Bitcoin Mining’s Long-Term Threats

Bitcoin’s security depends on miners—but with subsidies heading to zero, fees and usage must rise or decentralization will erode.

Bitcoin mining has undergone a dramatic transformation from a decentralized hobby pursued by believers to an industrial operation controlled by a handful of large pools and nation-states. This centralization creates an existential threat to Bitcoin’s independence and security. As mining becomes increasingly concentrated geographically and operationally, and as the block subsidy continues its programmed decline toward zero, Bitcoin faces a fundamental economic problem that could undermine the very mining incentives that secure the network.

Industrialization

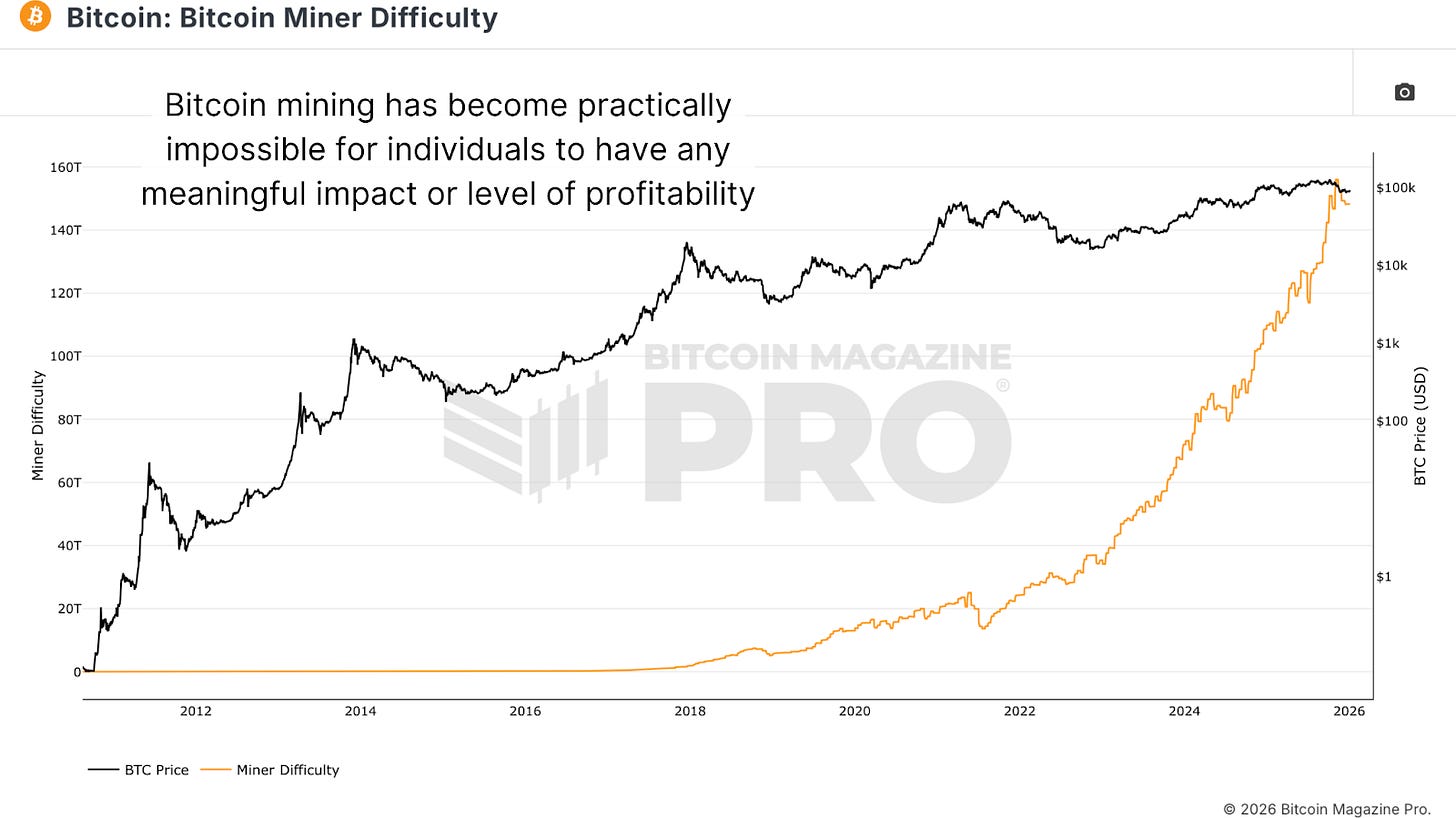

In the early days, Bitcoin mining was decentralized by default. Everyone had a laptop or desktop computer, ran the Bitcoin software, and mined Bitcoin. As Bitcoin became more valuable, so did mining rewards, and, as a consequence, mining became more competitive. Those willing to pour resources into expanding their operations increased their computational output. The Bitcoin Miner Difficulty, the measurement that determines how many hashes must be generated to find a valid solution to the next Bitcoin block, increased, and suddenly, domestic computer hardware was no longer competitive.

Figure 1: The high computational demands make Bitcoin mining almost impossible for individuals.

