Inflation Sends Rate Hikes Higher

In today’s issue, we will examine the macroeconomic backdrop with a particular focus on the state of the US Consumer.

U.S. inflation came in hotter than expected today with both the overall Consumer Price Index (CPI) and Core CPI coming in higher than month-over-month consensus growth. At an alarming 8.6% non-seasonally adjusted headline rate and with an acceleration in monthly Core CPI, which is what the Federal Reserve is laser focused on, volatility is rising across markets today.

Nearly every single subcomponent across expenditure categories except for apparel and physician services have increased relative to April 2022. To supplement the CPI data release, University of Michigan published their latest data on longer-run inflation expectations across both consumers and forecasters. The five-year inflation expectations survey increased to 3.3%, which is the highest print since 2008. As another data point, the Atlanta Fed’s sticky-price CPI, a weighted basket of items that change price relatively slowly, increased 7.5% on an annualized basis.

This is exactly what the Federal Reserve doesn’t want to see in the data, and as a result, markets are pricing in an accelerated pace of hawkish actions (more rate hikes in a shorter amount of time).

With inflation readings showing no sign of slowing down anytime soon, hawkish expectations are showing up across the board especially in the Eurodollar futures market. Eurodollar futures, a liquid market for the future federal funds rate, shows an implied rate of 3.56% by the end of the year. That’s meaningful above the current 0.75% to 1% target range we’re in today with five Federal Open Market Committee (FOMC) meetings left this year. The market is pricing in an average 50 basis point rate hikes for each meeting. In just two days, the market has priced in another full rate hike.

But that’s not all from the University of Michigan economic data releases today. Arguably the more important data point today is consumer sentiment hitting an all-time low. Sentiment of American consumers is now worse than what it was during the Global Financial Crisis. This is yet another data point to show that the “strength” of the consumer continues to deteriorate as inflation weighs heavily on the everyday person.

