By The Numbers: Key Bitcoin Metrics, Cycles, and Macro Positioning

A Comprehensive Review of On-Chain Metrics, Price Trends, Derivatives, and Macroeconomic Indicators.

Intro

As Bitcoin navigates the end of its consolidation phase, key metrics reveal increasing confidence among long-term holders and a bullish sentiment among traders. The Realized HODL Ratio and Perps Funding Rate indicate growing optimism, while rising moving averages support a positive price outlook. Despite this optimism, the broader macroeconomic landscape continues to flash cautionary signals, suggesting an impending recession. Investors must balance this bullish sentiment with the reality of tightening liquidity and economic contraction. Let's explore the significant developments and what they mean for the future of Bitcoin.

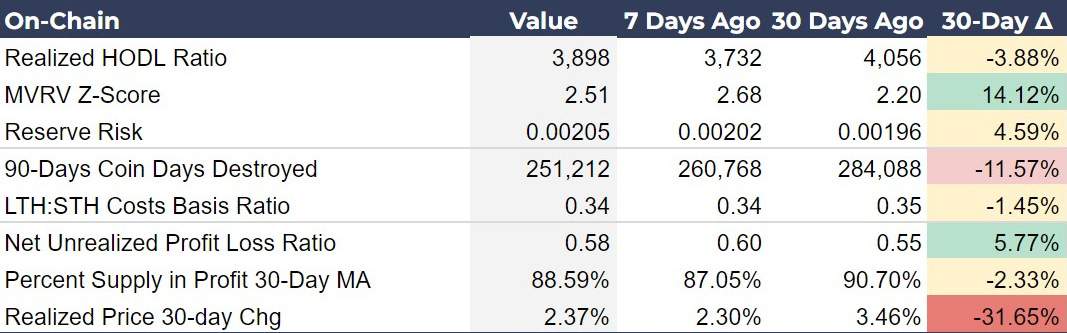

On-Chain Metrics Analysis

Each week, we break down relevant on-chain metrics to reveal insights into Bitcoin cycle timing, anticipate market volatility, and to learn more about Bitcoin’s market dynamics. This type of analysis is unique to Bitcoin due to the openness of the blockchain.

The Realized HODL Ratio, the ratio between the value of UTXOs last moved 1-week ago and 1-2 years ago, stands at 3,898, showing a slight decrease from 30 days ago and an increase from 7 days ago. This metric is relatively sensitive due to the 1-week timeframe. It bottomed on May 14th at 2850, therefore is showing a significant bullish shift, signifying the market bottom is likely in for this consolidation period.

The Reserve Risk, defined as price / HODL Bank, is inching higher. The HODL bank is a proxy for holders' confidence. If confidence is high and price is low, there is an attractive risk/reward for investors. The current reading of 0.00205 is still on the attractive side. When this metric reaches 0.01 it is time to watch for a cycle top.

Increased holding behavior can be seen in the 90-Days Coin Days Destroyed decreasing by 11.57%, and reinforces a bullish outlook. This metric rises as older coins in deep storage are moved, and falls as transactions are dominated by younger coins.

The Realized Price 30-day Change can be a useful proxy for tracking the rate of capital inflows and outflows (cost basis rising or falling). This has slowed but is still positive, meaning the overall bullish momentum is still intact, despite a long consolidation period. These metrics collectively suggest a solid foundation for Bitcoin's continued growth, despite minor fluctuations in some indicators.

Investor Insight

Long-Term Holding Strategy: Investors are returning to a long term holding strategy as on-chain metrics like the Realized HODL Ratio and 90-Days Coin Days Destroyed indicate a strong holding trend among long-term investors, typically indicating a lower risk of market volatility. Along with the relatively attractive Reserve Risk, this points to being a good time to increase position size for long-term holding.

