Inflation: Enemy Number One

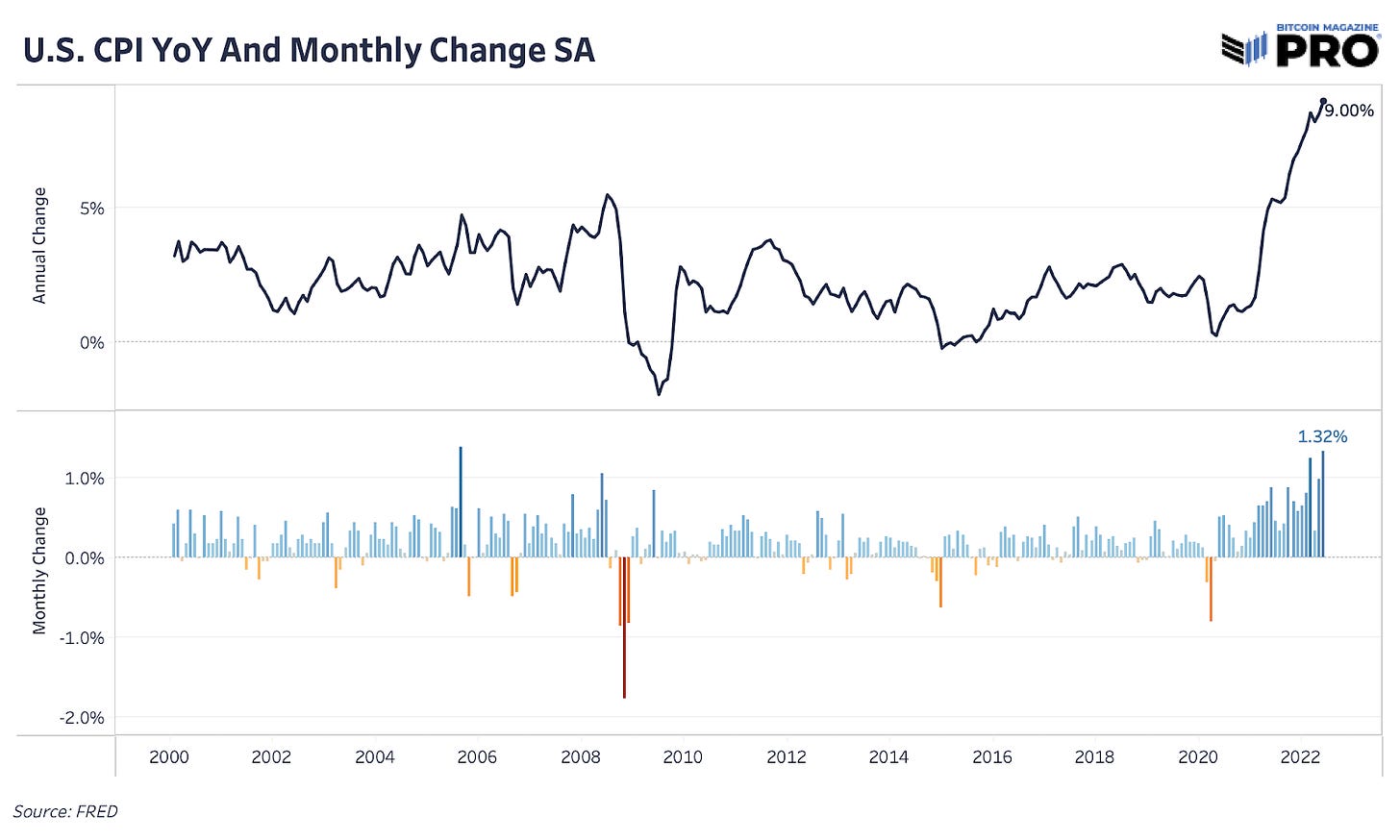

Both U.S. CPI and Core CPI with historic month-over-month acceleration. Bitcoin is not an inflation hedge; it’s a monetary debasement hedge.

Accelerated Inflation, Higher Rate Hikes

The U.S. Consumer Price Index (CPI) release for June this morning smashed through consensus coming in at a 9.1% non-seasonally adjusted annual change versus expectations of 8.8%. What’s more important is that the monthly change of both total CPI and Core CPI (less food and energy) showed significant acceleration, some of the largest over the last 20 years.

