Bitcoin Miners Weather Market Disturbances

Despite Bitcoin's Price Dip, Public Miners Show Strength and Adaptability, with Network Metrics Reflecting Stability and Growth

Introduction

As Bitcoin faces a notable price decline, the mining sector has demonstrated remarkable resilience and adaptability. This post explores how publicly traded Bitcoin miners have not only weathered the storm but have shown significant gains through strategic diversification and operational efficiency. We will also delve into the stability of general mining activity and the evolving trends in network traffic, highlighting the robust performance of the Bitcoin ecosystem amidst market turbulence.

Receive this content and more through bitcoinandmarkets.com!

Bitcoin Miners Outperform Amidst Market Turbulence

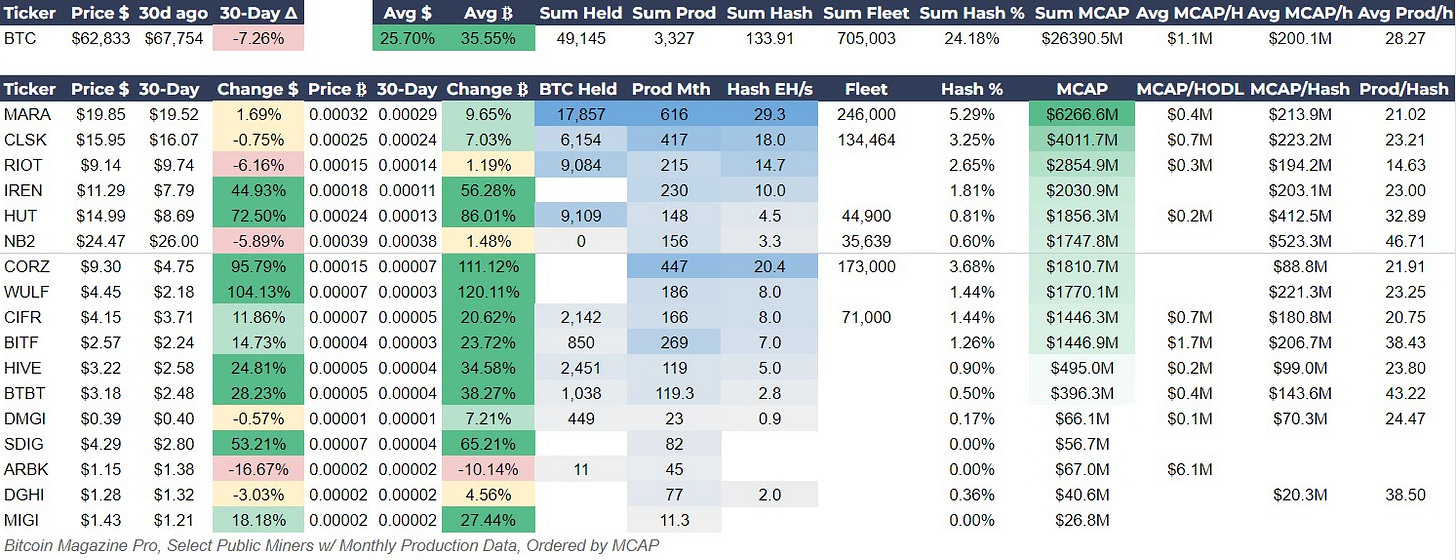

In the face of a Bitcoin price decline of 7.26% over the past 30 days, publicly traded Bitcoin miners have shown remarkable resilience, with an average stock performance of 25.70% in USD terms and 35.55% in BTC terms. This divergence underscores the adaptability and strategic diversification within the mining sector, which has enabled miners to mitigate the impact of market volatility and maintain robust operational performance.

Leading the pack, Core Scientific (CORZ), Terawulf (WULF) and Hut8 (HUT) have demonstrated significant gains of 95.79%, 104.13% and 72.5%, respectively, largely attributed to their innovative approach of hosting GPUs for AI computing. This strategic diversification not only provides an alternative revenue stream but also enhances their ability to scale operations and manage energy resources effectively. As the Bitcoin price stabilizes, these miners are well-positioned to capitalize on both AI and Bitcoin mining opportunities.

Investor Insight

Bitcoin Mining and AI: Currently, diversification of revenue into AI and Large Language Model (LLM) computing is paying large dividends for Bitcoin miners. However, there are some risks to be aware of. First, energy used for AI computing is subject to demand response repayment from energy providers like ERCOT. Second, the AI revolution is the center of extreme hype at the moment, and there will be a market cycle in this sector, too, which could harm the value of that LLM compute. Third, when bitcoin goes on a monster rally, diversified miners will underperform.

Reserves to Market Cap: The miners with the largest bitcoin reserves are starting to consolidate to the top of the list when sorted by Market Cap. Four of the top 5 miners by market cap are also the four largest bitcoin reserve holders.

General Mining Activity

Key metrics reveal that general mining activity has maintained stability, underpinned by strategic responses to market conditions. The 7-day moving average hash rate has seen a slight decline of 2.34%, settling at 553.77 EH/s, indicating a marginal reduction in network activity. Concurrently, the hash price has decreased by 7.33%, reflecting lower miner revenue per terahash.

