By the Numbers: Signals of Stability in Bitcoin Mining Sector

Calm returns to mining as we explore the significant rally in several Bitcoin miners, analyze their charts, and assess the stability of mining activity and healthy network traffic consolidation.

Introduction

Over the past month, several publicly traded miners have shown monster stock performances, while others have simply maintained. At the same time, general mining activity is displaying nice stabilizing post-halving, and network traffic is signaling readiness for potential market movements through slow return of calmness. This update explores these key areas, providing insights for investors navigating this complex landscape.

Public Miners Mixed, Caution Warranted

Over the past 30 days, publicly traded Bitcoin miners have experienced notable variations in their stock prices. Iris (IREN), Core Scientific (CORZ) and Terawulf (WULF) have all posted 100%+ gains in the last 30 days. While RIOT and Marathon (MARA), two of the three largest public miners and companies that have two of the three largest bitcoin reserves, have both posted negative gains.

Iris Energy (IREN): We’ve noted the performance of IREN for the last couple of issues, but the chart is saying it is time for a correction. Their luck changed on their last earnings update, with massive beats to revenue, earnings per share and their upgrade timeline is ahead of schedule where they will triple their hash rate. We also noted large options activity, specifically, 27 uncommon options trades set a price target of $10 per share, it is now at $14.45 as of yesterday. Now, we are seeing very overbought conditions on both the daily and weekly charts, with a bearish divergence on the daily.

Core Scientific (CORZ): Core Scientific’s stock price has risen 87% in June at the time of writing, but experiencing a significant sell-off today, down 13% in the last two days. We’ve written about CORZ’s significant earnings and revenue beats from their latest financial reports, and on Wednesday, 12 June, they announced an increase in computing capacity for the high-performance computing (HPC) that underpins AI operations. New details were revealed about the 300 MWs of available HPC infrastructure at an investor day event that will be added to 200 MWs committed under a recent deal with AI centric CoreWeave. Their chart looks more healthy than IREN, no divergences. Perhaps, they have another leg of their rally after cooling down a bit.

