Bitcoin Mining Weekly Analysis - Mar 1 2024

Deciphering the Surge: A Comprehensive Analysis of Bitcoin's Bull Run Through the Lens of Mining Stocks and Network Dynamics.

Executive Summary

Bitcoin's recent price increase has significant implications for miners, investors, and the overall network. This surge reflects not only increased interest and investment in Bitcoin but also impacts mining profitability, stock performance of mining companies, and network congestion. Analyzing these factors provides a nuanced understanding for investors.

Striking stats include two miners beating the spot price spike, miner revenue falling in BTC terms but rising in USD terms, and what low fees can tell us about the average new buyer of bitcoin. The analysis offers investors a comprehensive view of the current Bitcoin ecosystem, emphasizing actionable insights based on mining stock performance and network activity.

Bitcoin Miners' Stock Performance and Production Efficiency

Public Bitcoin miners like CleanSpark (CLSK) and Iris (IREN) have shown noteworthy performance, up 100% and 57% respectively in the last 30 days. They even beat bitcoin’s price performance in the last 30 days by 38% and 9% respectively. This indicates robust investor confidence and strong sector sentiment. Bitfarms (BITF) leads in hash rate efficiency producing 68 btc/EH/s. Investors should consider these aspects when evaluating mining stocks, looking at both production volume and efficiency.

Key Insights

Diversified Miner Performance: The varied performance of mining companies like BITF and CLSK underscores the importance of diversification. Investors should consider different aspects of mining companies apart from size, such as production efficiency, stock performance relative to the underlying asset and bitcoin balance sheet strategy, when building their portfolios.

Hash Rate Growth and Revenue Trends

The detailed examination of Bitcoin mining activity showcases crucial metrics that underline the network's robustness and the competitive landscape of mining. The hash rate has surged to 581.17 EH/s from 548.88 EH/s, demonstrating an increase in network security and mining competition. Simultaneously, the mining difficulty ramped up to 351.01 from 302.12.

Despite the upsurge in Bitcoin's price, the mining revenue in BTC terms dipped by 3.29%, moving from 30,177 BTC to 29,184 BTC over the last 30 days due to lower fees and inscription traffic. In contrast, the revenue in USD terms increased by 11.40%, reflecting the higher fiat value of the diminished Bitcoin rewards due to the price jump. These figures illustrate the nuanced impact of Bitcoin's price volatility on mining economics, emphasizing the delicate interplay between network security, miner competition, and the profitability of Bitcoin mining operations.

Key Insights

Mining Metrics and Bitcoin Price: The interplay between mining metrics and Bitcoin's price is crucial. A rising Bitcoin price can enhance mining profitability, but the relationship is complex and influenced by factors like macro influences. This understanding is extremely important for investors who have a longer time horizon. High fee periods are offset by low fee periods. As well as revenue measured in bitcoin will tend to decrease, but will increase in USD terms.

Bitcoin Mempool, Fees and Inscriptions Update

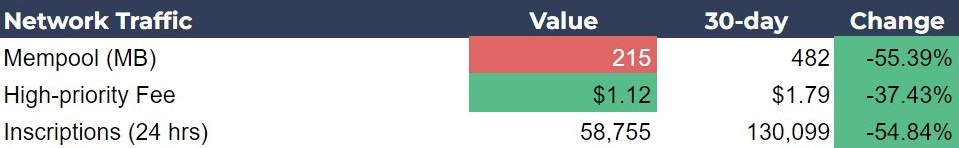

Below are a few metrics about the Bitcoin network's operational metrics, highlighting mempool size, transaction fees, and inscriptions. Specifically, the mempool size has sharply decreased from 482 MB to 215 MB in the last 30 days, indicating a significant reduction in the number of unconfirmed transactions waiting in the network's queue. This reduction suggests improved network efficiency and faster transaction confirmation times with lower fees.

Fees continue to fall, with next block confirmation costing only $1.12 at the time of writing. Inscription numbers have also stayed relatively subdued for the last several weeks, which has a direct impact on fees. At this rate, fees will remain low as the network chews through the mempool in coming months. However, if the price continues to surge, we could see a significant increase in network traffic along with it, and hence higher fees once again.

Key Insights

Bitcoin network traffic: The subdued number of inscriptions is a sign that even with the spotlight bitcoin has been under recently, inscriptions are struggling to find a product-market fit. From low fee levels in the $1 range we can infer the type of investors active in the market at this point in the cycle. Large transactions from the ETFs or wealthy investors have less effect on mempool keeping fees lower. Once retail investors come in force, the mempool and transaction fees should increase significantly with their smaller size transactions taking up more space.

Chart of the Day

Today’s chart of the day is Valkyrie’s Bitcoin Miner ETF (WGMI). This is an interesting product for several reasons. First, as you can see above, miners tend to have different performances based on individual business practices, therefore, owning a group of miners will mitigate volatility and the investor won’t miss out completely on one company’s overperformance. Second, WGMI also includes holdings of chip manufacturers like AMD, Nvidia and TSMC. This allows an investor that multi-factor exposure in their portfolio as well.

On the chart, we see WGMI has run into the Golden Pocket retracement Fibonacci and encountered resistance there. Price is currently bouncing off the 50 DMA and the 50% retracement. This is a strong level of support. Taking into consideration the bitcoin price surge to $62,000, WGMI will likely rise and break that resistance in the near term.

Summary

In conclusion, Bitcoin's ecosystem is multifaceted, with interlinked factors influencing its value and appeal. By keeping a close eye on mining dynamics, network activity, and broader market trends, investors can navigate the Bitcoin market more effectively, making informed decisions in a volatile landscape.

If you get value from our posts, please like and drop a comment down below to tell us how we are doing.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!

Having a fresh perspective might help y'all grow. There's momentum building around Bitcoin L2s, whether you support the projects or not, the demand is here now.