By the Numbers: Bitcoin Miners and Network Trends

Insights on Public Miner Performance, Mining Activity, and Network Traffic Dynamics

Introduction

Over the past 30 days, publicly traded Bitcoin miners have seen substantial gains, leveraging their access to capital markets to sustain operations and invest in growth. The nuanced environment for Bitcoin mining reflects both challenges and opportunities, with key metrics like hash price, hash rate, and difficulty pointing to fundamental growth despite current struggles with profitability. Additionally, network traffic data reveals a robust and active ecosystem, characterized by increased transaction fees and rising speculative interest.

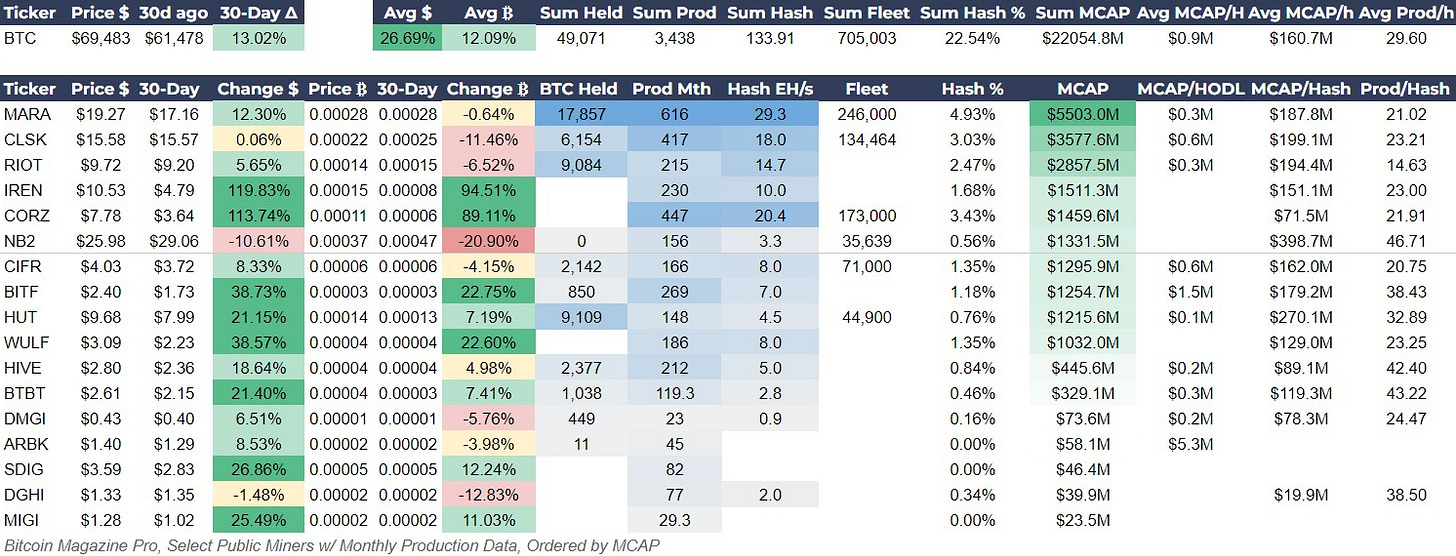

Public Miner Update

The performance of publicly traded Bitcoin miners over the past 30 days has shown substantial gains in dollar terms, with an average increase of 27%. In Bitcoin terms, the average performance was a notable 12%. In the context of market consolidation, particularly during the challenging post-halving period, being a publicly traded Bitcoin miner can confer several distinct advantages. Public miners have access to capital markets that private miners do not. This access enables them to raise funds more efficiently through equity and debt offerings, providing them with the liquidity necessary to sustain operations and invest in growth, even when Bitcoin prices are stagnant.

Iris Energy (IREN): As noted last week IREN continues to surge, now up 112% in the last 30 days. They beat their revenue forecasts, earnings per share and upgrade timing on their quarterly investor update, but the surge is likely due to specific trading behavior we also mentioned last week. Large options activity, specifically, 27 uncommon options trades set a price target of $10 per share, it is now at $8.21. There is still upside on that trade, but be careful of getting caught when those options get unwound.

Core Scientific (CORZ): I also reported last week on CORZ huge beat on Q1 earnings and the news continues this week with CoreWeave’s all-cash $1 billion acquisition offer. The offer was quickly rejected, with CORZ claiming it was undervaluing the company. However, the market cap has increased 60% in June alone, meaning its market cap was far below the $1 billion offer just days ago.

Kerrisdale Capital declares “war” on RIOT: In a pretty weird story, hedge fund Kerrisdale Capital calls bitcoin mining “snake oil” and actively chose to go after RIOT with massive shorts, announced on June 5th.

Investor Insight

Bitcoin Reserves Will Be Game Changer: Since the halving back on April 19th, we have yet to see the miners with large bitcoin reserves outperform. When the price of bitcoin finally breaks the multi-month ATH resistance, that is when the reserves will matter greatly. Interestingly, the value of bitcoin reserves for MARA and RIOT are both 21% of their companies market cap. Meaning in the price of bitcoin doubles, the market caps might have a significant multiplier on top of that.

