Mastering Bitcoin On-Chain Data

Beyond Price Speculation: Unveiling Bitcoin’s On-Chain Dynamics

Bitcoin’s price movements dominate headlines, but the real story of BTC lies beneath the surface. Beyond technical analysis and price speculation, on-chain data offers an unparalleled view of supply, demand, and investor behavior in real time. By leveraging these insights, traders and investors can anticipate market trends, follow institutional movements, and make data-driven decisions.

Realized Price & MVRV Z-Score

On-chain data refers to the publicly available transaction records on Bitcoin’s blockchain. Unlike traditional markets, where investor actions are obscured, Bitcoin’s transparency allows for real-time analysis of every transaction, wallet movement, and network activity. This information helps investors identify major trends, accumulation zones, and potential price inflection points.

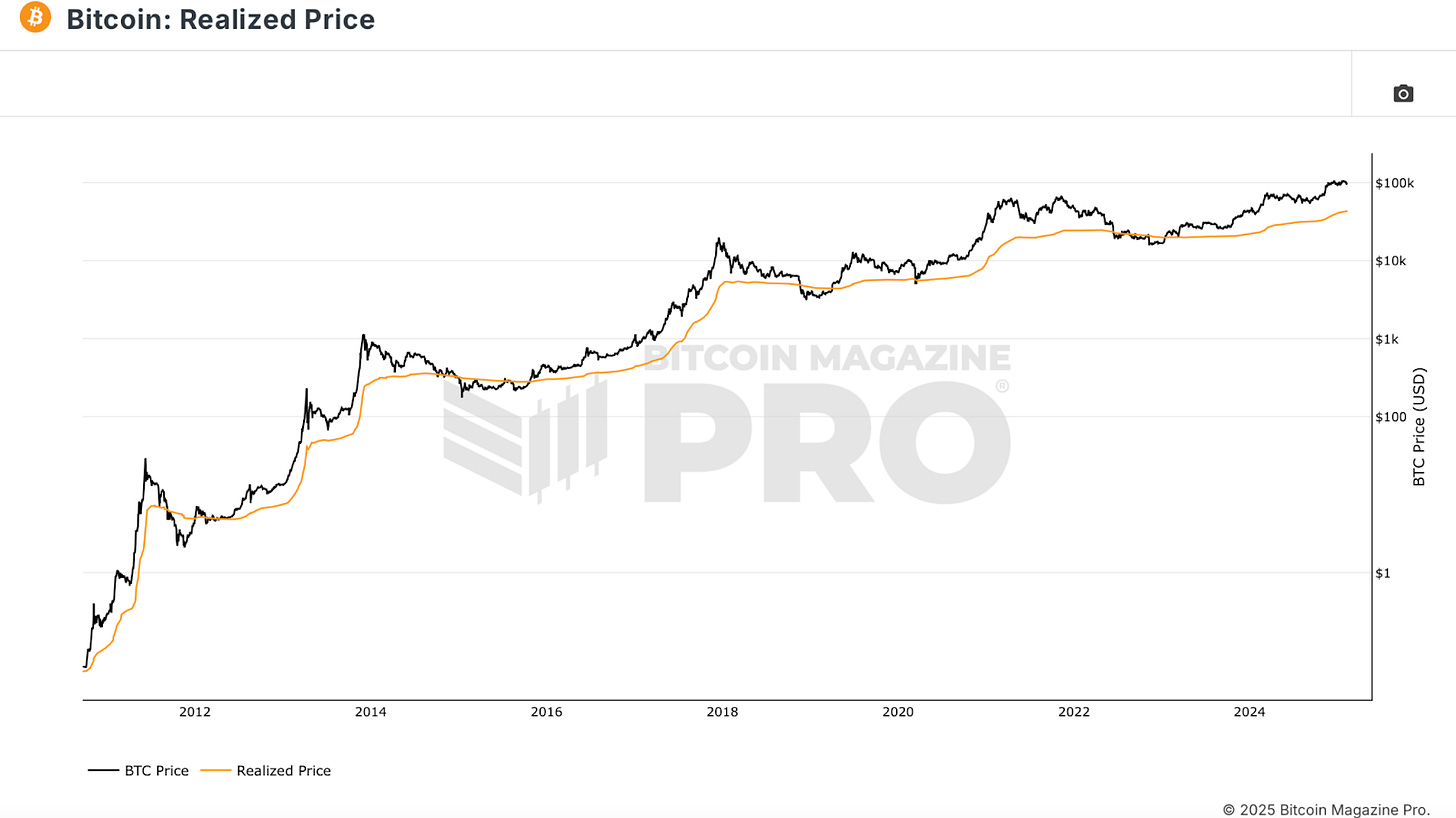

One of the most crucial on-chain metrics is Realized Price, which reflects the average cost basis of all BTC in circulation. Unlike traditional assets, where investor cost bases are difficult to determine, Bitcoin provides real-time visibility into when the majority of holders are in profit or loss.

Figure 1: The Realized Price shows the cost-basis for all BTC on the network.

To enhance the utility of Realized Price, analysts employ the MVRV Z-Score, which measures the deviation between market value and realized value, standardized for Bitcoin’s volatility. This indicator has historically identified optimal buying zones when it enters the lower range and potential overvaluation when it enters the red zone.

Figure 2: MVRV Z-Score has historically identified market tops and bottoms.

Monitoring Long-Term Holders

Another key metric is the 1+ Year HODL Wave, which tracks Bitcoin addresses that haven’t moved funds for at least a year. A rising HODL wave indicates that investors are choosing to hold, reducing circulating supply and creating upward price pressure. Conversely, when this metric starts declining, it suggests profit-taking and potential distribution.

Figure 3: 1+ Year HODL Wave shows the cyclical nature of BTC holders.

HODL Waves visualizes the entire distribution of Bitcoin ownership by age bands. Filtering to new market participants of 3 months or less reveals typical retail participation levels. Peaks in short-term holders typically signal market tops, while low levels indicate ideal accumulation zones.

Figure 4: HODL Waves can show when retail is experiencing FOMO.