There’s no hiding behind the 41.6% annual change in energy as the main culprit. The Atlanta Federal Reverse’s core sticky price CPI (measuring a weighted basket of items that change slowly) accelerated to a one-month annualized rate of 7.9%.

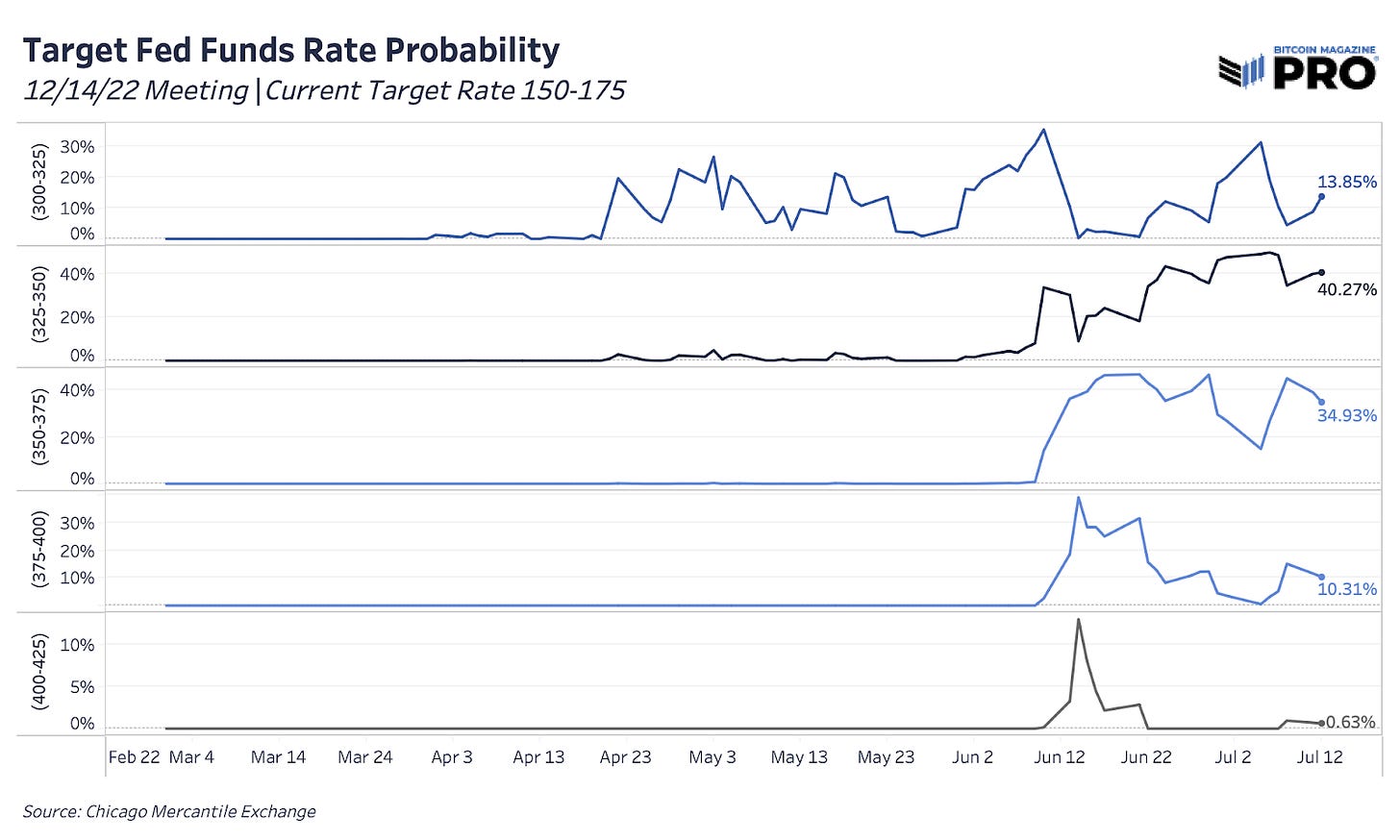

This is not what the Federal Reserve wants to see and the market quickly went to pricing in nearly a 50% chance of a 100 bps rate hike for the upcoming July 27 Federal Open Market Committee (FOMC) meeting.

