Deflationary Effects of Halving are Starting

Exploring public miner performance, general mining activity and how it is handling the post-halving environment, and what to watch in network traffic numbers

This week, we take a closer look at the current state of the Bitcoin network as it stabilizes following last month’s halving. Our analysis highlights the resilience and adaptability of miners, the emerging effects of the halving on revenue, and shifts in Layer 2 token activity. By examining the performance of public Bitcoin miners, the latest mining activity metrics, and changes in network traffic, we provide valuable insights for investors seeking to understand and navigate these developments.

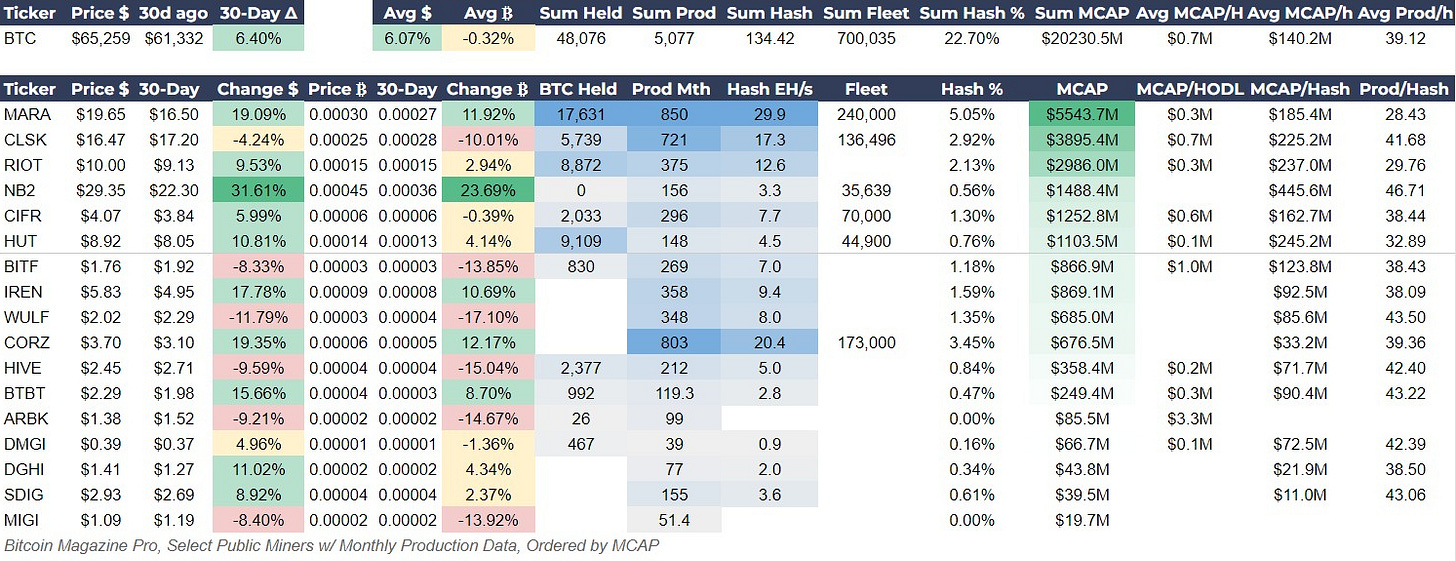

Public Miner Performance

Performance of public Bitcoin miners was mixed this week, but are showing resilience in this tough post-halving period. Despite the reduced block subsidy, miners have adapted their operations to maintain profitability. On average, public miners saw a 6% gain in their stock prices against the USD, although performance against Bitcoin was marginally negative. This highlights the adaptability of these miners amidst shifting economic realities and reduced transaction fees.

CleanSpark Inc. (CLSK) and Northern Data (NB2) particularly stand out for their production efficiency, producing at an efficiency of 41 and 46 BTC/EH respectively. These companies demonstrate effective management and operational efficiency, crucial for maintaining profitability in a challenging post-halving environment. Meanwhile, Marathon Digital Holdings (MARA) and Riot Platforms Inc. (RIOT) continue to leverage their substantial hash rates to sustain production levels, further underscoring the diverse strategies within the industry to navigate the new reward structure.

