ETF Flows Start to Trend Down

Institutional demand softens as ETF flows roll over, macro fear returns, and Bitcoin fights to hold key technical levels.

What’s Happening

Price Action

It’s been another tough week for Bitcoin, with the price falling 5.15% amid continued fears of a US government shutdown weighing on markets.

Figure 1: BTC has struggled this past week.

Bitcoin is now fighting to reclaim $90,000 as market participants remain extremely fearful (see the Fear & Greed Index chart later in this article).

Which means that over the past 3 months, Bitcoin has tumbled well over 20% from its plus $100,000 levels.

Figure 2: BTC past 3 months’ performance.

From a technical perspective, after the brief fakeout above the key reversal level of $95,000 (red zone on the chart below), BTC has drifted back to the bottom of the range (green zone).

Both the 1-year and 200-day moving averages are above $100,000 and are now trending down.

Figure 3: BTC back towards the bottom of the technical range.

The Big Story: Bitcoin ETF Flows Turn Negative as Fear Creeps Back In

Bitcoin spot ETF demand is showing its clearest signs of strain since early 2025.

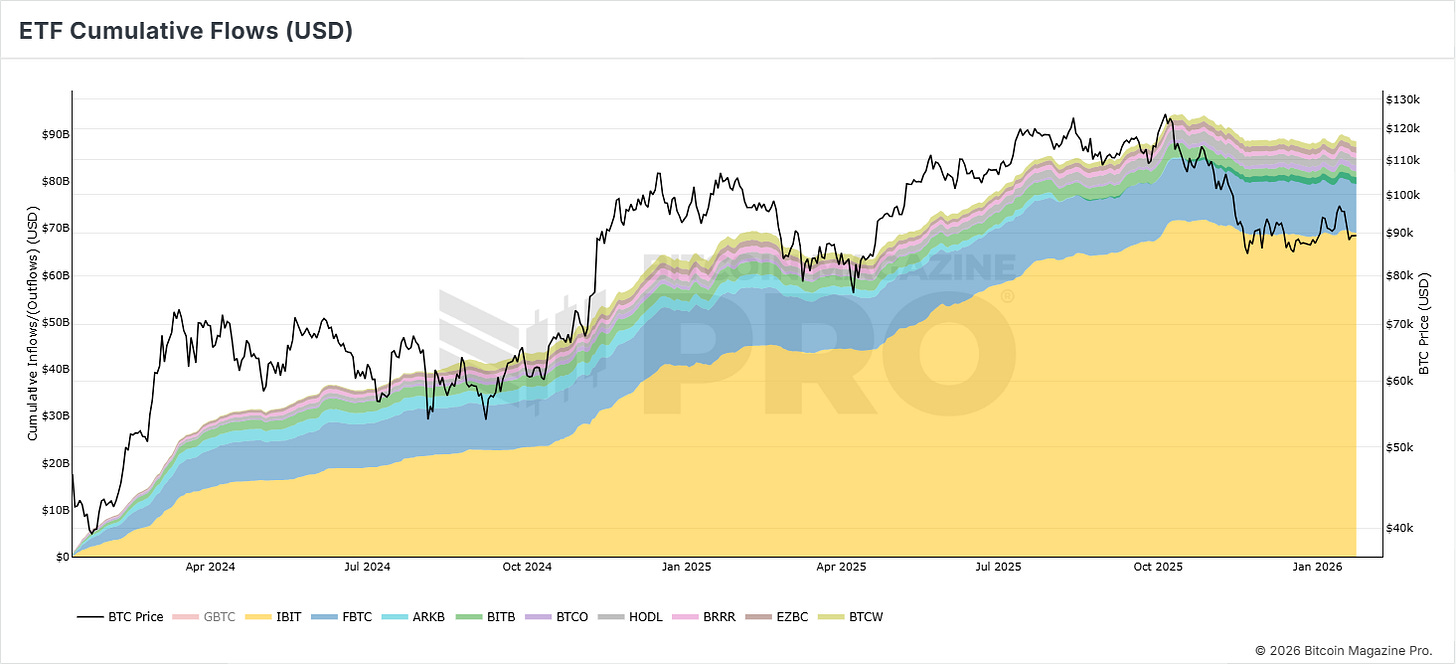

Cumulative ETF flows have started to trend lower, marking the first sustained rollover since April 2025.

