Exploring BRICS Pay: A New Blockchain-Based Payment System Versus Bitcoin's Global Influence

From BRICS Pay to Bitcoin, Comparison and Implied Breakdown of the Old System, Path to the New.

Background

The BRICS countries (Brazil, Russia, India, China, South Africa, and this year Egypt, Ethiopia, Iran, the United Arab Emirates) have introduced a new blockchain-based payment system called BRICS Pay. This system operates on a distributed ledger and is not a Central Bank Digital Currency (CBDC) or electronic cash like bitcoin. Its main objective is to facilitate trade and financial transactions between the BRICS nations, enabling payments to be made in their respective national currencies rather than relying on the US dollar or the euro, which is often seen as a step towards dedollarization.

Source: Wikipedia Commons

BRICS Pay aims to replace the SWIFT system, providing a secure and US-independent (BRICS-dependent) platform for international financial transactions. It's designed to serve various purposes, including cross-border payments between companies, investments, and microfinance. Institutions and businesses in BRICS countries are increasingly adopting this system, and it's intended to simplify and enhance trade and financial transactions among member states.

Monetary Evolution or Payment, Perception versus Reality

Globally, there is a growing awareness of the threat posed by CBDCs to privacy, free commerce, and free expression. Specifically, concerns are rising that CBDCs may facilitate the establishment of a communist-style total surveillance economy. In such an economy, every transaction would be meticulously tracked and subject to approval or censorship, enabling authorities to freeze or seize money at their discretion. Moreover, tax and subsidy interventions could be directed with pinpoint accuracy and are vulnerable to corruption and abuse.

Additionally, there has been significant speculation in macro circles about the BRICS nations launching their own multinational currency to challenge the US dollar in international trade. BRICS Pay is not a CBDC and does not have the all encompassing power over domestic internal transactions as well as not being a separate currency or unit of account. However, it does exert a certain level of control over international payments. Given these distinctions, it is understandable for confusion to arise regarding the nature of BRICS Pay.

Source: OMFIF

Long-time Bitcoiners, and newcomers as they familiarize themselves with some of Bitcoin’s intricacies, are primed to notice potential threats to US dollar dominance. They tend to see BRICS Pay as a component of a broader strategic maneuvering in a currency conflict that will eventually lead to a BRICS currency or CBDC. They view Bitcoin serving as a sanctuary from the turmoil of such conflicts.

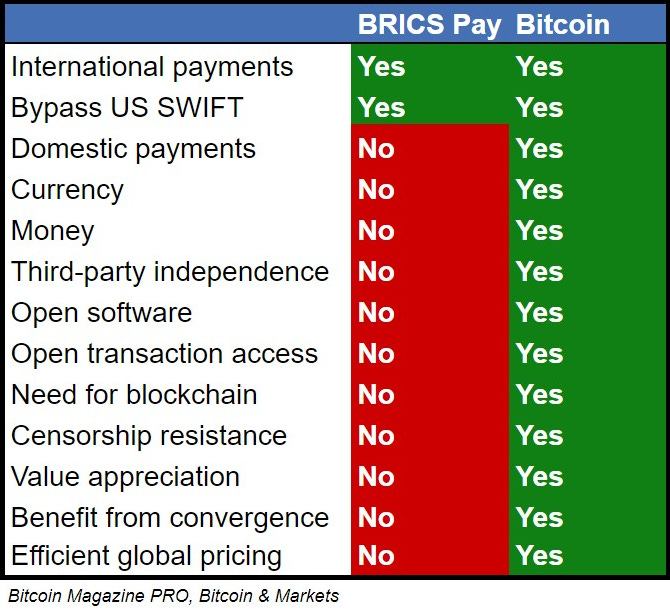

BRICS Pay versus Bitcoin

BRICS Pay and Bitcoin differ significantly in their nature and purpose as systems for financial transactions.

Nature of the Currency

BRICS Pay: Is not a currency but a payment system that enables transactions in external currencies of the BRICS countries. It does not fulfill any of the functions of money and is strictly a means of payment or a payment rail like Venmo.

