BM Pro Daily - Bitcoin 8% Down And Realized Losses

Major Thursday Sell-Off

Yesterday, broader markets and bitcoin both caught a glimpse of a major market sell-off with bitcoin having a 7.87% 1-day percentage change. In context, this is a relatively normal move over the last two years and capitulation moves to the downside have been much worse. As we've highlighted before, this is the consequence and short-term reality of an asset traded as a high beta, risk-on asset during a potential credit deleveraging playing out.

Bonds now face their worst year-to-date returns trajectory in history as measured by the Bloomberg Global-Aggregate Total Return Index with the 10-year U.S. Treasury yield now at 3.09%. The credit sell-off and rise in rates have been happening since November 2021 which coincide with both the fall of the Nasdaq 100 Index and bitcoin. Although bitcoin has held up well in its drawdown relative to the equities market as of late, it’s still moving in tandem and now the question is, how far will the broader equity market fall?

What’s different this time around, is that we have more long-term bitcoin investors and institutions in the market now. Everyone with a multicycle and decade view of bitcoin will see this as one of the best discount opportunities to acquire as this sell-off doesn’t relate to bitcoin’s fundamentals and growth potential, but rather relates to the flaws of the existing credit system and the end of the broader speculative, liquidity bubble at hand.

The latest downside move was accompanied with elevated long liquidations, the highest we’ve seen since price bottomed out at $35,000 on January 22. Right before the liquidations and sell-off, the annualized hourly perpetual funding rate reached new five-month highs and reached above the neutral rate for the first time since December 2021.

In a tight range below neutral to negative funding over the last six months, this deviation was a decent sign that short-term longs were getting overextended. In the macro environment we find ourselves in today, it takes less for long bias to get offsides than it did back in October and November 2021.

