Bitcoin’s Quantum Computing Threat

Why Bitcoin’s Greatest Risk Isn’t Regulation or Price — but Mathematics Itself

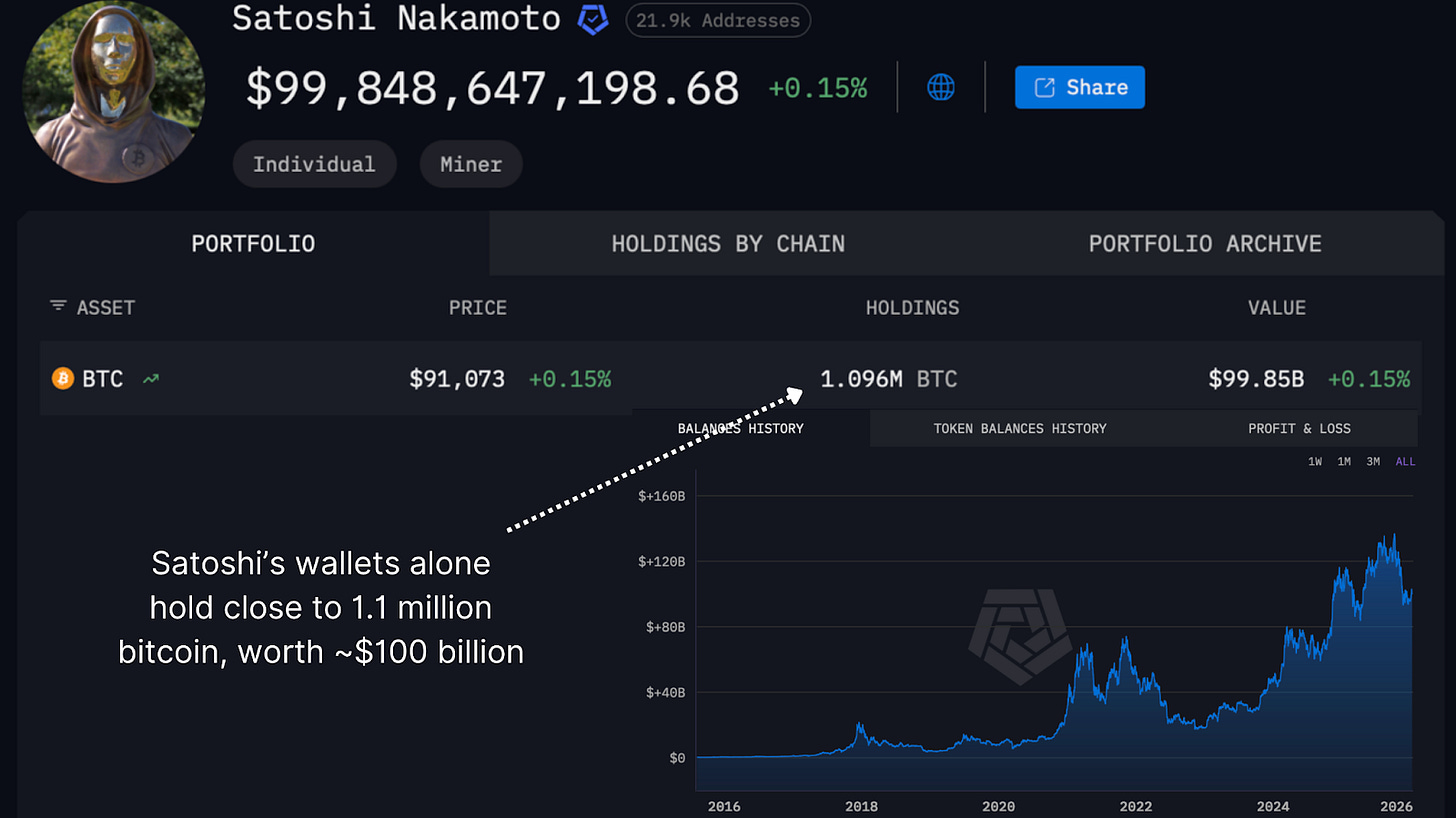

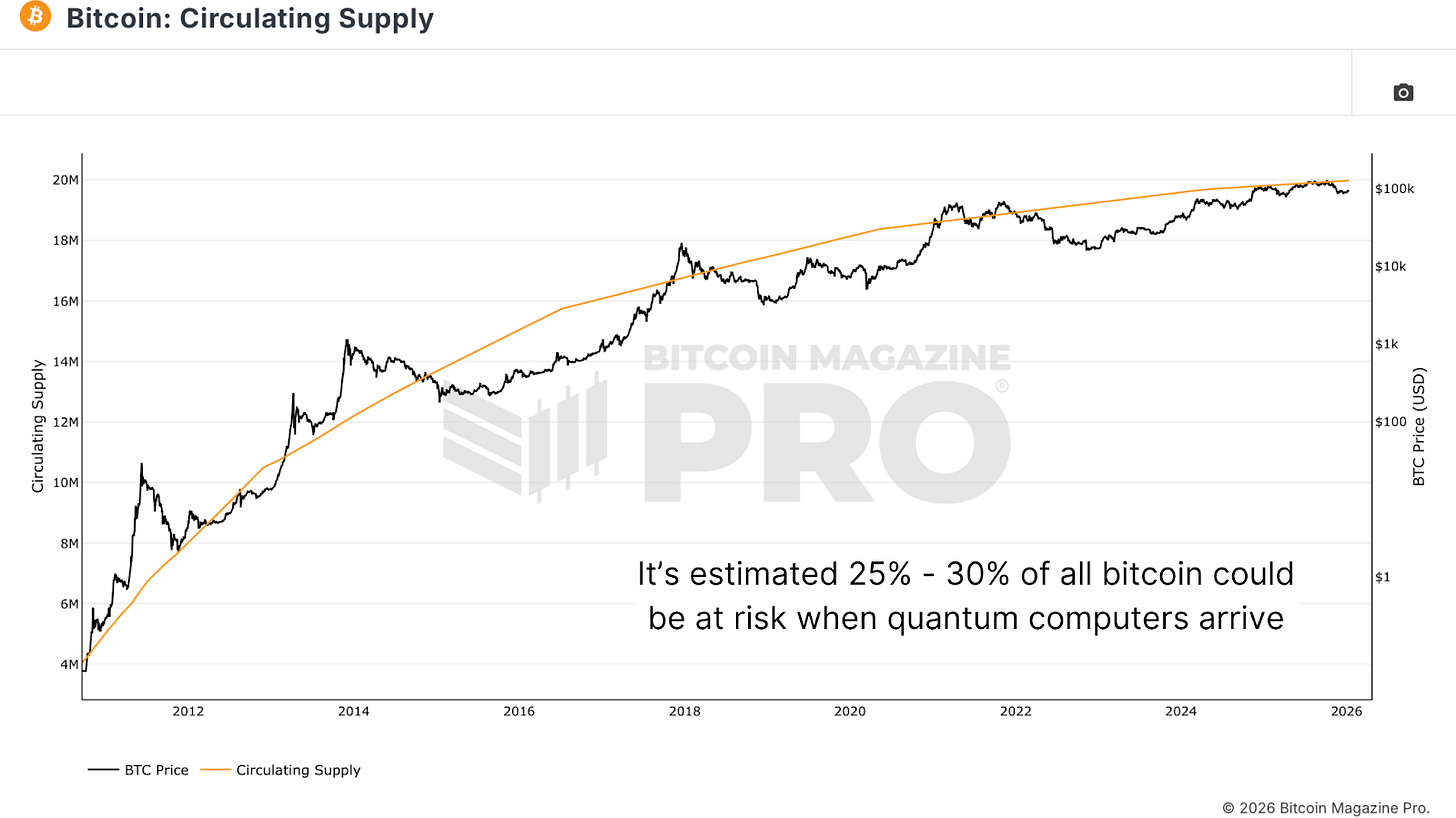

Bitcoin faces its first genuine existential threat, not from government bans or market crashes but from quantum computing. Over one million Bitcoin sitting in Satoshi’s wallets, worth around $100 billion, plus approximately 25% of all Bitcoin in circulation, are publicly exposed on aged cryptographic keys vulnerable to quantum attacks. When quantum computers arrive, whether in 5 years or 25 years, these coins will be cracked.

The Threat

Bitcoin security depends on elliptic curve digital signature algorithms or ECDSAs. These algorithms make it mathematically hard to forge a Bitcoin signature without knowing the private key. For traditional computers, these signature breaks would take millions of years. Quantum computers operate very differently. They can potentially solve the discrete logarithm problem underlying ECDSA within minutes or hours.

Figure 1: Satoshi’s wallets hold almost 1.1 million bitcoin.

