By The Numbers: Miners, Metrics and Market Movements

Big news for public miners, explore mining activity as price tries to advance, and some very interesting trends in network traffic.

In this week's analysis, we focus on the performance of public miners, key shifts in mining activity, and notable trends in network traffic. As Bitcoin prices remain within a multi-month range, miners with large Bitcoin reserves have yet to see substantial benefits, while those focusing on rapid expansion are outperforming. We also keep you updated on industry news of earnings and acquisitions. The mining sector faces significant revenue challenges post-halving, and network activity data highlights the impact of recent transaction spikes on fees and mempool sizes. This report provides critical insights for investors navigating the dynamic landscape of Bitcoin.

Latest Insights on Bitcoin Miners

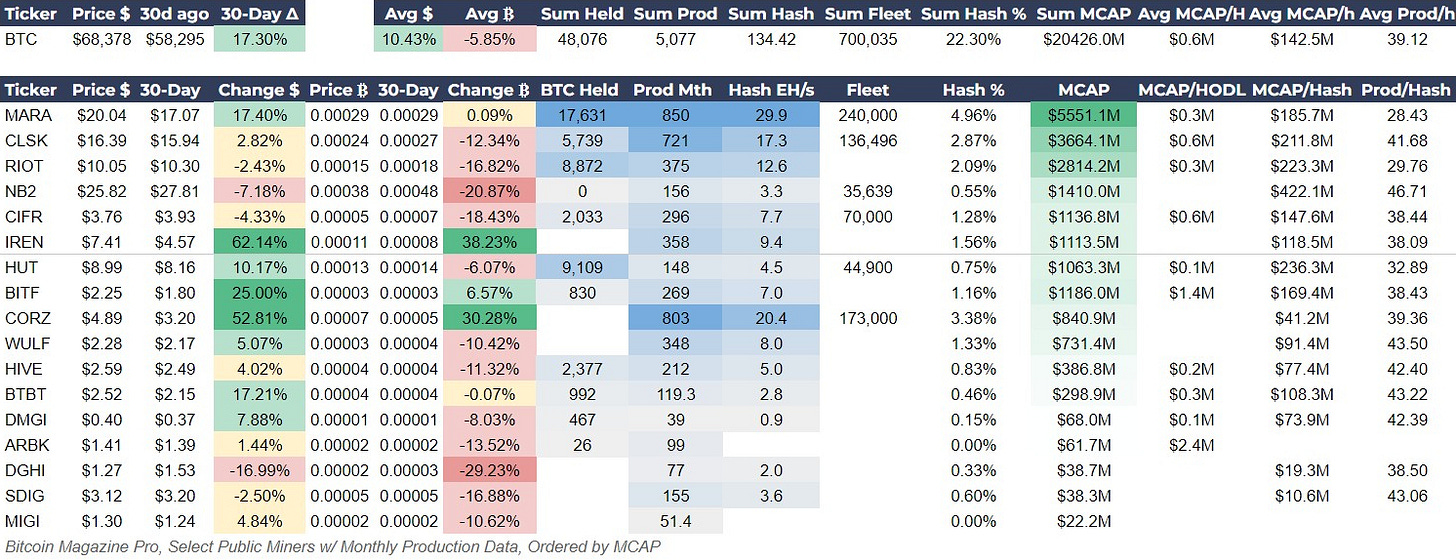

Most public miners have had a good 30 days, with the average return of 10% in USD terms, but have been down 5% in BTC terms. Most of the gains were concentrated in only a few companies like Iris Energy (IREN), Core Scientific (CORZ), and Bitfarms (BITF). With the price of bitcoin still in the months-old range, those with large bitcoin reserves are still not notably outperforming.

Riot and Bitfarms: The biggest news this week for public miners is the proposal from RIOT to acquire Bitfarms for $2.30 per share, effectively creating the largest public bitcoin miner. This move will cost RIOT approximately $950 million in total equity value. The proposal was initially made in private back in April and was quickly rejected without much consideration. They are now raising it publicly to get the shareholders involved. RIOT is the largest shareholder in Bitfarms with over 9% of the total stock.

