Bitcoin’s Bull Market Evolution

Examining Public Miners' Stock Performance, Mining and Network Activity, and the Shift Away from Old-School Altcoins

Intro

This Bitcoin cycle is already unlike any previous bull market. Price hit the previous ATH before the halving, and the price correction post-halving is more significant than ever before. But the biggest difference in my mind is the entire speculative landscape of this bull market. It is becoming clear that altcoins are debilitated ghost towns and that all the new interest in the space is coming from the new alts: Bitcoin-related equities and spot ETFs.

Follow me @AnselLindner and bitcoinandmarkets.com.

Public Bitcoin Miner Update

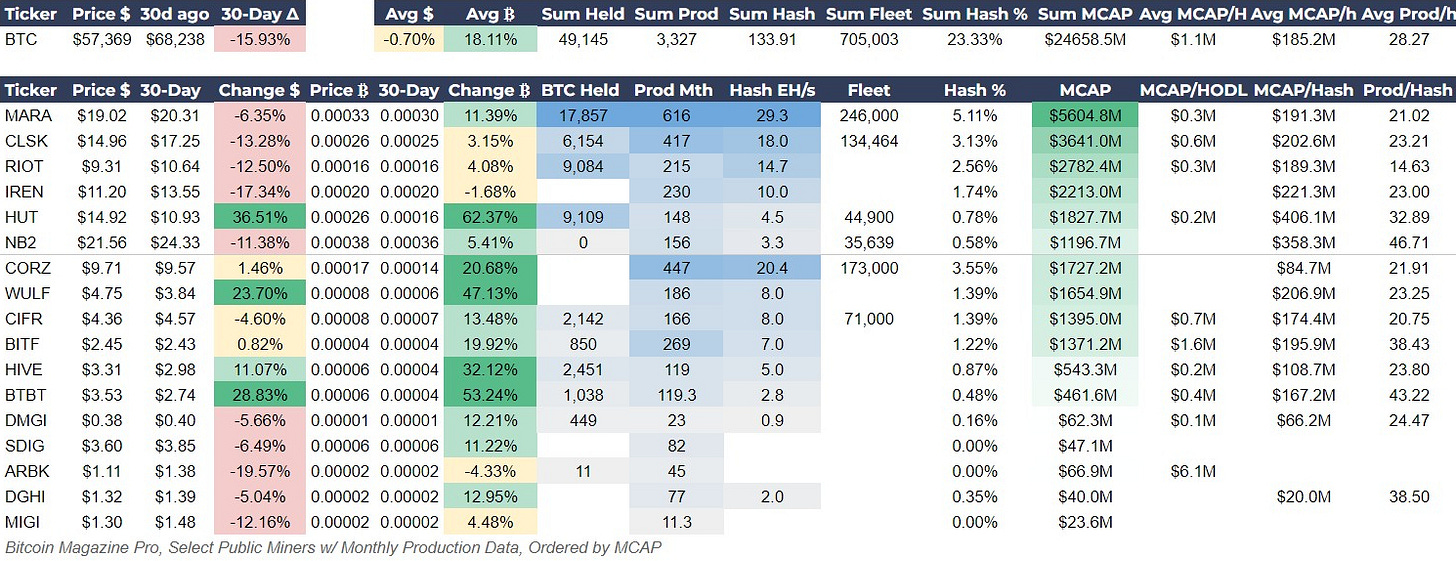

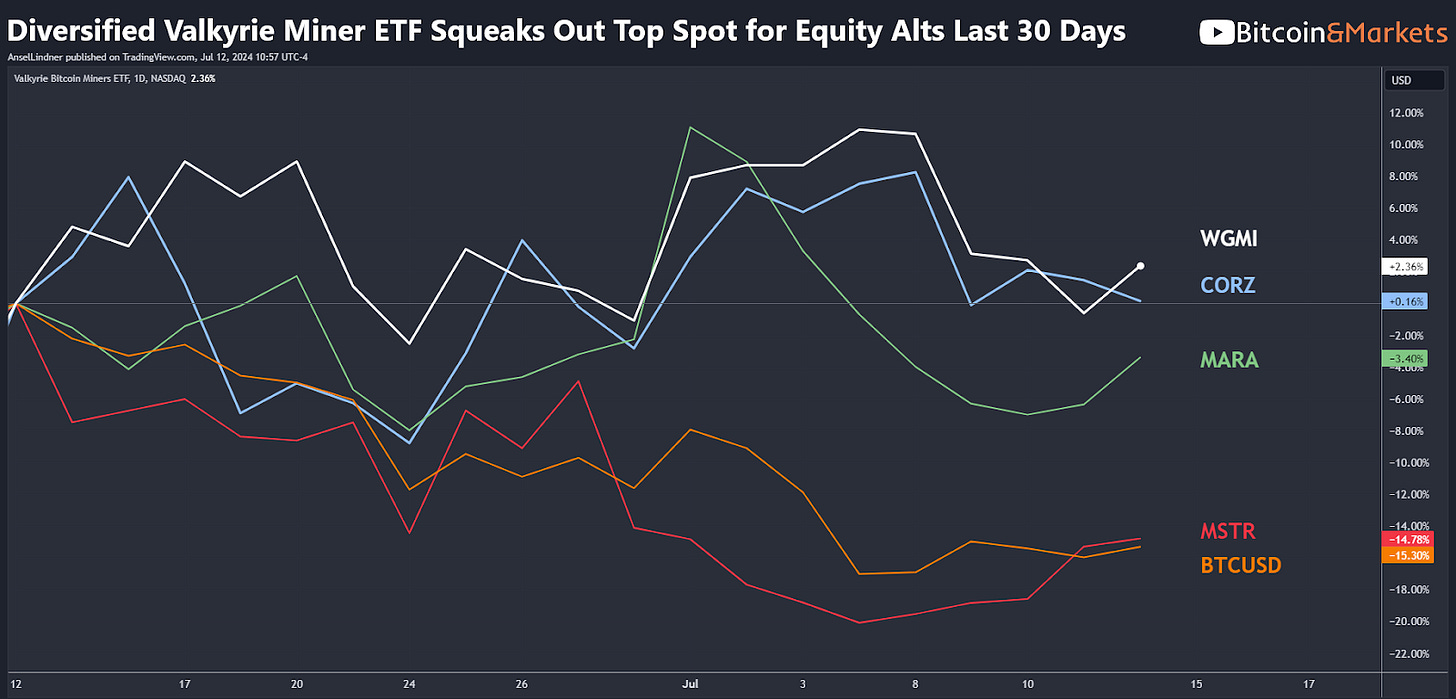

Bitcoin miner average performance over the last 30 days has been only slightly negative, but has been bolstered by a few good performers, despite most miners’ share prices being down. Against BTC, however, their performance was much better because bitcoin has fallen by 15%. There will be periods where Bitcoin’s emerging New Alts will outperform spot Bitcoin. Instead of diversifying within “crypto,” investors are realizing real diversification can be added to a majority Bitcoin portfolio by including exposure to miners and companies like Microstrategy (MSTR).

Below, I looked at several equities in this Bitcoin sector, and surprisingly, Valkyrie’s Miner ETF was the best performing. WGMI is an interesting play; it not only contains exposure to a breadth of bitcoin miners but also chip companies like Nvidia and TSMC, as well as a data center provider in Applied Digital Corp (APLD). I expect similar specially diversified ETFs to pop up in the next year or two around various investment strategies. ETFs of large Bitcoin reserve miners and large-cap versus small-cap miners would be interesting.

On-chain Mining Activity

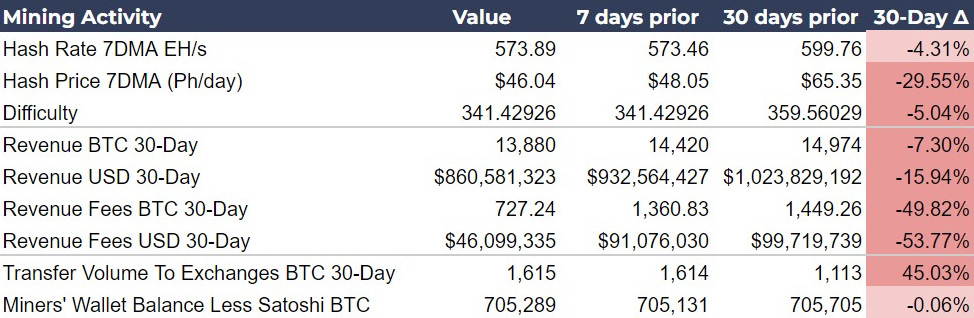

Mining activity numbers look pretty bad this week, but on closer inspection they are not that bad. Of note is the Hash Rate being stable as the Hash Price (revenue per Ph/day) ticked marginally lower WoW. Difficulty dropped dramatically, which is formatted red, but really is a sign that miners may be able to start recovering.

Revenue is down, which is almost entirely driven by the drop in fees rather than the drop in the bitcoin price. Total Revenue was down 540 BTC WoW, but Revenue from fees alone was down 633. Transfer volume to exchanges has stabilized this week, along with miners’ wallet balance.

