BM Pro Daily - Exchange Inflows Spike

LFG Exchange Inflows

As a result of yesterday’s chaos, exchanges had an estimated 52,333 of bitcoin inflows largely driven by the depletion of the Luna Foundation Guard (LFG) reserve balance. This doesn’t change the larger macro trend of exchange outflows over the last two years, but it is the largest daily inflow of bitcoin to exchanges since November 2017 and the all-time highest USD value of bitcoin moved.

From what we know so far, without a clear LFG statement yet on the latest status of reserves, 52,189 bitcoin has left known addresses dropping the reserve balance from 80,395 BTC to 28,206. At peak, that was nearly $3 billion in reserves (with a $10 billion goal) to support Terra’s previous $18 billion market cap. A large chunk of 37,836 BTC (approximately $1.13B) looks to have been sent to Gemini.

Total reserves fell after LFG announced that $750 million in bitcoin was deployed as a loan to market makers with efforts to defend the UST peg. It’s not as clear as to the exact percent of reserves that were completely sold on to the market versus what’s been loaned to market makers. The question now is how much bitcoin will make its way back to LFG’s reserves, or back to the market amid another potential wave of sell pressure if the recovery efforts fail and trust in this stablecoin experiment doesn’t return?

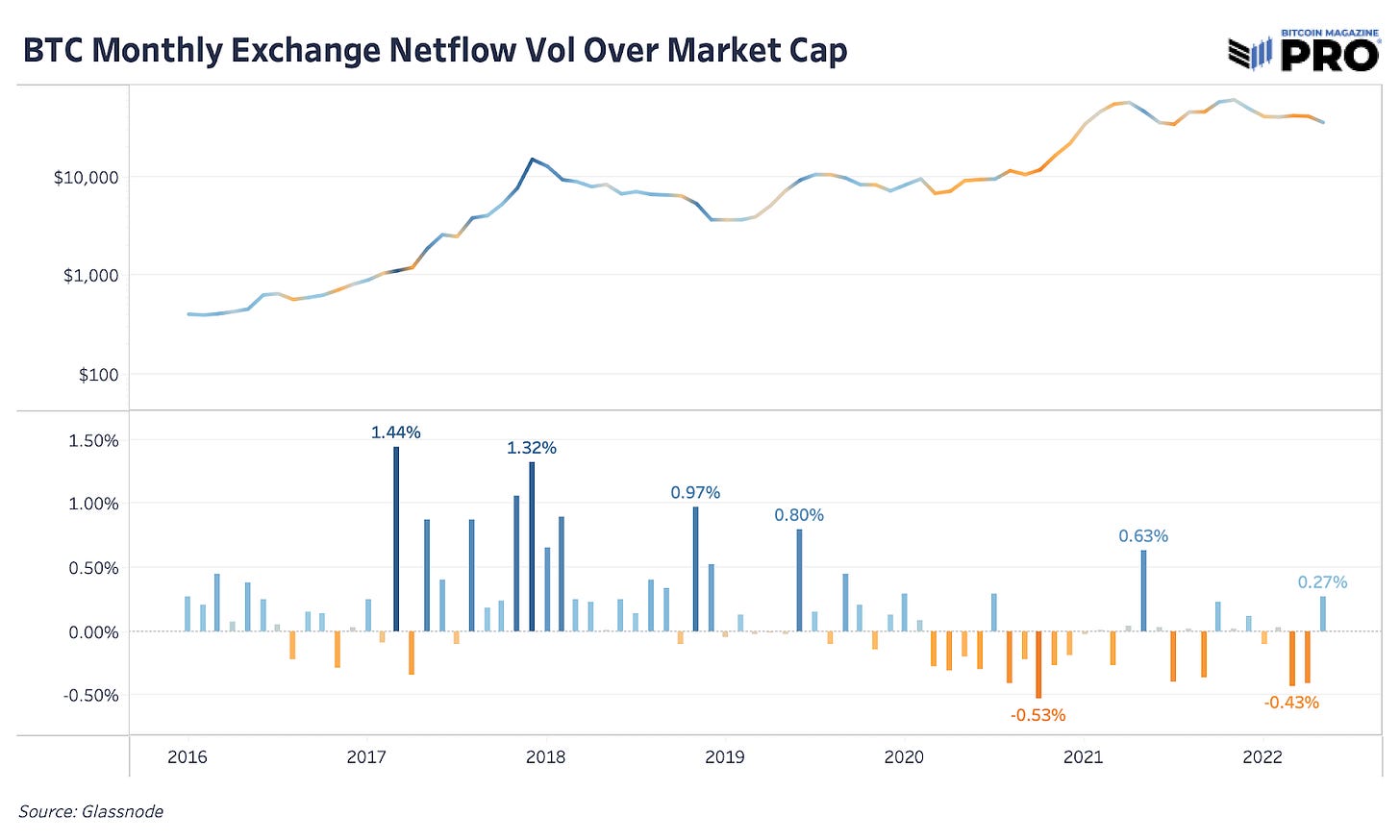

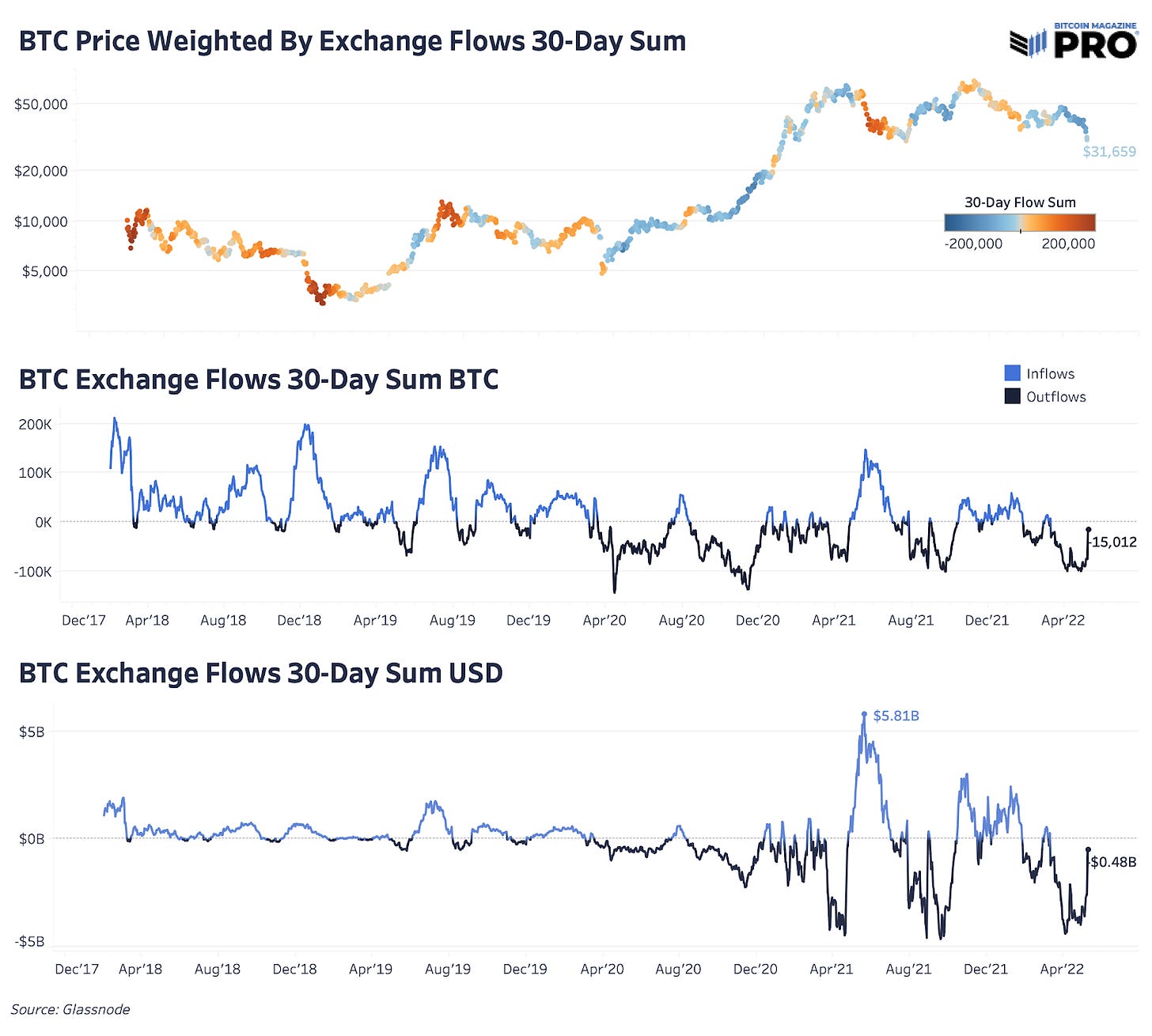

Normalizing the USD exchange net flows by bitcoin’s market cap on a monthly basis shows that although this was a historic inflow day, it’s a relatively small total monthly inflow as a percentage of market cap so far. Similarly, on a 30-day rolling basis, exchange outflows are still dominant with 15,012 BTC outflows from exchanges up from nearly 100k BTC in outflows at the recent peak.

The rolling 30-day sum is largely driven by the fact that April 2022 was the third-highest exchange balance outflow month of all time. Across both March and April, nearly 161,000 BTC left exchanges while so far, May has an estimated inflow of nearly 51,000 BTC nine days into the month.

That leaves estimated bitcoin on exchanges at 2.51 million worth $76.34 billion, which makes up 13.2% of all circulating supply. Although, bitcoin on exchanges can show one view of liquid, tradeable bitcoin on the market, the total tradeable bitcoin percent share of circulating supply is likely higher. In some of Arcane’s latest research, analyst Vetle Lunde argues that at least 20.4% is liquid, tradeable bitcoin based on its increased financialization and various bitcoin investment vehicles rising over the last two years.