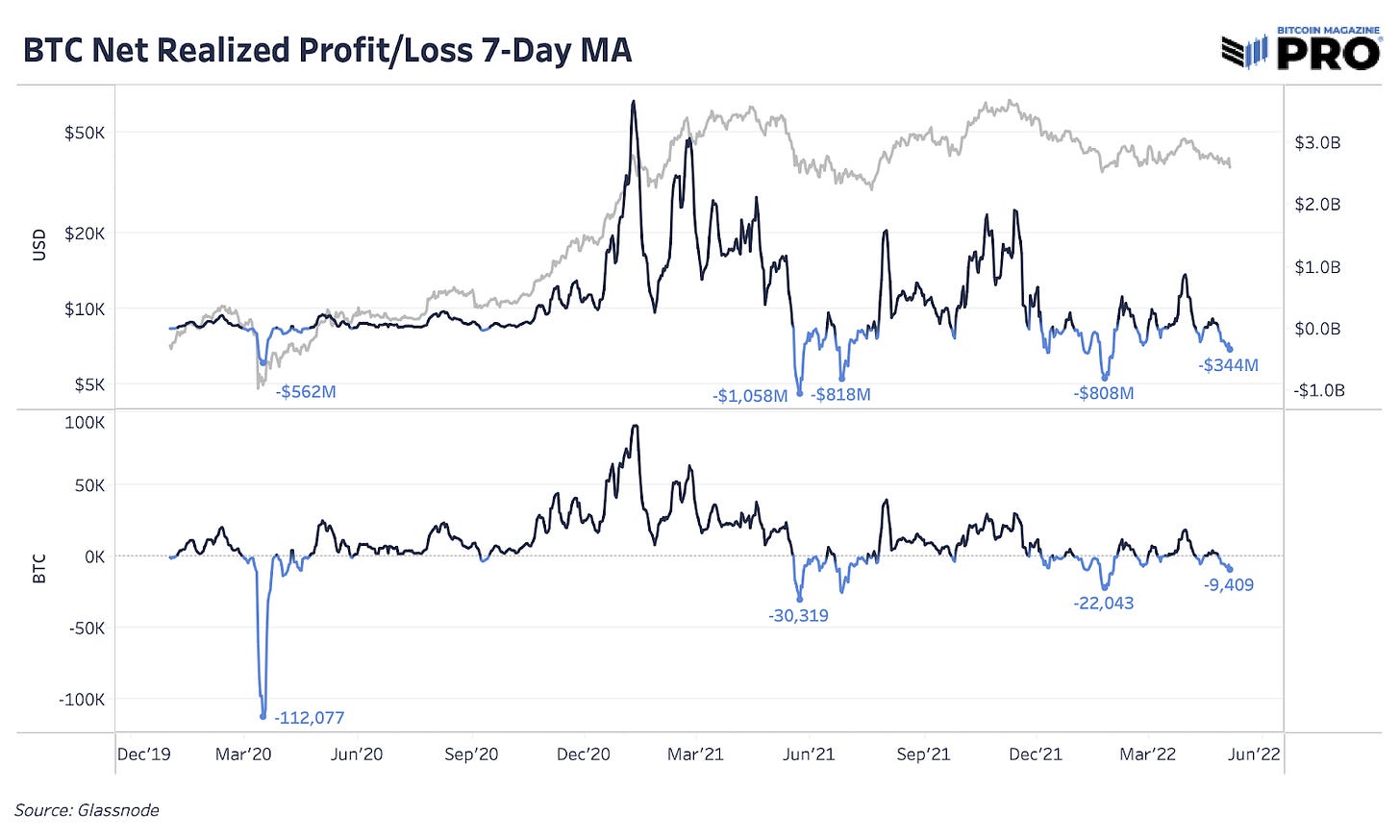

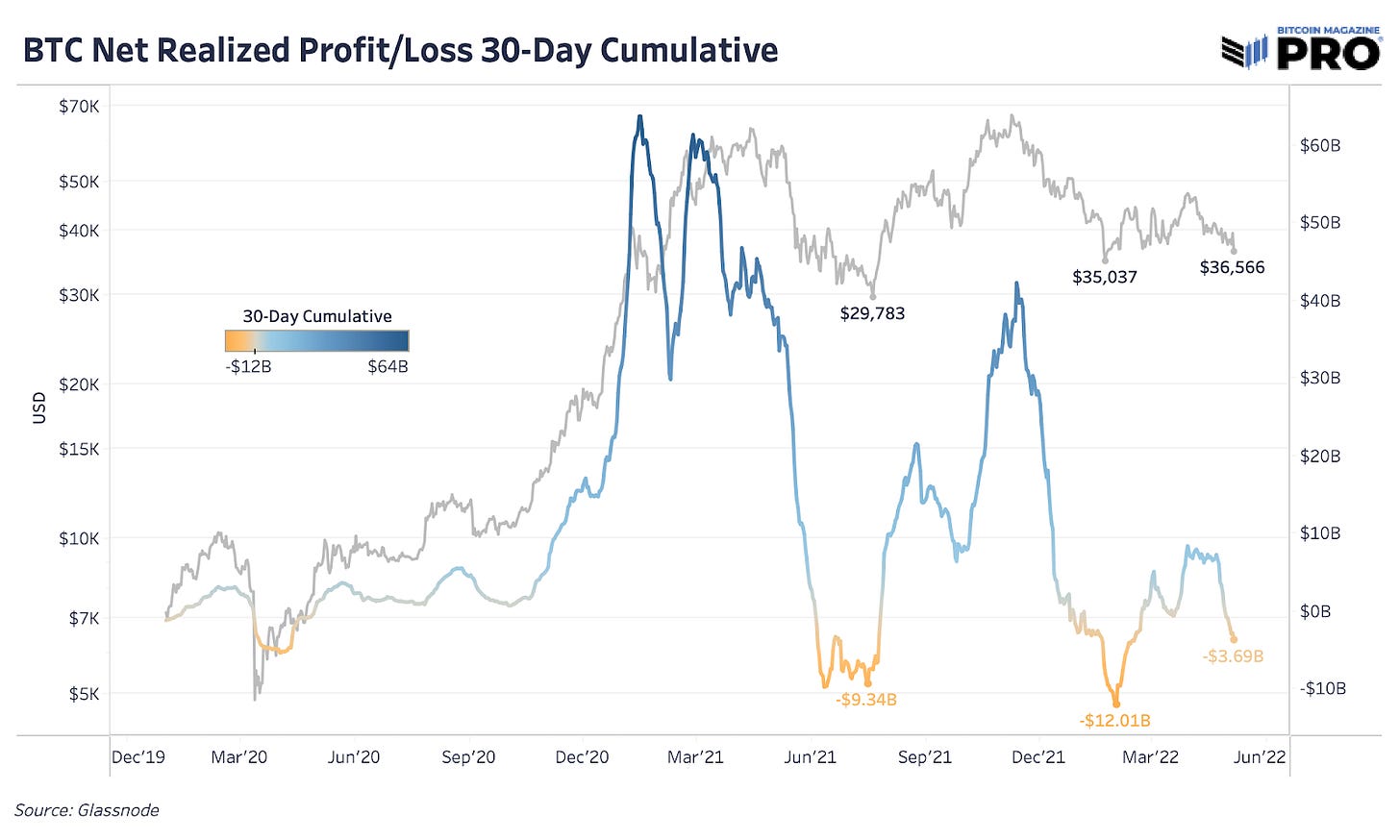

From an on-chain behavior view, there are many signs that we’ve been in a bear type market and that the typical capitulation hasn’t played out yet. Over the last seven days, we’re seeing an average of $344 million in losses on-chain which is now around 40% of the realized losses on the network during January 2021 and July 2022 bottoms. On a 30-day cumulative basis, July 2021 realized losses reached $9.34 billion and January 2022 $12.01 billion before the market reached local bottoms.

