Jobs Data: Good News Is Bad News

Unemployment Rate Hits 3.5%

Another day of good news is bad news with the U.S. payrolls data coming in much hotter than expected today. Nonfarm payrolls rose 528,000 for the month of July vs estimates of 250,000. With the latest data, the unemployment rate fell to 3.5% from 3.6%, revisiting lows that the United States hasn’t seen since the 1960s. In response, markets began pricing in slightly higher rate hikes as the Federal Reserve has been adamant on unemployment needing to increase.

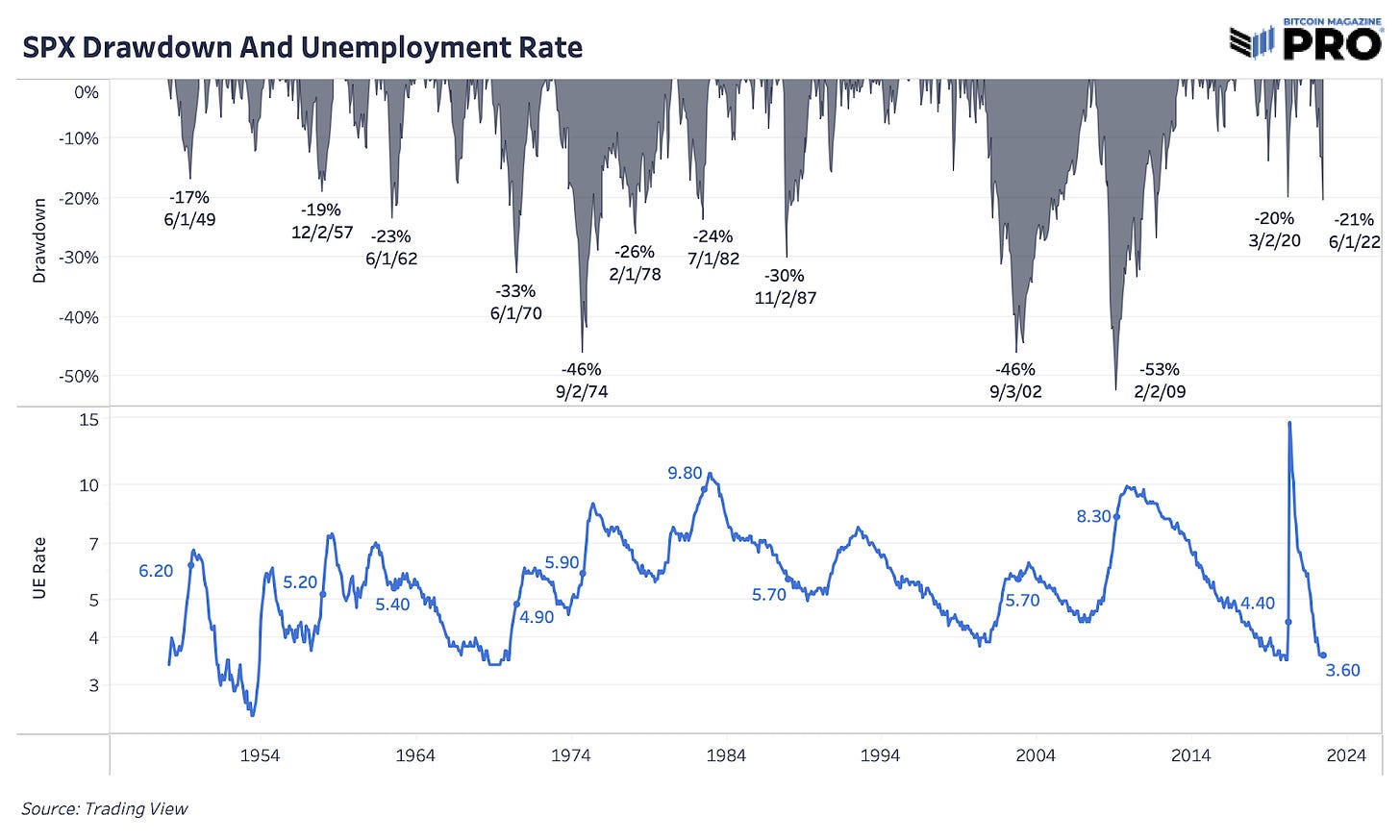

If we exclude the March 2020 pandemic shock event, this would be one of the longest periods of falling unemployment in history, beginning from the peak in 2009. Typically, unemployment follows the economic cycle as a lagging indicator. As equities also follow the economic cycle, it’s rare to see the S&P 500 bottom with unemployment at a cyclical low. There’s many examples since the 1940s of equities bottoming after unemployment rises significantly but before its peak.

It is worth noting however that as the unemployment rate has fallen since 2009, the global labor force is facing structural demographic problems with more of the population leaving the labor market. The U.S. labor force participation rate has been in a secular decline since 2000 and notably has continued to fall past pre-pandemic levels.

This should be taken into account when unemployment numbers continue to hover near record lows.

As mentioned in the opening line of this issue, the terms of the current monetary policy regime mean “good news is bad news, and vise versa” as implied Fed Funds futures for June 2023 jumped over 25 bp during today’s trading session, pricing in another full rate hike based on the strong employment numbers.

In pursuit of their dual mandate of full employment and stable prices (actually meaning slowly rising prices), the Fed is embarking on a monetary tightening cycle to kill inflation. They have implicitly stated that their way of accomplishing such a task will be by creating labor market slack and lowering asset prices.