Investor Insights

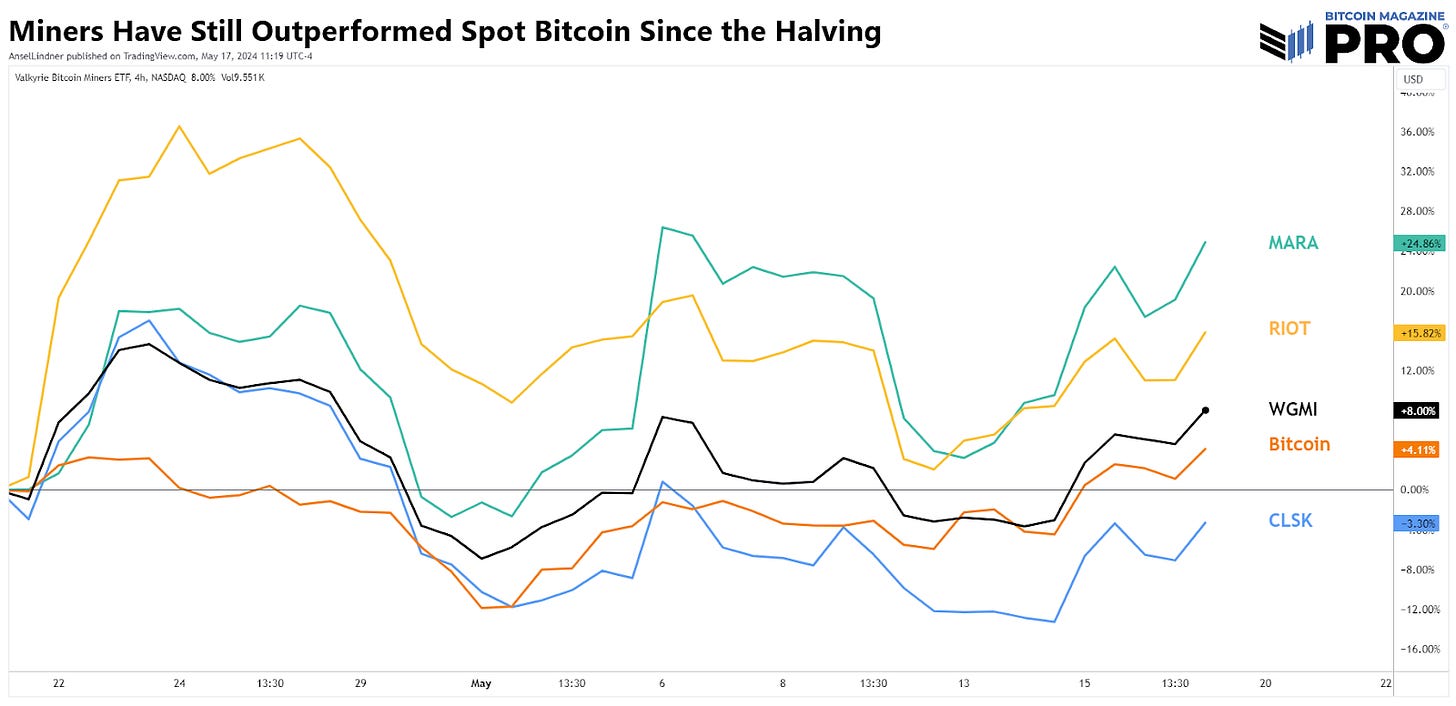

Miners Still Outperforming Spot Bitcoin: MARA and RIOT have shown strong resilience in the wake of the halving, likely benefiting from investors’ positive view on their high level of bitcoin reserves. Even the diversified Valkyrie Bitcoin Miner ETF has outperformed spot bitcoin.

HUT8’s (HUT) Legal Struggles: HUT’s legal issues have not affected their share price negatively post-halving. They have also outperformed spot bitcoin since the halving, up 17%. HUT is facing a class action lawsuit you can read more about here. Allegations include a ownership conflict of interest in the November merger and undisclosed issues with assets acquired in that merger. These undisclosed issues allegedly caused their former CEO to short their stock. They replaced him in February.

Bitfarms CEO Leaves Abruptly After Filing Lawsuit: “Bitfarms announced that Morphy was terminated as CEO and President. This decision came ahead of a previously planned transition. Morphy’s lawsuit, filed on May 10 in the Superior Court of Ontario, claims “breach of contract, wrongful dismissal, and aggravated and punitive damages” amounting to $27 million.” - CoinMarketCap

Mining Activity

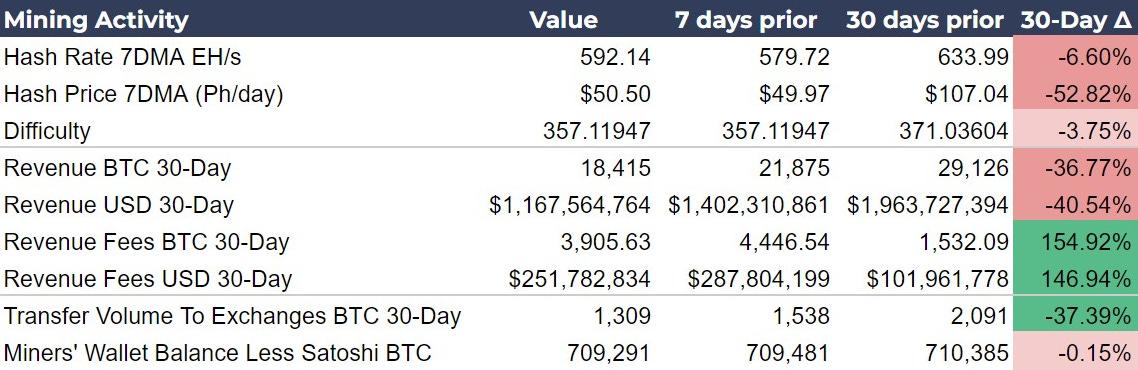

We are finally starting to see the effects of the halving come through in revenue numbers. The 7-day average hash rate has recovered slightly WoW posting a 1% gain, matching the current estimate for the next difficulty adjustment in 5 days' time, which is expected to be positive but <1%. Our Revenue and Fees numbers are 30-day moving averages, so it has taken a while for the effect of the halving to be represented, especially with the fee spike that accompanied the halving. As price begins to rise on the deflationary effects, the revenue in USD terms should rise back to pre-halving levels and even surpass them.

