Dipping Below $100k: Bitcoin and BlackRock’s ETF Revolution

Analyzing Bitcoin’s latest moves and Nasdaq’s game-changing ETF filing.

Today’s headlines:

BTC falls back below $100,000.

UK government may use £5bn seized bitcoin to fill public finances hole.

Nasdaq files for in-kind redemptions for BlackRock’s IBIT ETF.

BTC has dropped below $100,000 today as concerns run through wider global markets.

It is down -5.48% over the past 24hrs.

After holding steady at $105,000 price began to drop around 05:00 UTC. BTC is currently trading at $99,200 but is extremely volatile so price may rapidly shift over the coming hours.

Figure 1: BTC dropping below $100,000.

While this may be cause for concern for short-term participants, zooming out shows that over the past three months Bitcoin remains up +41%. Today’s dip is merely a blip when looking at higher time frames.

Figure 2: BTC up +41% since November 2024.

The Big Story

Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

Nasdaq has submitted a new proposal to the U.S. Securities and Exchange Commission (SEC) that could make operating Bitcoin exchange-traded funds (ETFs) more efficient and cost-effective. The filing seeks to introduce "in-kind" bitcoin redemptions for BlackRock’s iShares Bitcoin Trust (IBIT), offering an alternative to the current cash redemption process.

What Are In-Kind Redemptions?

Under the proposed system, authorized participants (APs) - institutional players responsible for creating and redeeming ETF shares - would have the option to exchange ETF shares directly for bitcoin instead of cash. This bypasses the need to sell bitcoin to generate cash for redemptions, simplifying the process and reducing costs.

It’s important to note that this option would only be available to institutional participants, not retail investors. However, experts believe that improving operational efficiency for institutions could indirectly benefit everyday investors by making Bitcoin ETFs more streamlined and cost-efficient.

Why the Change?

The current cash redemption model has been in place since January 2024, when spot Bitcoin ETFs were first approved by the SEC. At the time, regulators opted for cash redemptions to avoid requiring brokers and financial institutions to handle bitcoin directly, prioritizing regulatory simplicity.

However, with the rapid growth of the Bitcoin ETF market, Nasdaq and BlackRock see an opportunity to improve the system. Now, with evolving regulations and a more favorable environment, Nasdaq believes it’s time to adopt a more efficient model.

Benefits of In-Kind Redemptions

Operational Efficiency:

Reduces the number of steps and parties involved in the redemption process.

Streamlines ETF operations, saving time and lowering costs.

Tax Advantages:

By avoiding the sale of bitcoin for cash, in-kind redemptions minimize capital gains distributions, making ETFs more tax-efficient for institutional investors.

Market Impact:

Could reduce sell pressure on bitcoin during redemptions, potentially stabilizing the asset's price.

Regulatory and Market Context

This proposal comes amid significant regulatory changes under the pro-Bitcoin Trump administration. Recent policies, such as the repeal of Staff Accounting Bulletin 121 (SAB 121), have created a more favorable climate for digital asset innovation. The repeal removed obstacles that previously discouraged banks from offering cryptocurrency custody services, paving the way for developments like Nasdaq’s in-kind redemption model.

BlackRock’s Bitcoin ETF: A Market Leader

BlackRock’s iShares Bitcoin ETF has been a resounding success since its launch in 2024, attracting over $60 billion in inflows and solidifying its position as the largest spot Bitcoin ETF in the U.S.

