BTC breaks above $120K!

Bitcoin surges past $120K, hitting 0.618 fib target, with room to climb to $127K.

News Headlines

Price Action

In last week’s Weekly Alpha newsletter, we set out a near-term target of $121,500 for BTC at the 0.618 fib extension. Today, that target has been perfectly hit! Bitcoin has tapped the 0.618 and is slightly retracing.

Figure 1: BTC has already hit the 0.618 fib extension target.

With derivatives funding rates and other metrics still relatively low, it is our view at Bitcoin Magazine Pro that BTC can still continue higher. The next near-term target would be the 0.786 fib extension at $127,700.

Bitcoin funding rates show the extent to which derivative traders are bullish or bearish. Tall green bars on the charts below show derivatives markets skewing long - i.e. more traders expecting price to continue higher. That typically happens near BTC price peaks as traders become overconfident.

However, right now, positive funding rates (green bars) remain relatively low, implying BTC price can continue to rise further for some time.

Figure 2: BTC Funding Rates.

The Big Story: BlackRock’s IBIT now holds +700,000BTC, and may soon breach 1M BTC

Quick Snapshot

Holdings: Over 700,000 BTC (worth roughly $75–80 billion)

Market Share: IBIT holds around 55 - 56% of all Bitcoin held by U.S. spot ETFs

Assets Under Management (AUM): Approximately $80 billion, just 18 months after launch!

Performance Since Inception (Jan 2024): Total return of about 83%

How IBIT Can Reflect Market Sentiment

BlackRock’s IBIT fund recently surpassed 700,000 BTC in holdings, largely driven by consistent inflows. In just one week in July, the fund added roughly 1,500 BTC. At this pace, IBIT is acquiring several days’ worth of global mining output every week, reflecting sustained institutional demand.

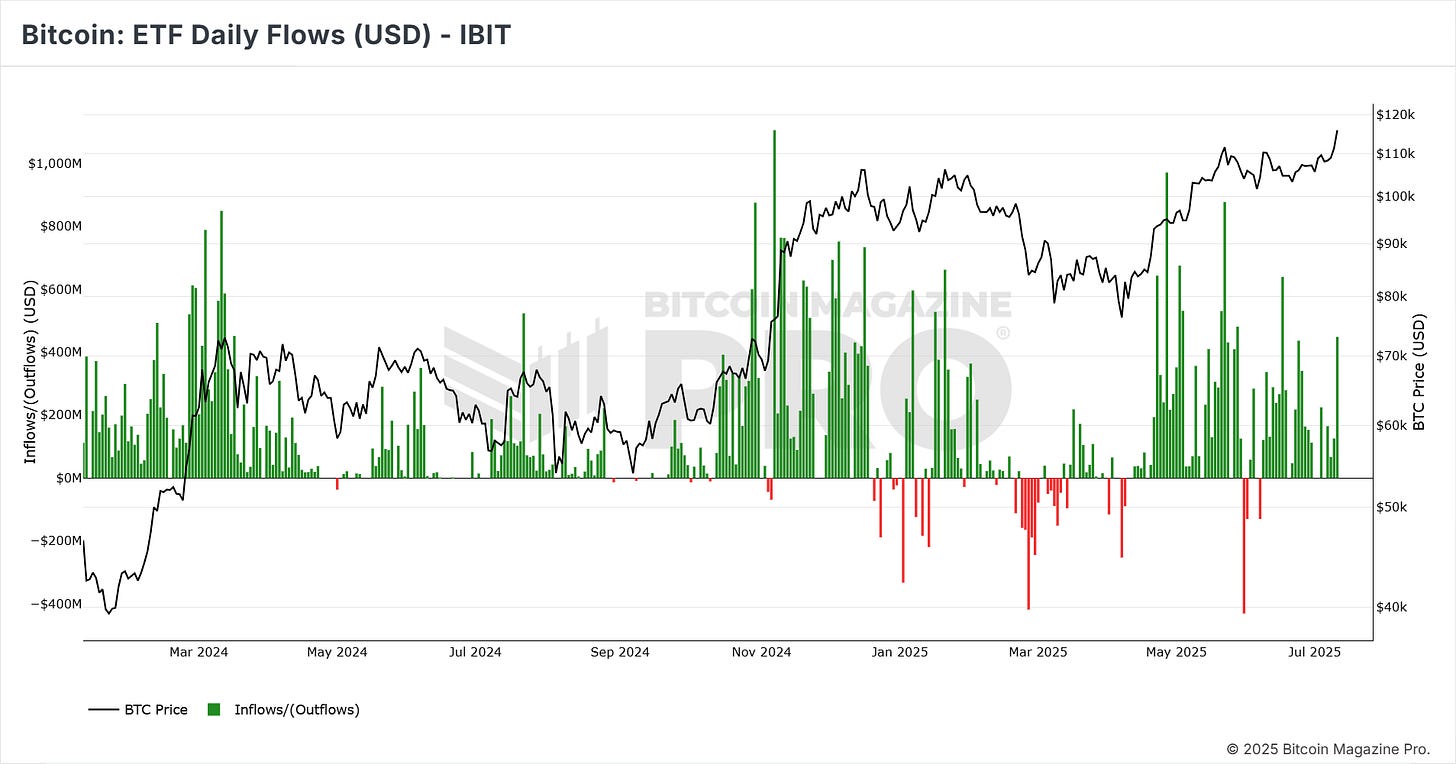

Figure 3: BlackRock IBIT Daily Inflows / Outflows.

What is interesting to note as BTC sails past $120k is that the daily inflows of Blackrock over the past couple of weeks have still not exceeded the daily inflows seen back in either March 2024 or Nov 2024 on the chart above.

This suggests that we are not close to reaching extreme greed or euphoria sentiment levels in the market despite the new all-time high in BTC price.

Looking Ahead

Projections based on Cumulative Flows shown in the chart below suggest total U.S. Bitcoin ETF assets could hit $200 billion by the end of 2025.

Figure 4: Cumulative Flows of Bitcoin ETFs.

IBIT is represented by the yellow section on the chart, making its dominance in the market clear to see.

If IBIT maintains its current market share, it could top $110 billion AUM and approach 1 million BTC within the next year.

One thing is for sure: with ETF inflows increasing and Treasury companies like Strategy also buying up Bitcoin, the demand is exceeding the supply being put onto the market, which is pushing BTC price higher.

⏳ Limited Time Offer

If you would like to access Bitcoin charts and chart alerts to understand where we are in the bull market cycle, use this code at checkout to get 30% off: NOW30

The code will expire in 48 hours, so get your 30% off while you can.

We hope you enjoy becoming a platform member, so that you can get an edge in the market.

Speak again soon.

Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

😳🤯🤩