Despite the tough time for miners, the number of bitcoins they are sending to exchanges continues to fall. While that is to be expected with the subsidy cut in half, they have not felt the need to financially cushion the change by selling their reserves. In fact, miners' wallet balance is only down 0.15% in the last 30 days.

Source: Mempool.space

Investor Insight

Deflationary Lags: The deflationary effects of the Bitcoin halving take time to permeate through the ecosystem due to operational buffers and market slack. Our 30-day average data illustrates that these deflationary pressures are only beginning to be felt. This lag is a critical factor for investors to consider, as the full impact on miner profitability and market dynamics may unfold gradually.

Network Traffic

Our conditional formatting for Network Traffic is almost completely green this week, signifying positive developments. Network traffic continues to stabilize with the mempool slowly dropping to 213 MB. It is safe to say that being above 200 MB is likely the new normal for the mempool. Despite that, fees are extremely affordable with the high-priority sitting at only $1.57. Overall, this is a well functioning network despite the halving and price consolidation causing pressure on miners.

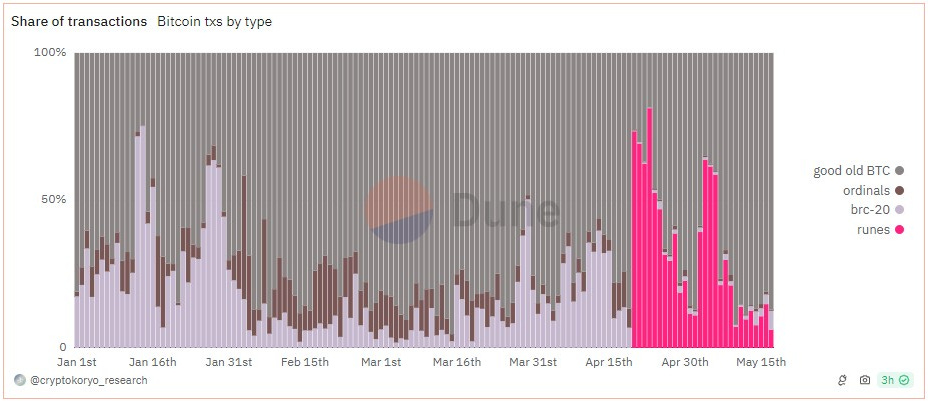

One of the biggest developments over the last 30 days has been the lack of Runes activity on the network. Runes jumped out the gate with nearly 500,000 transactions/day after the halving and has dropped 84% to only 70,000. Inscriptions plus Runes don’t even reach the pre-halving level of inscriptions alone. The share of daily transactions for these Layer 2 token protocols has flatlined at around 10% (see image below).

The ease with which users have moved from Inscriptions to Runes suggests a lack of deep commitment to any specific protocol. This behavior raises concerns about the long-term viability and user support for any one of these protocols.

Source: cryptokoryo

Investor Insights

Lull in Speculative Behavior: In previous posts, I’ve discussed using Layer 2 tokens as a measure of speculative interest in the market. Based on this heuristic, there appears to be very little speculative interest at present. Ethereum's poor performance and its issues with the SEC may be dampening the enthusiasm of the speculative "YOLO" crowd. However, there is still latent demand, as evidenced by Roaring Kitty's recent activity, which sent GameStop's stock up 100% in a day. This suggests that speculative interest could return swiftly under the right conditions.

Development > Tokens: In a repeat of last week’s insight, I wanted to reiterate the difference between Layer 2 development and Layer 2 tokens. The tokens themselves are likely not a safe investment, but do symbolize development on Layer 2 protocols is accelerating. Likely this market cycle will see the birth of at least one new Layer 2 that has great potential. Therefore, focus on development shops or platforms like Microstrategy’s (MSTR) new Bitcoin Orange or Blockstream’s Liquid.

Conclusion

In conclusion, the post-halving period is stabilizing nicely for Bitcoin miners and the network. Public mining companies’ stocks are generally keeping up with or outperforming the Bitcoin spot price. Revenue impacts from the halving are starting to emerge, with a gradual reflection of deflationary pressures in the market. Network traffic trends show the significant decline in Layer 2 token activity, raising questions about the long-term viability of these protocols. Investors should note the ongoing strategic adjustments by miners and the potential for renewed speculative interest in the market. Focusing on companies with robust operational strategies and monitoring developments in Layer 2 solutions will be key to navigating the evolving Bitcoin landscape successfully.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!