Bitcoin Mining Weekly Analysis - Feb 23 2024

Analyzing Bitcoin's Performance, Mining Dynamics, and Network Traffic for Informed Investment Decisions.

Executive Summary

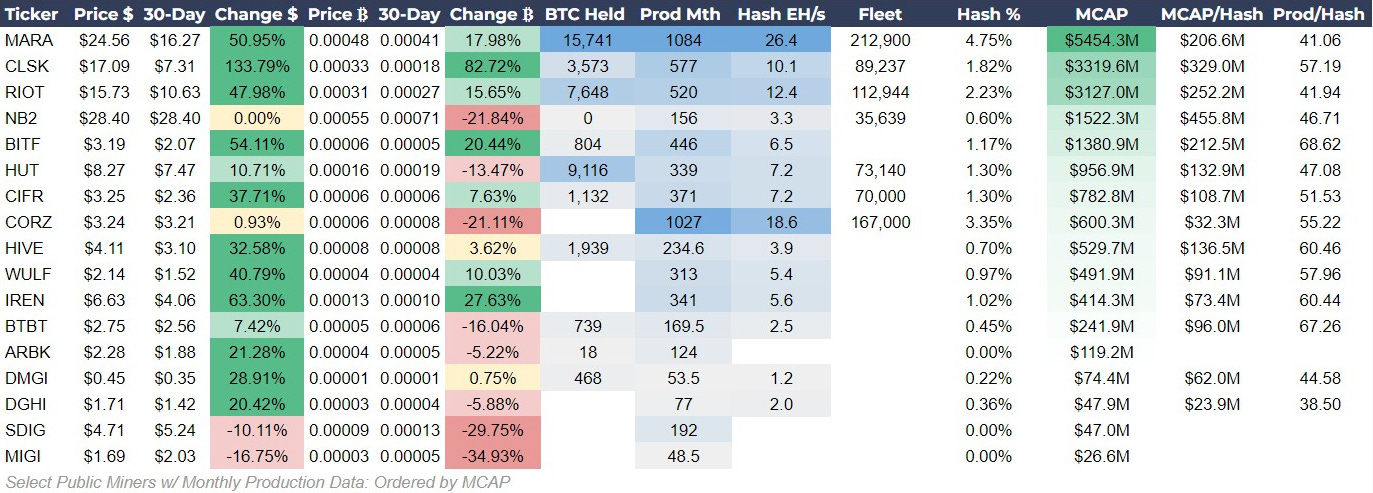

This week's Bitcoin mining weekly update provides an in-depth analysis of Bitcoin's current state, with a focus on miners' stock performance, mining activity, and network efficiency. It reveals that companies like 'IREN' and 'CLSK' are showing strong growth relative to their market sizes, suggesting potential investment opportunities in the mining sector. However, the sector's volatility underscores the need for diversified investment strategies.

In mining activity, the increased hash rate contrasts with a slight decline in hash price. Despite the challenges, rising USD revenue offers some respite, indicating mixed implications for prospective miners.

The network analysis highlights a decrease in congestion and transaction fees, pointing to improved efficiency. This trend suggests an opportune moment for enhanced transaction activities on the Bitcoin network.

Public Miners Update

Data reveals varying performances among these companies, with some showing significant growth in stock price when measured in Bitcoin terms. Interestingly, there is a diverse range of performances relative to market cap, indicating varying strategies and operational efficiencies among these miners.

Key Insight: Companies like 'IREN' and 'CLSK' showcase strong performance relative to their market capitalizations. This suggests that certain players in the mining sector are effectively leveraging their resources to navigate the volatile Bitcoin market.

Actionable Forecast: Investors should keep a keen eye on these high-performing miners, as they might offer attractive investment opportunities. However, diversification remains key due to the inherent volatility in the sector.

Bitcoin Mining Activity Trends

Next, we turn our attention to the mining activity itself. The hash rate shows a notable increase and the hash price has seen a slight decrease, meaning miners are experiencing a slight marginal decline in profitability per hash.

Key Insight: The rise in difficulty by 16.18% in the last 30 days has outpaced the rise in hash rate, suggesting that miners are feeling stressed. However, despite the decrease in revenue in BTC terms, the 30-day revenue in USD terms has increased by 4.06%, from approximately $1.328 billion to $1.382 billion, offsetting the lower Bitcoin earnings. Also, the amount of bitcoin sent by miners to exchanges has plummeted 42% in the last 30 days, potentially leading to higher price for bitcoin in the near term.

Actionable Forecast: With revenue up and a spread in hash rate to difficulty likely leading to at least one negative difficulty adjustment, this would be a good time to add hash rate to a mining operation to capture market share.

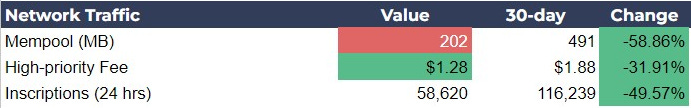

Network Traffic

The Bitcoin network traffic data reveals a decrease in mempool size and high-priority transaction fees, along with a reduction in daily inscriptions. This suggests a more efficient and less congested network. This will have implications for Bitcoin users and miners, shortening confirmation times, costs, and overall network dynamics.

Key Insight: The reduced mempool size indicates a less congested network, leading to quicker transaction processing. The decrease in high-priority fees could make Bitcoin transactions more attractive to inscribers due to lower costs.

Actionable Forecast: Users will find it more feasible to consolidate UTXOs or use a mixer due to lower fees and improved efficiency. Lower fees potentially help Layer 2’s like Lightning Network as users can more cheaply manage channels.

Chart of the Week

Our chart of the week is comparing Coinbase (COIN), the Valkyrie Bitcoin Miner ETF (WGMI) and the spot price of bitcoin. As you can see both stock market products outperformed bitcoin since the bottom of the current cycle, during the FTX collapse. The large out performance areas were June-July 2023, Nov-Dec 2023, and February 2024. This could be due to spot ETF hype because Blackrock’s filing on June 15, 2023 could have sparked a lot of interest from traditional investors who wanted to front-run the ETFs. This outperformance will likely not continue to the degree it has as the pre-launch ETF distortions work their way out of the pricing.

Conclusion: Piecing Together the Bitcoin Puzzle

The confluence of data from miners' stock performance, mining activity, and network traffic paints a comprehensive picture of the Bitcoin ecosystem. The mining sector, though challenging, offers potential growth opportunities, especially for efficient players. The network's increased efficiency and reduced transaction costs could spur more activity and adoption.

For investors, the key takeaway is to remain vigilant and adaptive. Continuously monitor the market for shifts in mining difficulty, stock performance, and network efficiency. Diversification and strategic planning are paramount in navigating the Bitcoin landscape.

As Bitcoin's network evolves, so does its impact on the financial world. Staying informed and agile is crucial in harnessing the opportunities this dynamic market offers.

Full Bitcoin Magazine Pro Mining Dashboard: 📊

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!

Hi, I’m relatively new here, so this could be a rookie question. Regarding the metric showing that miner transfers to exchanges decreasing, could this mean the miners expect a higher BTC price in the near term, so they are holding off transferring until that higher price? Kind of like a farmer who holds their grain, knowing they can make more at a future price.