Today’s headlines:

Saylor advises Microsoft that ‘Bitcoin is the best asset you can own’.

Japanese exchange DMM Bitcoin to close and transfer $300M assets after hack.

Russia officially recognizes Bitcoin as Property.

Swiss Canton of Bern approves plan to study bitcoin mining to stabilize grid.

ANALYSIS: Will December surpass November’s record-breaking price increase?

Bitcoin has continued to range over the past week, still unable to break $100,000. After two attempts to stay above $98,000, $BTC price is now back down at $95,166.

Versus this time last week price is down -3.47%.

Figure 1: Bitcoin price action over the past week.

The full extent of the ranging can be seen on the past month's chart, which shows $BTC price struggling to stay above $98,000 since 22 Nov. That followed the run-up which resulted in $BTC being up +37.18% over the past month.

Figure 2: Bitcoin performance over the past month.

The Big Story

Do ‘normies’ care yet?

This week, we take a look at five key charts to get the latest view on whether new participants are entering the Bitcoin space and whether or not the market is becoming overheated.

1. Bitcoin’s Relative Growth

A key driver of attention around Bitcoin is driven by its price performance - and how that compares to other assets investors could be investing in.

Over the past year Bitcoin has stormed ahead of other potential investments such as Tesla, Apple stock, the S&P500, and the Dow.

Figure 3: Bitcoin’s relative price performance.

2. Address growth

If new people are actually coming to invest in Bitcoin, there should be a significant growth in the number of addresses holding at least $10 worth of bitcoin in them. That is exactly what we have been seeing in recent weeks and months. The number of addresses that hold more than $10 worth of bitcoin now stands at over 36 million!

Figure 4: The number of addresses holding more than $10 worth of bitcoin.

3. Google Search

Online search interest has also been accelerating in recent weeks.

Though it is worth noting that we have still not yet exceeded the levels seen in the 2021 bull cycle.

Figure 5: Google search trends for Bitcoin.