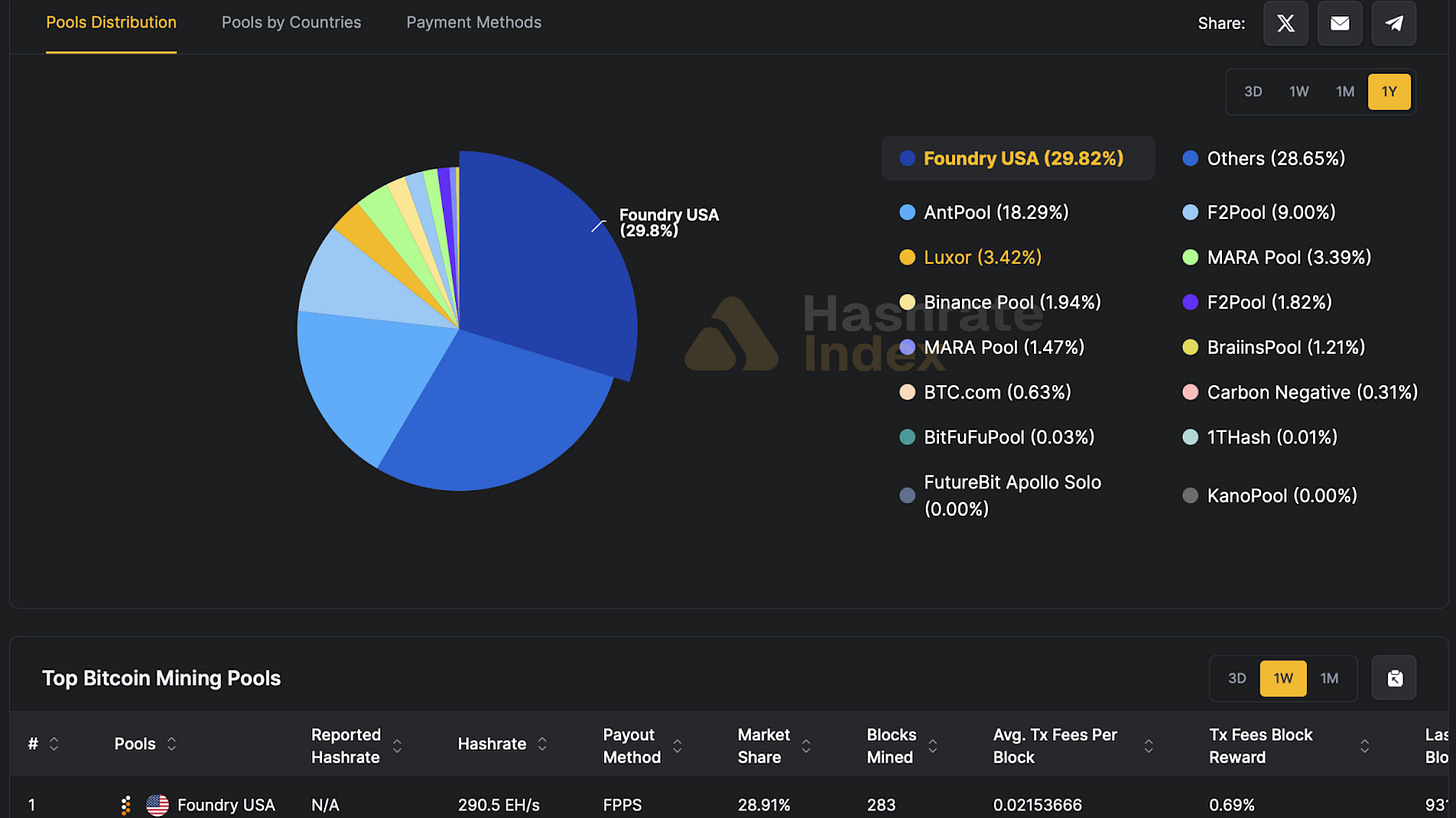

The reality is that economics beats philosophy every time. Bitcoin security depends on miners. But these miners exist because mining is a profitable venture. When mining was unprofitable, people mined Bitcoin out of belief. But belief alone does not pay the electricity bills. Those believers were eventually priced out of doing so, and now a majority of the total network hashrate is in just a handful of pools.

Figure 2: The growing centralization is evident.

