Global Risks Mount as Bitcoin Nears End of Correction

Bitcoin Signals Potential Bullish Resurgence as Global Economies Fear Deepening Recessionary Pressures

Introduction

As the global economy contends with tightening liquidity and potential recessions, Bitcoin emerges at a critical juncture, shaped by recent halving events and fluctuating market sentiments. Bitcoin's on-chain metrics are signaling a potential bullish reversal, price is nearing significant support, the derivatives market is in balance and far from highly leveraged, and the macro trends are testing Bitcoin. This post uncovers the underlying market conditions, preparing you for what lies ahead in Bitcoin.

Bitcoin On-Chain Metrics Showing Signs of Bullish Reversal

Following the recent Bitcoin halving, on-chain metrics provide insightful data that can help investors understand the current market dynamics. While the last 30 days show a general cooling in some holding behaviors and valuation metrics, shorter-term data from the past week suggests stabilization or slight recovery, indicating potential early signs of a bullish reversal.

Detailed Analysis

Realized HODL Ratio: This metric measures market extremes and has dropped significantly from 5,838 to 4,145 over the last 30 days, a -29.01% change. However, the recent uptick over the past 7 days indicates a returning bullish sentiment. This matches with Reserve Risk also decreasing, suggesting the attractiveness of this price has increased for long-term hodlers. This should affect hodling behavior, and can also be seen as a more attractive risk/reward for new institutional buyers. A decrease in 90-Days Coin Days Destroyed reinforces this theory even more, with a significant decrease meaning less movement of older coins. Together this is a bullish sign implying a return of strong hands.

STH LTH Cost Basis Ratio: This metric is interesting even though it is relatively flat. The move down is consistent with a bull market and LTH distribution. However, it is at a level that always corresponds to passing the previous ATH. This should give us a mile marker by which to judge where we are in the bull market, we are about to enter the parabolic stage.

Price and Technical Dynamics

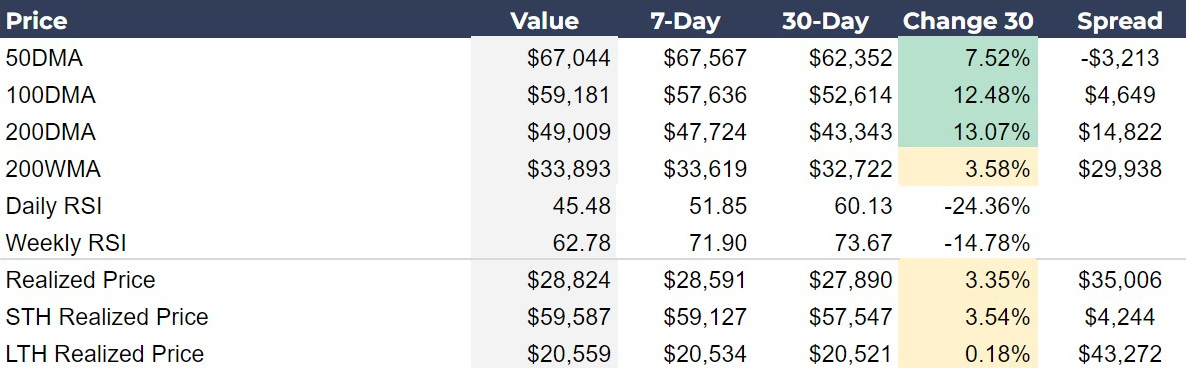

Bitcoin's pricing metrics over various time frames offer a comprehensive view of its current market state and future potential. The moving averages show a strengthening trend despite recent price consolidations, and the Realized Price metrics provide insights into both short-term and long-term holder behaviors.

