Is Bitcoin's Market Correction Peaking?

A look at on-chain data, price trends, derivatives insights, and global economic indicators as we approach the critical halving event.

Introduction

As we've observed since the launch of the recent spot ETF, the Bitcoin market experienced an intense heat-up, necessitating a period of correction and consolidation to stabilize from speculative excess. Today, we discuss the nuances of this adjustment phase, signaling what appears to be a climax in the market's correction. This analysis not only elucidates the current state of affairs following the ETF-induced fervor but also forecasts the potential paths ahead as we edge closer to critical events like Bitcoin's halving.

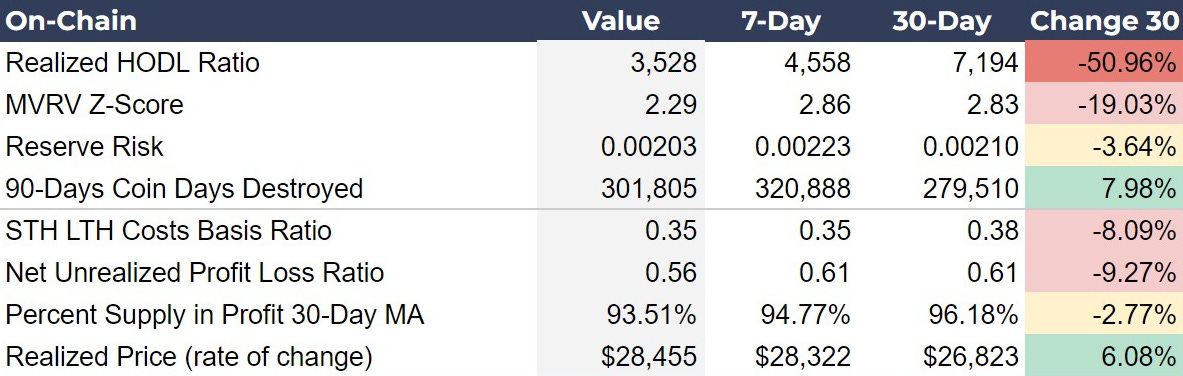

On-Chain Data Summary

The on-chain data for Bitcoin indicates increased market activity and movement of older coins, alongside a slight decrease in long-term holder confidence and profit margins, suggesting a period of market adjustment and potential volatility.

Realized HODL Ratio’s sharp decrease suggests a lower conviction in holding Bitcoin, indicating that older coins are moving, which can imply selling pressure or redistribution.

MVRV Z-Score, which measures market value against realized value, declined slightly implying that Bitcoin is cooling off after a possibly overheated market. This matches our previous forecasts.

Reserve Risk decreased marginally to 0.00200 from 0.00214. This suggests that the conviction of long-term holders has weakened slightly.

90-Days Coin Days Destroyed increased to 319,196 from 280,815 over 30 days, but has decreased slightly week-over-week, indicating that older coins, previously dormant, are still moving, but the early flush has subsided somewhat. This is consistent with distribution in a bull market correction.

STH LTH Costs Basis Ratio shows a slight decrease from 0.38 to 0.35 suggesting that the cost basis of short-term holders relative to long-term holders is decreasing. This indicates net short-term selling relative to buying, and signals a bottoming process in any correction.

Investor Insights

Realized HODL Ratio & 90-Days Coin Days Destroyed (CDD): The significant movement of older coins combined with a sharp drop in the Realized HODL Ratio on the month suggests heightened selling pressure distribution. However, the slowing in the Realized HODL and the shift in the CDD over the last 7 days tell us this pressure is waning.

MVRV Z-Score & Reserve Risk: The behavior of these two indicators are typical results of a correction. They do not outright point to lower prices in the near term, but a medium term return to the bullish trend.

Halving Countdown: The final moves of this correction phase could be exacerbated by uncertainty surrounding the halving and geopolitical stress. Expect a bottom to be founded as this uncertainty is cured by the halving itself.

