BM Pro Daily - Exchange Outflows Continue

Coinbase April Outflows

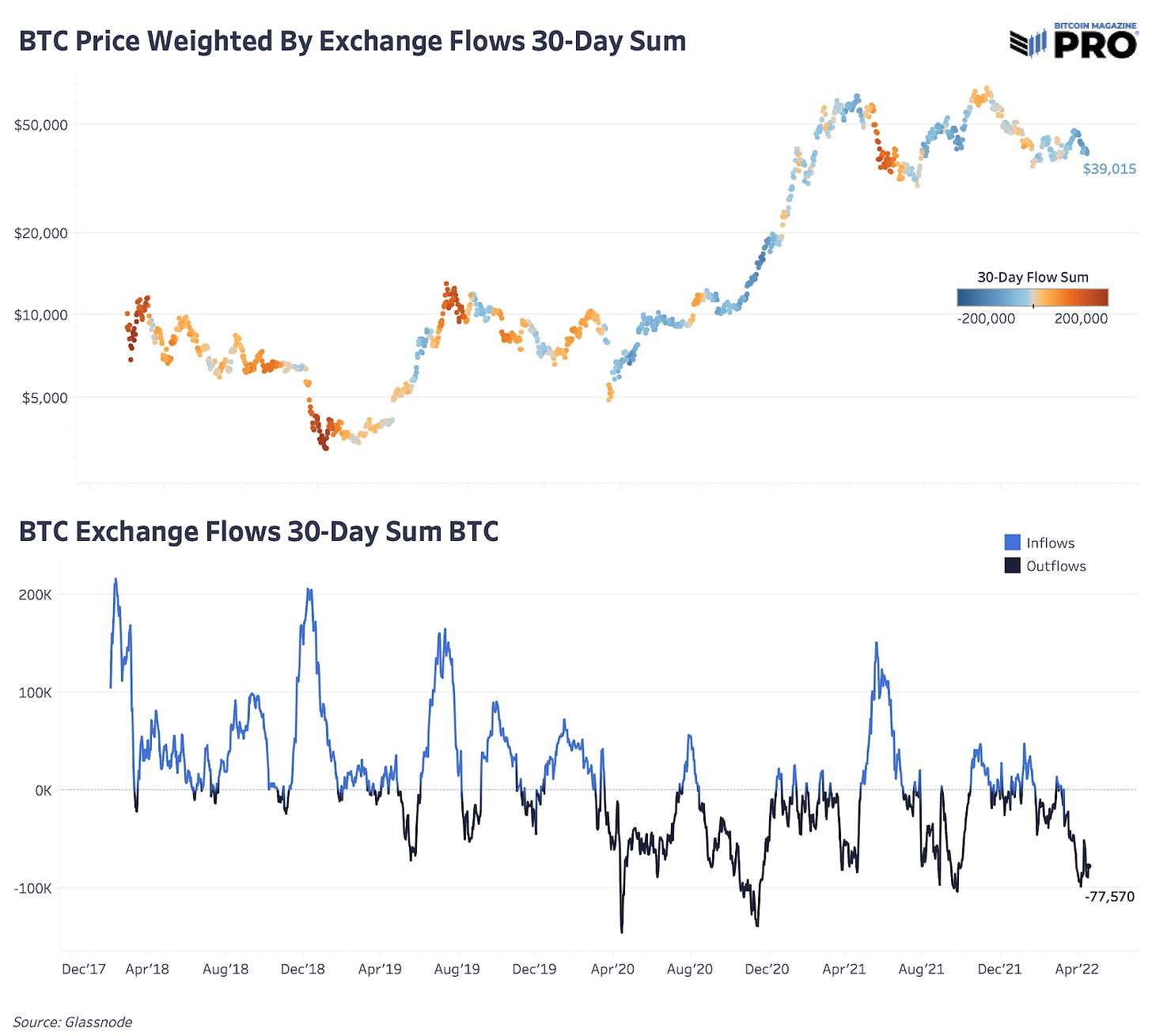

As we’ve highlighted in previous analyses, the latest bitcoin outflow from exchanges has been relentless over the last month despite a lack of price appreciation. With March 2022 being the second-highest outflow month in bitcoin’s history, April has followed up with similar outflow strength so far. In our view, exchange balance outflows is one of the better metrics available for assessing current demand and accumulation sentiment.

The key assumption is that these coins are leaving for long-term cold storage. We also see heavy inflows follow during times of major sell-offs, like May 2021, despite strong months of preceding outflows. Coins can and will come back to exchanges in macro sell-off events but the long-term trend of more bitcoin leaving the market entirely is evident since March 2020.

Over the last 30 days, nearly 80,000 bitcoin, worth over $3 billion, has left exchanges with the largest outflows coming from Coinbase. Previous major 30-day outflows at this level have corresponded to price appreciation but now we are in a much more unique market structure.

Exchange balance outflows don’t always lead to short-term price appreciation. Although there’s been a close relationship between 90-day exchange flows and price over the last year, this trend looks to be breaking down as of late. Although exchange outflows are persistent, the broader market lacks bullish catalysts across rising retail participants and risk-on asset positioning that seem to be the stronger forces at play right now.

