Institutional Accumulation Amid Long-Term Holder Selling

Data shows Bitcoin’s downturn stemmed from historic long-term holder selling, not institutional manipulation—ETFs absorbed less than 10% of supply.

Bitcoin’s underwhelming price performance throughout 2025 has generated conspiratorial narratives about institutional manipulation and price suppression through centralized custodians. Yet the data reveals a far more straightforward explanation: supply and demand economics. Over one-third of all Bitcoin in existence was cumulatively distributed by long-term holders throughout this cycle, creating such massive selling pressure that Bitcoin was always going to struggle.

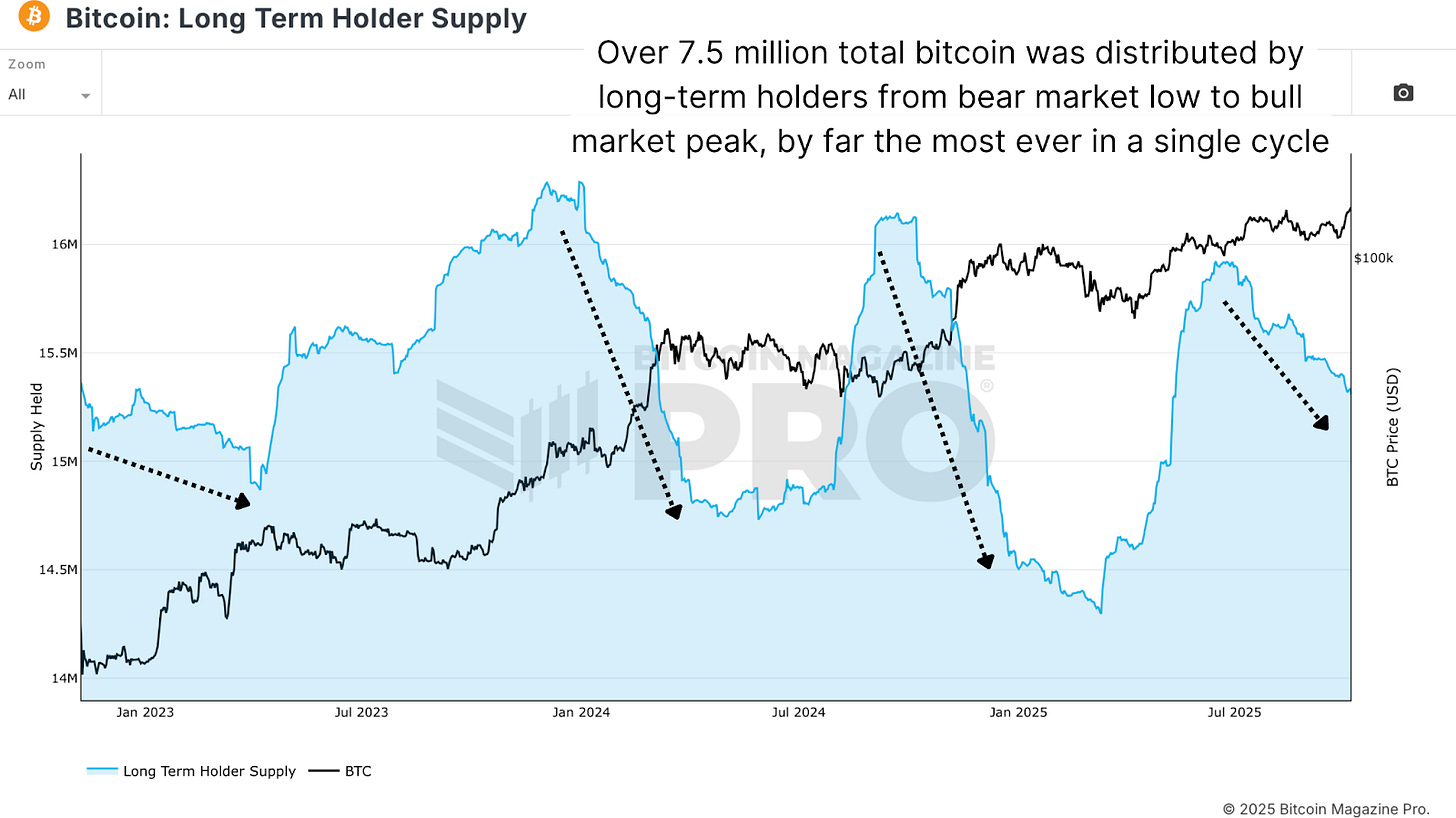

Long-Term Holder Distribution

The Long-Term Holder Supply chart shows that, cumulatively from the cycle lows to the October 6th peak, long-term holders distributed approximately 7.5 million Bitcoin. This represents an unprecedented flush of supply onto open markets, far exceeding what any institutional buyer could reasonably absorb without exponential price appreciation.

Figure 1: From the bear market low to the October peak, cumulative distribution from long-term holders reached approximately 7.5 million BTC.

