Bull Market Likely as Price Stabilizes and Industries Boom

Rumors of a bull market spread as Bitcoin hovers around $70k. Economic developments and successes in ETFs and mining clash with traders' psychological resistances.

With Bitcoin staying in the $70k range for several days, positive signs from the broader crypto economy are suggesting that a bull market may be starting up.

Bitcoin’s price has been doing well since it hit a new all-time high in mid-March. An elongated period of steady growth came to a climax as two different hype bubbles were circulating through the space: the SEC’s ETF approval in January and the halving in April. March was a seemingly natural point for the bullish sentiments around these two items to reach their peak, as the fledgling ETF industry had a series of growing pains and investment dollars tended to be conservative as the halving took place. Still, although Bitcoin’s price did lag for a while in May, it has recovered, and the coveted $70k mark has held for several days.

Now that Bitcoin has managed to hold a level near its all-time highs for several days, speculation is once again growing in the community that a bull market is likely to appear soon. How credible are these assertions? How big of a price jump is plausible, on what sort of time scale? What are the underlying economic factors that are contributing to Bitcoin’s current success? What sort of hazardous factors in the market could possibly cut these hopes short? All of these questions and more are very relevant to making any kind of meaningful prediction for Bitcoin. Although it is impossible to fully predict an asset as chaotic as Bitcoin, there are several key facts we can look at to assess these optimistic predictions.