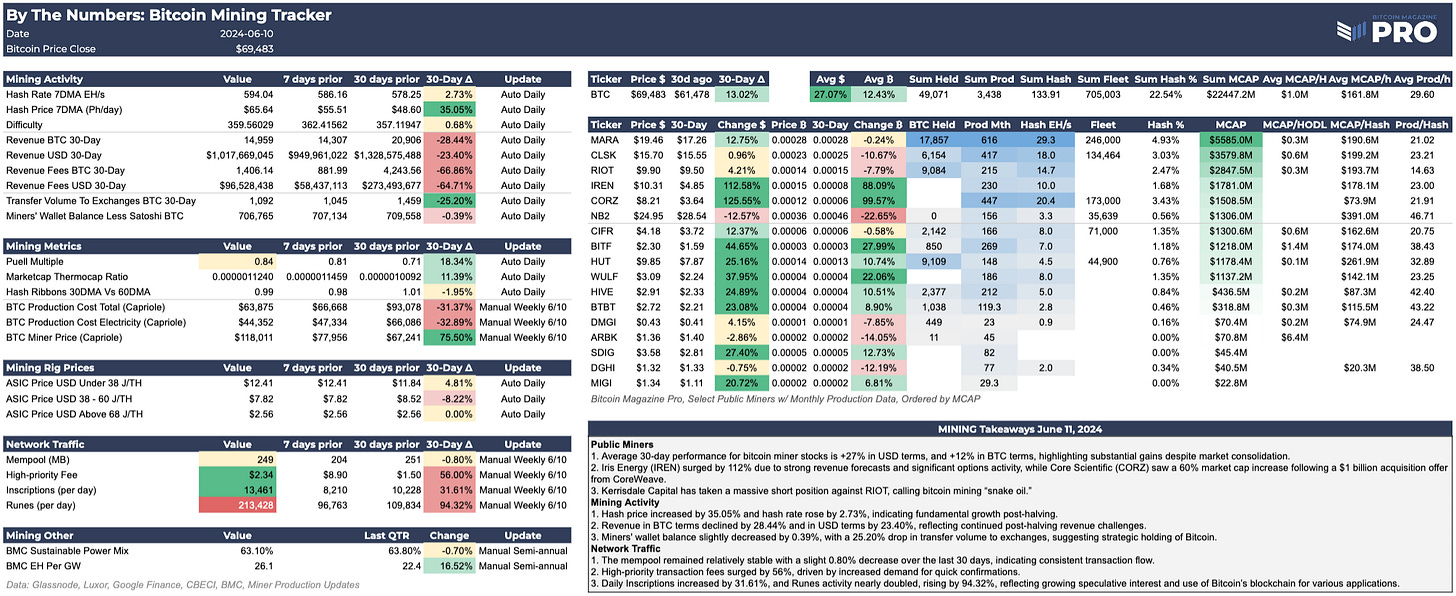

General Mining Activity

The recent mining activity data reflects a nuanced environment for Bitcoin miners over the past 30 days, highlighting both challenges and opportunities in the post-halving period. Overall, while miners face revenue challenges post-halving, the increase in hash price, hash rate and difficulty point to fundamental growth.

Hash price resumes its gentle rising trend established over the 6 weeks since the halving. The recent spike was due to the OKX wallet consolidation gone wrong where fees spiked. According to HashrateIndex.com, “hash price is positively correlated with changes to Bitcoin’s price and transaction fee volume and negatively correlated with changes to Bitcoin’s mining difficulty.”

Source: HashrateIndex.com

Revenues are starting to level off, with the month-over-month decline going from -46% last issue to -23% today. For the time being, changes to revenue in BTC and USD terms are very close to each other given the miraculously stable over the last 3 months.

Miners’ wallet balance took a hit this week as the stagnant price post-halving is forcing them to sell some of their reserves waiting for price to appreciate. It is still not significant in the grand scheme of things, selling only 0.39% of their total stack in the last 30 days, and a total of 359 in the last 7 days.

Investor Insight

The Deflationary Effect of Halving: The decline in the transfer volume to exchanges is exactly what we expect after the halving. This is the behavior that will trigger a deflationary spiral. Therefore, investors can watch this metric to confirm anticipated repeat patterns for price after the halving. The decrease in flow to exchanges will eventually cause price to rise, especially in the face of massive inflows to the ETFs and other other entities like Metaplanet, Microstrategy and Tether buying bitcoin.

Network Traffic

Network traffic data indicates a robust and active Bitcoin network, with increased fees for high-priority transactions, growing use of inscriptions, and a substantial rise in Runes activity. These trends point to increased speculative interest in the bitcoin ecosystem and a healthy demand for network services.

The mempool did increase from last week but it generally flat over the last month, meaning demand for transactions is very stable. We should expect the new normal for the mempool to be over 200 MB throughout this bull market.

Fees did have a spike mid-week due to some bad transaction management by OKX, but are back into the $2 range and remain quite reasonable.

Surprisingly, Inscriptions are increasing slightly but are still miles away from their previous peak in popularity that saw 200-400,000 inscriptions per day. Runes on the other hand are proving to maintain their popularity here, being the much more efficient form of token on top of Bitcoin. The increase also shows an increasing speculative interest in the ecosystem as a whole.

Investor Insight

Spike in Fees and Volatility: Once again this week, we saw a rapid spike in fees and, coincidentally, we are now witnessing volatility as price retests the 50-day MA. While the spike in fees was not directly due to an increase in coins being sent to exchanges, the correlation continues, that a spike in fees should raise the risk of volatility for investors.

Conclusion

In conclusion, the recent performance of public Bitcoin miners, along with key metrics from mining activity and network traffic, highlights a resilient and dynamic Bitcoin ecosystem. Public miners are effectively navigating the post-halving period by leveraging capital markets, while network activity indicates robust growth. Investors should monitor these trends to make informed decisions, recognizing the importance of strategic positioning in this evolving landscape.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

Not Financial Advice.