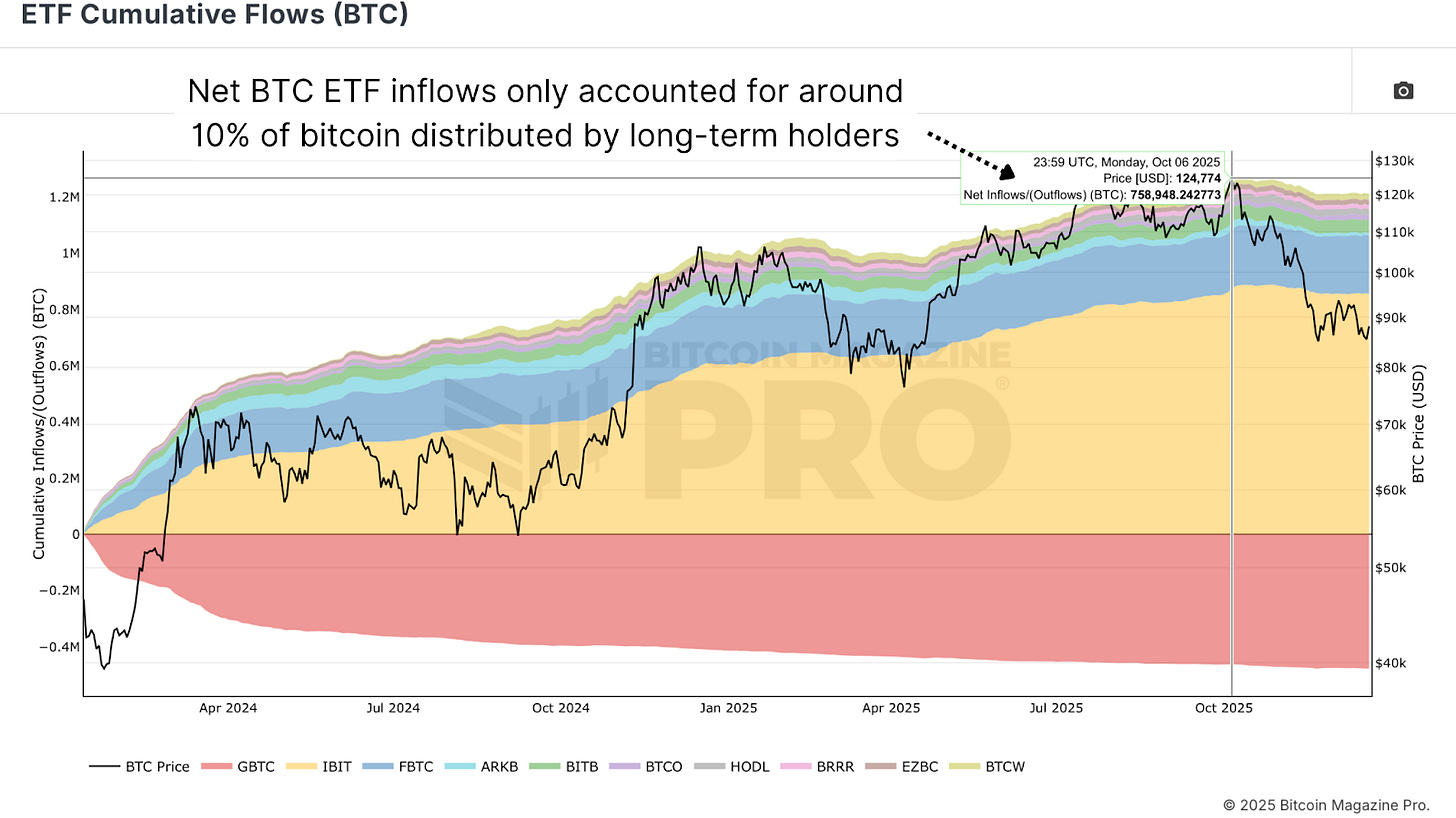

For comparative context, net Bitcoin ETF Cumulative Flows since approval total only around 700,000 Bitcoin (though gross holdings exceed 1.2 million, with many representing Grayscale GBTC transfers). Public Bitcoin Treasury Companies have accumulated roughly 1 million Bitcoin. Even combining all institutional channels, these accumulations represent only ~25% of the long-term holder distribution, meaning the vast majority of this supply found buyers among retail participants.

Figure 2: At around 700,000 BTC, net cumulative ETF inflows account for less than 10% of the bitcoin distributed by long-term holders.

Institutional “Manipulation”

The conspiracy narrative that institutions deliberately suppressed Bitcoin to accumulate at lower prices collapses under scrutiny. If institutions were controlling the market, they would have needed to absorb all 7.5 million distributed Bitcoin while simultaneously pushing prices lower, an economic impossibility. Instead, the data shows something far more benign: institutions have been consistent accumulators despite falling prices, while retail-driven selling pressure has dominated.