Figure 4: Cumulative spot Bitcoin ETF flows have been trending down since October.

While total inflows remain substantial, the shift in momentum is notable, particularly given the consistent ETF accumulation throughout the past year.

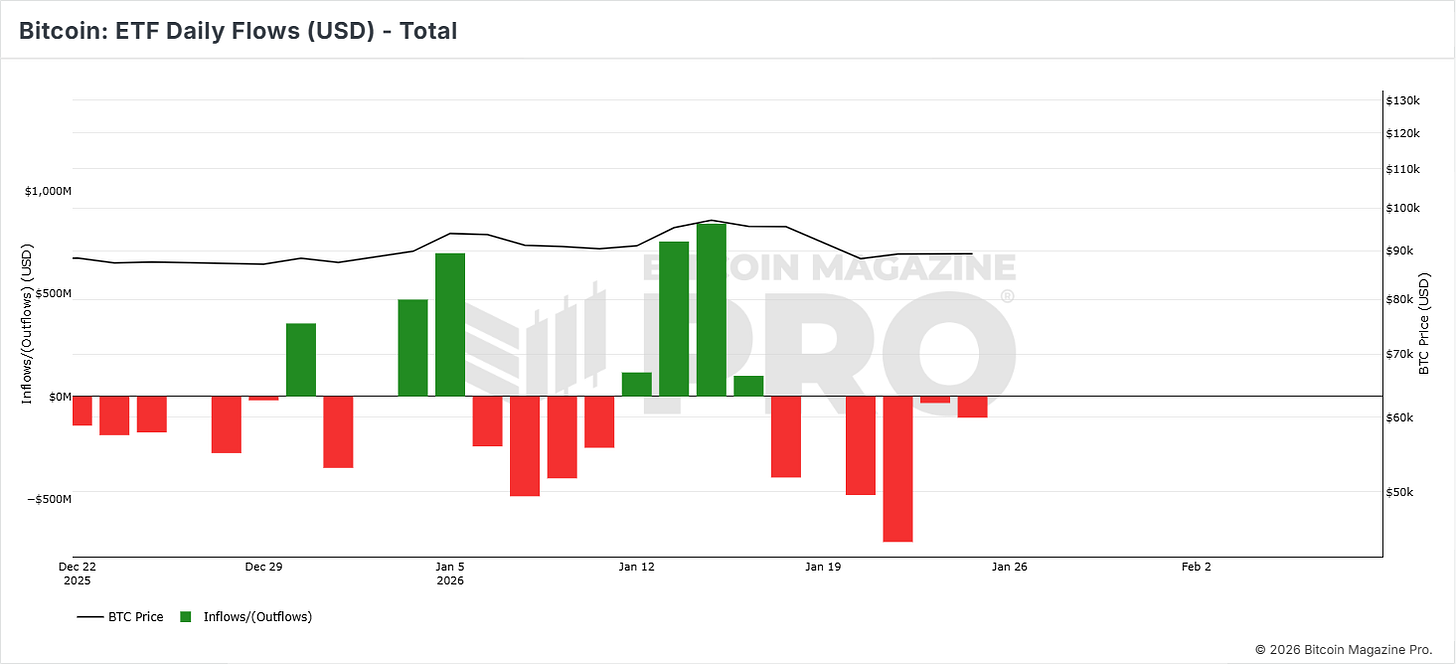

That slowdown accelerated last week. U.S. spot Bitcoin ETFs recorded $1.33 billion in net outflows, their worst weekly performance since February 2025, despite the shortened trading week due to the Martin Luther King Jr. Day holiday.

One session stood out: $709 million exited ETFs in a single day on Wednesday, highlighting the intensity of risk-off positioning.

Figure 5: Heavy outflows recently for the spot Bitcoin ETFs.

Rather than buying the dip, ETF investors have been reducing exposure as volatility picked up.

