Bitcoin's Pre-Halving Inflection Point

An in-depth analysis of Bitcoin's consolidation phase, looming halving event, and macroeconomic factors shaping investment strategies.

Introduction

In a contracting economic backdrop, Bitcoin is at a pivotal moment before the halving that will exacerbate the supply shortage. Data suggests Bitcoin is in a consolidation phase with shifts in long-term and short-term holder activities. Investors must weigh macro forces against Bitcoin's specifics and sector trends to craft strategies that capitalize on its dual potential as a speculative and hedging asset.

I’ve changed the format a little to make it easier to read. Please provide feedback in the comments. Thank you!

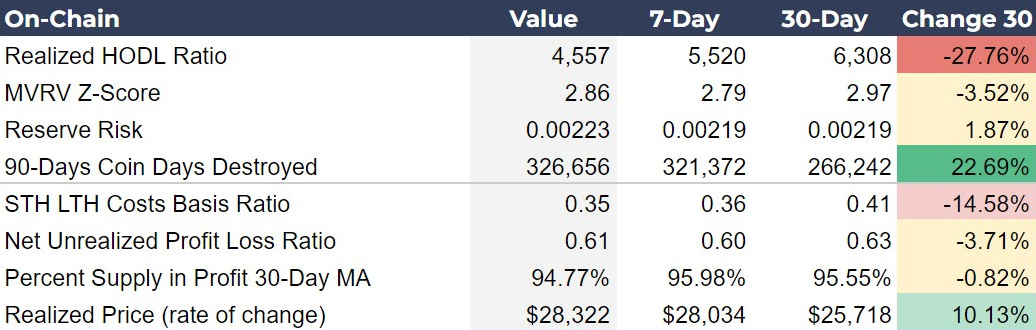

On-chain metrics

Realized HODL Ratio: Indicates a shift in market dynamics with long-term holders becoming less dominant (-27.76% change).

MVRV Z-Score: Suggests bitcoin is not at an extreme valuation level, with a slight decrease (-3.52%).

Reserve Risk: Shows a minor increase (1.87%), indicating a growing confidence among long-term holders.

90-Days Coin Days Destroyed: A significant rise (22.69%), suggesting increased activity from long-term holders.

STH LTH Costs Basis Ratio: Indicates that short-term holders have a lower cost basis compared to long-term holders (-14.58% change).

Net Unrealized Profit/Loss Ratio: A slight decrease (-3.71%) points to a cooling in market optimism.

Percent Supply in Profit 30-Day MA: A small decrease, hinting at a slight increase in coins not in profit.

Realized Price (Rate of Change): A notable increase (10.13%), indicating movement of coins bought at higher prices.

7-day versus 30-day changes: A notable increase in 90-Days Coin Days Destroyed suggests that long-term holders have been more active recently, potentially indicating profit-taking or portfolio adjustments as the halving approaches, which could lead to increased market volatility. Simultaneously, a decrease in the Short-Term to Long-Term Holders Cost Basis Ratio highlights a growing influence of short-term holders in recent days, possibly increasing the market's price sensitivity. Additionally, a slight uptick in the Net Unrealized Profit/Loss Ratio indicates a minor rise in market optimism or reduced unrealized losses, subtly influencing trading behaviors in the short term.

Investor Insights

Anticipate Increased Volatility: With LTHs becoming more active, as indicated by the recent uptick in 90-Days Coin Days Destroyed, the market might experience heightened volatility. Investors should consider this when planning their investment strategies, especially with the Bitcoin halving on the horizon, which could amplify price fluctuations.

Monitor Short-term Holder Dynamics: The decreasing Short-Term to Long-Term Holders Cost Basis Ratio highlights the rising influence of short-term holders, which may lead to more immediate market reactions to news and developments.

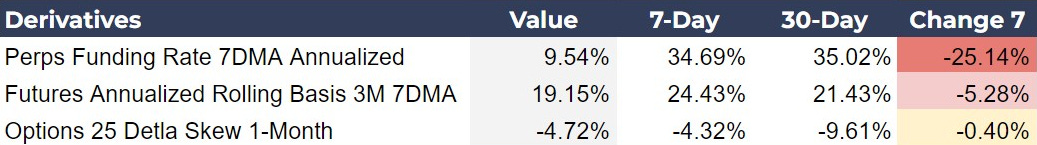

Bitcoin Price and Derivatives Analysis

50DMA, 100DMA, 200DMA, 200WMA: All moving averages are on an upward trend, indicating a bullish market sentiment over the specified time frames. The spread between the current price and these averages widens as we look at longer time frames, suggesting sustained positive momentum.

Daily and Weekly RSI: The Relative Strength Index (RSI) values show a decrease in the daily RSI while the weekly RSI remains high, indicating potential overbought conditions in the longer term but a cooling off in the short term.

Realized Price Metrics: There's a notable difference between the Short-Term Holder (STH) and 50 DMA price movements. The 50 DMA has risen much faster in the last month, and specifically in the last week. This likely means there is more downside support for price than last week.

Perpetuals Funding Rate: The 7-day annualized funding rate for perpetual swaps has decreased, suggesting a potential cooling off in overbought conditions in the very short term.

Futures Basis: The annualized rolling basis for 3-month futures contracts shows a slight decrease over the last 7 days, indicating a slight reduction in leverage or speculative long positions in the futures market.

