Bitcoin Magazine PRO Market Dashboard

Free preview of this insightful new feature for paid subscribers. Bitcoin Magazine PRO’s Market Dashboard includes various metrics and whether they signal bullish, bearish or neutral momentum.

The following is an excerpt of today’s article for paid subscribers where we walk through our new market dashboard in-depth. For access to the full dashboard and analysis, upgrade your Bitcoin Magazine PRO subscription or try a 30 day free trial.

Bitcoin Magazine PRO Market Dashboard Release

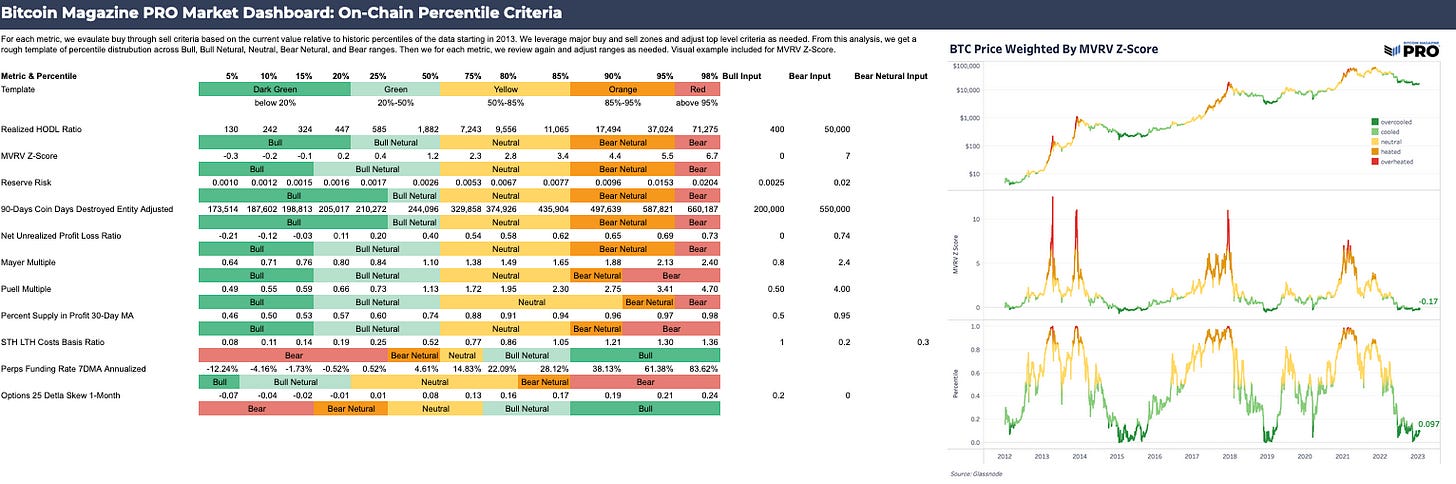

Today, we’re releasing a new feature for paid subscribers: the Bitcoin Magazine PRO Market Dashboard. The dashboard is designed to actively track 29 major market indicators and provide readers with a data-driven view of the market. It covers metrics across on-chain, derivatives, mining, price, fund flows, macroeconomic and correlation data. These are several of the key indicators we track on an ongoing basis to assess the current state of the bitcoin market.

We plan to release a complete snapshot of the dashboard every week along with a market summary of how we interpret the data. In today’s piece, we will cover the dashboard, the definition of each indicator, the criteria used for getting a signal and our rationale for choosing these specific indicators.

Below is the full market summary that paid subscribers will be getting on a weekly basis and a small segment of the Market Dashboard.

Market Summary

Looking at historical data, this latest price rally is starting to check many of the boxes of a cyclical low. Most on-chain indicators are still in some of their lowest percentiles with some even moving out of the lowest ranges.

Price has reclaimed the key on-chain realized price levels and has shown strength above the 200-day moving average (DMA). We’ve yet to see growth in realized price over the last 30 days but it is becoming less negative. Although less so over the last 30 days, bitcoin high-beta and SPX correlations are still relatively strong.

For macro, although major indicators are all still declining year-over-year, the overall trend is less negative growth. Liquidity tides look to have shifted over the last couple months and these tides are now the key trend to watch to see if it sustains. Still up YoY, the DXY continues to fall and remains below its 200 DMA.

Recently, the GBTC discount widened to below 41% and there is no sign of a resolution in the Digital Currency Group saga. Fund flows have been positive over the couple of weeks after weeks of deeply negative outflows. Overall, data is pointing to a largely bullish view in the short-term, but readers should stay cautious for a potential fake out over the next couple weeks. There are many upcoming and important economic data releases and the SPX is hovering at a major trend line of this bear market.

The following is a limited preview of the Market Dashboard. Click the image to zoom in.

Indicator Criteria

There are criteria for each indicator to assess whether it’s more bullish, neutral, bearish or in between. Each indicator gives us a Bull, Bull Neutral, Neutral, Bear Neutral, or Bear signal. All indicators have equal weighting. By observing these signals, we can get a high-level view of the momentum in the market. We will explain the criteria for different signals below.

For many on-chain cyclical indicators, we have used a simple percentile analysis since 2013. This compares the current indicator value to all previous historical values.

This method helps identify extremes in previous tops and bottoms in the market. For example, many on-chain indicators will be in their lowest percentile (dark green or bullish) near bottoms in price and in their highest percentile (dark red or bearish) near tops in price. We start with a basic percentile template and adjust the thresholds for each metric individually based on historical performance.

Indicators using this analysis are much more useful when they are at their extremes and when it’s expected the market is following historical cycles and previous patterns. We also apply this analysis to the futures’ perpetual funding rate and options 25 delta skew indicators.

The full Market Dashboard is an exclusive feature for paid subscribers of Bitcoin Magazine PRO. If you want access to the full dashboard, upgrade your subscription now!

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!