Federal Reserve’s Terrible Projections, Macro Implications for Bitcoin

Suspicious economic projections from the Fed, jobs and price data disagree, and bitcoin adds yet another major catalyst as political weapon

Introduction

This week has been pivotal for the global economy, with key US data releases: the CPI, FOMC policy decision, and PPI. Major economies like Japan, the UK, and Germany are already in recession, and despite CCP-reported data, China can be considered in recession as well.

Late last week, the ECB and BoC cut rates, highlighting worsening economic conditions. The US remains the last major market not in recession, but its trajectory is crucial; as the global economic center, it can drive the world into a deep recession.

This economic climate impacts Bitcoin adoption and price appreciation. As capital seeks safety amidst uncertainty, Bitcoin stands out as a premier hedging asset. In today’s post, we’ll examine the Federal Reserve’s policy decision, analyze the latest CPI and PPI data, and explore their influence on Bitcoin’s outlook. We’ll also discuss Bitcoin's growing political importance in the upcoming election.

If you like this content, please sign up for more at bitcoinandmarkets.com.

Federal Reserve FOMC Rate Policy

The Federal Open Market Committee (FOMC) meeting this week delivered no major surprises, as markets anticipated no change in the fed funds rate, which remains at 5.25-5.5%. However, the context and implications are crucial. The Federal Reserve's stance contrasts sharply with the ECB and BoC, which both started cutting rates last week, implying a much worse state for the global economy.