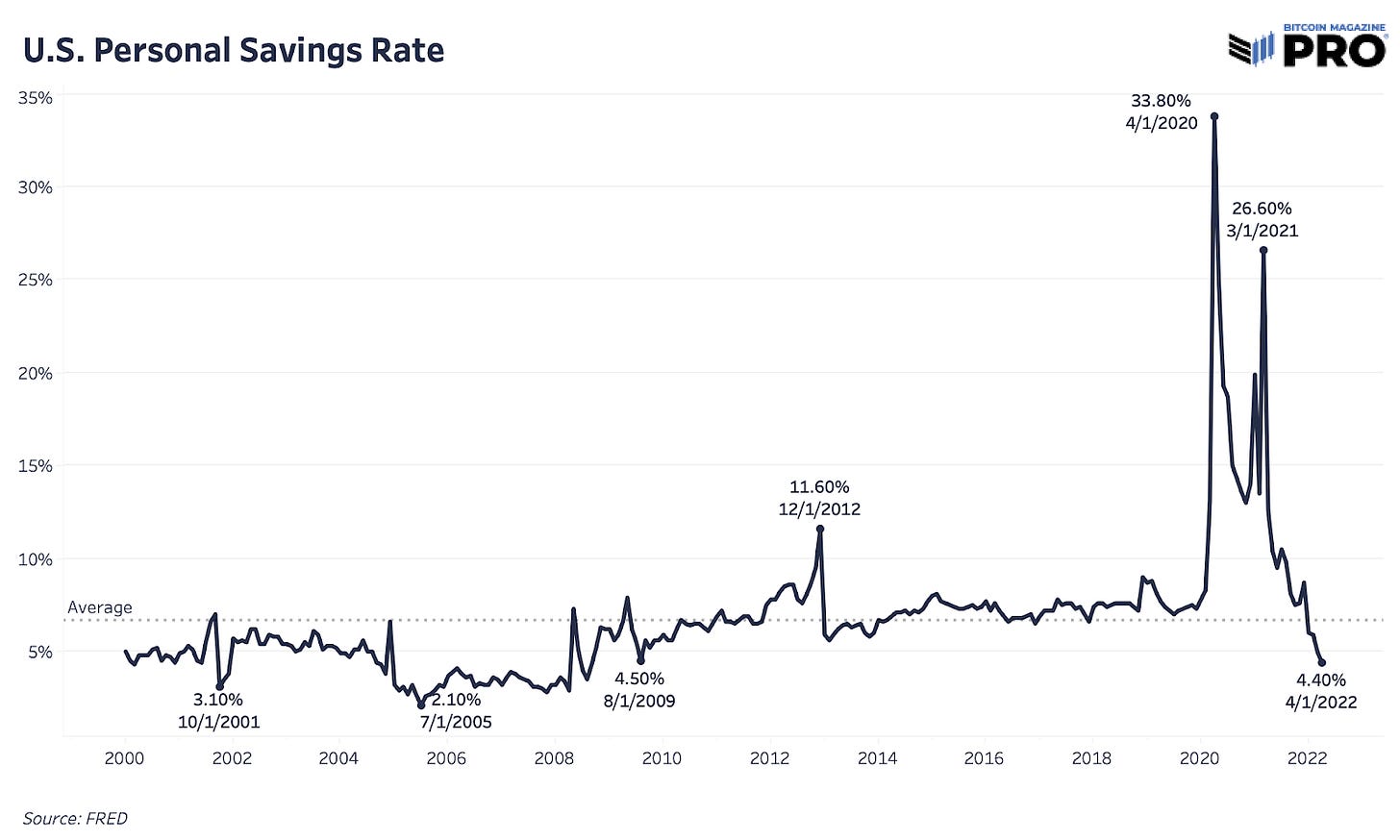

This comes at a time when the personal savings rate (personal savings as a percentage of disposable personal income) is hitting new lows since 2008, while consumer credit expands at the fastest pace seen over the last two decades. Although nominal wages have grown, real wages are getting crushed by inflation with the U.S. real average weekly earnings falling 3.9%, the most negative change in the data going back to 2006.

On the release of the inflation readings, bond, equity and crypto markets tanked across the board, as soaring yields placed further pressure on battered risk assets. The current economic backdrop continues to reinforce our belief that a so-called soft landing for the economy is increasingly unlikely, due to structural forces at play in global commodity markets combined with historic levels of indebtedness globally.

The toxic cocktail of supply side commodity shortages leading to accelerating inflationary pressures, a rise in yields (sell-off in bonds/duration), damaged consumer confidence and falling corporate margins is a recipe for economic disaster that is still in its early phases.

The first phase of the sell-off in risk assets during this inflationary bear market has been the result of rising yields and decreasing liquidity. This can be seen with a look at bond yields and legacy market volatility.

The next phase will be a result of a decrease in corporate earnings due to a squeezed consumer, contributing to a widening credit risk and liquidity troubles across the board. The pace of the current economic slowdown is truly remarkable, and it will eventually lead to a collapse in demand and a reversal in inflationary pressures to deflationary concerns.

An eventual shift in hawkish policy will come as a soaring dollar (relative to other global fiat currencies), and a deceleration in year-over-year inflationary pressures as demand destruction kicks in, necessitating a need for easing to prop up a collapsing economic system. Austerity isn’t a feasible long-term outcome, given >100% Federal Debt/GDP. With an economic slowdown and a collapse of asset prices comes a collapse in tax receipts and the ability for the U.S. government to repay its debts. If this sounds rather binary, it's because it is.

While bitcoin is subject to the whims of legacy market volatility and liquidity conditions, our thesis on the long-term prospects of the asset are unchanged. The most obvious difference between this bear market cycle and the ones of bitcoin’s past is that it is occurring in tandem with an economic slowdown. However, the dynamics of a general flush in long-biased leverage, the departure of unconvicted speculators, sell pressure and closure of weak mining operations (more of this to come), and a bleed of overpromised and underdelivered crypto projects is remarkably similar to past bitcoin market cycles, just on a larger scale.

With this in mind, we will conclude today’s piece with a final thought for readers, with a focus on the long term.

Hey guys these are great, will we be getting any more?