Similarly, as addressed in our latest July Monthly Report, an inverted chart of the U.S. NAHB Housing Market Index and the U.S. unemployment rate with an 18-month lag has a very tight correlation historically.

If history is any precedent, the cracks beginning to appear in the U.S. housing market will likely lead materially to a turn over in the labor market over the next 12-18 months

Yield Curve Flattens to 22-Year Lows

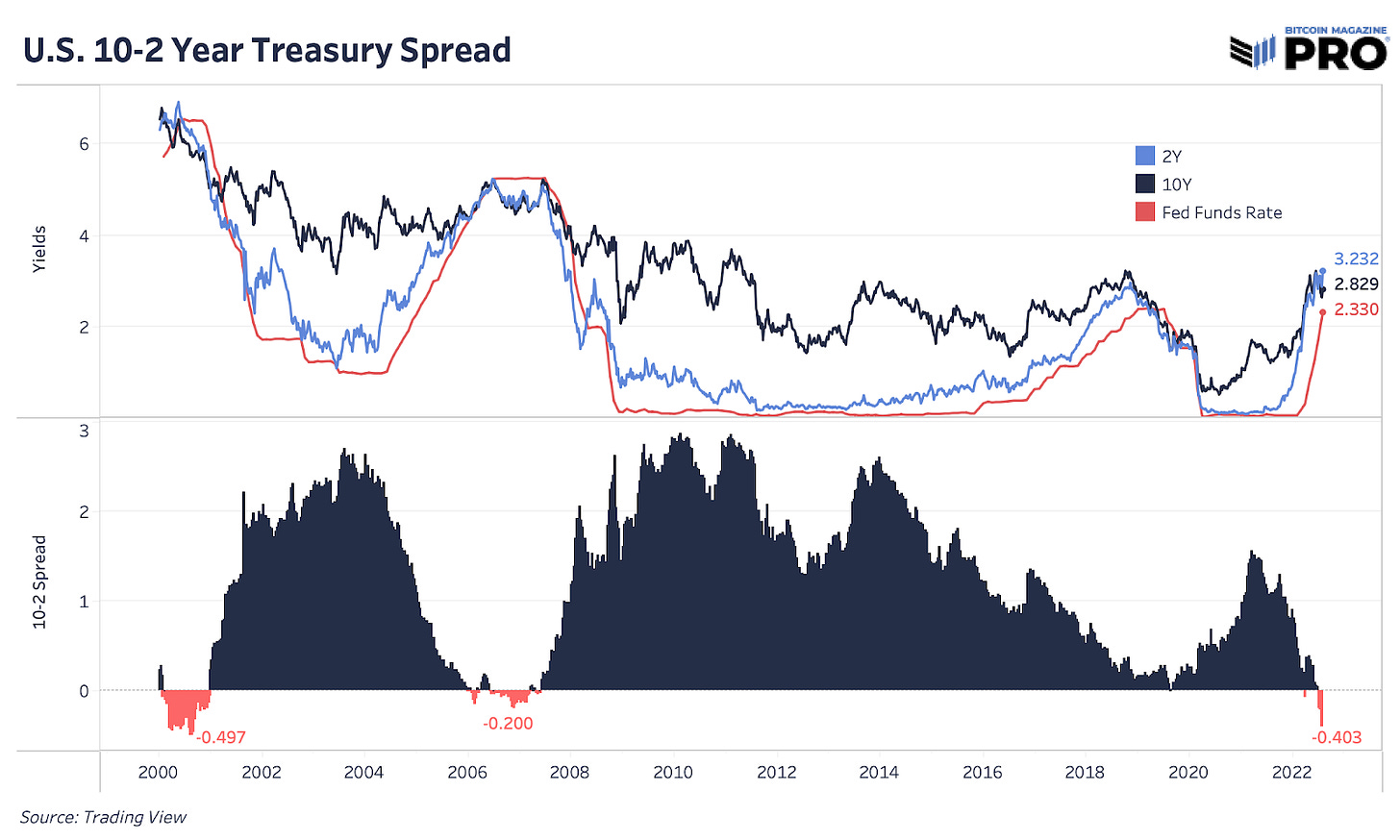

The difference between 10y and 2y Treasury yields in the United States bond market fell to a two decades low today. The difference between the two debt instruments’ yields has a near-perfect record of predating U.S. economic recessions and, more broadly, economic slowdowns.

This is partially due to the fact that the 10-year yield prices in long-term structural dynamics while the two-year prices in the short-term Fed Fed Funds rate and inflationary dynamics. As the Federal Reserve continues to hike interest rates in the near term, the long end of the curve begins to sniff out the structural issues with the public and private debt burdens that currently exist and falls in anticipation of a deflationary shock.

We suspect that in the coming 2-4 quarters, the tight labor market and booming economy (in nominal, not real terms) is likely to deteriorate significantly, leading to a pivot in policy that likely won’t immediately result in roaring asset prices and a booming economy.

As shown in the two previous hike cycles, the bond market (more specifically, the yields present in thereof) dictates the policy decisions of the Federal Reserve and as the economic landscape begins to materially deteriorate, yields will fall below the Fed’s policy rate in anticipation of a not-so-soft landing.

In regards to the yield curve, the historically tight labor market, dollar strength or asset prices, we suspect that this time is not, in fact, different. These signs lead us to the conclusion that financial markets will be subject to an increasing amount of weakness across these conditions.

IYCMI: The July Monthly Report - Long Live Macro