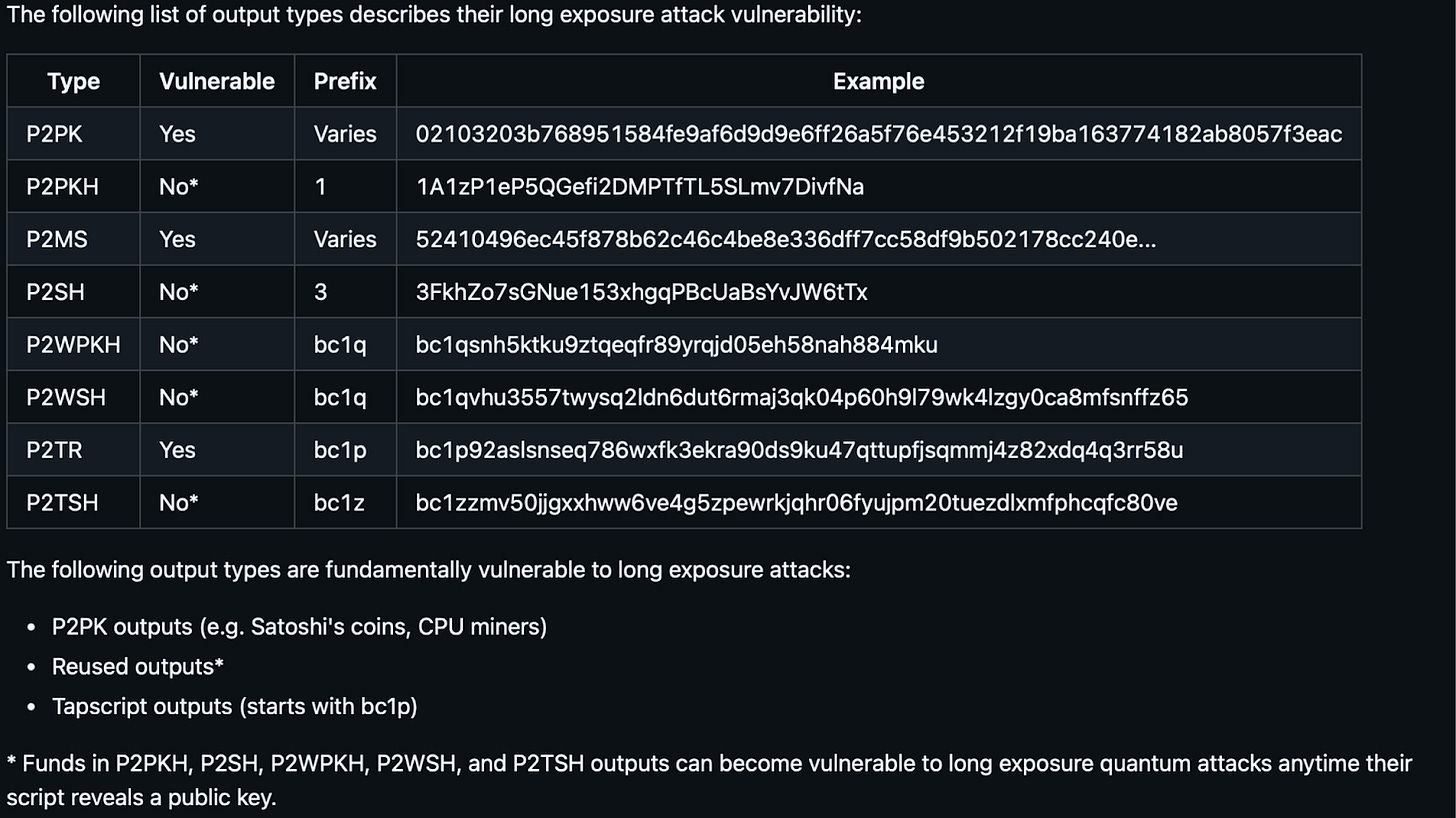

Not every Bitcoin is equally exposed. Early P2PK addresses (Pay-to-Public-Key), including Satoshi’s, have their public keys sitting on the ledger for all to see. For these coins, a quantum computer is potentially a skeleton key to access these wallets. However, later address types hide the public key behind a cryptographic hash (such as P2PKH), exposing the key only when a transaction is initiated, creating a brief window of vulnerability until the transaction is mined. Once you reveal your key to make a transaction, theoretically, a fast enough quantum computer could intercept it before confirmation.

Timeline Uncertainty

The timeline for quantum computing is genuinely uncertain. It could arrive in one year or never materialize. But uncertainty is the enemy because Bitcoin requires proactive migration, not reactive adaptation. If quantum computers arrive and Bitcoin has not migrated to post-quantum cryptography (PQC), Bitcoin loses. The public keys of hundreds of billions of dollars become exposed, and attackers can begin stealing coins and potentially dumping them on the open market, resulting in catastrophic price collapse.

Figure 2: The long exposure attack vulnerability of the various Bitcoin address types.

A PQC solution implementation timeline realistically involves 6 to 12 months just to finalize code and get consensus in a best-case scenario, with migration times between a further 6 months and 2 years depending on signature optimization.

Coin Burning

The question becomes whether to “burn” coins that have not migrated to quantum-resistant addresses by a certain deadline. If around 20-30% of the supply is unlocked at once, Bitcoin would face a massive trust issue, and the hard money argument would collapse. A supply dump of this magnitude would create bear market conditions and could compromise Bitcoin’s entire philosophy.

Figure 3: Bitcoin’s Circulating Supply.