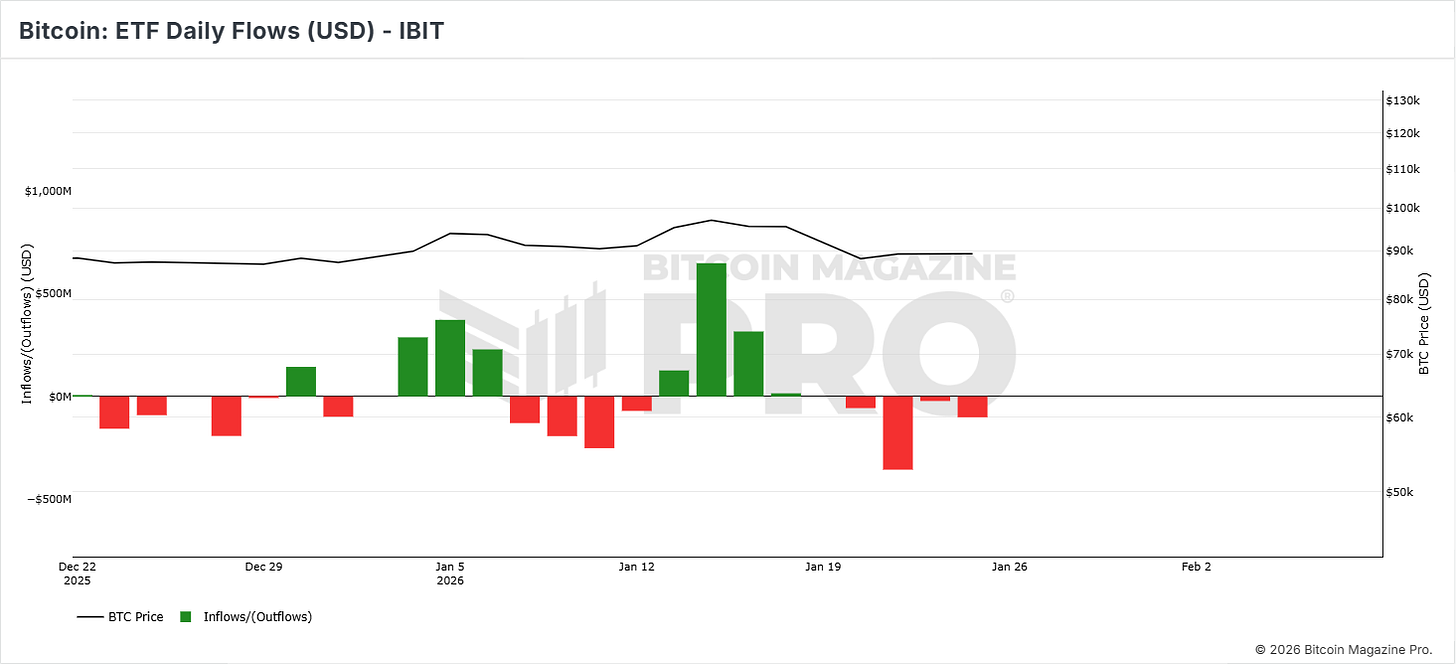

Crucially, this weakness extends to the strongest player in the space. As shown in the chart below, BlackRock’s IBIT ETF recorded outflows on every trading day last week, despite typically being the most resilient fund.

Figure 6: IBIT Outflows

IBIT alone holds nearly $70 billion in assets, making its behavior a useful proxy for institutional sentiment.

Macro uncertainty is feeding the caution. Renewed U.S. government shutdown fears have unsettled markets, pressuring risk assets broadly.

Sentiment reflects this stress. The Fear & Greed Index currently sits at 20, deep in extreme fear.

Figure 7: Fear & Greed Index.

Until sentiment turns decisively, ETF flows are more likely to remain a headwind than a source of support for Bitcoin.

To view all of these charts and receive more in-depth analysis, subscribe to the Bitcoin Magazine Pro platform here.

The Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else.

We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Wow, the part about Bitcoin ETF flows turning negative due to fear really stood out, making your consistent grasp on market psychology so evidant, just like your insightful piece last month on market sentiment.

The IBIT outflows are the most telling datapoint here imo. When the normally bulletproof BlackRock fund is seeing consistent exits, it signals more than just retail nervousness. Interesting that investors arent buying this dip despite the Fear index hitting extreme levels. Been wondering if the shutdown fears are just a convenient excuse for profit taking after the run or if theres genuine institutional repositoning happening. The $709M single day outflow is pretty wild.