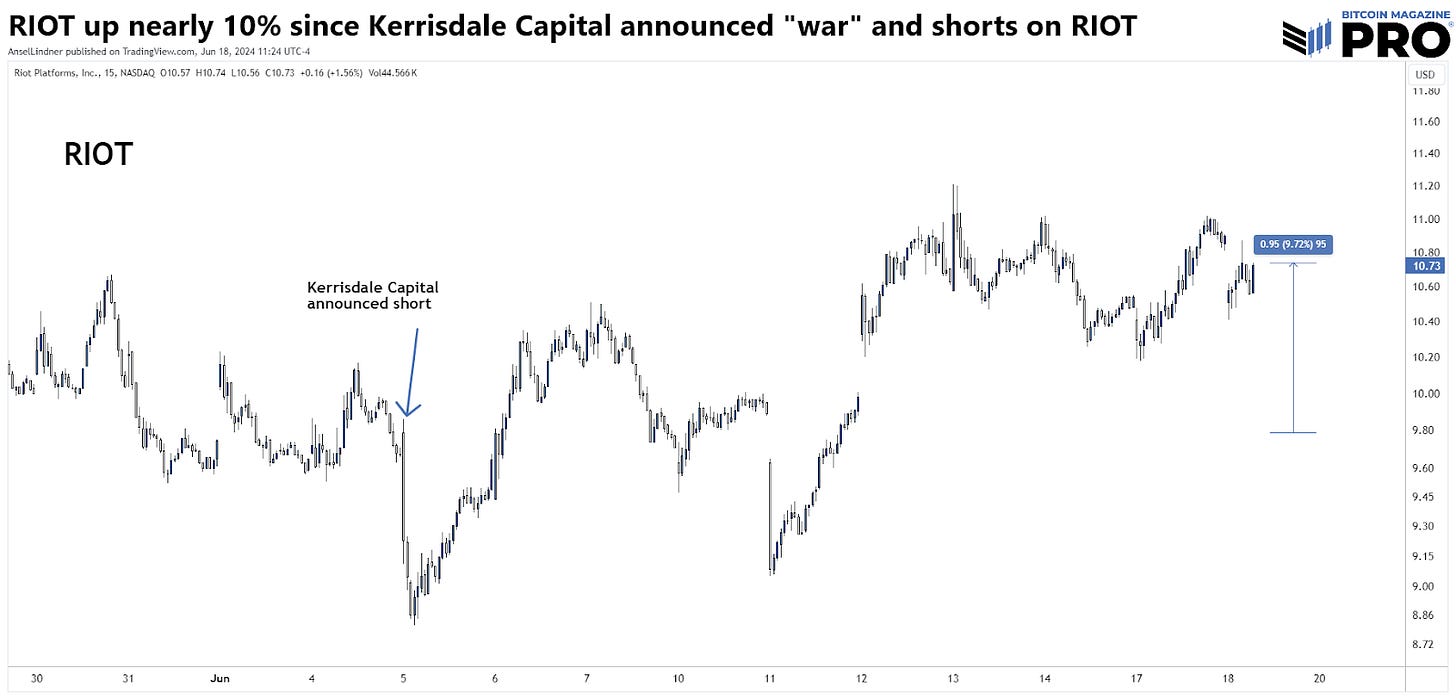

Riot Platforms (RIOT): A quick update on RIOT since the Kerrisdale Capital’s short-sell war announced 5 June on Twitter. RIOT is now up roughly 10% and will likely rally more as upgrades to their facilities continue throughout the year and Kerrisdale gets squeezed on their shorts.

Investor Insight

Strategic Holdings Matter: We have yet to see the benefit of Bitcoin reserves from the largest holding miners, because spot price has been stagnant for months. However, investors should pay close attention to these miners, such as Marathon Digital Holdings (MARA) and Riot Platforms Inc. (RIOT), who have underperformed other miners recently, as the spot bitcoin price rises. These reserves can be interpreted negatively during periods of weak spot price performance, but will enhance their attractiveness as the bitcoin price is appreciating.

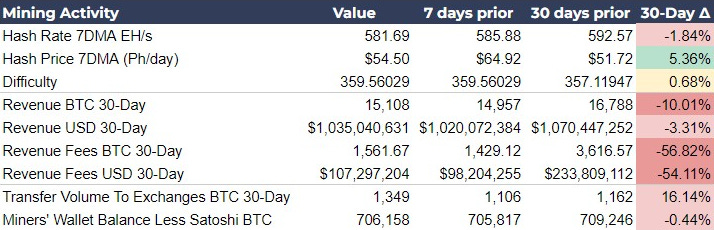

General Mining Activity is Stabilizing

Mining activity over the past 30 days has been resilient while adjusting to post-halving fundamental changes. For example, hash rate has stabilized, along with hash price and total revenue in USD. Overall, the only metrics with a large negative move is revenue from fees, but since that is a small portion of overall revenue, it has less significant impact on miners as a whole.

Source: Mempool.space

Transfer volume to exchanges increased by a significant amount, up 16% in 30 days, indicating that more bitcoin sales are needed to maintain profitability in this tough time. However, this is juxtaposed with the increase in Miners’ wallet balances, up 314 BTC in the last week. This means that miners are still stacking, but are stacking less than previously.

Investor Insights

Mining Activity Signaling Post-halving Consolidation Over: It’s not set in stone quite yet, but the stabilization of the mining activity numbers are signaling a balance returning to the core fundamentals. Miners are an important part of price formation, because they are not only earning money from mining, but they are the bridge between network fundamentals, industry-wide investor demand, and the spot market. If miners are recovering well, the many fundamentals in the space have to also be turning up.

Hash Ribbons are Crossing Bullish: Hash ribbons, consisting of the 30-day and 60-day average hash rate, are crossing back bullish for the first time since the halving. We have yet to get the “Buy” signal from this indicator, but that will follow very shortly as these moving averages right themselves. While not fool-proof, it is a very strong indicator of future bullishness during a bull market.

Network Traffic: Calm Before the Storm

This week’s network traffic paints a picture of relative calm within the Bitcoin ecosystem, potentially signaling the market's readiness for increased activity. Despite the uneventful metrics, there are subtle hints of underlying resilience and preparation for future movements.

Mempool is shrinking, down 9% in the last 30 days. High-priority fees are stable, showing an 80% increase, but within a very low band and remaining in the reasonable $2-$3 range. Token inscriptions and Runes have also declined but remain well inside a stable range over the last couple of months. We are witnessing a calm before the storm. Traffic has slowed to a point where it can handle more activity that will come along with a significant rally.

Investor Insight

Layer 2 tokens, when used as a proxy for speculative interest, have mirrored the recent downward trend in Bitcoin prices. However, their activity remains non-zero, suggesting that innovation and speculative interest in the overall industry remain active.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!