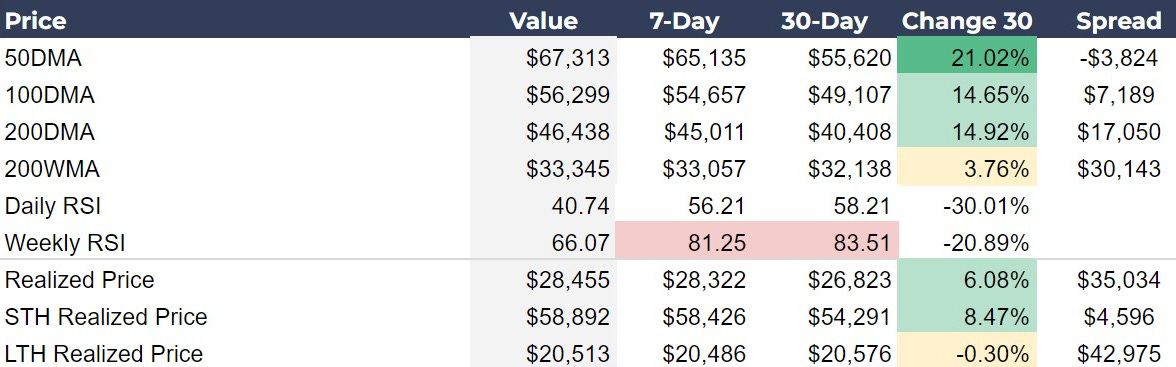

Bitcoin Price Trends and Reversals

The data shows a robust upward trend in Bitcoin's short to medium-term moving averages, with significant increases in the 50-day and 100-day. However, the recent drop of the spot price below the 50DMA suggests a potential short-term reversal and warrants a cautious approach to recognizing the bottom of the correction.

The 50 DMA serving as a technical support or resistance point that the spot price has now fallen below suggests a potential short-term trend reversal. While the 50DMA showed a substantial increase indicating strong upward momentum previously, the current price dropping below this average signals that the bullish momentum is weakening.

RSI Implications: The previously noted need to cool off the Weekly RSI prior to the next leg higher has now been met, dropping below 70. Daily RSI in the lower half of the RSI channel could mean we will continue to sell off until it hits oversold at 30, but that is still an outside chance.

Realized Prices: The overall Realized Price has increased modestly by 6.08%, from $26,823 to $28,455, suggesting a steady bull market increase. The Short-Term Holder (STH) Realized Price also rose by 8.47%, from $54,291 to $58,892, for us indicating the weak-hand level we don’t want the price to breach.

Investor Insights

Importance of the 50 DMA: While breaching the 50 DMA is usually interpreted as a trend reversal, in this specific scenario, it could be a bear trap before a post-halving rally. That is the very near-term level to watch closely. A close back above the 50-day should be the beginning of a return to significant bullish momentum.

No-Man’s Land Between STH Realized Price and 50-day: While we watch price in relation to the 50-day over the coming week, the STH Realized Price is also of extreme importance. That is the average level short-term holders have acquired their bitcoin. If price dips below that level, STHs who tend to be holders of less conviction could start liquidating their coins. That creates a very important window between these two metrics that will dictate the price action for the next couple of months.

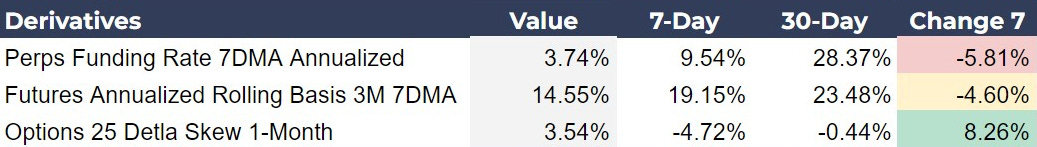

Derivatives Market Data Summary

This dataset provides insights into the derivatives market for Bitcoin, focusing on perps (perpetual contracts), futures, and options. Here’s a detailed examination of the changes over 7-day and 30-day periods:

Perps Funding Rate 7DMA Annualized: The perps funding rate, currently at 3.74%, has seen a sharp decline from 28.37% over the past 30 days, and a decrease of 5.81% from the previous week. This significant reduction means that the cost to hold long positions in perpetual futures contracts has become markedly cheaper, indicating a big reduction in overheated conditions and leverage in the market.