Jason Les, Chief Executive Officer of Riot, added, “We are deeply concerned that the founders on the Bitfarms Board – Nicolas Bonta and Emiliano Grodzki – may not be acting in the best interests of all Bitfarms shareholders. The abrupt termination of the Bitfarms CEO without a transition plan in place at a critical period of execution for Bitfarms and the industry, as well as the allegations, if accurate, regarding the actions of certain members of the Bitfarms Board set out in the lawsuit filed by that recently terminated CEO, raise serious governance questions. This is why we intend to call a Special Meeting to give shareholders a chance to bring needed change to the Bitfarms Board and make repairing Bitfarms’ broken corporate governance and maximizing value for all Bitfarms’ shareholders their top priorities.” - RIOT

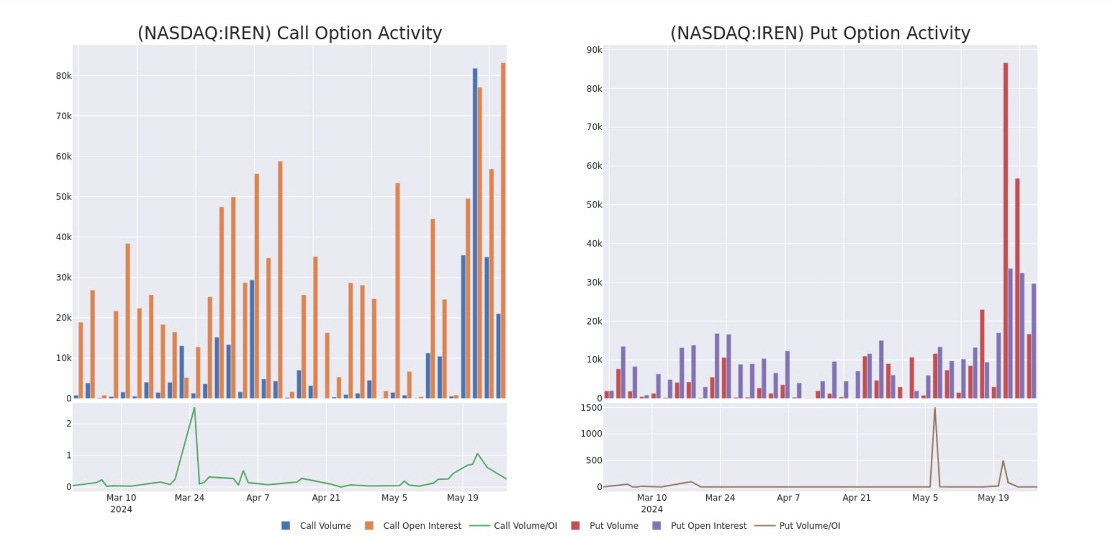

Iris Energy (IREN): As noted last week IREN continues to surge, now up 62% in the last 30 days. This is likely due to beating their revenue forecasts, earnings per share and upgrade timing announced in their quarterly investor update. This week there has been some large options activity reported in their stock. Specifically, 27 uncommon options trades with a price target of $10 per share.

Source: Benzinga

In the graphs above, the blue columns on the left graph and red columns on the right graph are the anomalies.

Core Scientific (CORZ) was recently upgraded by Investing.com and BTIG to a “buy” after a strong rally of 60%+ since 8 May 2024’s release of a huge profit beat in Q1 ($179M vs $150M expected).

Investor Insight

Bitcoin reserves will come into play: We have yet to see a notable benefit to miners holding large bitcoin reserves, but also have yet to see significant bull market action to staggering new highs. When bitcoin does start to take off, we expect to see bitcoin reserves paying off. Interestingly, companies that are not bitcoin miners are the ones currently seeing a big pay from holding bitcoin reserves. For example, when Semler Scientific (SMLR) announced they had added $60M in bitcoin reserves to their balance sheet, their stock jumped 48% (currently still up 30% on the week). Seven public miners have more bitcoin than that on their balance sheet, Marathon (MARA) alone has over $1 billion in bitcoin.

Mining Activity: Latest Trends and Insights

Over the past 30 days, several key metrics have shifted, reflecting broader market trends and the post-halving environment. Below, we analyze these changes and their implications for miners and investors.