However, coin burning creates a massive philosophical hurdle. It effectively means Bitcoin can be seized property. If the network decides coins can be burned to save itself, what stops governments or controllers from deciding which coins and addresses can be burned and censored? What about terrorist coins or dissident coins? This sets a precedent, destroying self-sovereign ownership.

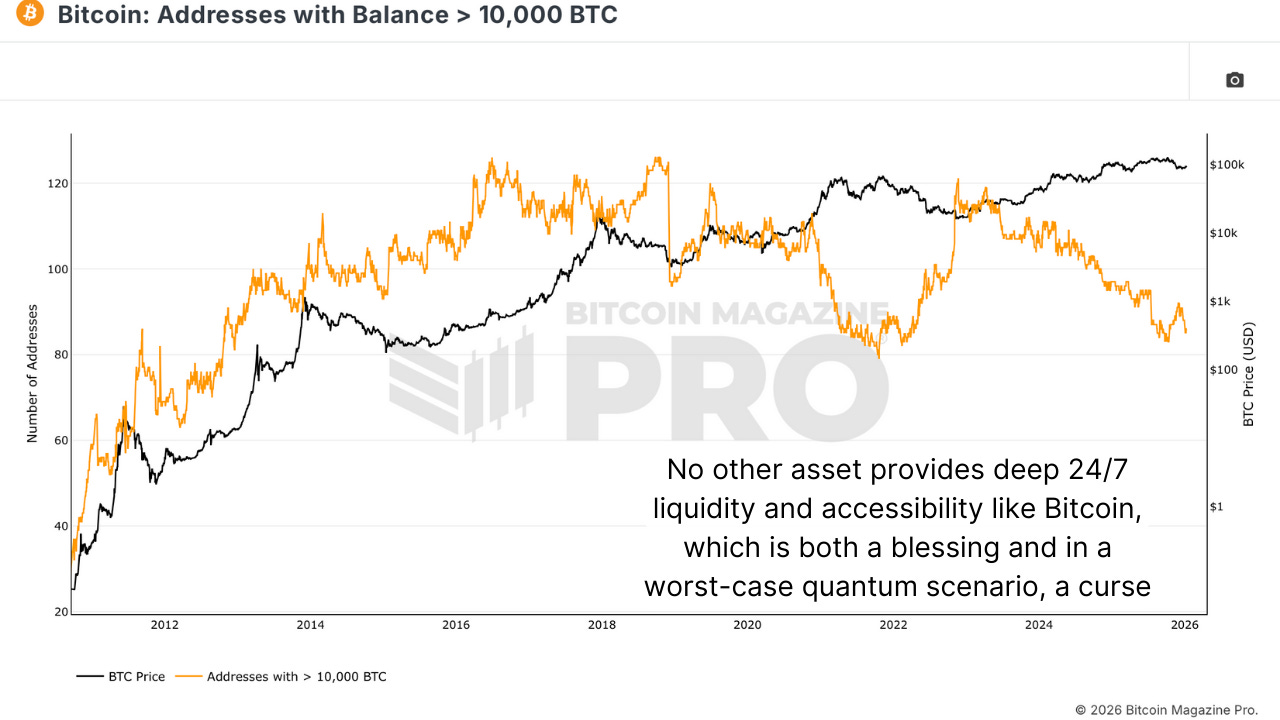

The Primary Target

Bitcoin is the biggest honeypot in the world. It is the only financial network where you can literally steal value and have 24/7 liquidity to sell it with plenty of willing transactions. You could not do the same with dollars. Stolen massive amounts of money would result in wires being blocked. Even if hacked, institutions refund customers. Bitcoin has no such luxuries, built purely on trust in code.

Figure 4: A significant number of addresses have balances over 10,000 BTC.

If someone achieves quantum computing capability to break encryption, Bitcoin wallets will be the first target because they are easier to liquidate and represent a first-mover advantage. The second person to break Bitcoin gains no value if money is already gone.

Conclusion

While this existential-level vulnerability has long been recognized in cryptographic literature, the narrowing window for preventive action demands immediate strategic attention from miners, exchanges, wallet providers, and individual stakeholders. The real test is not whether the threat exists, but whether the network can coordinate a methodical migration to quantum-resistant signature algorithms before cryptographically relevant quantum computers achieve sufficient computational maturity.

For a more in-depth look into this topic, watch our most recent YouTube video here: Existential Threat | The 131 Year Bitcoin #6

Matt Crosby

Director of Research & Analytics

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else.

We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

The awareness is good, but I have to admit that these quantum posts seem more about FUD clicks than anything. You lay out concerns, but give no concrete steps about what YOU are doing to move a solution forward or what readers can do to help. We expect better from Bitcoin Magazine.

Absolutely nonsense’. Too far away from this happening’. The biggest risk is still the nonsense posted 😂