Microsoft Urges Shareholders to Vote Against “Bitcoin Investment”

Bitcoin Market Holds Steady as Election Day Approaches: ETF Demand Hits Six-Month High

GM. Today’s headlines:

Microsoft shareholders to vote on Bitcoin Diversification Assessment.

Denmark to impose unrealized gains tax on Bitcoin.

Bitcoin ETF demand hits 6-month high.

$BTC is ranging between resistance of $70,000 and support of the 200-day moving average at $63,264. Traders appear unsure ahead of the 5 Nov US Presidential elections as Bitcoin continues to range between these two key levels.

Figure 1: Bitcoin ranging between resistance and support.

Bitcoin is up nearly 100% over the past 12 months on higher timeframes, and after a period of ranging may be preparing for an upside breakout soon if the bull run continues.

Figure 2: Bitcoin is up +96% over the past 12 months.

News You Need to Know

Standard Chartered believes Bitcoin will hit $73,000 on Election day.

Microsoft shareholders to vote on Bitcoin Diversification Assessment.

Denmark to impose unrealized gains tax on Bitcoin.

Bitcoin ETF demand hits 6-month high.

The Big Story

Bitcoin ETF demand hits 6 month high.

The past week has seen a huge surge in demand for the spot Bitcoin ETFs.

After a period of mixed performance and outflows in recent months, the tide appears to have turned with significant inflows recently.

This can be seen by the large green bars over the past 10 days on the chart below. The chart is showing aggregated inflows to all the major spot Bitcoin ETFs in US Dollar terms where green bars are positive net inflows, red bars are outflows.

Figure 3: Bitcoin ETF Daily Flows (USD).

The consistent green candles are reminiscent of the performance seen at the start of the year around the initial launch of the spot Bitcoin ETFs.

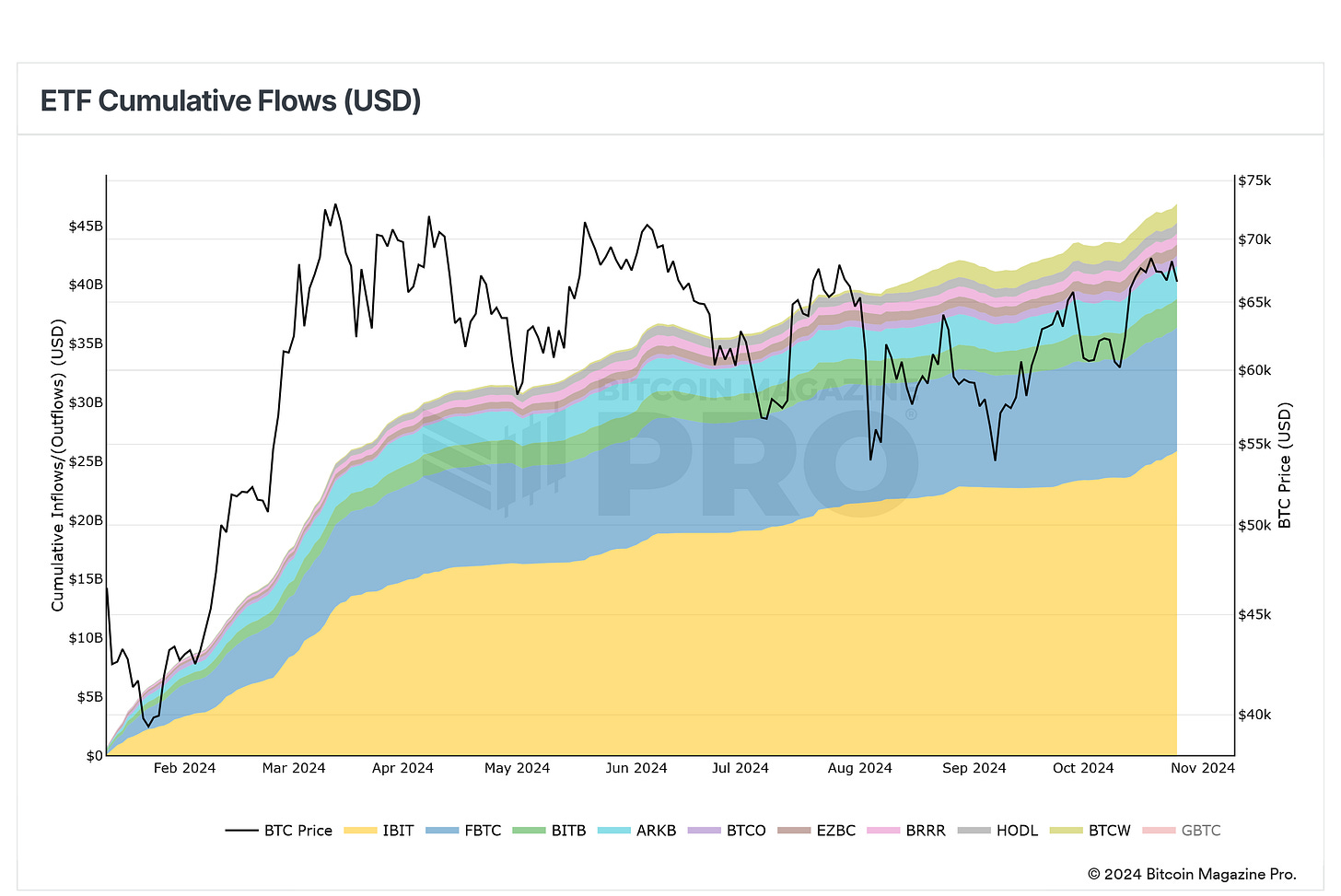

Blackrock’s IBIT continues to be the star performer, with over $25B worth of inflows.