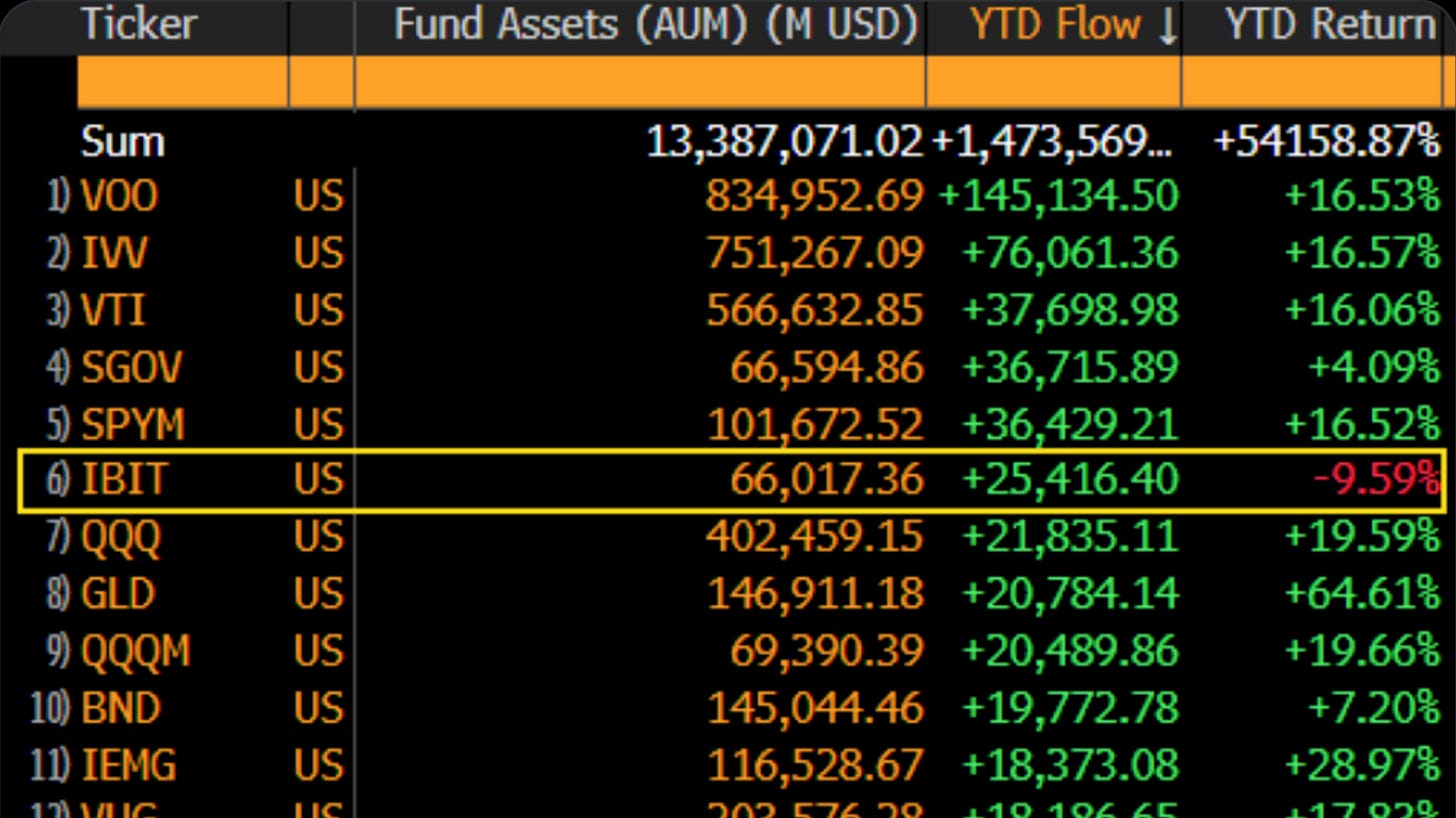

Figure 3: In BlackRock ETF inflow terms, their iShares Bitcoin Trust (IBIT) ETF out-ranks the Nasdaq (QQQ) and Gold (GLD).

BlackRock’s iShares Bitcoin Trust (IBIT) ETF provides telling evidence. According to BlackRock’s leaderboard data, IBIT ranked sixth in total inflows among all ETFs on the platform, ahead of the Nasdaq (QQQ) and even Gold (GLD). This occurred despite Bitcoin declining for the year while all other funds saw positive returns.