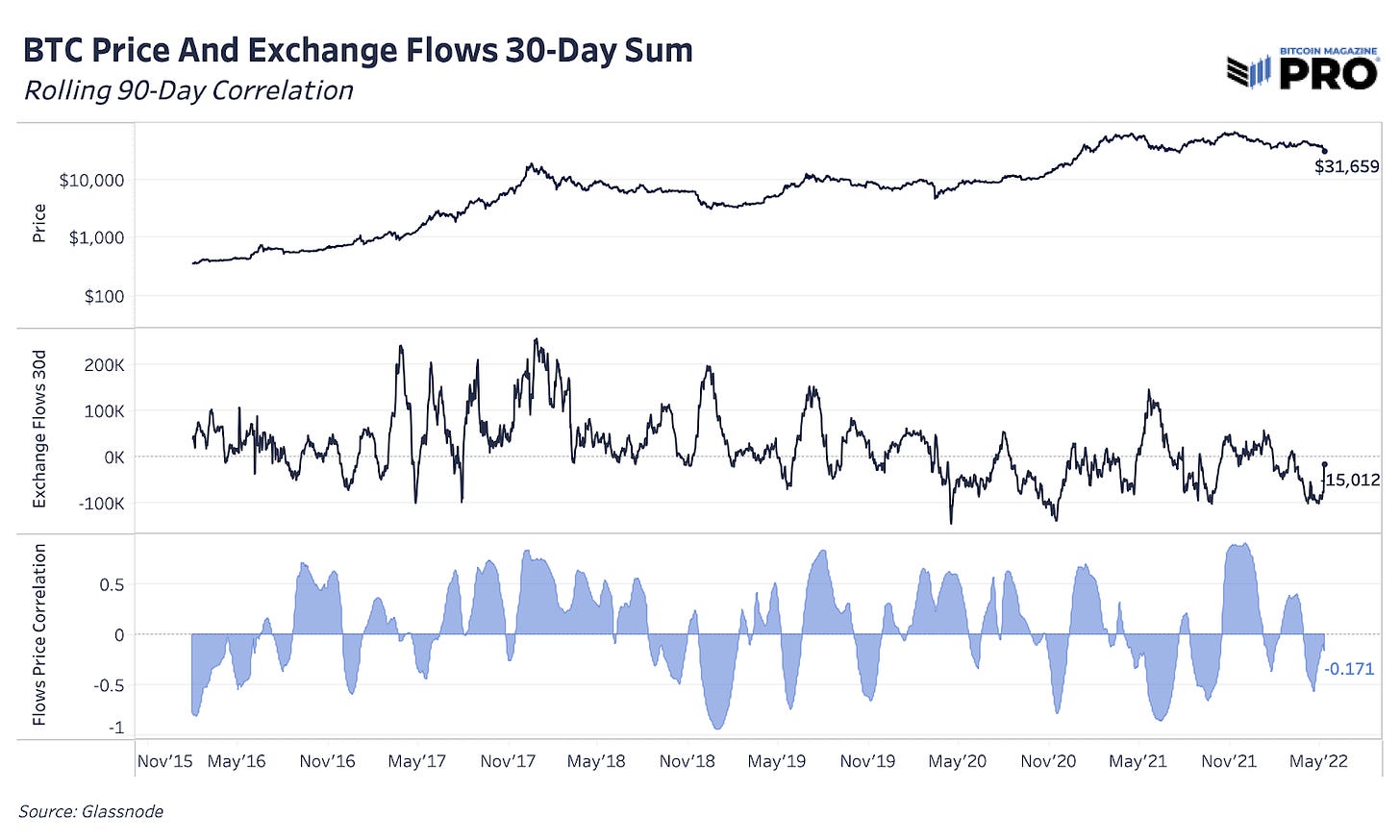

With markets becoming more sophisticated over time, balances on exchanges alone don’t tell the whole story — with fairly noisy, insignificant correlations to short-term price action when looking at rolling 90-day correlations using 30-day flows. Exchange balances are still useful at understanding flows, monitoring economic activity and analyzing longer-term trends, but they are certainly nuanced.

Final Note

As a final thought unrelated to exchange balances, Michael Saylor highlighted that MicroStrategy could still pledge collateral on their recent $205 million term loan even if bitcoin price fell to $3,562 in response to many overblown concerns about their margin liquidation price on a smaller portion of their overall debt liability. The company is still sitting on 115,109 bitcoin that it can leverage for collateral with the majority of their debt liability to mature by 2027. Price is now back up above their average cost basis of $30,700.

Although there are legitimate concerns around the company’s revenues, cash flow position and rising debt expenses to cover their leveraged bitcoin strategy, many concerns have been overblown as of late and a bitcoin price below even $10,000 is likely off the table in the worst of scenarios.