Bitcoin Mining Weekly Analysis - Mar 9 2024

Mining Dynamics, Stock Performance, and Network Traffic Trends as Bitcoin Approaches the Halving Event

Bitcoin Mining Trends and Market Cycles

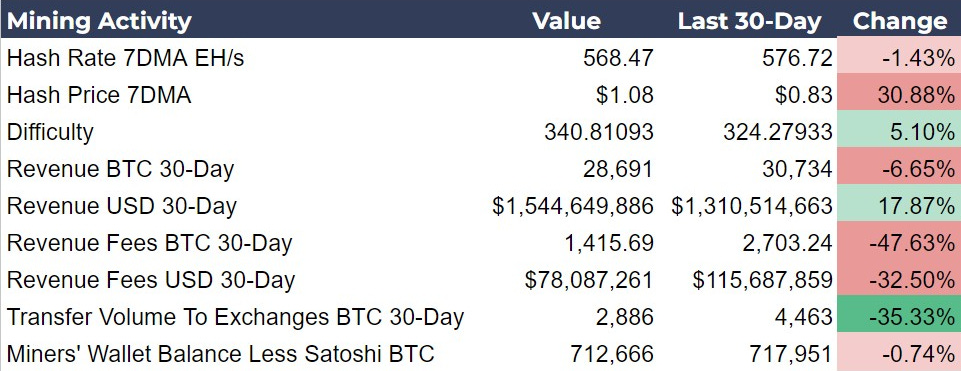

The Bitcoin mining sector is undergoing nuanced shifts, evidenced by the latest data. The slight decrease in hash rate juxtaposed with an increase in mining difficulty suggests industry consolidation, where only efficient entities thrive. Remarkably, the hash price has surged, indicating an uptick in mining profitability per unit of computational power. Despite a decrease in BTC revenue, USD revenue has risen, reflecting Bitcoin's price appreciation, which compensates for the reduced bitcoin earnings. This scenario highlights the sector's volatility and its tight linkage with Bitcoin's market value.

The dual-revenue trend in Bitcoin mining, reflecting a divergence between BTC and USD revenue, is a critical concept for understanding the industry's dynamics. If the price of Bitcoin continues to rise, the increase in USD revenue could potentially offset the reduction in BTC revenue post-halving. This would be crucial for miners, as their operational costs, such as electricity and maintenance, are typically denominated in fiat currencies like USD.

Investment Insights

Monitor Industry Consolidation: The data hints at potential consolidation in the mining industry. Investors could look for companies that are gaining market share or are innovatively reducing operational costs, as these could be poised to outperform in a more competitive environment.

Tracking Revenue Trends: Investors should closely monitor trends in both BTC and USD revenues. An upward trend in USD revenue, even with a downward trend in BTC revenue, can indicate a healthy or expanding industry, especially if driven by rising Bitcoin prices.

Understanding Market Cycles: Assessing Reinvestment and Market Cycles: High USD revenues suggest that miners have more capital to reinvest in expanding their operations, which could include purchasing new equipment or optimizing operational costs. Investors should monitor these trends as indicators of the industry's expansion phase.

Bitcoin Miners' Stock Performance: Navigating the Turbulence

In the realm of publicly traded Bitcoin mining companies, we see varied performance metrics. MARA's stock has seen a slight increase in USD value but a decrease in Bitcoin value, indicating a potential divergence from Bitcoin's market trends, despite its strong operational metrics, including significant Bitcoin holdings and production rates. CLSK stands out with notable gains in both USD and Bitcoin values, reflecting robust operational health and investor confidence. Conversely, RIOT faces declines in both currencies, suggesting potential operational challenges or market skepticism, despite substantial Bitcoin reserves and production capabilities.

The data indicates that while some miners experienced increases in USD stock prices, their performance in BTC terms varied. This discrepancy highlights the miners' leverage to Bitcoin's price movements and the potential for stock valuation to decouple from Bitcoin's market dynamics in the short term.

Investment Insights

Bitcoin Reserves: Mining companies with higher BTC holdings might be viewed as more exposed to Bitcoin's price fluctuations, impacting their stock valuation.

Halving Considerations: As the Bitcoin halving approaches, the miners' ability to maintain profitability becomes crucial. The recent rise in Bitcoin's price could provide a cushion against the halving's impact, as the value of reduced block rewards might still be substantial in USD terms, aiding miners' revenue despite the halving. Given Bitcoin's price increase, evaluating miners' strategies for managing their BTC holdings—whether they hold, sell, or leverage their assets—could provide insights into their long-term outlook and financial health.

