Bitcoin's Realized Price and MVRV Z-Score: A Guide to Profitable Investment

Unlocking the Power of Key Bitcoin Metrics to Maximize Your Returns

Bitcoin's transparency allows us to monitor in real-time the profit or loss for every investor, providing significant advantages for outperforming the market. In this post, we explore the simplest and most effective Bitcoin metrics to guide your investment decisions.

Realized Price: The Foundation Metric

What is the Realized Price?

Realized price calculates the average price paid for all Bitcoins in circulation, based on the USD value when they were last moved between wallets.

This metric usually lies below the current market price, indicating that most investors hold profitable positions.

Current Realized Price

The current realized price is around $31,000, suggesting that investors, on average, paid this amount for their Bitcoin. With Bitcoin trading above $60,000, this represents a 2x profit for the average holder.

Buy Opportunities and Market Cycles

Identifying Buy Opportunities

When Bitcoin's price falls below the realized price, it indicates widespread investor losses and potential market capitulation, presenting golden buying opportunities.

Historical data confirms that buying below the realized price often coincides with market bottoms.

MVRV Z-Score: A Deeper Insight

What is the MVRV Z-Score?

The MVRV Z-Score is derived from the realized cap (realized price multiplied by circulating supply) and market cap (current price multiplied by circulating supply).

This score normalizes data, filtering out extreme signals and providing clear buy and sell zones.

Interpreting the Z-Score

A Z-Score below the realized price indicates a buy zone, while extreme profits (5-10x) signal potential sell zones.

Historical peaks in the Z-Score align with market tops, suggesting optimal times to take profits.

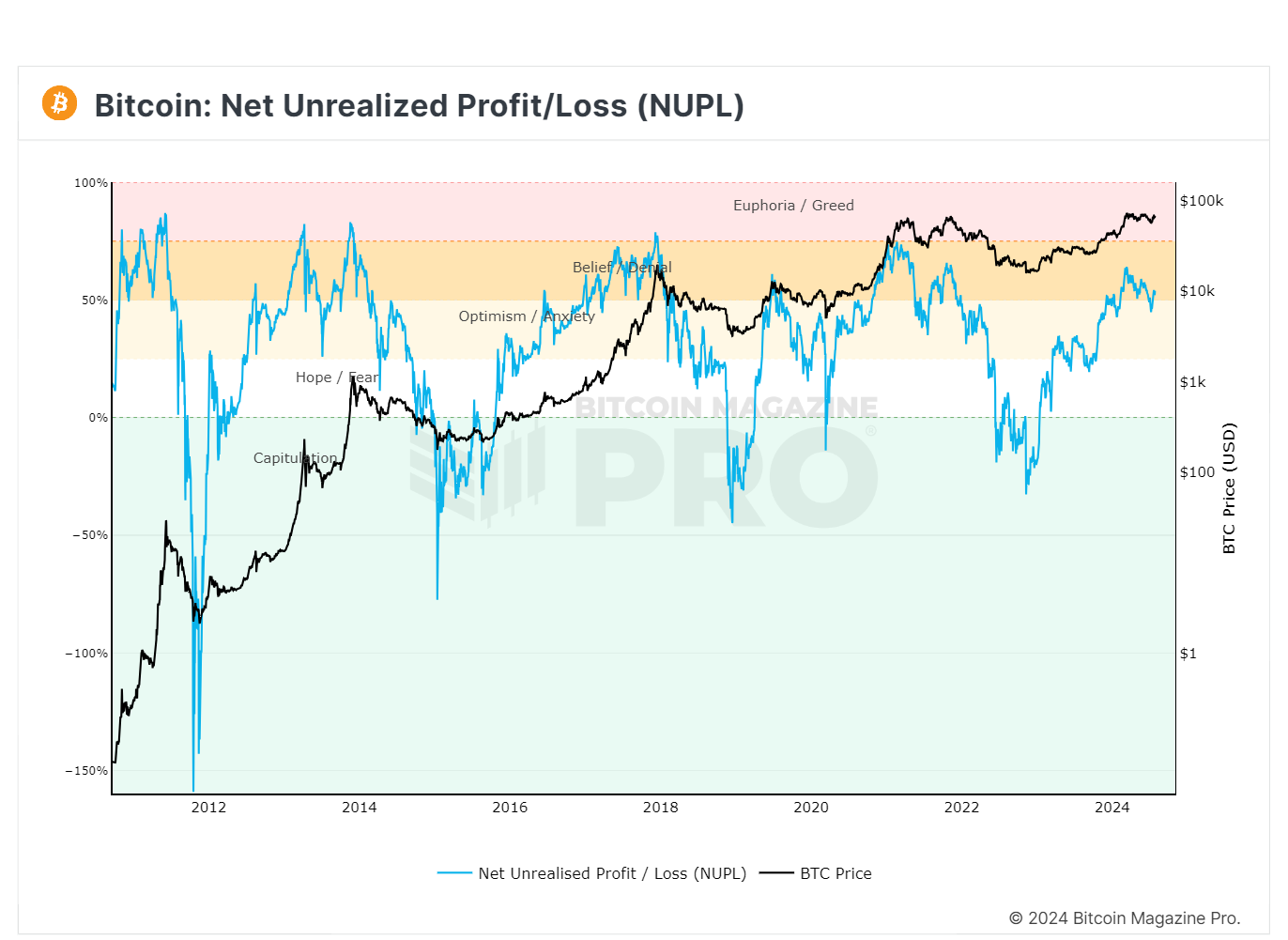

Net Unrealized Profit and Loss (NUPL)

Understanding NUPL

NUPL measures the net profit or loss of all Bitcoin holders, providing a sentiment gauge.

High NUPL values (>70%) indicate market euphoria and potential overvaluation, while negative values suggest capitulation and undervaluation.

Current Market Sentiment

The market is currently in the "belief" or "denial" stage, suggesting there is still room for upside if the bull market continues.

Long-Term and Short-Term Holder Metrics

Long-Term Holder Realized Price

This metric isolates the cost basis for long-term investors, offering refined buy signals.

Buying below the long-term holder realized price has historically provided excellent entry points.

Short-Term Holder Realized Price

This metric tracks the cost basis for new market participants and is useful for identifying accumulation opportunities during dips.

Conclusion

The realized price and MVRV Z-Score are invaluable tools for making informed Bitcoin investment decisions. By understanding these metrics, investors can identify optimal buy and sell opportunities, maximizing their returns.

If you found this analysis helpful, consider subscribing to our Substack for more in-depth crypto market insights. Don’t forget to like this post, share it with your network, and leave your thoughts in the comments below.

For more detailed Bitcoin analysis and to access advanced features like live chats, personalized indicator alerts, and in-depth crypto industry reports, check out Bitcoin Magazine Pro.

Stay Informed with Bitcoin Magazine Pro

For more in-depth analysis and access to the most comprehensive Bitcoin analytics, visit Bitcoin Magazine Pro. Enjoy a 3 month free trial and explore premium features designed to help you make data-driven investment decisions.

Don’t forget to like this post, share it with your network, and leave your thoughts in the comments below.

For more detailed Bitcoin analysis and to access advanced features like live chats, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. The 3 month free trial is only available for a limited time for all new subscribers, so don’t miss this opportunity!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.