Detailed Analysis

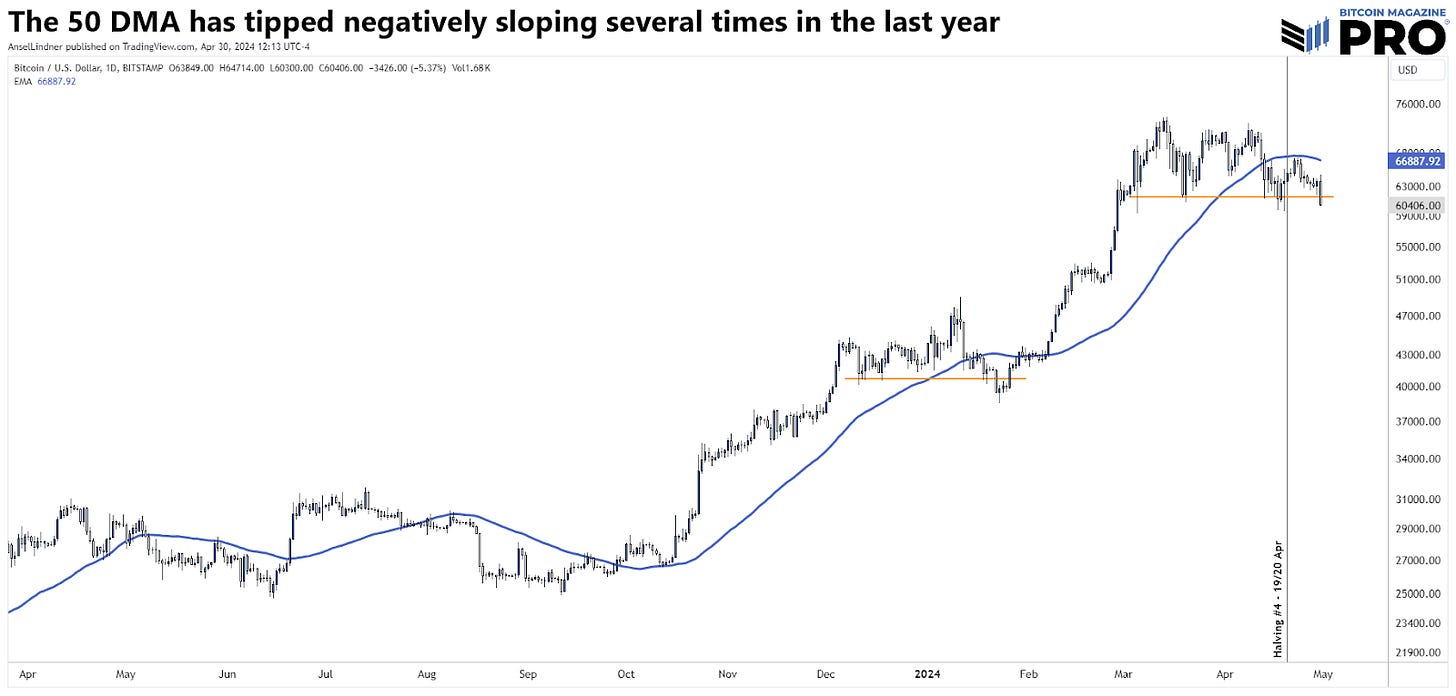

Moving Averages: All moving averages are still rising, except for the 50 DMA just recently. This could be taken as the first sign of trend reversal toward bearishness, however, it is coming at the end of a nearly two-month consolidation.We’ve seen this same pattern repeated in the last year, each time marking the bottom and quickly reversing.

RSI Levels: The Daily Relative Strength Index (RSI) has decreased from 60.13 to 45.48, indicating a shift from potential overbought conditions to more neutral level. The daily RSI is not delaying any potential buyers are this point, like it would in overbought territory. Meanwhile, the Weekly RSI has also cooled down from 73.67 to 62.78, suggesting that the market is stabilizing after previously being massively overextended.

Investor Insights

Optimizing Entry Points: Traders will often use the 50, 100, and 200 DMAs as entry points on a trade. The 100 DMA is currently at $59,355 and might serve as an entry point as it did back on 23 January in the post ETF launch dip. Regardless, to spot the reversal of this consolidation, watch the moving averages for support and resistance.

RSI Confirming Support and Resistance: Spotting the bottom/end of the consolidation can be tricky. We can leverage the RSI levels on top of the moving average support and resistance levels to gain a greater confidence in a market shift. For instance, in the coming days if the daily RSI continues to slide downward with price, and we reach the 100 DMA as RSI is touching into oversold territory, that would lend confidence for a reversal call.

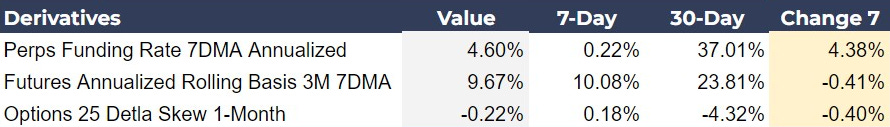

Derivatives and Price Stability

The derivatives market for Bitcoin provides critical insights into investor sentiment and market leverage, which in turn, can influence price stability and direction. The latest data from the derivatives market shows a very stable and neutral options market. It would be odd to crash from this very neutral leveraged position. Instead, it is the perfect environment for the start of a new leg higher.