Futures Annualized Rolling Basis 3M 7DMA: The three-month rolling basis for futures stands at 14.55%, down from 23.48% over the past month, with a weekly decline of 4.60%. This trend again means a cooling off in the extreme bullish expectations about $100k before halving.

Options 25 Delta Skew 1-Month: The one-month 25 delta skew has shifted significantly, moving to 3.54% from a negative -0.44% over the last 30 days and showing a notable 8.26% increase from last week’s -4.72%. This change indicates a swing in option traders’ sentiment from bearish to bullish. The shift from negative to positive means options traders are perceiving the risk changing to the upside, and are hedging price rises.

Investor Insights

Reduced Leverage Indicators: The substantial drop in perps funding rates and futures basis suggests a pullback in leveraged positions and speculative bullishness. Investors have become more cautious of further declines becoming more balanced to face increased volatility. This could potentially limit big downside liquidations.

Options Market Sentiment Shift: The positive swing in the 25 Delta Skew highlights a bottom in options trader sentiment, suggesting that despite the cooling in leverage-driven markets, there remains a segment that is positioning for upside.

Macro and Geopolitical Risk

The recent sell-off in reaction to news out of the Middle East has some investors questioning Bitcoin’s safe haven status. However, several key aspects must be considered. First, the sell-off happened over the weekend when other assets were unable to be traded. This means that Bitcoin is the King of Liquidity on the weekends. If investors need to access cash to derisk their portfolios a little, Bitcoin is the only option they have in that case. It is a great thing that Bitcoin is becoming a valuable tool for that kind of market need. Second, Bitcoin is up 59% on the year. While the very short-term volatility is driven by Bitcoin’s outstanding liquidity characteristics, in the medium-term bitcoin is proving its safe haven potential.

Global M2 Money Supply YoY: There's a year-over-year decrease of 0.49% in the global M2 money supply, with a continuous contraction over the past month. This suggests deteriorating economic conditions globally, which could reduce the amount of free-flowing capital available for investment in assets like Bitcoin, but at the same time make Bitcoin’s added liquidity properties more attractive.

DXY YoY (U.S. Dollar Index): The DXY has increased by 4.36% year-over-year, signifying a stronger dollar relative to a basket of the largest currencies. However, it is down drastically against safe havens like bitcoin and gold. A strengthening dollar typically indicates risk-off sentiment that does not favor inflation hedges like Bitcoin. In this case, with other currencies like the Japanese Yen (JPY) and Euro (EUR) crashing against the dollar, this signifies a growing dollar shortage to meet financing and liquidity needs, a recession signal.

Bitcoin is also a global money, so its performance relative to the depreciating currencies is part of the equation. Bitcoin is a hedge against inflation and deflation at the same time depending where you live..

Investor Insights

Macro Uncertainty: The macroeconomic data presents a complex picture; while the ISM PMI indicates underlying economic strength, significant contractions in global M2 and central bank assets, coupled with heightened market volatility (VIX), point to an uncertain landscape moving into the summer, fitting out forecast for recession starting the US later this year.

Bitcoin Macro Certainty: Investors can not help but notice the glaring difference between the uncertainties of tradfi macro metrics and the certainties of Bitcoin, such as its global 24/7/365 trading hours and the upcoming halving event, which ensures predictable issuance.

Chart(s) of the Day

Today, I wanted to show and briefly discuss some USD currency pairs. The JPY is hitting multi-decade lows as we speak and the EUR is also approaching parity again at 1.06 currently. This represents very weak economic activity in these currency areas. With low economic activity, there is less need for that currency. It also creates a painful USD shortage as much debt in the world is denominated in USD. This puts even more downward pressure on the currency as they sell it to get USD.