Figure 4: ETF breakdown by individual spot ETF’s.

The long-term trend across the board for spot Bitcoin ETF flows is clearly up.

If Bitcoin price breaks out to new all-time highs we expect this trend to accelerate, which has the potential to have a reflexive impact on Bitcoin price, driving it higher over the coming months.

Key Chart

Each week, our BM Pro Analysts hand-pick a must-see chart for you. This week:

Bitcoin HODL Waves

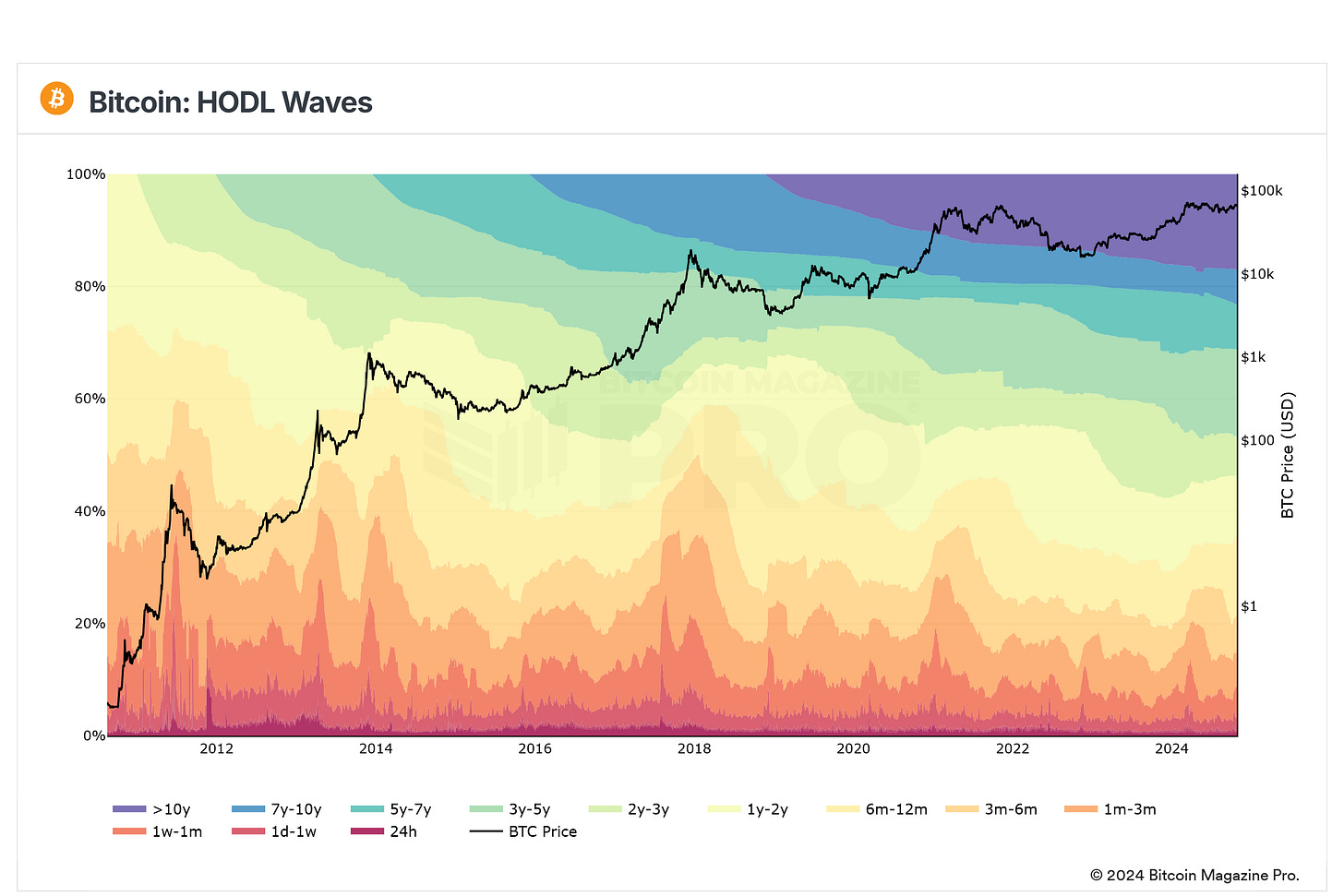

Figure 5: HODL Waves

What it is

Bitcoin HODL Waves visualize the duration of Bitcoin holding by categorizing wallets based on how long coins have remained unmoved.

They use color bands to represent different holding periods, such as under a week (hot colors) to over ten years (cold colors), creating "waves" that show age distribution trends.

Why it matters

Indicates market sentiment: HODL Waves reveal whether investors are holding or selling, helping to gauge current market sentiment.

Shows accumulation patterns: When long-term holding increases, it often signals a belief in future value growth, as investors are reluctant to sell.

Historical price correlation: Changes in HODL patterns have historically aligned with Bitcoin's market cycles, aiding in timing investments.

What it is showing right now

Increased long-term holding: Recently, HODL Waves indicate more coins are sitting idle for extended periods, which could signal strong conviction among holders.

Decreased short-term trading: Fewer coins are moving in the shorter-term bands, suggesting a reduction in speculative trading and possible preparation for a market shift.

This chart is available to view for free on Bitcoin Magazine Pro here. Subscribers can set alerts for this chat and many others. Subscribe here.

The Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to the YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.