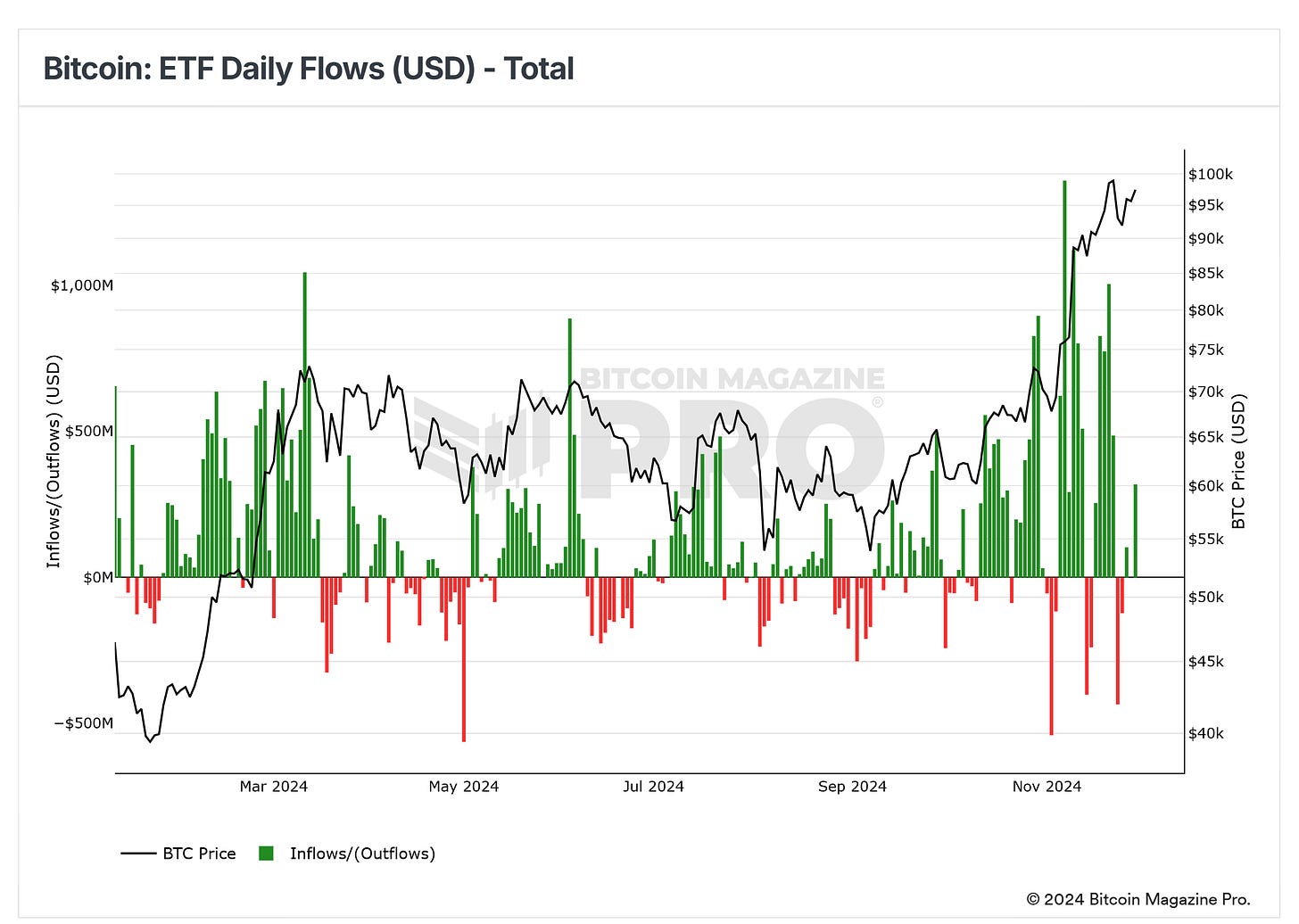

4. ETF Daily Flows

As more institutions begin to be able to access the Bitcoin spot ETFs, we are seeing increases in the green bars on the chart below, which represent daily net inflows. We expect this trend to continue and, in fact, accelerate when $BTC finally breaks above $100k.

It has never been easier to buy bitcoin, and that means both individuals and institutions now have simple access to the hardest asset on the planet.

Figure 6: Bitcoin spot ETF daily flows.

5. Hot New Money

A key indication of when new money is entering the ecosystem is when the cost-basis value held in new bitcoin addresses begins to increase rapidly. That is what we can track on the Bitcoin Cycle Capital Flows chart. This particular view shows the % of cost-basis value held in addresses that have only had bitcoin in them for less than a month.

When the red on the chart increases it shows that these newer wallets are proportionally holding more cost-basis value than longer-term bitcoin holders.

Figure 7: Cost-basis value in addresses that have held bitcoin for less than one month.

When this metric gets close to 50% it has historically indicated that the market is overheating and the bull cycle may be approaching its end.

For now, this metric does not appear to be close to levels seen in prior cycles. So, while there may be a clear increase in new participants entering the Bitcoin ecosystem, we do not appear to be near the cycle top just yet.

You can access the Bitcoin Cycle Capital Flows chart on the Bitcoin Magazine Pro Advanced Plan here.

The Bitcoin Magazine Pro Team.

🎁 Cyber Monday: Our Biggest Ever Sale

The BEST saving of the year is here. Get 40% Off all our annual plans.

Unlock +100 Bitcoin charts.

Access Indicator alerts - so you never miss a thing.

Private TradingView indicators of your favorite Bitcoin charts.

Members-only Reports and Insights.

Many new charts and features coming soon.

All for just $15/month with the Cyber Monday deal. This is our biggest sale all year.

Don't miss out! 👉 https://www.bitcoinmagazinepro.com/subscribe/

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

The address growth really surprises me. I always assumed normies don't understand self-custody. Looks like I was wrong.

I'm laughing WITH you. Promise.