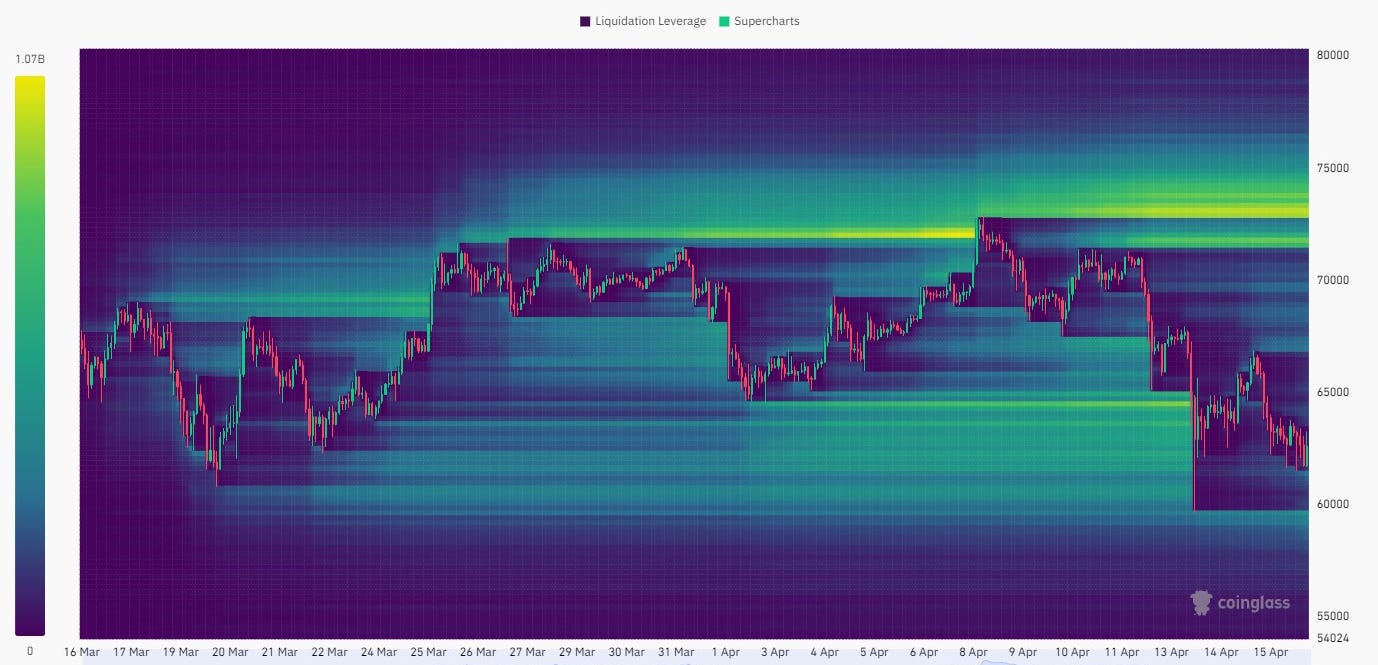

The second chart of the day is the Bitcoin Futures Heat Map, showing the levels where futures positions will get liquidated. Price tends to move toward liquidity and here that is the glaring yellow above the price at roughly $73,000. Notice, below the price there are few liquidations to add fuel to any price dip.

Source: Coinglass

Conclusion

In conclusion, our analysis of on-chain data, price trends, derivatives markets, and macroeconomic factors underscores a crucial correction and consolidation phase in the Bitcoin market. As we approach the halving and face economic uncertainties, Bitcoin's unique features like predictable issuance and global access continue to affirm its resilience. These insights help investors navigate the evolving market with informed strategies.