Political Vulnerability

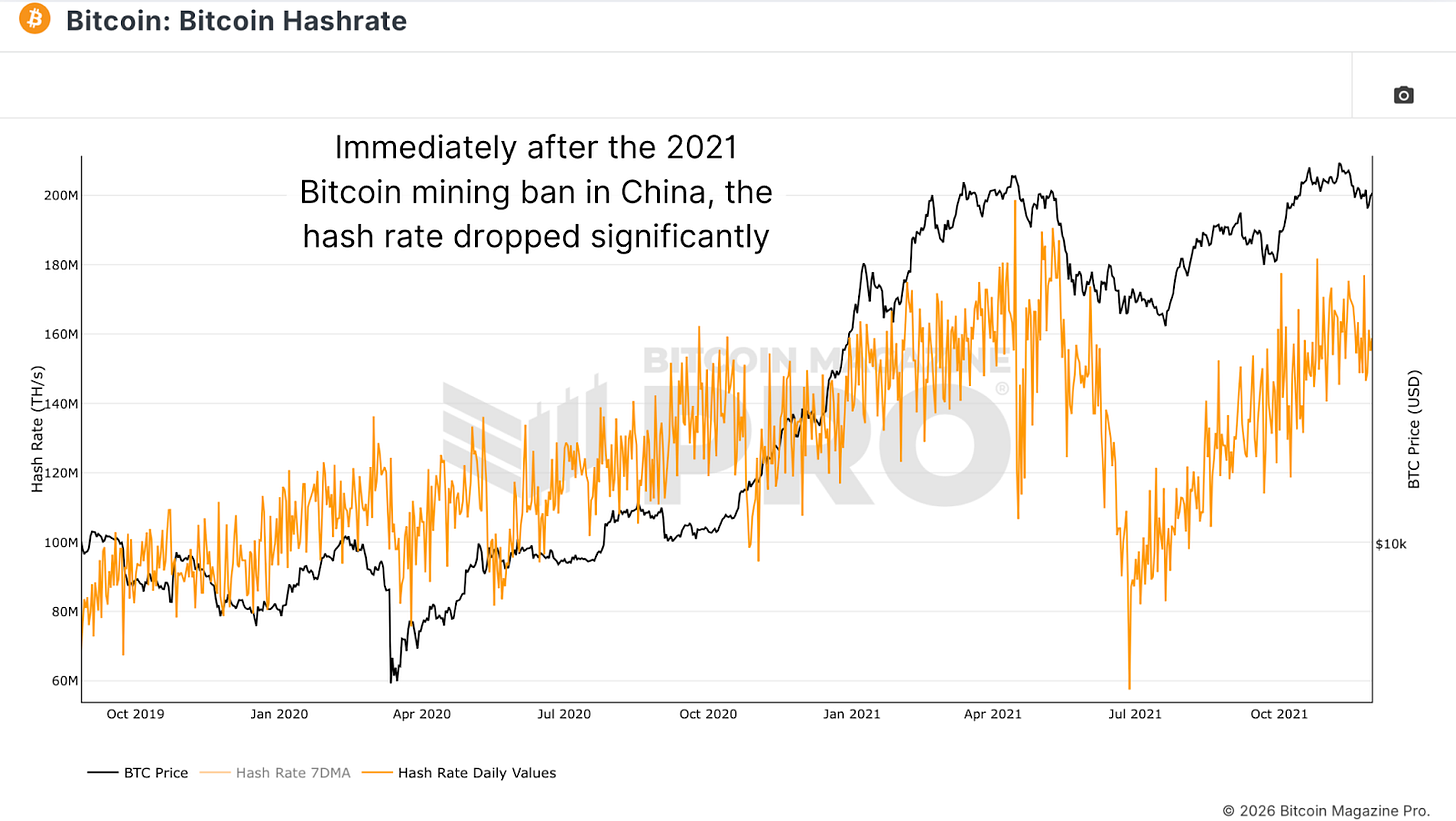

There is growing concern that electricity costs could be considerably cheaper in smaller and smaller regions around the world. We have already seen huge spikes in energy costs in many places due to demand for AI, for example, pushing miners to locations where electrical costs are considerably cheaper. Once again, this leads to geographical centralization within the mining network. If a majority of the mining equipment is situated within one jurisdiction, then potentially one political party in that region may have a significant influence and control over Bitcoin mining.

Figure 3: The dangers of geographical centralization were evident when China imposed its ban on Bitcoin mining.