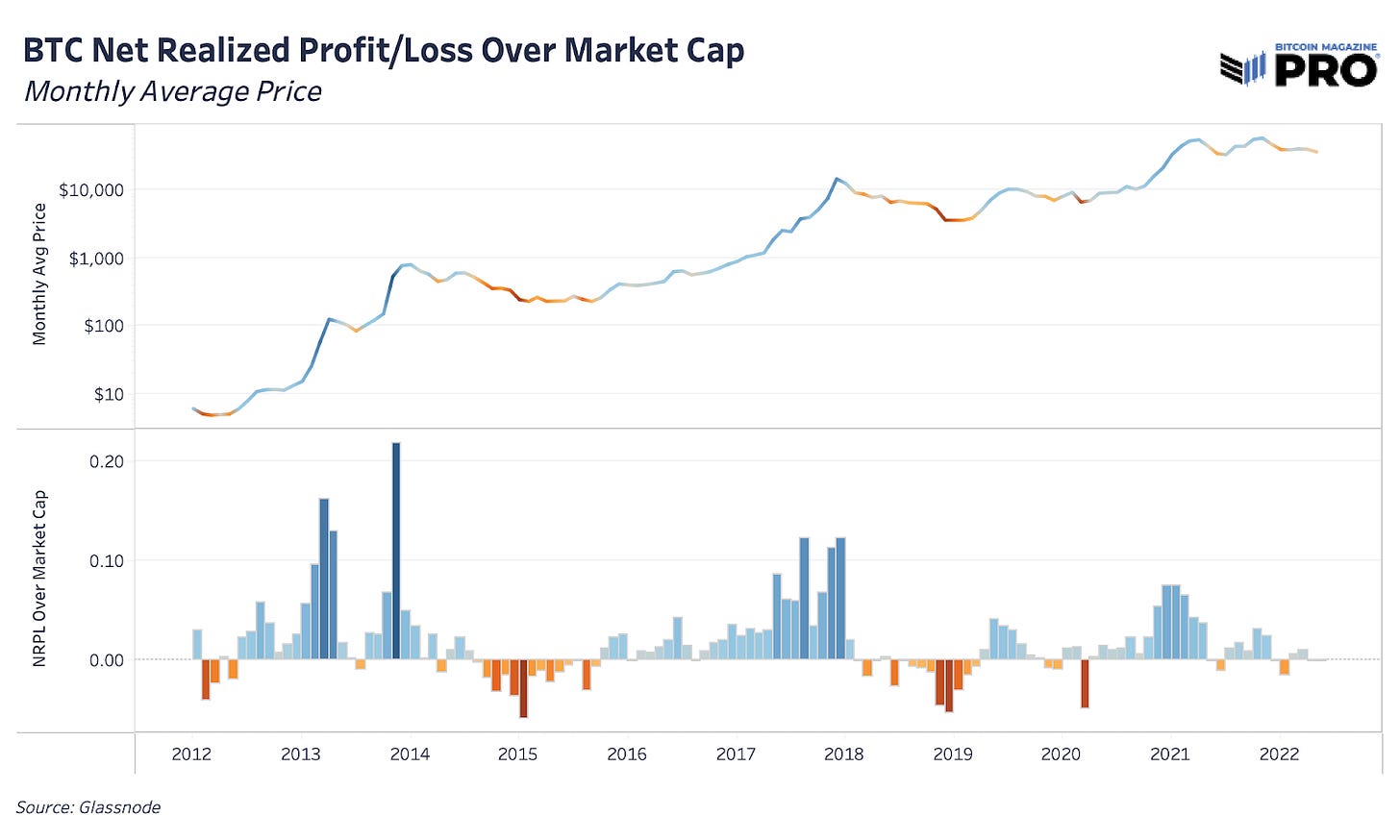

Normalizing those realized profits and losses by market cap, we can compare a ratio across cycles and time frames. In context, we have yet to see elevated losses relative to market cap compared to every other major capitulation event. That could be both that it has yet to play out and that the market overall is becoming more efficient, making capitulation and peak profit-taking diminish over time.

Along with the persistence of realized losses on-chain, the realized price (cost basis) continues to decelerate which is a more bearish market reflection. Although these thresholds are more subjective, a bullish sign for the bitcoin market is to see the 30-day percentage change in realized price accelerating in steep fashion as evidence of new, strong capital inflows into the market.

Since the July 2021 top, we’ve yet to see steep capital inflows with realized price rate of change over 10% while recently realized price is down 0.61%. Along with a confluence of many other indicators, historically these periods of decelerating realized price have proven to be good times for cheaper long-term accumulation.

Final Note

Overall, we’ve yet to see short-term bitcoin demand catalysts large enough for the market to deviate from much larger forces at play. Our base case is that equity market volatility has yet to hit the high this year, the larger monetary policy tightening cycle playing out will continue to impact market liquidity and something larger in the market will break related to credit. Until we see these dynamics reverse and play out or see a major external bitcoin demand shock, we’re expecting more downside to come.

This is worth every satoshi that i paid for my suscription in a country where i belong unfortunately one of these 87% of people who don't belong to financial privilege country

Helpful historical context. Thank you.