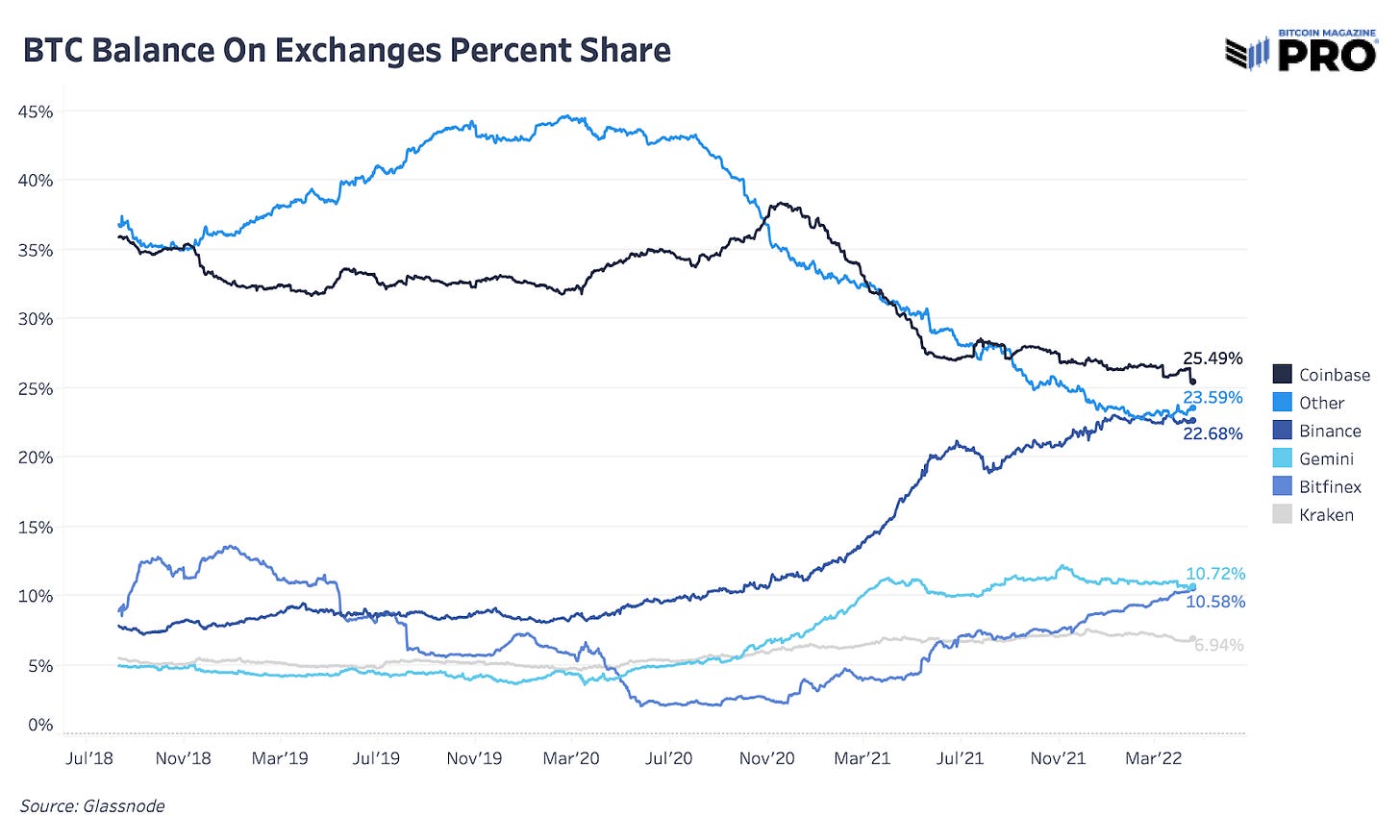

When we talk about exchange balances, the majority of the market can be explained by trends in Coinbase and Binance, with both exchanges having over 20% of total known bitcoin exchange balances on their platforms, respectively. Together, they make up 48% of known bitcoin on exchanges. We rely on Glassnode’s heuristics and data science techniques to determine known exchange addresses and balances.

Coinbase reports a much higher number of bitcoin “assets on platform” as they also include the amount of bitcoin in their institutional custody services. At the end of last year, they reported over 2.4 million bitcoin on their platform while their exchange balances were estimated to be around 680,000 at that time.

As for their exchange balances, the total bitcoin balance is down 8.63% year-to-date and down 39% since the peak in May 2020. We see this continued stair-step pattern over the last six months where large 10,000-plus chunks of bitcoin are being removed from the exchange at a time. Last Thursday was one of the largest one-day outflow days (in bitcoin-relative terms) over the last few years.

In USD terms, value on Coinbase continues to increase with price, with over $24 billion in bitcoin on the exchange. Last Thursday’s outflow was $1.16 billion in size, and it’s worth noting just how significant the size of the move was in historical context. The size of the move would represent the equivalent in dollar value of approximately 40% of the total value of bitcoin held on Coinbase in the depths of the 2019 bear market.

With the highest percentage of exchanges share, Coinbase has the largest amount of bitcoin, in USD terms, on their exchange. The top four exchanges have over $65 billion on their platforms combined.

Great color around Coinbase flows, thanks.