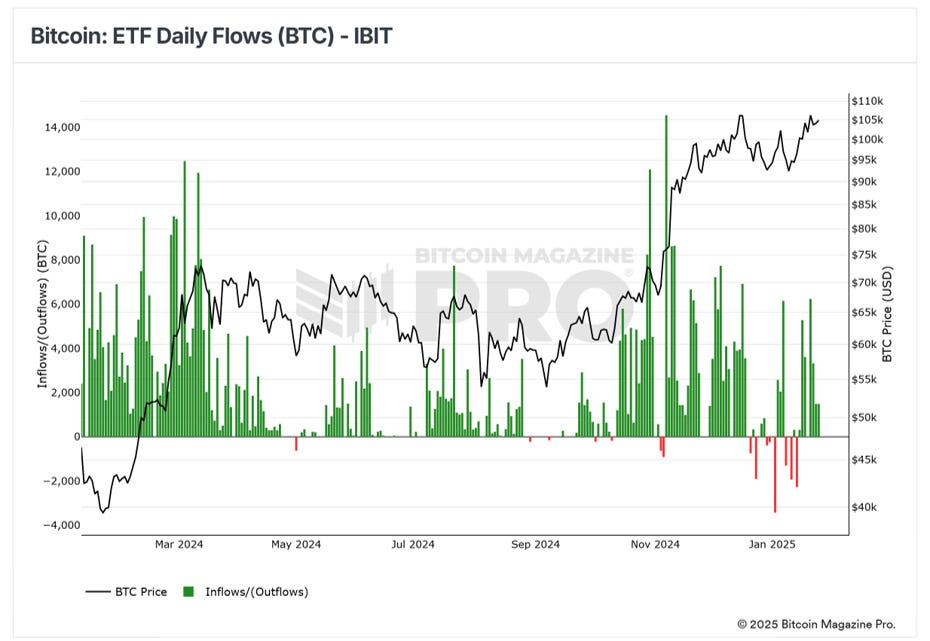

Figure 3: BlackRock’s IBIT Inflows since launch.

Note the consistent green candles on the chart above showing how positive the inflows have been since launch.

Conclusion

Nasdaq’s proposed in-kind redemption model could make IBIT even more appealing to institutions by reducing costs and improving efficiency. As the Bitcoin ETF market matures, innovations like these are expected to drive further growth and adoption.

If approved, Nasdaq’s proposal to allow in-kind redemptions for BlackRock’s Bitcoin ETF could mark a significant step forward for the industry. By simplifying the redemption process, offering tax benefits, and reducing sell pressure on bitcoin, this model has the potential to enhance the appeal and performance of Bitcoin ETFs for institutional investors while indirectly benefiting retail participants.

With supportive regulatory changes and growing institutional interest, the future of Bitcoin ETFs looks increasingly promising.

Key Chart

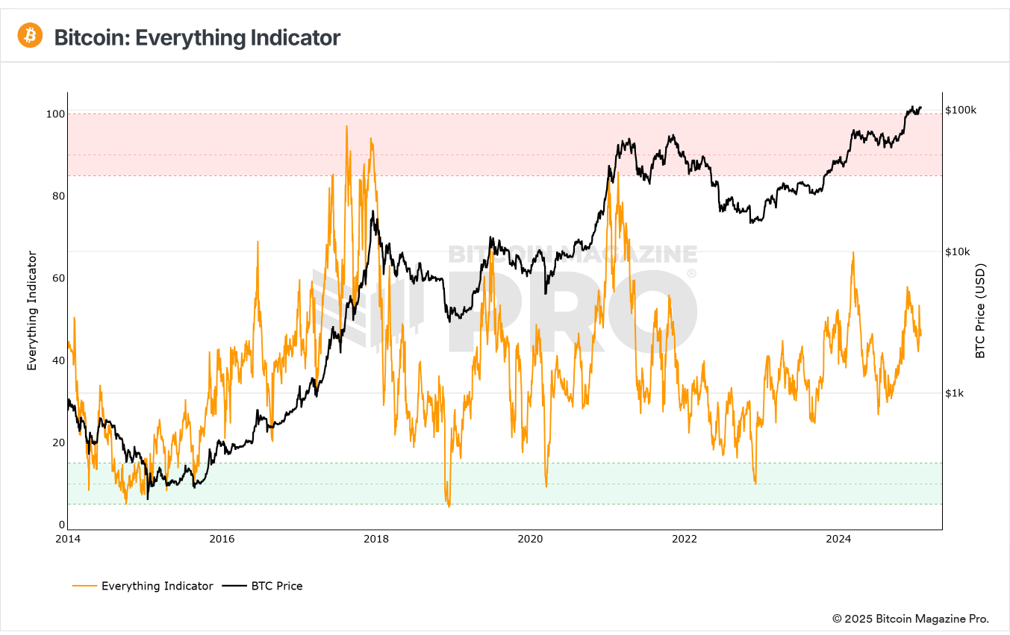

NEW CHART - The Everything Indicator

Figure 4: The Everything Indicator.

The Bitcoin Everything Indicator is a new chart that is exclusive to Bitcoin Magazine Pro.

It consolidates multiple metrics into one score to provide a comprehensive market overview. The result is a reactive, historically reliable oscillator that identifies market peaks and bottoms for Bitcoin.

It combines the following critical inputs for Bitcoin’s market cycles, applying weighting across each of the metrics:

Market Profitability: MVRV Z-Score

External Macro Supply: Global M2 Money Supply

Miner Profitability: Puell Multiple

Onchain Profit Taking: Spent Output Profit Ratio (SOPR)

Volatility Trends: Crosby Ratio

Relative Network Growth: Active Address Sentiment Indicator (AASI)

Bitcoin Magazine Pro platform subscribers can view this chart directly on the platform and see it update every day here.

To subscribe, join us here.

The Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.