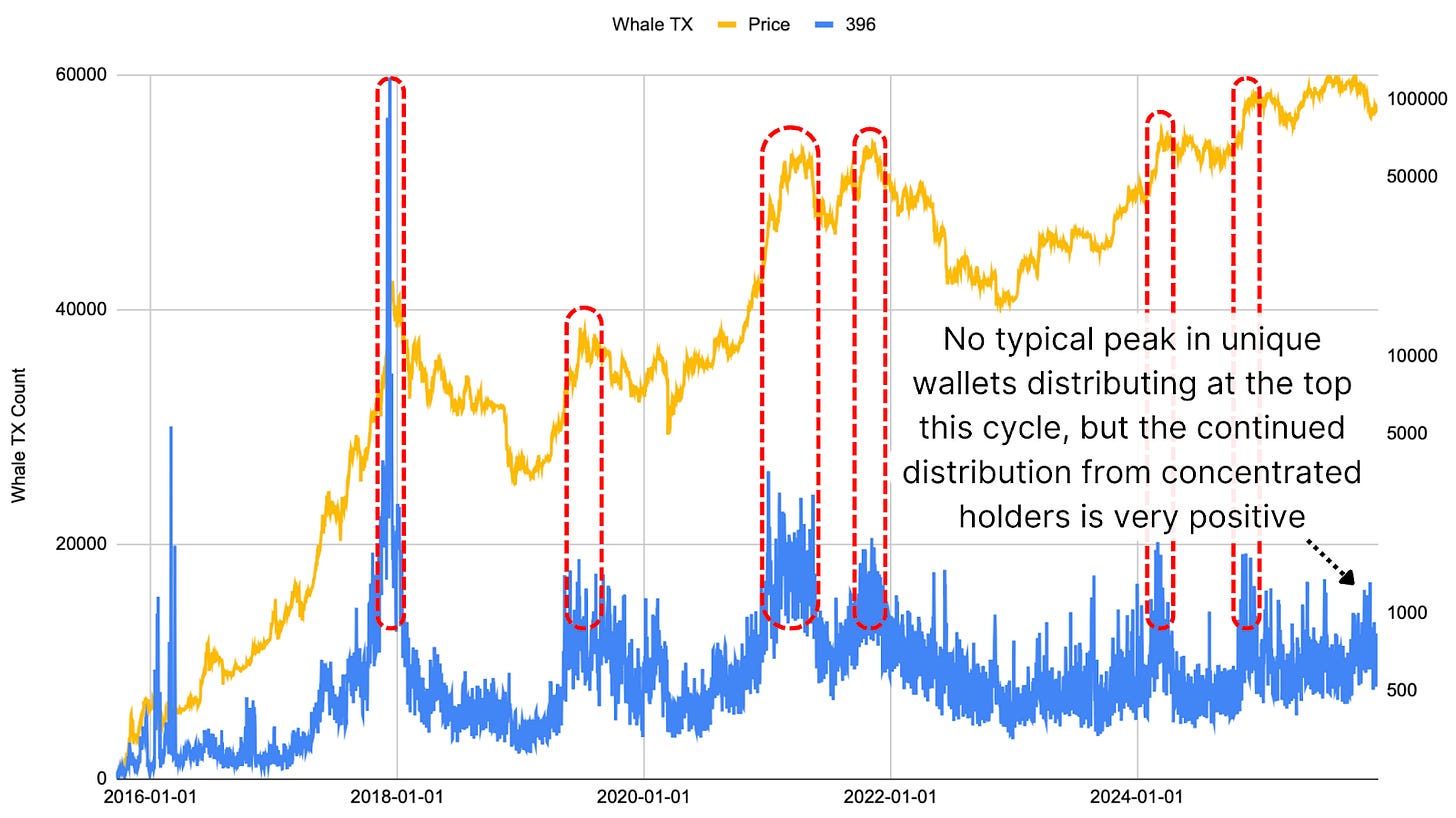

Whale Concentration

Despite massive volumes of Bitcoin being transferred, these distributions originated from relatively few participants. This concentration has been decreasing over time, a genuinely positive development for Bitcoin’s decentralization. Rather than a small number of OG whales controlling a large percentage of the supply and threatening price control if only a few decide to sell, Bitcoin now sees distribution across hundreds of thousands more holders. This requires significantly broader consensus to create equivalent supply pressure, reducing the risk that a few concentrated holders can dictate market movements.

Figure 4: Fewer whales distributing at the cycle peak, and the dilution of whales generally can only be positive for the market structure.

Conclusion

Bitcoin’s 2025 performance reflects straightforward supply-and-demand mechanics, not institutional manipulation. Vast volumes of Bitcoin hit markets as long-term holders took profits, as liquidity like never before flowed into the market. As a result, the asset’s distribution improved materially as it transitioned away from whale-concentrated holdings. This is precisely the evolution required for Bitcoin to function as intended, as a decentralized, difficult-to-manipulate monetary asset serving as a store of value and medium of exchange.

For a more in-depth look into this topic, watch our most recent YouTube video here: Institutions Manipulating Bitcoin? [Hint: No & It’s Bullish]

Matt Crosby

Director of Research & Analytics - Bitcoin Magazine Pro

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else.

We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.