The new CPI print further pushes end-of-year market expectations for the federal funds target rate higher. The most probable scenario currently prices in 175 bps hikes across the next four meetings. With a 75 or 100 bps hike slated for this month, the market is expecting rate hike increases to slow.

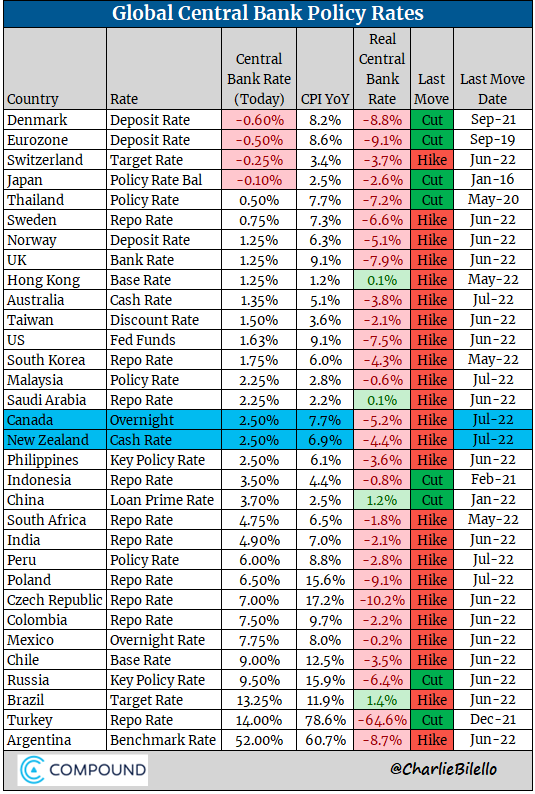

Inflation Is Global

If you think the United States’ inflation rate is high, then just take a look at inflation rates across major G20 regions. Elevated inflation continues to be a global problem and there’s only a few countries who have been able to avoid it. Other non-G20 countries are in much worse shape. Nearly 20% of countries in the world are facing 15% or more inflation while 35% are facing 10% or more inflation. Even a 5% inflation rate is abnormally high and that covers 74% of countries.

