Bitcoin’s Billionth Transaction: Milestones of Progress, Investments for the Future

Bitcoin reaches 1 billionth transaction as price and markets rebound. Financial instruments and Layer-2 protocols have transformed Bitcoin’s economy and created many novel investment opportunities.

Bitcoin has finally reached its billionth transaction after 15 years, and the Bitcoin ecosystem of 2024 has undergone radical changes at every level, creating a wide array of new opportunities.

On May 6th, 2024, Bitcoin marked a significant milestone by processing its billionth on-chain transaction, achieving this 15 years and 4 months after its creation. Although the revolutionary digital asset has seen more than its fair share of market setbacks and legal derision during this time, Bitcoin has actually come into this moment with a heightened sense of optimism. Bitcoin hit its highest-ever price shortly before the halving, but the immediate post-halving period saw prices fall and investment decline for all sorts of Bitcoin-related endeavors. However, the situation has since come to a remarkable recovery, with open speculation that this record will be broken again in the near future.

The price value has not been the only positive sign for Bitcoin’s future during this period. Bitcoin’s highest-ever day for transactions clocked in at 926k a few days after the halving, and it is still consistently managing 600k. This volume stands head and shoulders above the average rate for Bitcoin’s entire history, which sits around 178k. This wildly increased activity is a symptom of the dynamic new energy in the air, and it’s this energy that brought one anonymous whale to finally capitalize on a decade-old Bitcoin supply. Bought for around $62k in 2014, this whale’s Bitcoin sat completely cold until this period, until it was moved into a new wallet on May 6th. This $62k has blossomed into a fortune worth $44M, and it’s emblematic of how far Bitcoin has come financially. However, the market that early users knew more than a decade ago has radically changed into new investment opportunities.