Source: Federal Reserve

Source: Federal Reserve

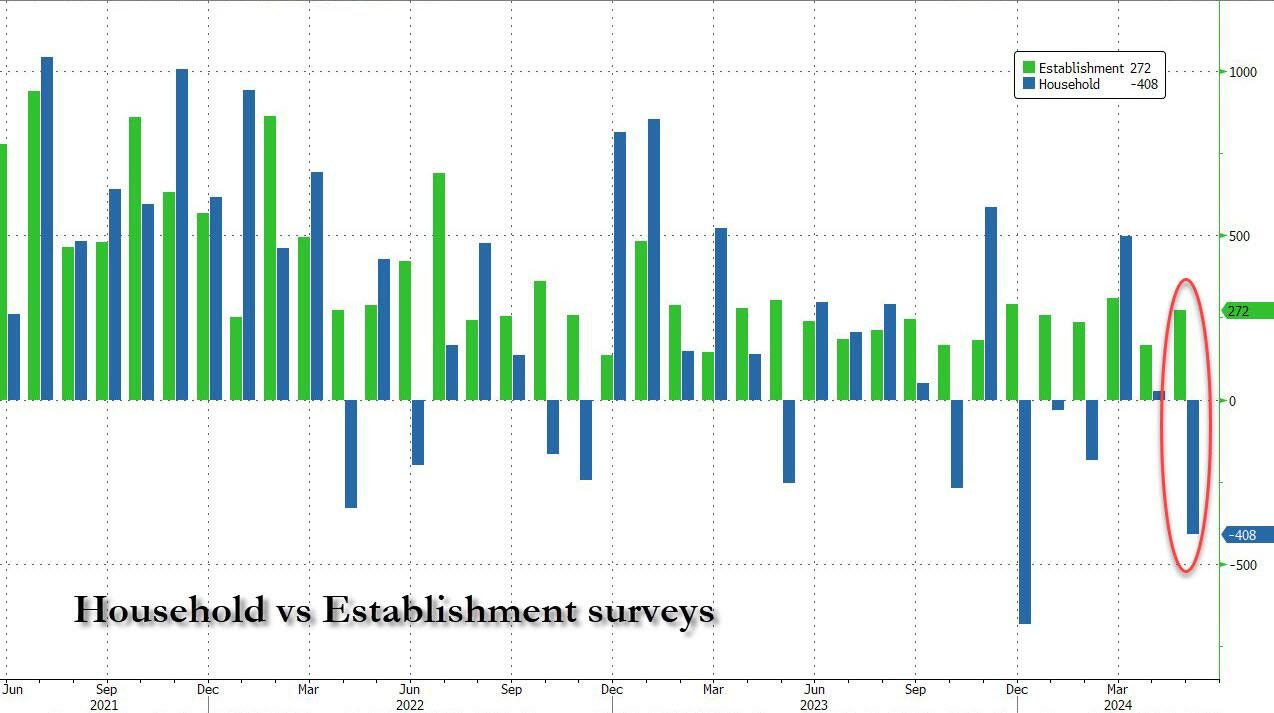

The FOMC released an updated Summary of Economic Projections (SEP) with notable adjustments. Their average projection for the fed funds rate by year-end increased from 4.6% (three 25 bps cuts) to 5.1% (one 25 bps cut), suggesting they don't foresee a severe economic downturn. This is dangerous group-think, as worsening economic data contradicts their forecasts. For instance, they don't expect the unemployment rate to rise above 4.5%, despite the household survey showing massive job losses in May, diverging drastically from the Non-farm Payrolls data. Including the drop in labor force participation, over 600,000 jobs were lost in May, pushing the unemployment rate to 4.0%, creating a significant job gap.

Source: Zerohedge

The Establishment Survey, shown in green below (Non-farm Payrolls), is consistently positive, caused mainly the birth-death adjustment (estimating business creation and failures) that desperately needs revamping.

Source: Zerohedge

Labor market deterioration in the last year is sobering. There has been a loss of 1.1 million full-time jobs, and a gain of 1.5 million part-time jobs.

Source: Zerohedge

This discrepancy, of their smooth uneventful projects from jobs data, highlights the blind group-think within the FOMC. Similar arguments can be made regarding their PCE forecasts and GDP projections. Let’s take a look at May’s CPI and PPI to demonstrate this.

CPI and PPI

The Federal Reserve's dual mandate is to achieve maximum employment and stable prices, which are closely linked in a debt-laden, credit-based system. As the economy and private credit creation slow, layoffs occur and prices decline. Consequently, the Fed will be compelled to cut rates and adopt a more accommodative monetary policy. These factors—rising unemployment, declining prices, and Fed rate cuts—will coincide. While we’ve noted the worsening job market, let's now examine price trends.

May CPI came in softer than expected. The transitory nature of this period of high CPI is starting to become more clear. MoM CPI for May was unchanged at 0.0%. Forecasts were already low at 0.1% but this was a surprise. Our second piece for recession is starting to fall into place.

