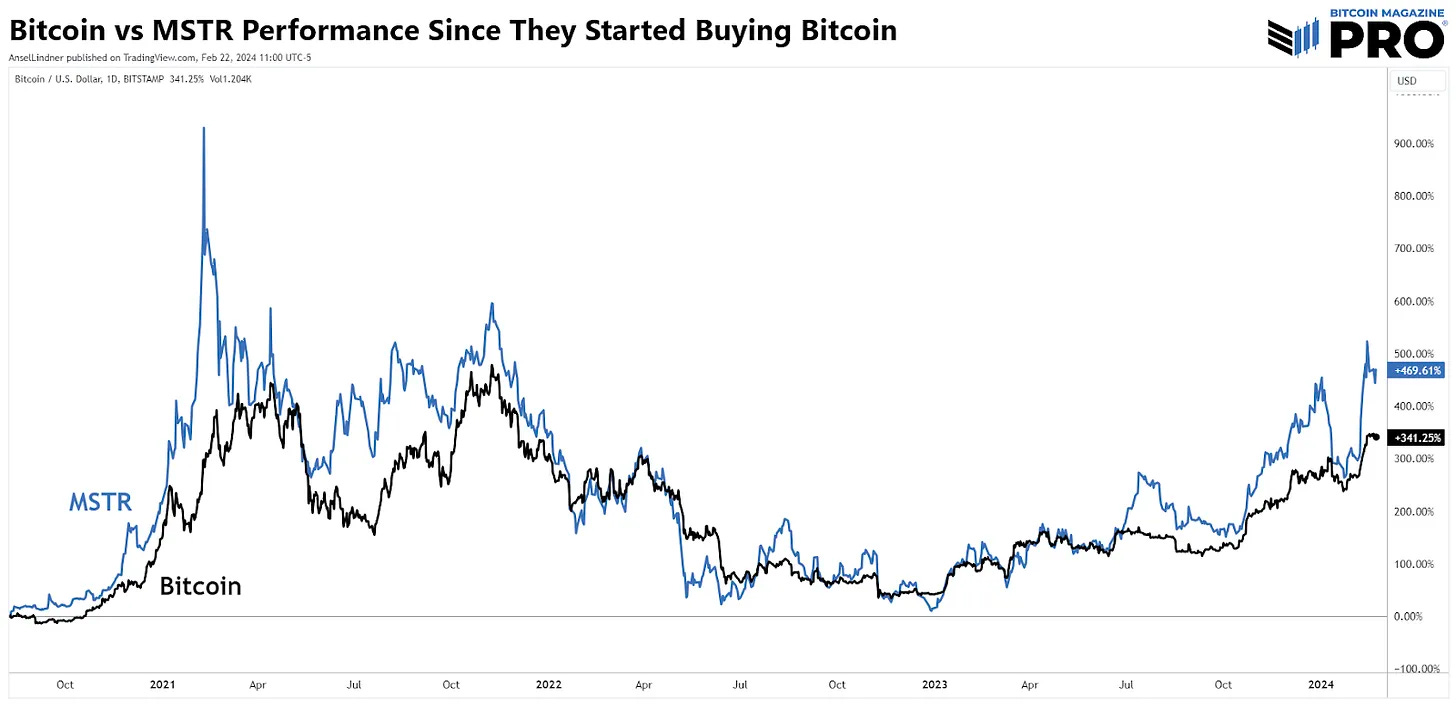

Saylor has long been one of Bitcoin’s most prominent public supporters, having committed his company for several years now. In 2020, he famously declared in an interview that “there is no second best” to Bitcoin, and began a series of massive purchases the following year. As of this latest purchase, MicroStrategy has invested more than $6B into its various Bitcoin acquisitions. Not only has this given the firm a reserve of assets that are worth substantially more than the initial price, but MicroStrategy’s own stock price has also seen direct benefit. As Bitcoin rallied to its highest level in more than 2 years, MicroStrategy’s valuation went up to its highest level in one year. Ironically, even though Saylor made the declaration that Bitcoin had no second-best alternative, MicroStrategy has actually outperformed the currency on a fairly consistent basis. Even though this percentage data is relative, and Bitcoin as a whole is obviously stronger than any individual company, it’s still very impressive that MicroStrategy has benefitted so thoroughly from its bullish stance.

Although the company itself has managed to make substantial wins with this remarkable show of confidence in Bitcoin, MicroStrategy’s reputation among general crypto enthusiasts has also indirectly led to a minor headache. In a humorously ironic twist, the firm’s Twitter account was specifically targeted for an attack, with scammers hijacking their platform to publish a fake token airdrop that stole user funds. Despite the company’s reputation as a bastion of Bitcoin maximalism, the hackers were able to use the lure of this bogus Ethereum-based asset to steal more than $440k from MicroStrategy fans. The company itself was obviously unharmed and has regained control of its accounts, but it’s still an interesting sign that so many supporters were willing to believe that MicroStrategy would suddenly endorse a new token. And, of course, it’s a very telling sign for the company’s influence over the community that its fans have $440k to lose.

In any event, it’s not as if MicroStrategy’s confidence in Bitcoin is the only reason that the cryptocurrency has been performing so well. After all, Bitcoin will have to rise substantially above its previous record highs for Saylor to turn a profit, when buying at $51k. And even his most substantial commitments are not enough to create that sort of success alone. Saylor’s purchase may be the cherry on top, but right now the sundae is found in the ETF market. Despite somewhat sluggish sales in February, inflows of capital into the Bitcoin ETF were bouncing back over the week of Friday 23. After the weekend, however, the market came in guns blazing, with a trading volume unsurpassed even by the long-awaited ETF launch. The 9 leading spot ETFs collectively pulled in $2.3 billion in trading volume on Monday 26, with BlackRock alone pulling in more than $1 billion. Wildly high ETF revenues like this have created a guarantee that Bitcoin itself would be barreling right alongside them.

The ETF sales and MicroStrategy’s intense bullishness have certainly paved the way for Bitcoin to spike like this, but Saylor has based his decision on more solid ground than ETFs alone. Specifically, the investment banker Benchmark has claimed that this gambit is also based around the future gains from the Bitcoin halving. Benchmark analyst Mike Palmer wrote that “We believe the boost in demand for bitcoin resulting from the launch of multiple spot bitcoin ETFs, combined with the reduced pace of supply resulting from the halving, has the potential to drive the price of the cryptocurrency meaningfully higher during the next couple of years”. He called attention to a previous trend of bull markets following major halvings, and added that a timely hype-up from MicroStrategy would give the firm even more cash before the halving hits. In other words, their analysis postulates, Saylor has found a way to materially benefit all of Bitcoin right between two fortuitous events, and even make his own company a handsome profit to boot.

It should be clear, if nothing else, that Michael Saylor’s continued decision to keep backing Bitcoin is a deeply well-considered and strategic one. He has seen his fair share of ridicule over the years for his defense of Bitcoin, and has even had to step down from the position of CEO during a bear market. And yet, the executive chairman has held on to a significant position of influence within the company, and has seen all his naysayers silenced with a vindicating success. The data bears it out: MicroStrategy has done nothing but benefit from its association with Bitcoin in the long run. As we consider Saylor’s remarkable decision to invest $155M like this, we should all ask ourselves: why shouldn’t Bitcoin keep on going higher? Is there any reason to believe that the highest prices are miles ahead of us? No matter how much the market may stumble during its volatile actions, it seems clear that Bitcoin is a very safe bet in the end.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you enjoyed this article, please consider liking and sharing it. This will enable us to reach and inform a larger audience.

Very safe indeed