Spotting Whale Movements

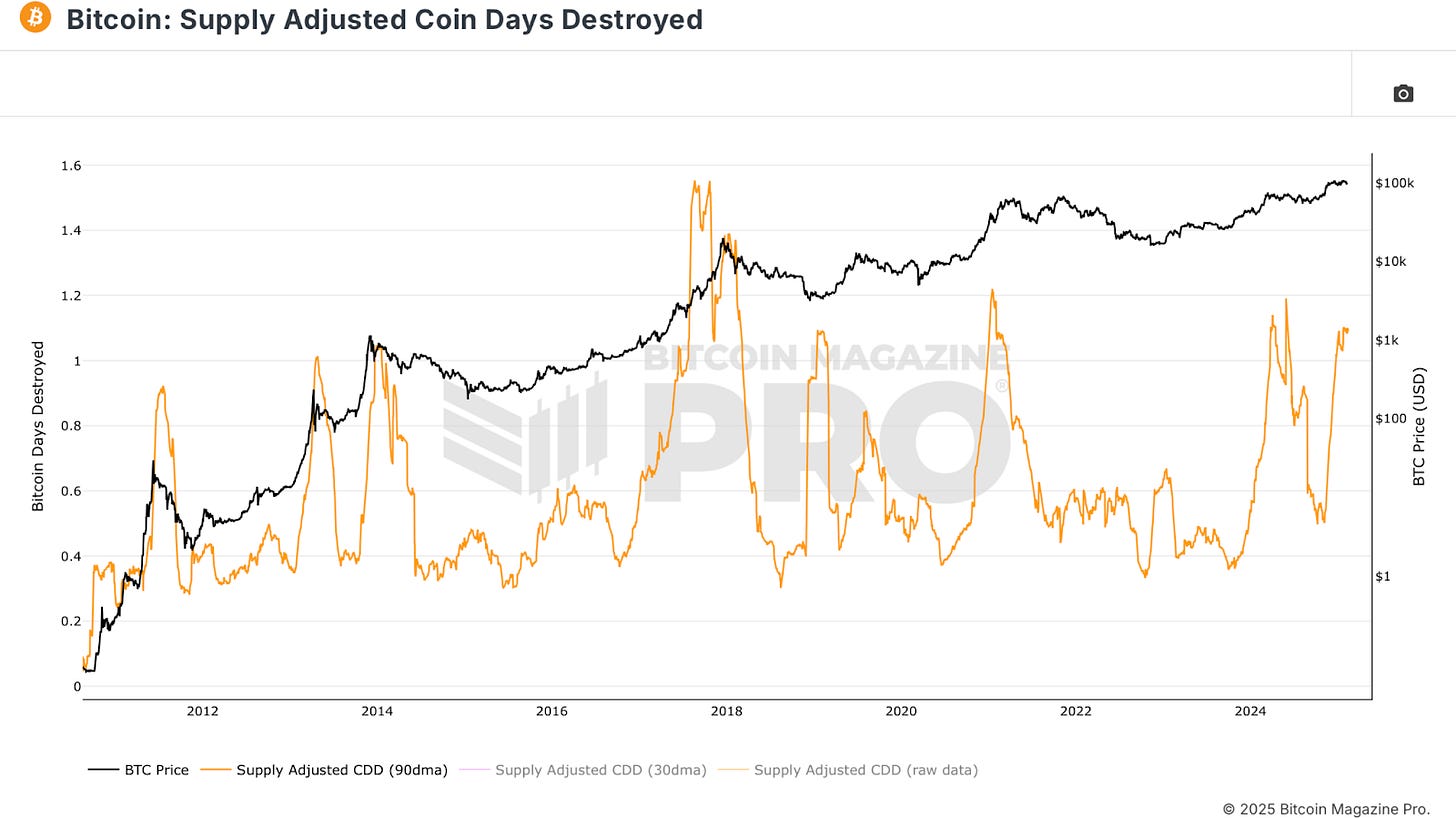

Supply Adjusted Coin Days Destroyed quantifies the total BTC moved, weighted by how long it was held, and standardizes that data by the circulating supply at that time. For example:

1 BTC held for 100 days → 100 Coin Days Destroyed

0.1 BTC held for 1,000 days → 100 Coin Days Destroyed

This metric is invaluable for detecting whale activity and institutional profit-taking. When long-dormant coins suddenly move, it often signals large holders exiting positions. Historical data confirms that spikes in this data point align with major market tops and bottoms, reinforcing its value in cycle analysis.

Figure 5: Supply Adjusted CDD shows the velocity of BTC transactions.