The Subsidy Death Spiral

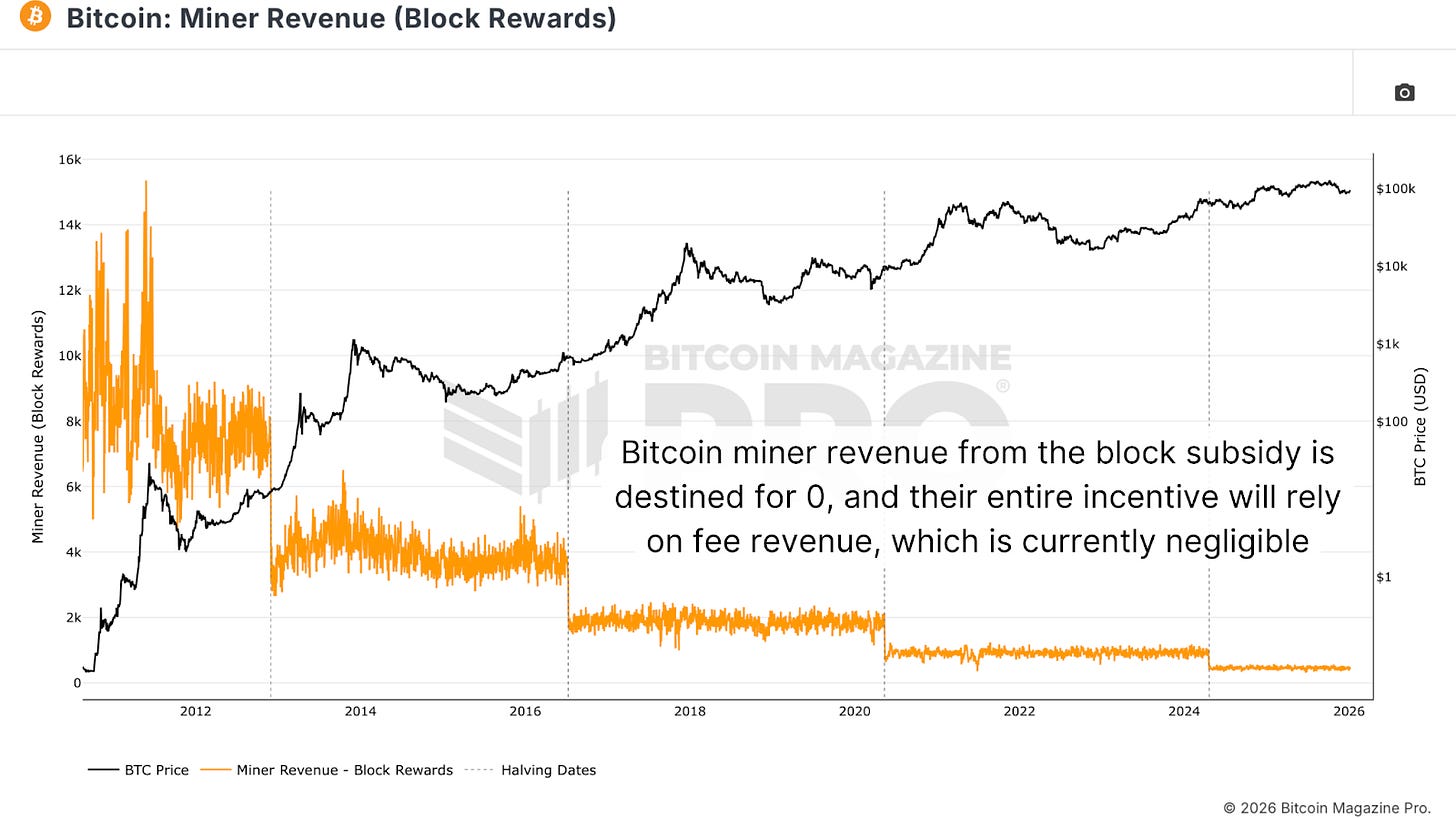

Bitcoin’s block subsidy, the amount of Bitcoin paid to miners for securing the network, was designed to decrease over time. In 2009, miners got 50 bitcoin per block. Every 210,000 blocks, or approximately every 4 years, that subsidy is halved. We went from 50 to 25, 12.5, halving to the 3.125 bitcoin per block we are currently at. In around 2028, it will drop by 50% again, following this pattern until 2140 when it reaches zero.

Figure 4: Bitcoin’s block reward halving means this form of miner revenue will be exhausted by approximately 2140.

The problem is that around 99% of the revenue for miners comes in the form of block subsidies. If miners want to retain the same revenue they currently earn, then in six or seven halving times, the Bitcoin market capitalization, the total value of all coins in circulation, is going to have to be hundreds of trillions of dollars just to maintain where we are today, unless transaction fees or volume massively increase. By 2140, when the block subsidy is zero, miners must be paid entirely by transaction fees.

Conclusion

The network relies on miners. Miners rely on profitability. And the longer Bitcoin exists, the more that profitability becomes dubious. If nobody is using Bitcoin on-chain, the fees are not sustainable, and the security and decentralization of the network are both at risk. This is either a fundamental flaw that needs to be addressed or something that will inevitably resolve itself.

For a more in-depth look into this topic, watch our most recent YouTube video here: Ticking Time Bomb | The 131 Year Bitcoin #3

Matt Crosby

Director of Research & Analytics

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else.

We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Strong piece. The subsidy death spiral math is real, and the fee-only model assumption has serious holes.

I explored this from a different angle: who has structural incentives to mine even when it’s not profitable? Three groups emerge: large Bitcoin holders (mining as insurance), energy companies (mining as energy management tool with marginal cost near zero), and governments (mining as infrastructure enabler for remote areas).

The hypothesis: mining may shift from “standalone business seeking profit” to “operational cost for those exposed to Bitcoin or managing energy.”

Full analysis (Portuguese, easily translatable):

https://joulebtc.substack.com/p/quem-vai-pagar-pela-seguranca-do

Strong analysis of the mining centralization problem. The subsidy death spiral math is sobering when you realize 99% of miner revenue comes from block rewards that will hit zero by 2140. I've been following hash rate distribution for a while and the geographicl concentration risk you mention is real, especially after we saw what China's mining ban did to the network. The fee revenue dependency becomes an existential issue if onchain activity doesn't scale dramatically.