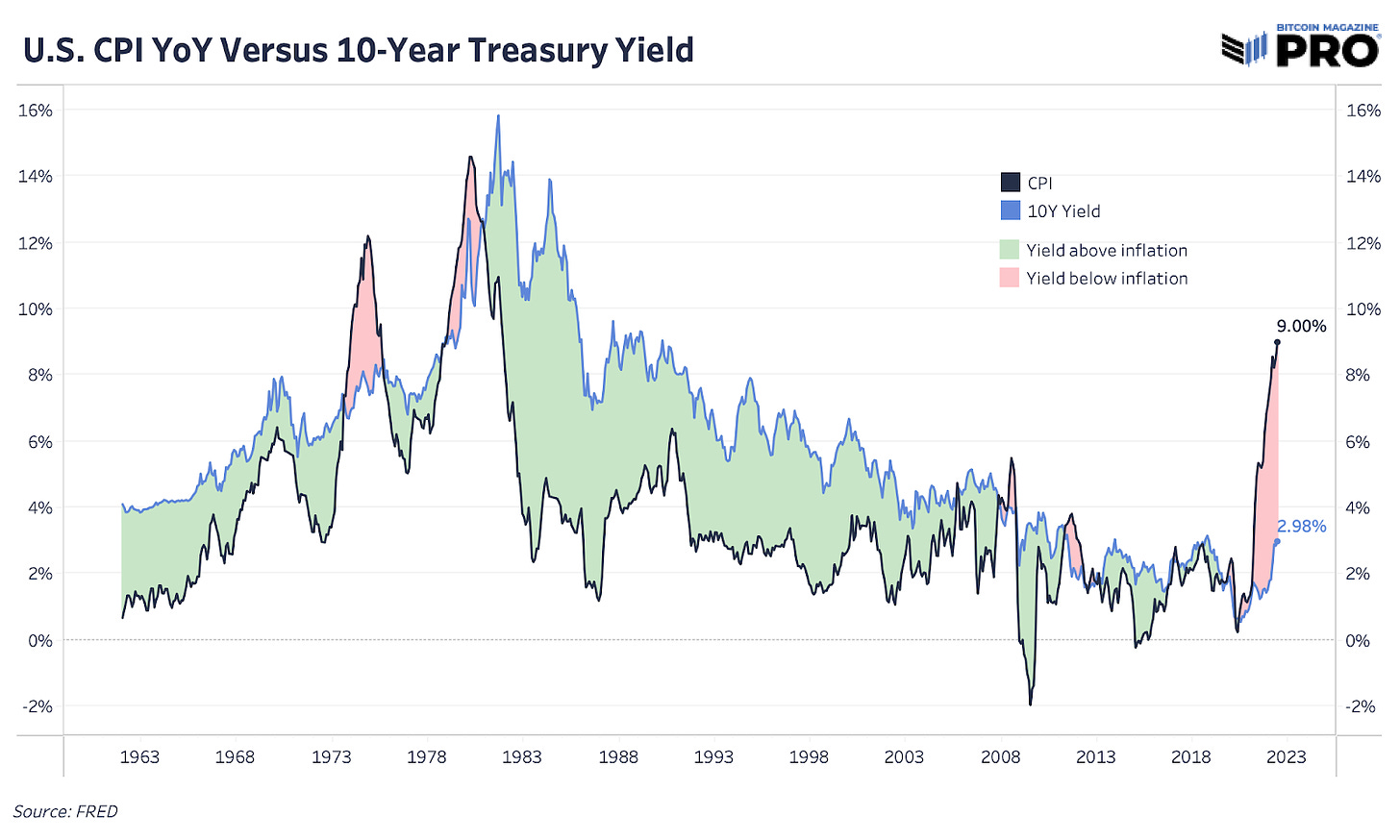

Central Banks Behind The Curve

Even with the United States’ latest aggressive moves in rate hikes, central banks around the world are seeing some of the largest historical gaps in key target rates and inflation. Even despite the rampant inflation over the last year, the European Central Bank still maintains a negative deposit rate. They are expected this month to rate hike for the first time in 11 years.

Source: Charlie Bilello

Bitcoin Is Not An Inflation Hedge

In our view, bitcoin acts as the hedge against perpetual monetary debasement and has never performed well as a classic CPI “inflation hedge,” especially in a bear market. However, demand for bitcoin as an inflation hedge is a different argument in countries that are experiencing higher inflation relative to bitcoin’s recent depreciation. In this scenario, stablecoins and increased access to U.S. dollars will also thrive.

Higher inflation in today’s market environment is worse news for any risk asset. It not only works to destroy consumer sentiment and erode purchasing power but also brings forth a wave of monetary tightening actions that drain market liquidity.

It’s the response and actions post these events that make the case for owning bitcoin.

It’s the forced reversal of monetary policy to maintain adequate liquidity to avoid markets freezing up.

It’s the pinning of government debt interest rates at low levels to spur economic growth and manage unsustainable debt-to-GDP positions alongside rising interest payments.

It’s the increased possibility of gas rebates, food subsidies and various fiscal policies that shift the economic landscape to a more UBI-centric approach.

It’s the rollout of central bank digital currencies (CBDCs) that increases the capabilities of centralized economic engineering.

Immediate Bitcoin Price Action

Following the release of the CPI data at 8:30am EST, the price of bitcoin whipsawed from a high of above $20,000 to below $19,000 within a 15-minute time span, as derivative traders forcefully closed positions and then speculated on further downside with short bets.

Shown below is the bitcoin price and aggregate stablecoin margined (bitcoin derivative contracts using stablecoins as collateral) leading up to the CPI print to the time of writing. It is important to remember that for every unit of open interest, there is both a long and a short position; for every buyer, there is a seller.

What’s important in regards to price action is where these open interest contracts are located. Uncertainty finds expression through volatility, and the bitcoin derivative market is a ruthless arena for investors and speculators alike to trade/hedge their positioning.

The long-term impact of derivatives on the price of bitcoin is zero sum but, over the short term, dislocations find resolution through violent spurts of volatility.

If bitcoin is to move another leg lower, expect spurts of volatility and plenty of fakeouts along the way as the market makes it as difficult as possible for speculators to hold onto positions.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section.

anyway...despite today, im still rolling for a rollover 🎲🎲 ------> July CPI

June CPI was primarily driven by an 11% rise in gasoline

but in the last 4 weeks gas prices have been falling nationally 🧐

"Bitcoin Is Not An Inflation Hedge"

they say the truth sets you free...and it hurts