Realized Gains & Losses

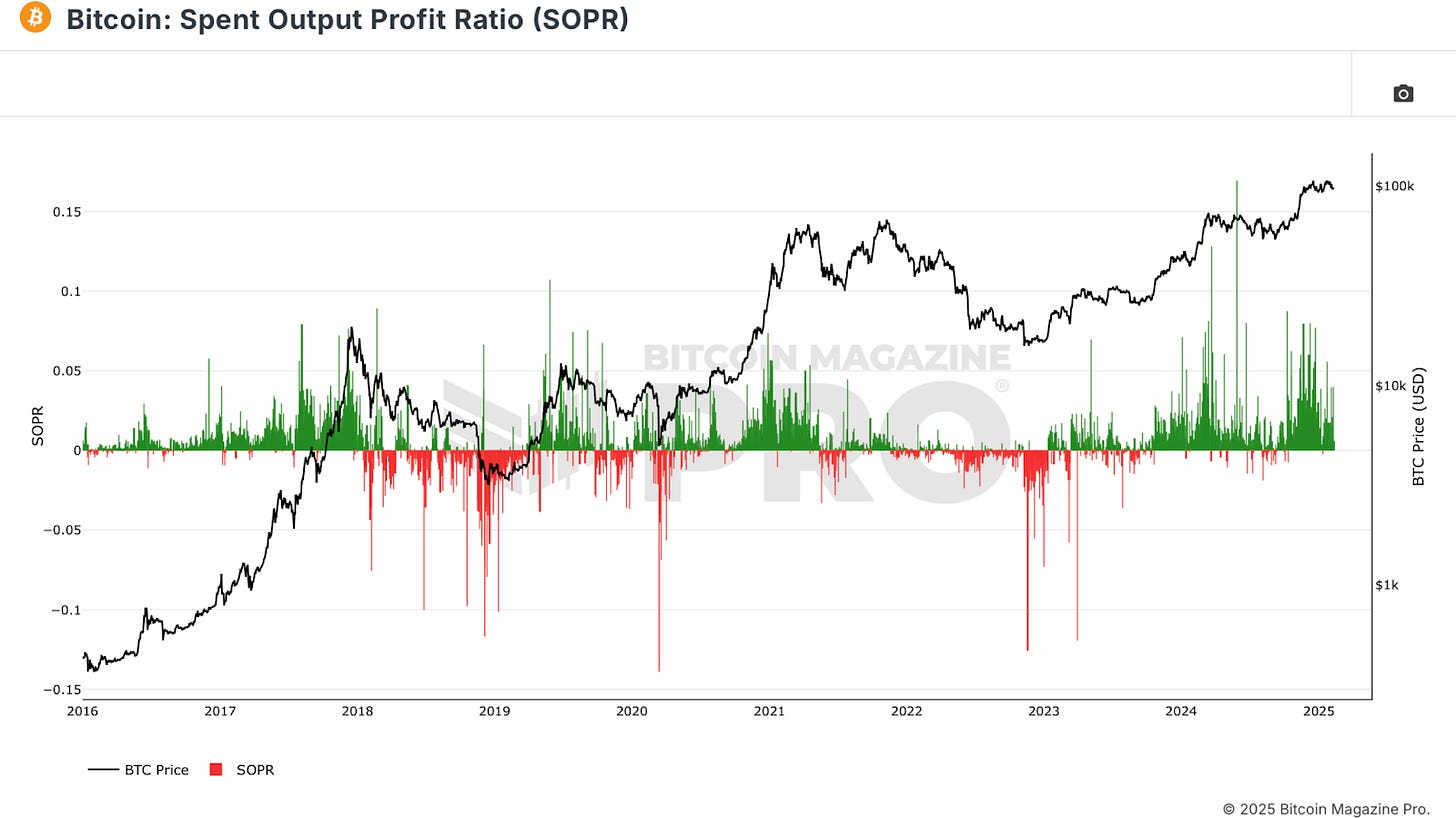

The Spent Output Profit Ratio (SOPR) reveals the profitability of BTC transactions. A SOPR value above 0 indicates that the average Bitcoin being moved is in profit, while a value below 0 means the average sale is at a loss. By observing SOPR spikes, traders can identify euphoric profit-taking, while SOPR declines often accompany bear market capitulations.

Figure 6: SOPR shows the real-time realized euphoria and capitulation.

Relying on a single metric can be misleading. To increase the probability of accurate signals, investors should seek confluence between multiple on-chain indicators.

For example, when:

MVRV Z-score is in the green zone (undervalued)

SOPR indicates high realized losses (capitulation)

HODL waves show a decline in short-term holders (selling exhaustion)

This alignment historically marks optimal accumulation zones. You should also look for confluence for any planned profit-taking for your BTC holdings, looking for the above metrics all signaling the opposite to outline overheated market conditions.

Conclusion

Bitcoin’s on-chain data provides a transparent, real-time view of market dynamics, offering investors an edge in decision-making. By tracking supply trends, investor psychology, and accumulation/distribution cycles, Bitcoiners can better position themselves for long-term success.

For a more in-depth look into this topic, check out a recent YouTube video here:

Mastering Bitcoin On-Chain Data

Matt

Lead Analyst Bitcoin Magazine Pro.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.