Bitcoin: Is a decentralized digital money, with a finite supply, that operates globally, and independent of any central authority. Bitcoin is not just a means of payment, it is money which fulfills the three associated functions of money: store of value, unit of account, and medium of exchange.

Bitcoiner Perspective: It is important to note that BRICS Pay is not a CBDC. It does not compete directly with Bitcoin in any way, other than the hope that it makes BRICS currencies appear more attractive relative to the US dollar and Bitcoin.

Underlying Technology

BRICS Pay: Utilizes a permissioned blockchain, which is controlled and accessible only by authorized participants. Software is closed and updateable by a centralized party.

Bitcoin: Bitcoin's network is public and permissionless, meaning anyone can participate or own it. Bitcoin’s base is open-source code and specifically allows for global transactions without a central trusted third-party.

Bitcoiner Perspective: BRICS Pay’s use of “blockchain technology” is not like Bitcoin’s. The only reason Bitcoin uses a blockchain structure is to enable decentralization and hence censorship resistance. BRICS Pay does not even want to compete in that regard. It has all the drawbacks of a blockchain, slow and expensive, without any benefit.

Purpose

BRICS Pay: The primary purpose is to facilitate trade and financial transactions among the BRICS nations, allowing them to bypass traditional financial systems like SWIFT and reduce reliance on dominant global currencies like the US dollar.

Bitcoin: It serves as a digital money that provides a global, peer-to-peer method of transaction and store of value, independent of any central control.

Bitcoiner Perspective: At its most simplistic, Bitcoin’s purpose is to enable transactions on the internet with no need for trusted third-party or intermediaries. Its design and circumstances of creation, are irreplicable and finely tuned to accomplish this goal. BRICS Pay’s purpose is much more narrow and contrasted to this wider vision.

Value Determination

BRICS Pay: Since it's a payment rail for external currencies, there is no token to value. The value of the network is the benefits accrued to BRICS countries through the independence from US regulation, interference or censorship.

Bitcoin: Its value is determined by market supply and demand dynamics.

Bitcoiner Perspective: The BRICS Pay value metric is as wobbly as the purpose. BRICS nations are not especially known for their valuable treatment of capital. No one is forcing them to use the dollar currently, meaning there are likely benefits gained from using dollars, like higher liquidity, lower interest rates, stable global regulatory treatment, and access to the American consumer. Monetary forces favor convergence on one standard, BRICS Pay is working against these natural market forces, and hence will be inefficient.

Bitcoin on BRICS Pay and Bitcoin-backed Government Currency

BRICS Pay functions as a conduit for various currencies, without inherently excluding the use of bitcoin. Any prohibition against bitcoin on BRICS Pay would likely stem from ideological motives rather than practical concerns. If the adoption of bitcoin expands globally, as many of us anticipate, users of BRICS Pay will seek to transact in bitcoin through this platform. Thus, BRICS Pay could potentially evolve into a Layer 2 payments system for Bitcoin.

Whether transactions involve bitcoin directly, bitcoin-backed currencies, or fiat national currencies, BRICS Pay reflects a decline in international trust, signaling a shift towards a neutral commodity-based monetary system. Rather than facilitating the liberation of foreign currencies, it indicates the erosion of global economic unity and the trust that underpins it. BRICS Pay should not be viewed as a driver of dedollarization, but rather as a symptom of deglobalization.

The BRICS nations are misinterpreting the waning trust within the global economy as a mere malfunction in currency access and payment mechanisms. However, they will soon realize that simply adopting alternative means of payment does not address the underlying trust deficit inherent in credit-based monetary systems, especially at the twilight of the greatest global credit cycle in history. In fact, relying on their own currencies will exacerbate liquidity and elasticity issues. What is truly needed and will inevitably be demanded is a neutral commodity-based currency that embodies trust.

In Bitcoin We Trust.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics. Thank you.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!