Network Traffic Signals

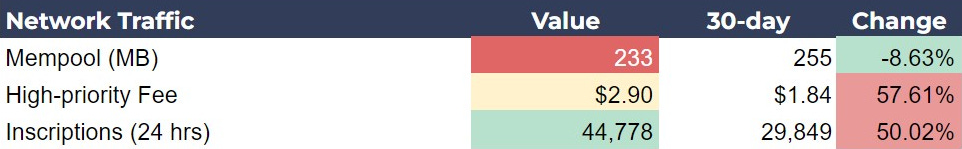

While the mempool has seen a slight decrease in the last month of 8.63%, high-priority fees have slightly risen from $1.84 to $2.90. Fees are a snapshot in time and can vary widely throughout the day. The mixed signal here of a falling mempool and rising fees can be explained by the behavior in the last week of that month-long period. Check out the Chart of the Week for the mempool and you will see that the mempool has increased in the last 7 days. Fees are not at historically elevated levels and the number of inscriptions is still low. Inscriptions were hitting as many as 400,000/day in January.

Heading into the halving, the interplay between inscriptions and transaction fees will be particularly important. As block rewards halve, miners will increasingly rely on transaction fees as a revenue source. Many believe inscriptions are a way to amplify fee revenues for miners, but that has, so far, not been proven. Network congestion is a double-edged sword. It isn’t fun paying fees of $5 or more, but it does mean that demand for blockspace is high. It also proves the long-term theory that fees will supplement a declining block reward.

Investment Insights

Bitcoin Price Sensitivity: Elevated transaction fees and network congestion do not affect Bitcoin's price directly, but we can infer a higher demand to send bitcoin during high fee environments, which could be a sign that bitcoin are urgently moving to exchanges.

High Fee Incentives: Higher fees are a boon for miners, but they also incentivize Layer 2 development. Investors should understand the dynamic between fees and transaction behavior if they are planning to invest in a Layer 2 project.

Inscription adoption: There is still little evidence of real demand for inscriptions and ordinals. Projects centered around these products must be given extra scrutiny.

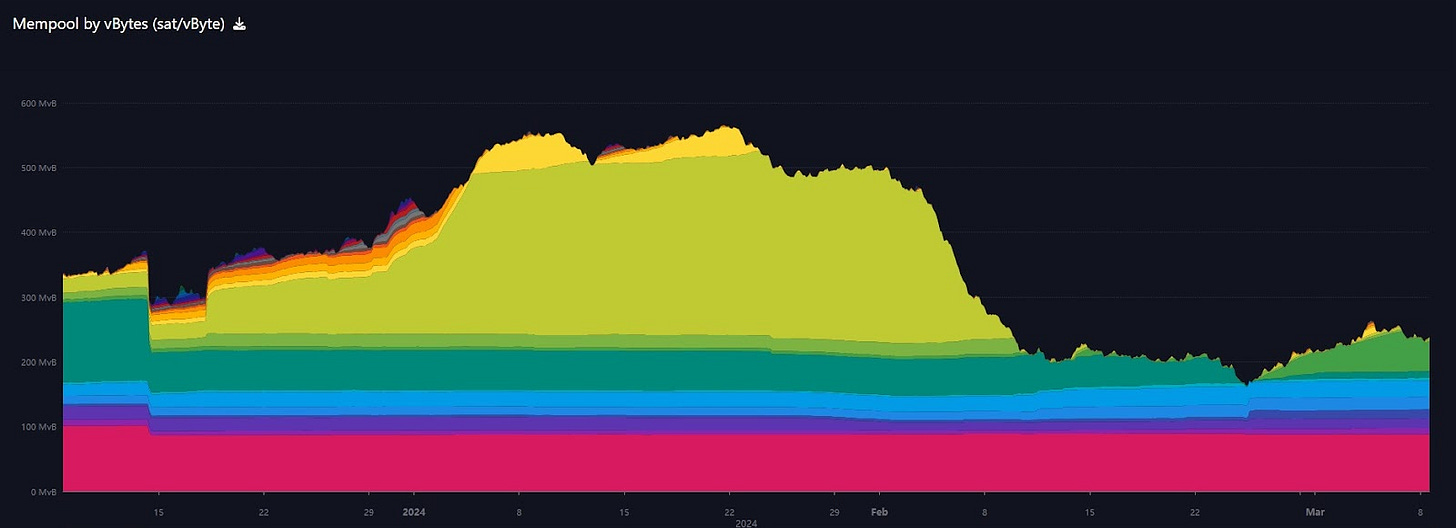

Chart of the Day

Lastly, we have the chart of the day. I love the mempool charts from Mempool.space because they break it out by bands of different levels of fees. As you can see, this month the mempool has risen and even added a little fee color above the green. That happened on 4 March, which corresponds to the big pump into a new ATH. As I stated above, many times a spike in the mempool and fees can be attributed to urgent transactions to the exchanges. That theory fits the data in this case.

Source: Mempool.space

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!

no more, LIVE access to the Dashboards, or i miss something?