Exchange Balances Finally Affected by Bitcoin ETF Inflows

The outflows from GBTC have waned and inflows to the new ETFs remain strong. Plus, a lackluster FOMC meeting has zero effect on progress into recession.

Bitcoin ETF Inflows are Relentless

January is in the books for the spot Bitcoin ETFs. Fourteen trading days has yielded $1.3 billion of net inflows. If we exclude selling from GBTC, those inflows are nearly $7 billion.

Flows are starting to level out, favoring net inflow. The average daily flow in the first 14 days, including GBTC, is $95.6 million per day. However, when projecting future flows, we should take into consideration the fact that $1 billion of the GBTC selling was the FTX receivership that can’t be repeated. If we average daily flows from this week, which occurred after the FTX selling and during a slightly more mature market than the first few days of trading, we get an average inflow of $193 million. That number is closer to the inflows we can expect over the next couple of months until to the halving.

Prior to the ETF launch, estimates from sources like Bloomberg and Galaxy Digital were for total inflows for the year to be around $10 billion. The ETFs began trading on January 11, which gives them 245 trading days in 2024. To reach $10 billion of inflows they have to average only $40.8 million/day. We are well ahead of that pace. If the ETFs continue near their daily average from this week for the rest of the year, inflows would total $45.8 billion.

Price chart

Price has not yet reacted strongly to these flows. This will come. For those who don’t know, most of these ETFs are using Coinbase Prime’s over-the-counter (OTC) desk. The coins sold by GBTC don’t hit the market, they come out of a Coinbase custody account and are sent to Authorized Participants (APs). APs can hold them on Prime or sell them to market makers. However, with all the inflows, the APs are likely recycling them into shares of other ETFs. This process interfaces with the spot market if the APs don’t have enough bitcoin to create shares on-demand for the new ETFs.

The day the ETFs launched there were 2.104 million BTC on exchanges, according to CryptoQuant. That remained relatively stable until January 24, and since we’ve seen a decline to 2.084 million BTC. It is possible that the APs have now started to source coins elsewhere besides their pre-launch stack and GBTC recycling.

Source: CryptoQuant

Bitcoin inflow to the ETFs this week has totaled 16,067 BTC, which is in the ballpark of the 20,000 difference in exchange balances. This could be considered supporting evidence for the claim that APs are now having to source outside bitcoin. At a net demand of roughly 5,000 BTC/day, price will have to respond to the relentless buying pressure.

Last week, we discussed the possibility that the 100 DMA could provide support similar to September 2020, right before the monster rally to end 2020. I was expecting one final dip this time, touching a toe in technically oversold territory before a turnaround. However, back in 2020 it did just this, never reaching oversold before it took off.

As long as inflows to the ETF outweigh GBTC outflows, which is looking increasingly likely, price should move higher this week. After the 50 DMA, there is really no resistance until the swing high at $49,000. After that, the all-time-high is only another 40% move. We’ll be there before you know it.

FOMC Decision and Recession Status Update

The FOMC monetary policy decision came out yesterday and it was a dud. After the high anticipation for the December meeting being the last possibility for a hike, the January meeting was very lackluster. The committee decided to hold their policy exactly the same, Fed Funds at 5.25-5.50%, and no change to QT.

Source: AP

I streamed live coverage of the press conference on Bitcoin & Markets, and what struck me in Powell’s initial comments was the insanity we are meant to believe. With all the highly paid economists and other specialists at the Fed, and all the data they follow and create each week, somehow the correct policy decision was to do precisely nothing. I’m not saying they should do something, I’m saying, one would think that with a data-driven quantitative approach, as the Fed claims to have, they would tweak something, anything, even by a single basis point.

In the Q&A section of the press conference, the takeaway I got was of imprecise language. He claimed they would start cuts when they “had higher confidence” they’d done enough of inflation. Yet, he could name a single number, level, or even a specific metric that would be influential on their confidence. I know he has to be vague, but the point here was intentionally to cause confusion.

Recession Update

The FOMC’s effect on markets was as expected. Stocks initially sold-off, but they are back in the green today.

Long time readers will know I use a unique macro thesis, which says prior to a recession, stocks and bonds should rally together. So far, we are right on track. This pre-recession trade turns into a recession trade as we approach the event horizon of the recession. At that time, stocks should sell-off as bond yields drop toward zero. I will keep you posted on this progress throughout this year.

