Bitcoin Mining: Managing Change

Exploring how the recent Bitcoin halving has reshaped mining strategies, network traffic, and investor perspectives

Introduction

In the evolving world of Bitcoin mining, the recent halving event has marked a significant turning point, challenging miners and reshaping the broader network landscape. This blog post delves into the resilience and strategic adaptations of public Bitcoin miners, who have maintained production levels close to pre-halving figures, thanks to an initial surge in transaction fees. We also explore the broader network dynamics, including a notable shift in mining activity and the introduction of Runes transactions which are quickly replacing the more resource-heavy Inscriptions. Additionally, this analysis offers critical insights into investor misconceptions about hash rate changes and network security post-halving, highlighting the inherent robustness of Bitcoin's protocol and its adaptability in the face of significant operational challenges.

Analyzing New Norms: April Production Numbers

In April, following the Bitcoin halving, public Bitcoin miners surprisingly reported performance metrics fairly close to their March outputs, despite the reduced block subsidy. This was primarily due to the exceptionally high transaction fees immediately after the halving. These higher fees temporarily buffered revenue losses, but have since normalized, removing the temporary financial cushion. Some mining companies explicitly highlighted this dynamic in their April investor updates. As these fees return to regular levels, miners face the challenge of maintaining profitability under the new reward structure, necessitating strategic operational adjustments.

Miners continued to add to their hodl stacks in April and many are in the process of adding hash rate or whole new facilities. Below, I pull out from April highlights that struck me when reading through their production updates.

April Production Highlights in Context of Halving

Iris (IREN) mined 358 bitcoins (101% of March production), they don’t publish their bitcoin reserves, but their hash rate increased from 7.1 EH/s to 9.4 EH/s.

Cipher (CIFR) mined 296 bitcoins (93% of March production) increasing their hodl stack by nearly 17%.

Cleanspark (CLSK) mined 721 bitcoins (89% of March production) and only sold 2.88 in April increasing their hodl stack by 14%.

Hive (HIVE) mined 212 bitcoins (95% of March production) increasing their hodl stack by only 4%.

Marathon (MARA) mined 850 bitcoins (95% of March production) increasing their hodl by 250 btc or 1%.

Riot (RIOT) mined 375 bitcoins (88% of March production) increasing their hodl by 382 btc (more than they mined) or 4.5%.

Hut8 (HUT) stood out for bad performance, mining only 148 btc (64% of March production) and increasing their hodl by only 4 btc. Their hash rate also dropped from 5.4 EH/s to 4.5 EH/s. The source of the decrease in hash rate is likely due to hash rate at their King Mountain JV joint venture dropping almost 1.1 EH/s from March to April. That should be a one off event.

Investor Insight

The Halving Crucible Winners and Losers: The halving a particularly testing time for any miner. The miners that breezed through April highlighted their excellent management and strategic decision making. No surprise really, that CIFR and CLSK were among the best, and significantly increased the hodl stack as well. IREN belongs in this conversation, but we don’t know the level of the bitcoin reserves.

Network Adjusting to New Realities

The narrative remains consistent across the mining sector as it adjusts to the post-halving environment. The hash rate has seen a decrease from 629.12 EH/s to 575.33 EH/s, marking an 8.55% reduction over the last 30 days. This decrease coincides with a drop in mining difficulty from 371 to 357, a change of -3.75%. Interestingly, despite the halving, the hash price showed a week-over-week (WoW) increase after initially being halved.

Source: Mempool.space

Revenue has understandably declined and is expected to continue falling as the full effects of the halving are integrated into the 30-day timeframe. The transfer volume of Bitcoin to exchanges decreased by 31.26%, indicating reduced selling pressure from miners.

Furthermore, the continued decrease in the transfer volume of Bitcoin to exchanges over the past month supports the idea of an impending supply crisis that could drive the price higher. Public miners' production updates for April revealed that most are increasing their reserves rather than selling. Notably, RIOT reported that they accumulated more Bitcoin than they produced in April. Overall, miners' wallet balances rose WoW, nearly returning to pre-halving levels.

Investor Insight

Misconceptions Around Hash Rate and Difficulty Adjustments: The recent drops in hash rate and difficulty are often misconstrued as negative signals regarding network security. However, newcomers to Bitcoin should understand a decrease in hash rate following the halving is anticipated and is counterbalanced by the difficulty adjustment. This highlights one of Bitcoin's fundamental innovations. It’s crucial for investors to recognize that these dynamics are indicative of a well-functioning, adaptive protocol, rather than a vulnerability.

Changing Traffic Patterns

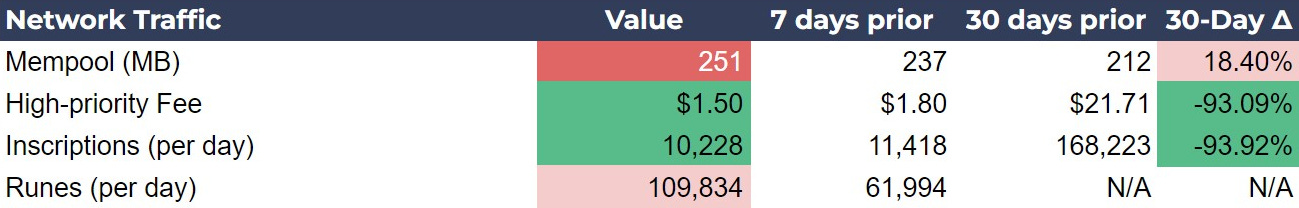

Following the recent Bitcoin halving, network traffic has stabilized. The mempool increased slightly to 251 MB from 216 MB, indicating a modest uptick in network activity. Despite this increase, transaction fees have maintained surprisingly low levels of around $1-2.

The significant development in network usage has been the rapid adoption of Runes, which are now overshadowing the previously popular Inscriptions. Runes utilize the op-return part of the transaction code, making them more efficient and less costly in terms of resource utilization compared to Inscriptions, which are known for their higher resource intensity and expense.

The swift and seamless shift from Inscriptions to Runes also reveals an interesting aspect of user engagement and loyalty within Layer 2 protocols. The ease with which users have abandoned Inscriptions for Runes suggests a lack of deep commitment to any particular protocol and highlights dubious behavior by purveyors of these tokens, as they appear not to care about the actual product but will abandon ship to the new hot thing. This trend raises questions about the long-term viability and user support for emerging technologies within the Bitcoin ecosystem. It indicates that while these innovations are readily adopted by a few, they can just as quickly be set aside. This behavior will likely increase the skepticism in buyers of inscriptions, Runes and ordinals. It also highlights the rapid pace of experimentation on bitcoin and the robustness of the incentive structure to continue to operate while allowing for these types of things to go on.

Investor Insights

Block Times and Mempool Size: In the difficulty epoch that just finished, block times were averaging around 10.7 minutes. This could explain some of the increase in the size of the mempool, since slower blocks means a lower number of transactions can get confirmed per minute on average.

Layer 2 Tokens vs Layer 2 Development: With the recent lack of loyalty to specific types of tokens I highlighted above, we advise against any significant participation in these tokens. The secondary market could dry up overnight, leaving you holding a bag of unwanted inscriptions. However, investments in Layer 2 development shops, like what Microstrategy’s (MSTR) new Bitcoin Orange, announced May 1.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

GOOD JOB GUYS