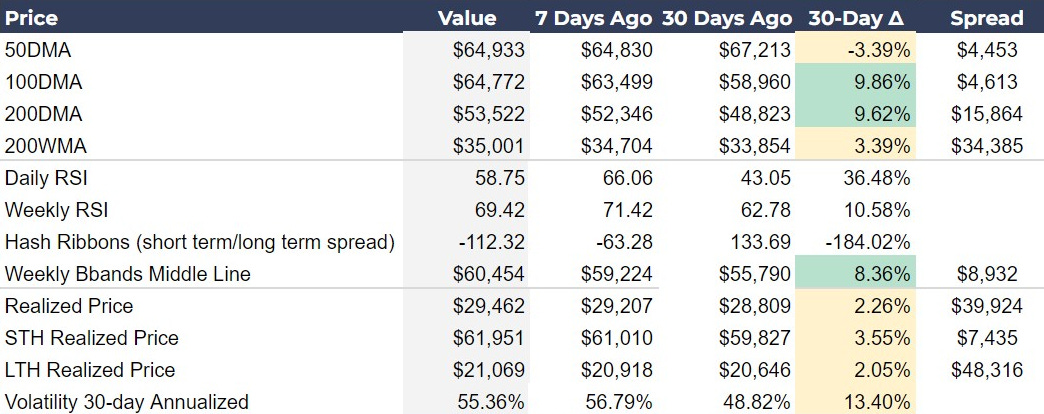

Price Metrics Analysis

I have been adding price metrics to our data over the last month to give a more complete view of the market. Today, we are introducing the Volatility 30-day Annualized metric, it is basically a Bitcoin VIX. This is the standard deviation of price over the last 30 days and then annualized. Volatility has increased slightly over the last 30 days, but is relatively consistent since the halving on April 19th. The recent high in volatility was back on March 23rd at 81%.

The 50 DMA increased slightly over the last week, turning to a positive slope, which is bullish for short-term price. All other moving averages continue to rise, reflecting a sustained upward momentum despite the recent consolidation.

Hash Ribbons, the difference between short and long moving averages of hash rate are increasingly negative, down to -112.32. Hash ribbons are seen as one of the final confirmations of bullish momentum returning to the market. This particular flip negative is due to the halving affecting profitability of less efficient miners, not a bear market or negative price movement.

Investor Insights

The 50 DMA for better risk/reward: Traders should keep an eye on the price in relation to the 50 DMA in the context of other metrics like the above on-chain metrics. Since it is a very basic and very widely watched indicator, the 50 DMA offers an entry point with a very tight stop-loss just on the other side.

The 50 DMA in combination: Swing traders or even long term accumulators can watch the position of price relative to the 50 DMA and the slope of the 50 DMA, in combination with on-chain metrics to form a robust confidence level in price direction. For example, if the price is above the 50 DMA, and it is upward sloping, and on-chain metrics are tipping in holders favor, price is very likely to move up.

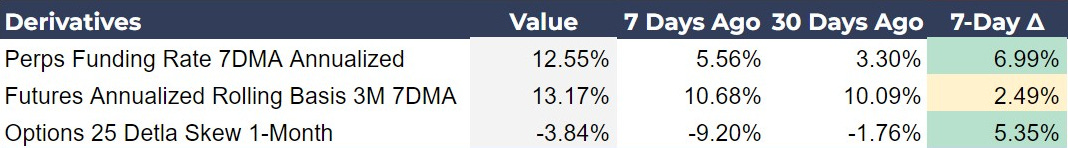

Derivatives Market Analysis

The derivatives market provides valuable insights into the sentiment and positioning of traders in the Bitcoin market. This week's data shows a significant bullish shift.

A notable increase in the Perps Funding Rate to an annualized 12.55%, up from 5.56% just a week ago and 3.30% a month ago. This sharp rise indicates growing bullish sentiment and a willingness among traders to pay a premium to open and maintain their long positions.

