Bitcoin Mining Industry’s Pre-Halving Dynamics

An in-depth analysis of the current state of Bitcoin mining, network activity, and market forces as the halving event draws near, revealing strategic insights for investors.

Introduction

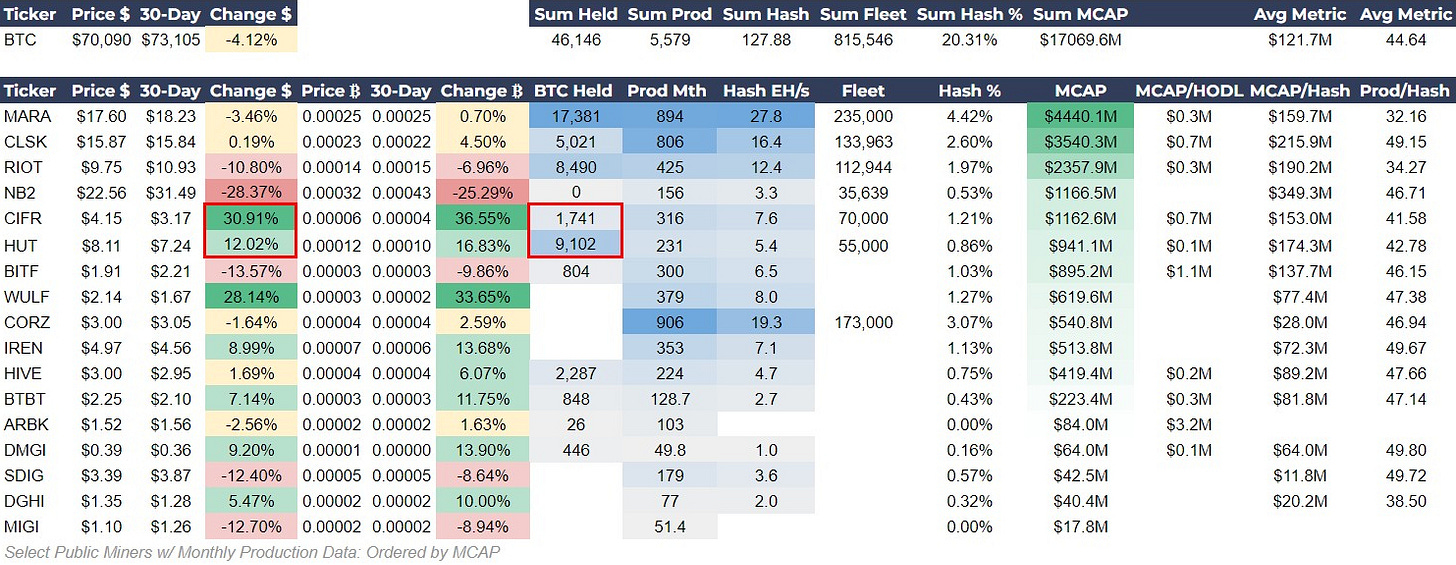

As the Bitcoin halving draws near, the public mining sector presents a mixed performance, with no noticeable correlation to BTC reserves, production, or production per hash rate. Miners with high levels of BTC should be more insulated from the volatility around the halving. Mining activity points to preparation for the halving with fewer BTC being sent from miners to exchanges and miners’ wallet balances rising. Lastly, network traffic is highly turbulent with a massive spike in fees amidst whispers of potential spam attacks and rising speculative interest as evidenced by rising number of inscriptions. Be prepared for heightened volatility over the next two weeks.

Mixed Performance of Public Miners

Outperformers

Cipher (CIFR) stands out with a 30.91% increase in USD price and a 36.55% increase in Bitcoin price, highlighting its exceptional performance during this period. TeraWulf (WULF) is not far behind with 28.14% and 33.65% performances respectively. Hut 8 (HUT) also is hanging onto a positive performance of 12.02% and 16.83% respectively.

Underperformers

Northern Data (NB2) is the standout loser over the last 30 days. RIOT has been disappointing as well. Among the other losers we have Bitfarms (BITF), Stronghold (SDIG) and Mawson (MIGI), all with double-digit losses in both USD and BTC.

There is no correlation between BTC held (0.006), Production/Hash (0.04) or Production (0.02) in general to stock market performance.