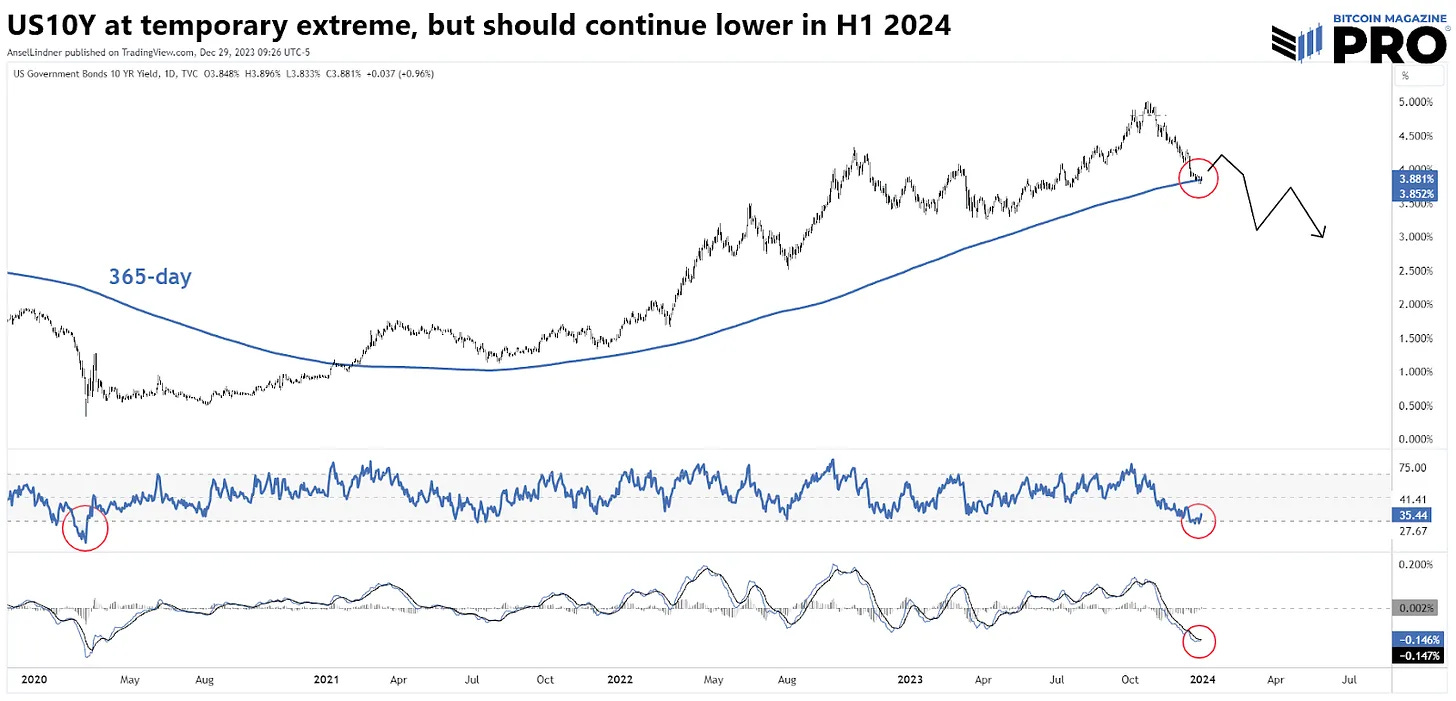

The following chart appeared on a post back on January 3, where I was looking at what to expect in 2024.

And this is today (below), zoomed in a little. The next leg down in yields should correspond to increasing banking stress toward the end of Q1 and the BTFP. We already have seen New York Community Bancorp (NYCB), the bank that bought struggling Signature Bank last year, having problems, when their share price dropped 40% yesterday alone.

Everything is pointing toward a repeat of March 2023 and a recession starting H2 2024. Bitcoin performed very well during last year’s banking crisis, rising 45% from March 10 to March 24. If that happens again, this time with ETF demand, it is likely we see at least a similar rise, which would take us back to the ATH.

If you liked this content, please like and share! Thank you!

Next time we reach $68k, that's not returning to the all-time high because inflation has really fucked up the dollar since 2021, you know?