The Futures Annualized Rolling Basis over 3 months has also increased to 13.17%, reflecting higher expectations for future price appreciation, and an increased pressure for price appreciation due to a more attractive carry trade. Traders can buy spot bitcoin and short the quarterly futures to lock in this difference. That obviously puts upward pressure on the spot price in the short term.

The Options 25 Delta Skew has also improved significantly, moving from -9.20% to -3.84%. This reduction in skew suggests that options traders are less pessimistic about downside risks compared to a week ago, though there remains a slight bias towards protective positioning. Overall, the derivatives market signals an increasingly optimistic outlook among traders, with a substantial shift towards bullish positioning over the past month.

Investor Insight

Reduced Downside Risk Perception: The improvement in the Options 25 Delta Skew suggests that traders are less concerned about immediate downside risks. This can be taken in context of other metrics, like Reserve Risk showing a still attractive risk/reward and price in relation to the 50 DMA. All these metrics are agreeing that the risk for a potential large downside move is declining.

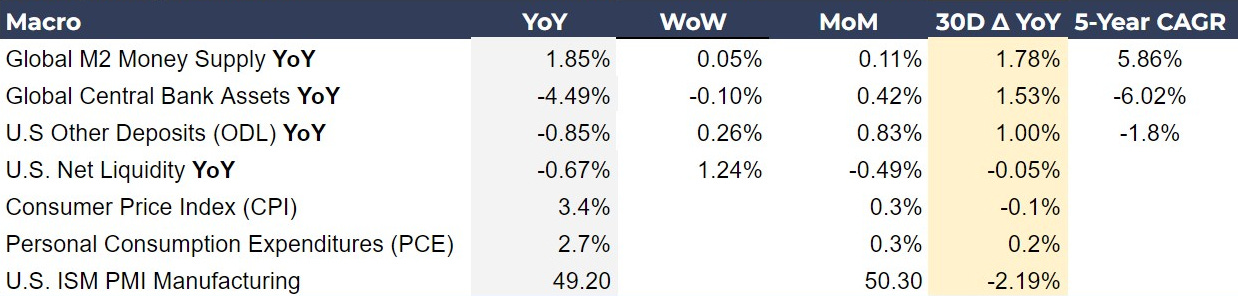

Macroeconomic Indicators Analysis

The latest macroeconomic indicators present a mixed outlook, reflecting ongoing adjustments in global and US financial conditions. The Global M2 Money Supply has shown a modest increase of 1.85% year-over-year (YoY), with slight week-over-week (WoW) and month-over-month (MoM) gains. This uptick signals a gradual easing of liquidity conditions, which could support asset prices, including Bitcoin.

Conversely, several of our metrics are still flashing contraction and worsening liquidity conditions. Global Central Bank Assets have declined by 4.49% YoY, despite a minor monthly increase. This reduction reflects the ongoing unwinding of pandemic-era monetary expansions.

In the US, Other Deposits (ODL), a refined M2 excluding cash and money market funds, have decreased by 0.85% YoY but showed positive momentum on a weekly and monthly basis. ODL has recovered from being very negative, showing deposits shrinking over 8% YoY in April 2023. Perhaps the economy has yet to feel the fallout of such a drastic decline in deposit levels. It is important to note that since then, the rate of change of deposits has not gone positive YoY since then. US Net Liquidity, consisting of Federal Reserve Assets, the Treasury General Account and the amount in overnight Reverse Repo with the Fed, is also negative YoY.

Overall, our macro metrics are pointing to a bearish and deflationary global economic picture.

Investor Insights

Defensive Positioning in a Shrinking Liquidity Environment: With 3 out of 4 of our liquidity related metrics are negative, PMI is shrinking in 17 of the last 18 months and May forecasted to be unchanged at 50.0, investors should consider defensive positioning to navigate increased recessionary pressures. We are seeing increased interest by companies to add bitcoin defensively to their balance sheets as well. Just today, Semler Scientific announced they purchased $40M of bitcoin for their cash reserves.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!