Options 25 Delta Skew: The skew has slightly decreased over 30 days, but is relatively steady WoW, suggesting a fairly small bias toward downside protection, and slight bearishness in the options market.

Investor Insights

Leverage and Speculation: The slight decrease in futures basis and perps funding rate may signal a reduction in leverage use and speculative long positions, which is reducing the risk of sharp corrections driven by liquidations.

Consider Entry Points: With sentiment cooling from exuberance back to “normal” levels, but with some bearish bias, as in the Options Skew data and uncertainty around the halving, support levels like the 50 DMA should be considered for any price dip. Any dip until the halving could be viewed as a good entry for a longer term trade.

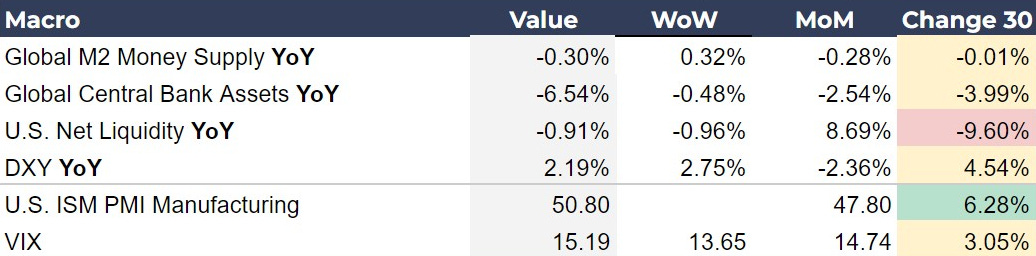

Global Macro

Global M2 Money Supply YoY: M2 is steady. A slight YoY decline in global M2 money supply suggests tightening liquidity conditions globally. Considering the massive government spending by the US this year, we might expect some effect on M2, especially considering the recent rise in M2 velocity. Despite this, Global M2 is essentially flat, meaning that the private sector is likely performing worse than this number would imply.

Global Central Bank Assets YoY: A significant YoY decrease indicates that central banks are contracting their balance sheets. There has been one major central bank, the Swiss National Bank, who has started to cut rates and make the pivot from restraint to accommodation.

U.S. Net Liquidity YoY: The notable YoY drop after a period of growth suggests a tightening liquidity environment in the U.S., which can impact investment flows into risk assets like Bitcoin.

DXY YoY: The increase in the U.S. Dollar Index (DXY) does not meet the standard for significant strengthening. Therefore, it should not have a noticeable impact on the Bitcoin price. It will, however, affect global dollar access as it strengthens against other currencies.

US ISM PMI Manufacturing: The PMI indicates that manufacturing is expanding, which can be a sign of economic health. However, this tiny expansion comes after several months of much more significant contraction.

VIX: Is within a normal range. Nothing significant to report.

The macroeconomic environment is tending toward tightening liquidity, contraction in Global M2, Central Bank Assets, and US Net Liquidity. As we progress through the year, these conditions should exert more and more pressure on risk assets. However, Bitcoin's unique position as a new technology and non-sovereign asset could make it a hedge against the traditional financial system's challenges.

Investor Insight

Diversification Super-tool: Given the tightening liquidity and potential shift into global recession, investors will increasingly see Bitcoin as an essential part of a diversified portfolio. It is a hedge against inflation and the deflation that accompanies recession. It is the only asset that can combine the investment opportunities of a brand new technology, high-powered tech stock and safe haven monetary asset.

Miscellaneous Metrics Round Out Our Picture

Mayer Multiple: The Mayer Multiple, which measures the current Bitcoin price over its 200-day moving average, stands at 1.59. A decrease from both last week (1.60) and last month (1.77) suggests that Bitcoin's price is consolidating and becoming less overheated. The fact that this is occurring in the middle 1’s range means the bull market cycle is only in an early stage correction.

BTC Fund Flows Weekly $M: Flows remain significant this week at $663 million. Year-to-date has seen over $13 billion of inflows.

Valkyrie Bitcoin Miner ETF (WGMI): This ETF's price drop from both the previous week and month indicates underperformance in the Bitcoin mining sector. Miners will tend to do better in very early stages of a bull market cycle, like they did back in 2023.

Investor Insight

Bitcoin Miners and Bitcoin Reserves: Many bitcoin miners hold significant bitcoin reserves, with three public miners holding 8,000 BTC or more. While miners as a whole may underperform spot bitcoin during spikes in price, the ones that hold more bitcoin will do better.

Chart(s) of the Day

The first chart I’d like to discuss is the vanilla daily bitcoin chart. As you can see, we are consolidating in this bullish pennant for almost 5 weeks now. By the time of the halving, it will be 6 weeks. This is extremely healthy behavior, where bitcoin is not acting like an out of control speculative asset, but one that is slowly building a base for an extended bull market.

The absence of a pre-halving pump also implies the absence of a post-halving dump. Therefore, I’m forecasting a price to rise significantly after the uncertainty of the halving passes.

The second chart I have for you today is of the long-term Mayer Multiple (MM). This bull market is looking similar to the 2016-2017 bull market. In 2019, the initial pre-halving bullish breakout took the MM all the way to two, but in 2016, the MM gradually approached two. After the halving, expect a move toward two on the MM.

Source: Glassnode

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

THE BIGGEST CELEBRATION IN BITCOIN

THE BITCOIN HALVING LIVESTREAM BEGINS AT BLOCK HEIGHT 839,979 ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!