BlackRock Leads the Pack as ETFs Reach New Heights

BlackRock overtakes Grayscale Bitcoin Trust to be leading Bitcoin ETF. Banking giants turn increasingly positive on the ETF field.

As the Bitcoin spot ETFs reach record inflows and milestone acceptance from the world of traditional finance, BlackRock takes a comfortable lead over all its competitors.

After a brief period of rough market conditions centered around Bitcoin’s most recent halving, the ETF market seems to be rebounding to new all-time highs. Driven by BlackRock and Fidelity, the collective inflows associated with these new financial instruments are pushing past the $30 million mark and show no signs of slowing yet. So far, the net inflows between all the ETFs have been on a streak of over 12 days, seeming to suggest that this rally is here to stay.

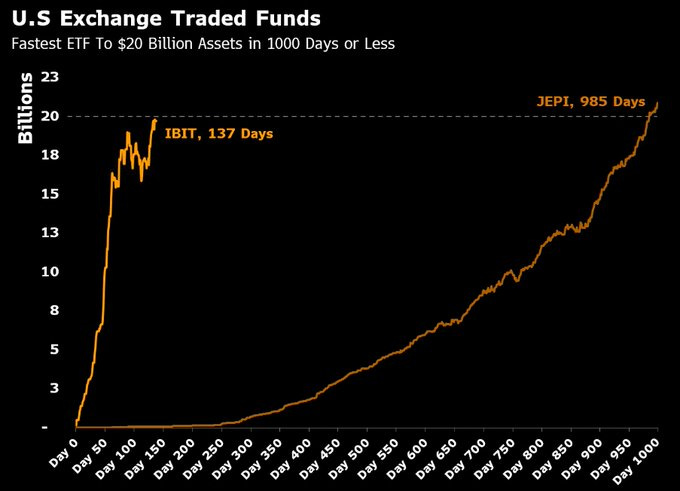

A particularly interesting feature of this phase in ETF history is BlackRock’s apparent dominance over both inflows and total assets. On May 29th, the firm finally overcame competitor Grayscale to hit $20 billion in assets. To be sure, just because the field as a whole has been seeing such increased inflows, it does not mean that these successes are visiting all of the applicants equally. Ark Invest, for example, reported losses of $100 million on May 31st, nearly equaling the $119 million that BlackRock acquired. The potential for intense individual losses despite broader prosperity has been a consistent component of the Bitcoin ETF market, and no company has been better able to illustrate this trend than the recently-dethroned Grayscale. The firm, for its part, reported neither significant gains nor losses on this same day.

Grayscale came to this field through entirely different methods than BlackRock; where the former is a young and Bitcoin-native firm with a laser focus on the cryptoasset space, the latter is a titan of traditional finance that has been something of a latecomer to the ETF race. Grayscale was an early leader in the political campaign to win ETF approval, and for this reason, it’s been able to offer a unique product. Grayscale Bitcoin Trust (GBTC) was a pre-existing investment fund that was converted into an ETF after approval took place. From the earliest days of this switchover, GBTC has been party to no shortage of strange happenings.

In essence, Grayscale had a head start in that its ETF product had years of inflows from its pre-ETF operations, while all its competitors were starting from scratch. Despite this lead, however, GBTC has been reporting consistent and extreme outflows for practically the entire post-ETF period. Although experiments with new products and reduced fees saw a brief period of inflows in early May, these gains were quickly reversed as GBTC’s steady hemorrhaging continued. In contrast to this, BlackRock’s ETF has shown a consistent upward trend throughout its entire period, including certain momentary setbacks. It has finally caught up, and BlackRock took the crown at a moment when it was one of the most successful ETFs ever launched.

BlackRock’s rise to the top has coincided with a moment where some of the largest titans in traditional finance are coming around to the Bitcoin ETF in a big way. On the same day that BlackRock took the lead, the New York Stock Exchange (NYSE) announced plans to launch new financial instruments tied to the value of Bitcoin. These new cash-settled index options are legally distinct from the Bitcoin spot ETF but are very similar in a number of ways; in fact, both products assess Bitcoin’s spot value from the CoinDesk Bitcoin Price Index (XBX), literally calculating their value from the same data. Although this may seem like a trivial development while the ETFs are active and profitable, new revenue streams from the trillions circulating on the NYSE can only be a benefit to Bitcoin.

The day after this announcement, Goldman Sachs echoed these bullish sentiments when its Global Head of Digital Assets, Matthew McDermott, called the Bitcoin ETF “an astonishing success." Although he acknowledged that Goldman Sachs was initially hostile to the entire asset space, McDermott referred to the SEC approval as a “big psychological turning point” for the Bitcoin community, and his company has since changed its position entirely. A particularly interesting point, then, was when fellow banking titan JPMorgan commented on the proposed Ethereum-based ETF the same day.

Although it has not yet been approved, a hypothetical Ethereum-based ETF has been generating a certain amount of buzz in the broader cryptoasset community, though doubtlessly less excitement than Bitcoin. In a report released on May 30th, analysts from JPMorgan bluntly claimed that “Bitcoin had the first mover advantage, potentially saturating the overall demand for crypto assets in response to spot ETF approvals.” They added that Ethereum as a product “differs from bitcoin in its value proposition for investors” and that “bitcoin [has] a broader appeal by competing with gold in portfolio allocations.”.

Watch the Oslo Freedom Forum 2024 | Financial Freedom Track Livestream

Still, despite the likely outcome that such a product will underperform relative to the Bitcoin ETF, it still has its advantages. Noted Bitcoin maximalist and advocate Michael Saylor has pointed out that an Ethereum ETF’s approval “may be better for Bitcoin," as such a move would truly drive home the point that Bitcoin is a durable movement. Bitcoin was the trailblazer, but it can be legitimized further if its copycats are treated as a genuine asset class. Saylor added hypothetically that future investors may regard a crowded ETF market as if “there is a crypto asset class now; maybe we’ll allocate 5% or 10% to the crypto asset class, but Bitcoin will be 60% or 70% of that.”.

Nonetheless, as profitable as the Bitcoin ETFs have been, there have still been definite holdouts. A particularly bizarre case has been that of Vanguard, which appointed BlackRock’s Salim Ramji as its new CEO. During his tenure at BlackRock, Ramji was one of the figures most directly responsible for launching the ETF product that has now set such tremendous financial records. Despite this career background for Vanguard’s new CEO, Ramji has since stated that Vanguard remains resolute in its decision to offer no Bitcoin ETF product of any kind. This doesn’t rule out any sort of investment in other products like the NYSE will soon be offering, but the field of Bitcoin spot ETFs is not seeing a new competitor any time soon.

There are a few possible outcomes, like the Ethereum ETF or the NYSE index options, that may or may not shake up the market in the near term, but at the moment, things seem relatively stable. As stable as things can be in the chaotic world of Bitcoin, in any event, Altogether, the ETF era has been one of unrivaled mainstream acceptance for Bitcoin, where durable prosperity has finally given the community some real political victories. The wave of ETF approvals is sweeping over jurisdictions worldwide, and the new products are making money wherever they crop up. For the time being, Bitcoin seems to be approaching a true heyday.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!