Investor Insights

Uncertainty and BTC HODL: Investment in mining stocks is influenced by the uncertainty surrounding halvings. Post-halving, miners holding substantial Bitcoin reserves are expected to have a performance edge over those with minimal or no reserves, thanks to their financial cushion.

Timely Outperformance: A mining company that outperforms the market during the heightened uncertainty before a halving could indicate that its operational strategy is well-tuned to the forthcoming changes in block rewards. This outperformance might reflect the company's strategic efficiency and readiness for the halving, contrasting with other miners who might be conserving their resources in anticipation of the event.

Miners to Watch: The above two insights combined, highlight HUT and CIFR as two companies that are outperforming, heading into the halving and have high and/or growing bitcoin reserves. WULF does not publish their bitcoin reserves in monthly statements.

Mining Activity

We find ourselves in the midst of a month-long consolidation in price and on the doorstep of the halving. The difficulty has surged by over 8% this month, underscoring an increasingly competitive mining environment. While USD revenue has seen a notable increase over the past 30 days, there's a slight decline over the past week, suggesting that revenue growth isn't keeping pace with the rising difficulty.

Fees are down on the month, but slightly up over the last 7 days. This could be due to uncertainty rising heading into the halving, causing market participants hedge exposure.

Moreover, the transfer volume from miners to exchanges has been consistently decreasing, indicating that miners are bracing for the halving. The increase in miners' wallet balances by approximately 400 BTC week-over-week suggests that miners are retaining their holdings, likely in anticipation of post-halving price movements, rather than satisfying the current demand, possibly influenced by new spot ETFs.

Investor Insights

Watch for Post-Halving Shifts: The period immediately following the halving will be critical for observing how the adjustments in mining difficulty and miner behavior impact the broader market. Stay tuned to Bitcoin Magazine PRO for this analysis.

Fee Revenue and Market Dynamics: We should expect fees to increase with uncertainty, due to the effect on transactions to and from exchanges. The slight increase in fees over the past week, reflects this very market dynamic. Post-halving, fees should also remain high as hedges are unwound. Be cognizant of rapid changes in fees, we will cover this more below.

Network activity

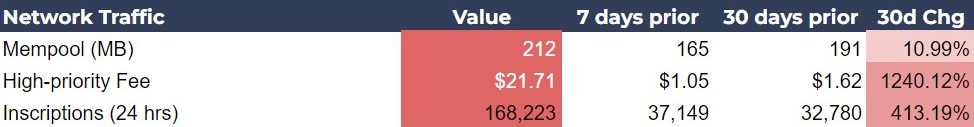

The Bitcoin network is currently witnessing a notable surge in activity, as evidenced by the significant increase in the mempool size and transaction fees, alongside a substantial rise in the number of daily inscriptions. This surge comes at a critical juncture, just days before the Bitcoin halving, a key event that historically has been a catalyst for volatility and speculative interest.

The mempool has grown by 10.99% from 30 days ago. More striking is the explosion in high-priority transaction fees, which have skyrocketed by 1240.12% from a month ago. Such an increase suggests a rush of users willing to pay a premium to have their transactions processed swiftly, I call these fee-insensitive transactions as opposed to fee-sensitive transactions like inscriptions. These are people who are urgently getting their bitcoins to exchanges because they are expecting volatility.

Inscriptions, which can serve as a barometer for speculative interest in Bitcoin, have seen a 413.19% increase over the last 30 days. Although the levels haven't reached the extreme spikes of 400,000 inscriptions/day observed in the past, the current numbers still represent a significant uptick.

Amidst this heightened network activity, there are rumors of a potential spam attack, purportedly orchestrated by Roger Ver and associates, aiming to reignite the block size debate from 2017. If true, this could introduce an additional layer of complexity, particularly affecting inscriptions that are sensitive to transaction fees.

Such a scenario unfolds against the backdrop of the impending halving, an event that traditionally amplifies uncertainty and speculative trading. The convergence of these factors—a possible spam attack, the significant increase in network traffic, and the approaching halving—creates a fraught environment for Bitcoin, potentially impacting transaction costs and processing times.

Investor Insights

Strategic Fee Management: With transaction fees liable to spike at any moment, investors need to strategize their transaction timings and fee settings carefully. Prioritizing transactions and possibly waiting for traditionally slower transaction times like weekends could be prudent, especially for non-urgent transactions.