Detailed Analysis

Perpetual Futures Funding Rate (Perps Funding Rate 7DMA Annualized): The increase in the perpetual futures funding rate from 0.22% to 4.60% over the last 7 days lends evidence to our above analysis of the Realized HODL and Reserve Risk telling us that some bullishness has returned. It has greatly cooled off from the extreme levels of 37.01% last month, but has started to increase again, indicating that longs are becoming slightly more popular and therefore more expensive to keep open.

Futures Annualized Rolling Basis 3M 7DMA: The slight decrease to 9.67% over the past week suggests overall bullish sentiment is still present and hasn’t taken much of hit from this slow consolidation.

Options 25 Delta Skew (1-Month): While skew did flip positive to negative, it is relatively negligible, and signals an equal weighting in the options market for upside vs downside hedging.

Investor Insights

Market Corrections from Neutral Leverage: With the Perps Funding Rate at a normal 4.6%, the market's neutral leverage suggests milder, healthier corrections compared to those from overleveraged conditions. This stability allows for corrections to serve as buying opportunities in a less volatile environment, enabling strategic, rather than reactive, investment decisions.

Macro Trends Impact on Bitcoin

The global macroeconomic indicators provide a critical backdrop for Bitcoin's market behavior, influencing investor sentiment and positioning. Current data show mixed signals across various metrics, from liquidity conditions to economic activity and market volatility, which are essential for predicting potential shifts in Bitcoin investment strategies.

Detailed Analysis

M2 Money Supply and Central Bank Assets: The slowdown in the YoY growth of the global M2 money supply—from 0.28% to a mere 0.06%—alongside a significant decrease in global central bank assets by -6.02%, indicates a tightening global liquidity environment. Many observers view Bitcoin as merely an inflation hedge, and these numbers don’t bode well for that investment thesis. However, Bitcoin is also a non-sovereign asset without counterparty risk, and extreme adoption driven price appreciation potential.

These numbers do not point to a robust growth picture, quite the opposite. Tightening global liquidity signals a festering recession. Tomorrow’s FOMC policy decision is likely going to be holding the Fed Funds rate steady, meaning the Federal Reserve having to cut rates even faster once the recession shows it ugly head.

DXY: The US Dollar Index (DXY) has increased by 1.60% YoY, suggesting a stronger dollar. This has mostly been driven by a sharp devaluation in the Yen (JPY) due to a severe recession there. A strengthening dollar typically pressures commodities and other currencies but when seen as a precursor to recession, safe haven assets including bitcoin should benefit from a rising dollar in this global macro environment.

US Net Liquidity YoY: In contrast, US net liquidity, defined as the Federal Reserve Balance Sheet less the sum of both the Treasury General Account and Reserve Repo facility, shows an increase to 0.85% from a negative -0.96% last month, a rebound indicating more fluid market conditions domestically, which could support risk-on behavior in a melt up scenario into a recession. Everything is good for Bitcoin.

Investor Insight

Testing Bitcoin’s Safe Haven Status: Given the ongoing recessions in major economies and tightening global liquidity, along with the significant miss in Q1 GDP at 1.6% annualized versus 2.5% expected, recession is looking more likely in the US in coming quarters. This period will be a definitive test for bitcoin as a safe haven asset. Will it shine in a post-halving bull market or will a recessionary dip be too strong for it? How bitcoin performs this year will go a long way to entrenching a perception in the minds of investors globally.

Chart of the Day

Bitcoin holding is a rollercoaster. Bull markets are not easy to hold through, you will be tested. Most outsiders, fence-sitters and nocoiners think we get lucky or that we just had to hold. Today’s chart of the day shows all the pull backs in bull markets that were 20% or greater. Don’t listen to the FUD.

This also should be viewed in context of the derivatives market stats above. They are showing that the current market is not over-leveraged. It is generally balanced according to many different metrics. Therefore, we should not expect this minor pull back to cascade into a larger bearish reversal.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

This article is not being responsible. Presenting such a one sided view. I wouldn't make any decisions based on this article.