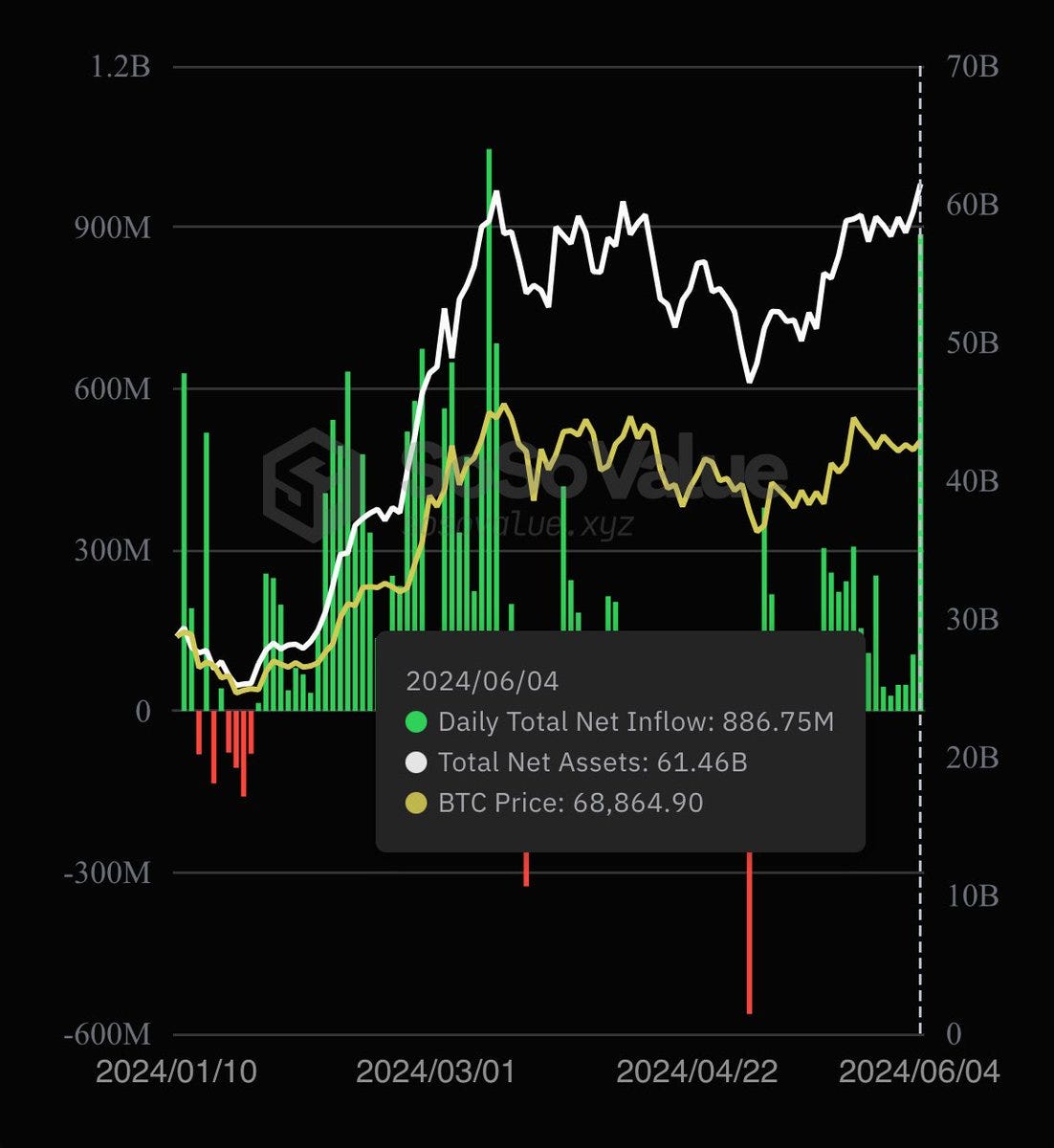

First of all, multiple large industries intimately linked with Bitcoin’s success are doing very well at the moment. Bitcoin ETFs saw a “second wave” of inflows in early June, with net inflows of $880M across the entire industry. This represents not only the highest single day of trading since March, when Bitcoin’s value was at its all-time high, but it also represents the second-highest day of ETF trading ever. The ETF price and Bitcoin’s value itself are very intimately linked but not directly correlated; nonetheless, Bitcoin’s all-time record happened the day after this ETF record in March. So, this current ETF rally is very encouraging on this front alone. Additionally, there are several other factors in the ETF world that seem positive: this record comes after a 16-day streak of net inflows, and even the hemorrhaging Grayscale saw a net daily gain. This would be the seventh time the company has achieved positive sales since ETF approval. With ETF approval soaring worldwide, Bitcoin’s success seems like a no-brainer from this angle.

The ETF market is not the only business near and dear to Bitcoin that’s been performing well. A definite point in the currency’s favor is the rally that mining stocks are undergoing at the moment. The halving in April was still a significant hardship for the industry despite all the preparation that took place, as mining revenues were cut in half overnight for everyone. In the intervening months, leading firms have been coping with the new market conditions through several fundamental reorganizations. Not only are businesses working to upgrade their equipment and infrastructure, but they are also seeking alternative revenue sources to keep a steady income regardless of the mining industry.

However, some of the leaders are also looking for a third key aspect of reorganization, in the form of mergers and acquisitions. Several high-profile mergers involving industry leaders like Riot Platforms and Core Scientific were attempted in early June, although none of them quite succeeded. Core Scientific, for example, ended up signing several 12-year contracts with CoreWeave but rejected their new partner’s subsequent buyout offer. Although these mergers did not go through, they did put drops of blood in the water, and a wide variety of sharks can sniff them out. Titans of traditional finance have gained a new interest in assessing possible buyouts in the “undervalued” mining industry, led in particular by JPMorgan. This wave of hype, ironically, has been leading the “undervalued” stocks to soar in valuation since news of the failed buyouts. Leading miners may still be chafing somewhat in the post-halving mining environment, but Bitcoin is a particular business where media excitement can turn temporary profits into a bedrock of success. Soaring miner stocks are only a benefit to Bitcoin overall.

Although these industries’ successes are certainly both encouraging, the real jewel in Bitcoin’s crown at the moment comes from wider developments in the global economy. For example, a few factors like global currency liquidity and investment patterns are both very similar to some of Bitcoin’s previous successes, and things like this are always reassuring to Bitcoin investors. However, for more concrete evidence of gains, look no further than rate cuts among several leading economies. Canada’s Central Bank cut interest rates for the first time in four years on June 5th, and Bitcoin saw a corresponding price jump at the same time. Rate cuts are generally good for Bitcoin, as they encourage risky investments and increase fiat currency supplies. As mentioned above, liquidity in the world of fiat generally trends towards Bitcoin investment.

Canada’s Central Bank cited factors like rising inflation before making these rate cuts, and the corresponding financial agencies in both the United States and the European Union echoed these sentiments. These economies are much larger than Canada’s, and both are heavily entangled in the global Bitcoin market, so naturally, it became very easy to make bullish predictions. The European Central Bank committed to its own rate cuts the following day, and the US is believed to be very likely to follow. Analysts from Bloomberg have described Bitcoin’s success in the near term as practically a foregone conclusion because of these factors, as every previous trend in Bitcoin’s history points to these rate cuts as positive factors.

Still, it’s not as if Bitcoin’s success is an absolute certainty. There are several potential hazards that have been identified as future roadblocks. For one, although the price has been holding steady around $70k for several days, traders have noticed a level of stiff price resistance at the $72k mark. The price has approached this metric several times and been swatted away since mid-March, as supplier congestion has turned into an apparent psychological block for certain traders. If Bitcoin fails to cross this threshold after several days, it may blunt the overall momentum. Speaking of psychological factors, another point to consider is that 100% of long-term traders, those who’ve held Bitcoin for more than five and a half months, are currently in the black from that investment. Figures like this are a likely cause of FOMO, which can cause investors to behave in very unpredictable ways. For example, open interest data is on the rise, which can exacerbate price swings. A pullback from some traders may end up magnified beyond its initial proportions. Bitcoin needs to overcome these possible oddities from the trader angle, or a rally may not materialize.

Ultimately, the most pessimistic cases for Bitcoin seem somewhat flimsy compared to the points in its favor. It may be possible that Bitcoin’s ostensible plusses may work against it somehow, or at the very least won’t be much of a help. Arguments like this include attempted mergers and acquisitions disrupting the mining industry or rate cuts contributing to an overall economic recession, for example. However, the evidence in Bitcoin’s favor presently seems quite convincing. At the end of the day, it is up to Bitcoin investors to help their assets cross these thresholds, but all the ingredients seem to be there for a period of success. As long as Bitcoiners keep their characteristic optimism, the future is indeed looking rather bullish.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!