Monitoring Network Health and Sentiment: Given the potential for a spam attack and its implications, investors should closely monitor network congestion and community sentiment. An understanding of the underlying causes of the surge in network activity can provide crucial context for investment decisions, particularly in discerning whether the current trends are temporary anomalies or indicative of a deeper market shift as the halving approaches.

Chart(s) of the Day

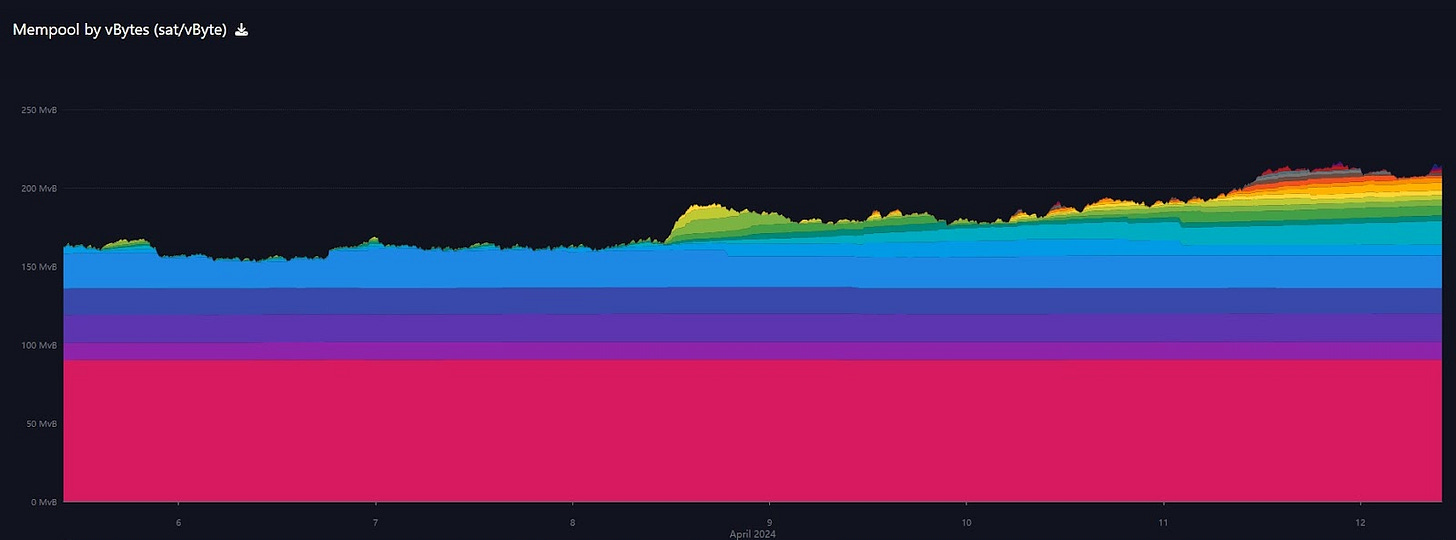

This morning the mempool was seeing significant action. Fees temporarily spiked over $20 (222 sats/vb). That condition didn’t last long, but a spiking fee and mempool is due to urgent fee insensitive transactions and can be interpreted as a leading indicator for volatility. Which why is that volatility likely to be is the question.

Source: mempool.space

If we take a look at the bitcoin futures liquidation heat map provided by Coinglass, this one is from Binance but all the exchanges are similar, there is a cluster of liquidation levels up to $74,500. That is where the liquidity is.

Source: Coinglass

A dip here is not going to face a cascade of liquidations, meaning it will tend to be more difficult for price to move down. The cascading liquidation risk is the upside. A rapid spike in price to $75,000 would cause billions of dollars in shorts to close by buying bitcoin. Whatever the price does over the next two weeks, signs of volatility ahead are flashing red.

If you find yourself overly concerned about near term volatility, it is a sign you are over-invested or trading in too large of size. Hodling bitcoin is a winning strategy with the lowest risk around halving events. Be careful out there. Happy trading.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

THE BIGGEST CELEBRATION IN BITCOIN

THE BITCOIN HALVING LIVESTREAM BEGINS AT BLOCK HEIGHT 839,979 ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!