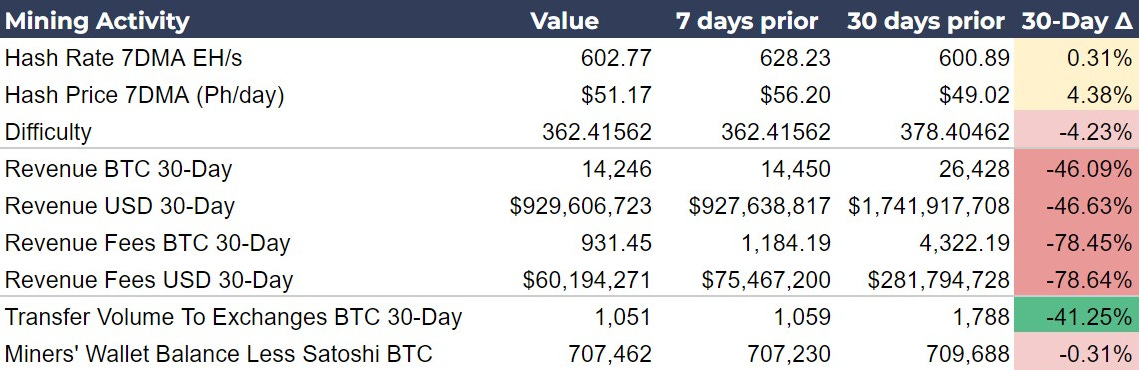

Hash rate and difficulty: Hash rate and hash price (the value of a Ph/s per day) have both retreated this week, likely based on the lack of follow-through in upward price movement. Hash rate’s performance since the halving should be seen as relatively well-performing, there hasn’t been a significant capitulation event for miners. Not registered in the 7 or 30-day difficulty numbers is the recent difficulty increase 8 days ago of +1.48%. We have seen a positive adjustment after the halving and the next adjustment is estimated to take place in 5 days and also be positive.

Revenue numbers look atrocious as is to be expected after the halving. Revenue in USD terms is down 46% in the last 30 days, matching the fall in BTC terms almost exactly. This is because the price has been so range-bound since early March. Fees are also down significantly, however, they are starting to come up a little in recent days.

Transfer volume from miners to exchanges has leveled off at roughly 1000 BTC in the last 30 days, which is a good sign for applying pressure to the supply side. Miners’ wallet balances actually increased slightly this week, meaning despite the reduction in revenue, miners’ net financial position is likely stable.

Investor Insights

Bitcoin On Exchanges: Related to the decline in transfer volume from miners to exchanges and the increase in miners’ wallet balances, the amount of bitcoin on exchanges plunged this week. On the chart below, you can see that exchange reserves fell from 2.57 million BTC on May 26th, to 2.51 million BTC today. That is approximately $4 billion in liquidity getting removed from exchanges. Based on this data, there is likely some volatility in the near future.

Source: Coinglass

Bitcoin Network Activity Update

This week, network traffic increased slightly, with the most notable changes occurring in the last 48 hours. The mempool, which represents the pool of unconfirmed transactions, has climbed back above the 200MB mark, showing a 13% increase week-over-week (WoW). While this level is within the normal range observed over the past year, the context of transaction fees is crucial for understanding its implications.

The fee for high-priority transactions has surged by 250% WoW, a significant increase that highlights the heightened demand for quick transaction confirmations. Although fees are known to be highly volatile and very well could drop back to $4 or lower by tomorrow, the current spike is noteworthy. Historically, such fee increases often precede periods of price volatility. Presently, Bitcoin's price is threatening to break below its 20-day moving average, testing lower support levels after appearing poised for a breakout just last week.

In terms of transaction types, Runes traffic has lightened up this week, likely influenced by the rising fees. At 96,000 Runes made up 19% of all transactions for that day on Bitcoin. The number of daily Inscriptions, despite the WoW increase, remains under 10,000, indicating relatively very low activity compared to peak periods.

Investor Insight

Daily Volume of Transactions in USD: Related to fees and mempool, there was a very sharp spike in the dollar volume of Bitcoin transactions on 27 May that could have affected these metrics. The spike was up to $25 billion! If this data is accurate provided by long-time data provider Blockchain.info it would be an ATH record volume. This was the day that former President Trump spoke at the Libertarian National Convention and publicly supported Bitcoin. Seems to be some major movement on that day.

Source: Blockchain.com

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!