May’s CPI Numbers

0.0% MoM vs 0.1% forecast

3.3% YoY vs 3.4% forecast

Core 0.2% MoM vs 0.3% forecast

Core 3.4% YoY vs 3.5% forecast

Less Shelter -0.2% MoM

Less Shelter 2.1% YoY

Supercore (core minus shelter) -0.05%

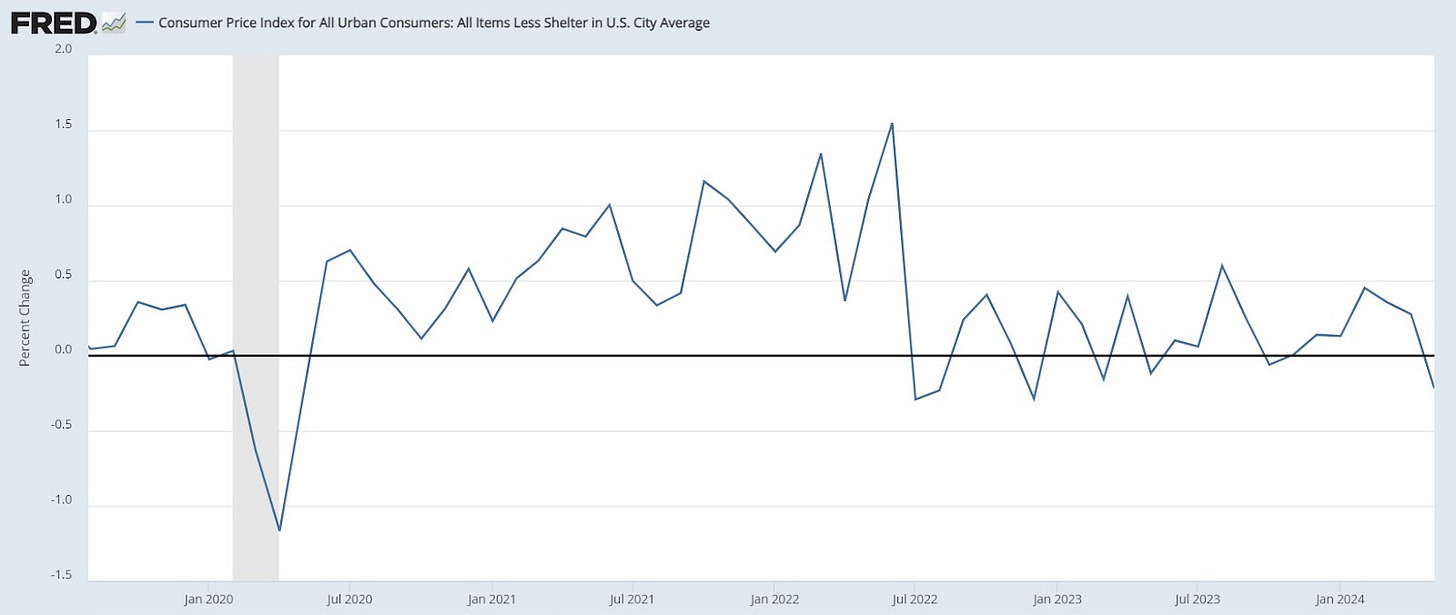

Since shelter makes up nearly one third of the CPI and is a lagging indicator, we can get a clearer view of the broader economy by looking at all items excluding shelter. This also gives us insight into the immediate inflation trend. As shown, the recent slight rising trend has completely collapsed.

Source: FRED

Producer prices are seen as a leading indicator for CPI, being upstream from consumer prices, and these costs get passed on to consumers. May’s PPI came was -0.2% vs +0.1% expected, and down from 0.5% in April.

May’s PPI Numbers

-0.2% MoM vs 0.1% forecast

2.2% YoY vs 2.5% forecast

Core 0.0% MoM vs 0.3% forecast

Core 2.3% YoY vs 2.5% forecast

Source: Zerohedge

Most of the increase in both CPI and PPI is coming from services, which can easily collapse if job losses continue to pile up.

What does all this say about the Fed’s dual mandate and their smooth and uneventful SEP? Unemployment is starting to tick higher with the labor market deteriorating and the prices are stabilizing, with certain analysis showing actual price declines. All this points to a recession on the horizon and the Fed will likely not be able to hold to their projections of only 1 cut this year.

Bitcoin in the Macro Environment: Political and Economic Perspectives

The Fed did not cut rates this month, but they will likely be forced to cut rates soon according to jobs and price data. What does this mean for Bitcoin? The immediate price implications are as follows. First and foremost, when the Fed cuts rates the market will interpret this as inflationary, and since Bitcoin is at the forefront of many wealthy investors’ minds, this should spike the price of bitcoin as an inflation hedge. Second, it will quickly sink in that a rate cut is an admission of economic trouble and a deflationary recession is upon us, especially since the Fed has backed itself into a 1 cut corner for 2024. If they cut twice, it means they were wrong and the economy is worse than expected.

Bitcoin offers a distinct advantage due to its deflationary characteristics and independence from central bank policies. Investors are increasingly recognizing Bitcoin's potential to preserve wealth in times of economic uncertainty, driving its adoption as a critical component of a diversified and defensive investment strategy.

This change in opinion by investors is being supercharged by the rise of Bitcoin as a vital voter demographic. This week, Trump posted on Truth Social that bitcoin mining is of major national security and economic interest. This follows on from his recent statements about protecting privacy and self-custody of bitcoin. Biden also is trying to do what he can within his more negative stance on Bitcoin by exploring accepting bitcoin donations to his campaign.

Source: Gage Skidmore / CC BY-SA 2.0 / Wikimedia, via CryptoSlate

The convergence of these factors—economic instability, the need for defensive investment strategies, and the political endorsement of Bitcoin—marks a significant turning point for the digital currency. Bitcoin is no longer a fringe asset; it is at the forefront of financial innovation and political debate. This unique position underscores Bitcoin's potential to shape the future of both the financial system and the political landscape, making it an essential consideration for investors and policymakers alike.

Conclusion

The Fed didn’t cut rates along with other central banks, but their SEP is far too optimistic as the jobs market, CPI, and PPI signal economic deterioration. Bitcoin offers a safe haven from economic uncertainty and is becoming an important political topic. This may lead to the perfect storm for Bitcoin, as institutional demand rises, supply shortages from the halving take effect, and Bitcoin enjoys massive political tailwinds.

BM Pro Offer: Bitcoin 2024, Nashville, July 25 - 27

——— USE CODE BM10 FOR 10% OFF ADMISSION ———

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

Hopium. It has already hedged people who bought at 17k. Priced in.