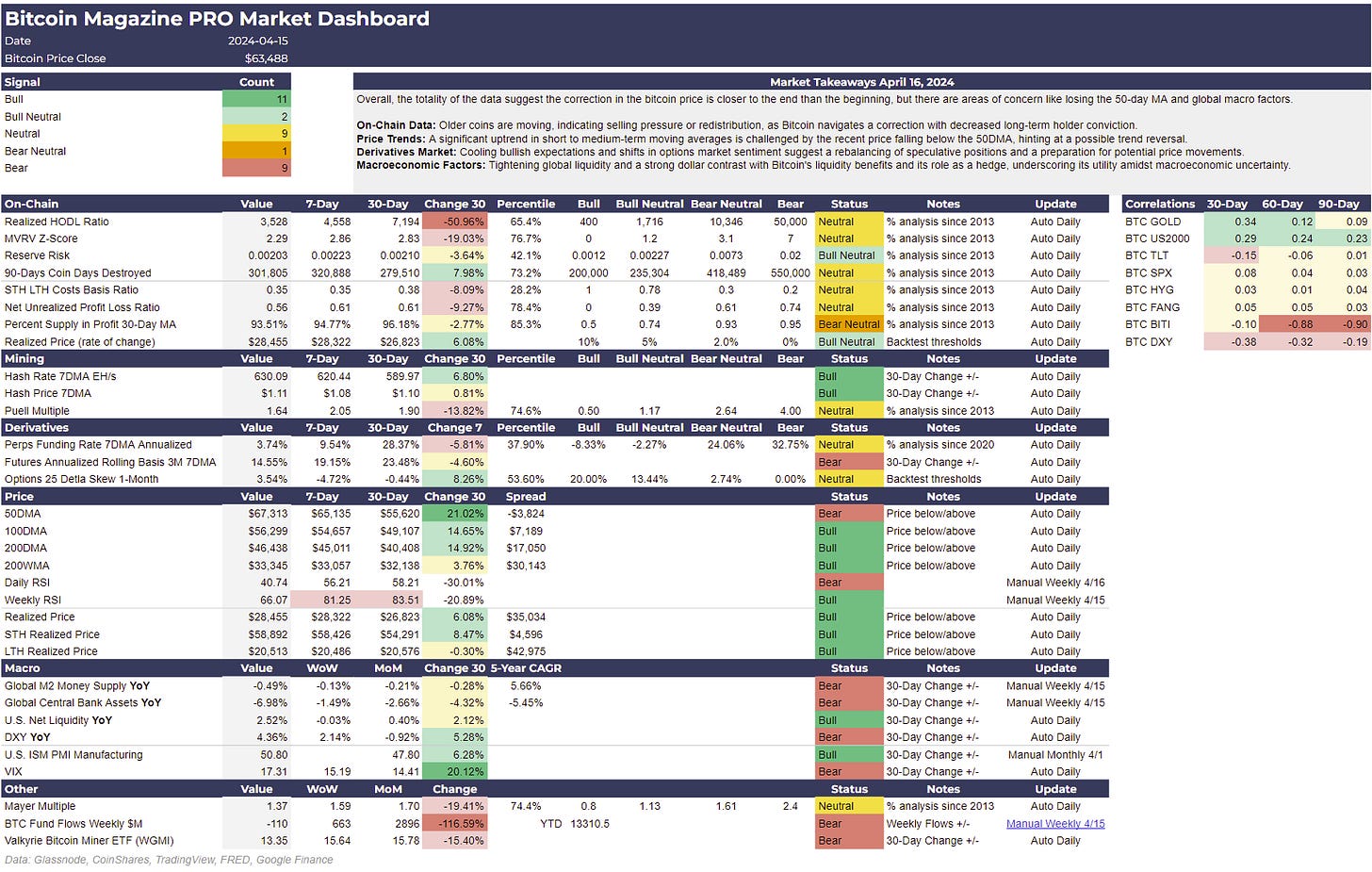

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

THE BIGGEST CELEBRATION IN BITCOIN

THE BITCOIN HALVING LIVESTREAM BEGINS AT BLOCK HEIGHT 839,979 ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!