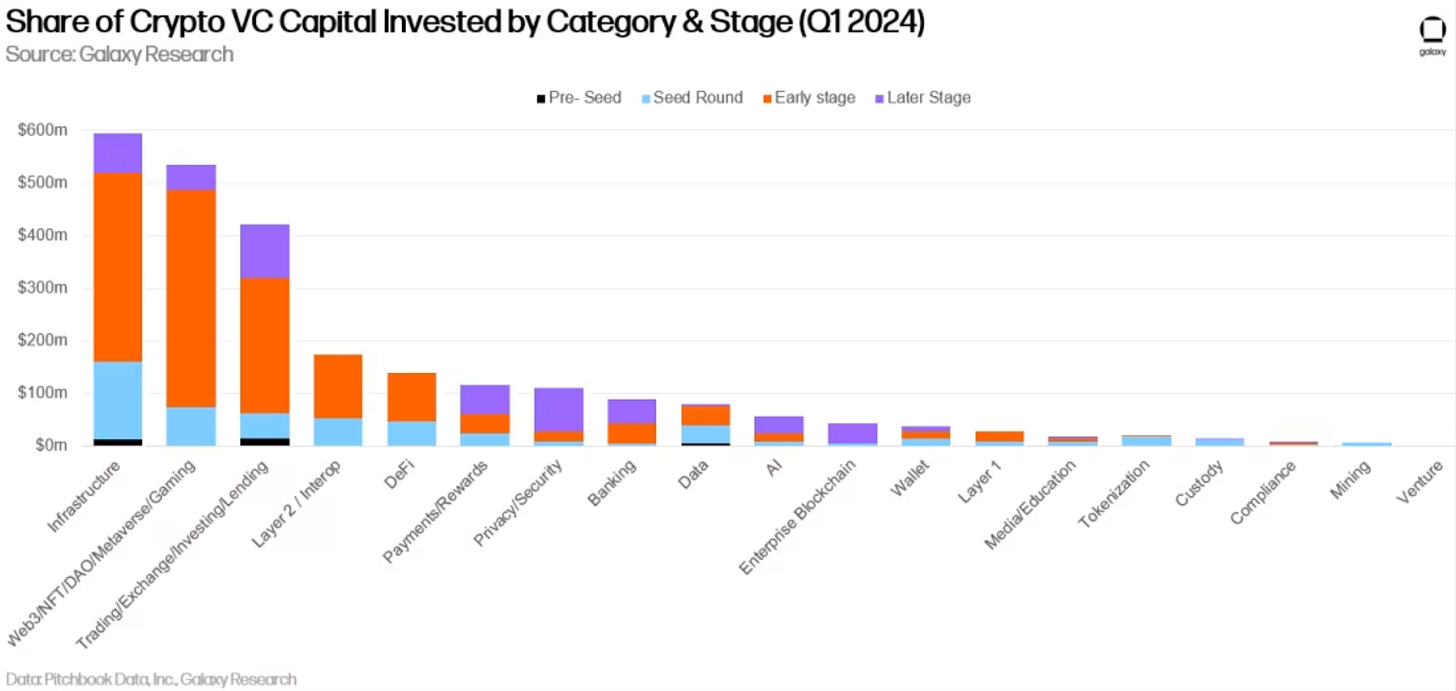

For example, one of the most prominent new financial instruments related to Bitcoin is the spot Bitcoin ETF, which was only approved in the US in early 2024. Although the halving brought a conservative period for these assets, the ETF market has bounced back into action, with the previously-declining Grayscale leading the charge. The early champion of ETF approval has finally managed to see consistent inflows into its product, and the entire industry is coming along, to the tune of hundreds of millions on a daily basis. These ETFs were initially conceived as a convenient on-ramp for new investors to gain direct access to Bitcoin’s profits without actually custodying the asset, and it seems that the plan was a perfect success: after several quarters of declining venture capital interest, the ETF has spurred investors to pour fresh billions into the Bitcoin industry in the first few months of 2024 alone.

Financial instruments like the ETF are not the only way that Bitcoin has changed, however. The ETF's approval was an important victory for the community’s political lobbying efforts and for Bitcoin’s overall acceptance as a new component of the global financial establishment. It can’t be forgotten, though, that Bitcoin’s various developers have been hard at work to revolutionize the new possibilities for the blockchain. MicroStrategy, the largest corporate holder of Bitcoin, made headlines when it announced in early May that it was launching a new Bitcoin-native platform for decentralized ID. This platform would be based on the controversial Ordinals, an inscription protocol that enables a wide variety of completely novel code to be stored and executed directly on the blockchain. MicroStrategy’s plan with this code is to help facilitate Bitcoin’s decentralized and trustless spirit with a new way of establishing online credentials.

Inscription protocols like Ordinals have seen their fair share of detractors, though. Its creator, Casey Rodarmor, launched a successor called “Runes” on the day of the halving to try and serve as a better vehicle for these novel new Bitcoin apps. Since its launch, however, Runes transactions have persistently fought with all other on-chain functions of Bitcoin to be the leader. Bitcoin’s transaction volume is at a massive high compared to its entire history, but on some days, most of that volume can be attributed to this new protocol alone. The overwhelming impact of “spam” from inscription protocols into Bitcoin’s market has even been cited as a possible leading cause in Bitcoin’s post-halving doldrums. Inscription protocol transactions drive up fees for users everywhere and can reduce liquidity for the entire market.

This situation is not helped by the perception that most inscription protocol users are only “clogging” Bitcoin’s blockchain with meaningless tokens and other speculative tchotchkes, despite the potential of creating important new technology on-chain. However, even the pursuit of non-Bitcoin tokens can still have novel uses. Hermetica, for example, is using the Layer-2 Stacks protocol to create a synthetic dollar, essentially a stablecoin tied to USD, directly on Bitcoin. The altcoin market has historically been plagued by a variety of parties offering tokens of “equivalent value” to one US dollar, with many of these backed by very shaky promises. By using Layer-2 solutions to put these assets directly on Bitcoin itself, Hermetica may have found a way to utilize Bitcoin’s trustless and decentralized nature to meet the apparent demand for such a product.

For good or ill, the power of Layer-2 protocols like Ordinals, Runes, or Stacks has injected a great possibility for new development solutions onto Bitcoin. Lightning made headlines for several years as the first household name in Layer-2 solutions, but its main aim has been to quietly facilitate Bitcoin’s usage as an actual currency. In the age of ETFs and other complicated financial instruments, these protocols are instead seeking to open up new revenue streams altogether. Their misuse can undoubtedly cause problems for Bitcoin’s use as an actual currency, but nevertheless, there is a clear interest for Bitcoin developers to keep pursuing this strategy. Such transformations on the blockchain were hardly anticipated in Satoshi’s time, but Bitcoin has been operational for more than 15 years.

There have been a number of dramatic changes to Bitcoin’s overall position over its history, and we can look at this billion-transaction milestone at a moment where Bitcoin may be changing even more dramatically. Bitcoin and its community have come a long way since the days when a pizza could cost you 10k BTC, and it’s only natural that some community members even see a different vision for Bitcoin’s future. No matter what happens, however, a few things are clear. The new possibilities for Bitcoin development and investment are symptoms of a rapidly maturing community that may transform even more over the next few years. Any number of these developments may prove to be wildly successful profit opportunities, just as Bitcoin itself has proven to be. As far as the next billion transactions are concerned, Bitcoin doesn’t seem to be going anywhere but up.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you enjoyed this article, please consider liking and sharing it. This will enable us to reach and inform a larger audience.