Hash Ribbons are still very bearish. The brief recovery in mid-June never triggered a Buy signal since price never broke above the 20-day MA. You need both to signal a buy: short-term hash rate MA above the long-term MA, and price above the 20-day MA.

ETF flows have been positive for the last 5 trading days, and for 10 of the last 12 trading days. They have been decreasing through this week, so we’ll have to see how the flows come out today as the German state of Saxony nears the end of their Bitcoin stash to dump. This highlights the fact that there is new interest in Bitcoin; it is just not coming from the same source as previous cycles.

Network Traffic is a Ghost Town

Network Traffic metrics, in opposition to the Mining Activity metrics, look all green. But scratching below the surface, we can interpret them a little differently. The mempool has been flat WoW implying sustained demand for block space, however MoM is down, meaning demand is falling despite very low fees.

Inscriptions and Runes usage is once again disappearing, which could explain this drop in fees and the mempool. These protocols have been a great proxy for speculative demand in the space as a whole. If these L2 token protocols are going basically unused at these low fee levels, it means speculative demand from retail is nowhere to be found in the market right now. Combined with the fact that altcoins in general are struggling, we can conclude that is indeed the case.

At the recent Ethereum Community Conference, reports of boredom and lack of innovation are spreading. This is an extension of the lack of L2 token activity. They thrive off of new, less educated retail investors coming into the space, and that is just not happening. You get the feeling that the altcoin and L2 token space is full of bag holders trying to sell each other on fantastical claims, and no one is buying it anymore.

Source: @tzedonn

Conclusion

The current landscape indicates a significant shift in demand dynamics in this cycle. Institutional and tradfi players have taken center stage, becoming the new alternatives to Bitcoin, much like altcoins and L2 tokens once pretended to be. This shift highlights the stability and legitimacy of Bitcoin and Bitcoin companies, contrasting sharply with the deceptiveness and gaslighting of most altcoin/crypto projects. This trend underscores the evolution of Bitcoin from niche magic internet money to an important asset in global markets. Bitcoin is where actual innovation and change is occurring as YOLO pump-and-dumps fade away.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!