Interestingly, mining revenue has demonstrated slight growth despite these challenges. Over the past 30 days, revenue in BTC terms has increased by 1.11% over 30-days to 14,523 BTC, while revenue in USD terms has risen by 1.08% to approximately $958 million. Both those numbers are very stable over the 30-day period. This growth can be attributed to transaction fees, with USD-denominated fee revenue increasing by 55.29% in 30 days but is slightly lower the 7-day period.

Additionally, the volume of Bitcoin transferred to exchanges has surged by 47.37% but slowed dramatically over the last 7 days. Despite this increased selling pressure, the miners' wallet balance has remained relatively stable, actually increasing WoW.

Overall, the data underscores the mining sector's resilience in navigating market downturns through strategic adaptation and efficient management. The slight decline in hash rate and hash price is offset by stable revenue, indicating the health of the industry despite recent troubles.

Investor Insight

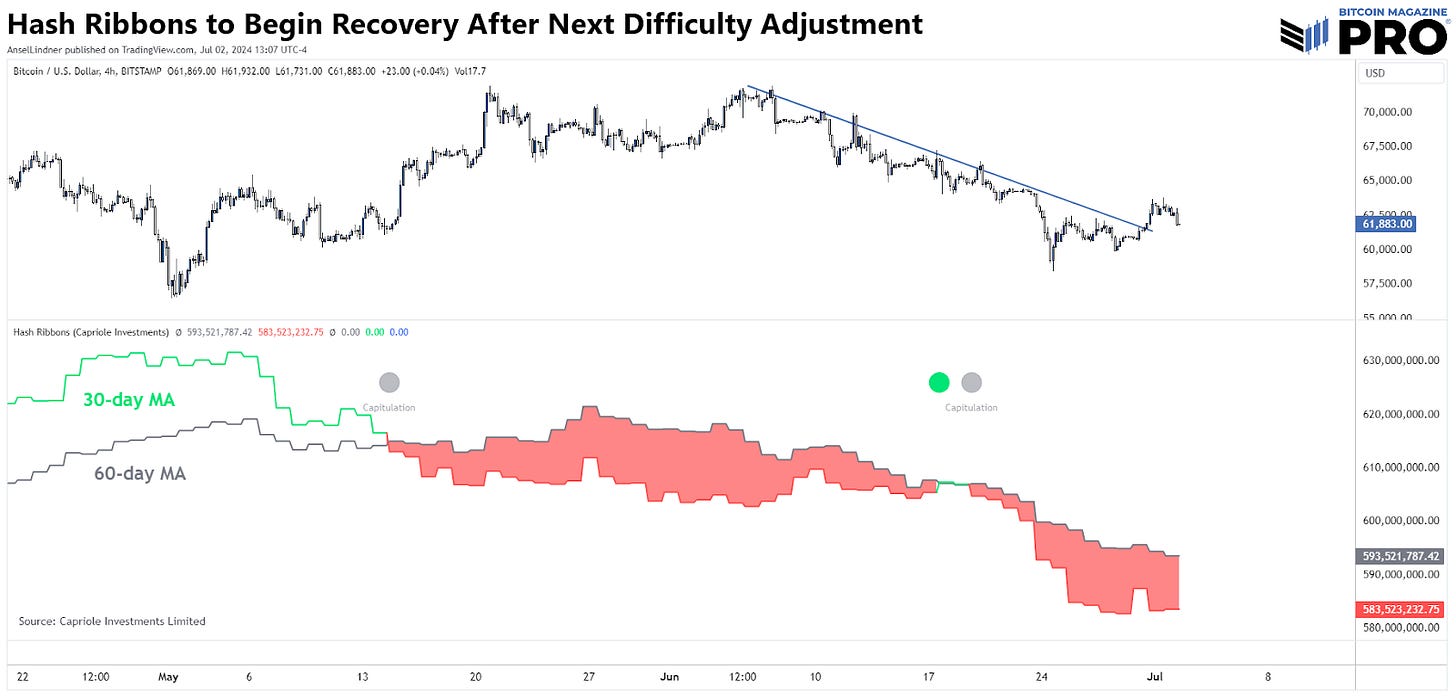

Hash Ribbons Will Give a Buy Signal: The Hash Ribbon indicator is a snapshot of the balance of forces on bitcoin mining. Capitulation occurs when the 30-day MA of hash rate drops below the 60-day MA. The green circle indicates “recovered,” or when the 30-day MA has recrossed the 60 DMA. The “Buy” signal comes when the 10-day MA of price crosses above the 20-day MA for price. This limits any false Buy signals.

Network Traffic and Transaction Types

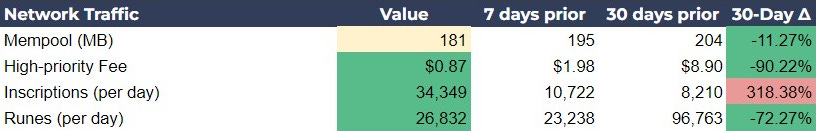

Network traffic numbers for this week are extremely calm. They are not showing signs of urgent transactions to exchanges to sell, or a particular decrease in a base-line stable network activity.

The mempool size has decreased by 11.27%, from 204 MB to 181 MB over 30 days, but that can be reversed in a single day with price volatility. One of the surprising trends is the dramatic increase in inscriptions, which have surged by 318.38%, from 8,210 to 34,349 per day. I thought it was a dead protocol because it is so inefficient with block space and fees, but with very low fees perhaps inscriptions are more affordable to mint. Runes held roughly the same numbers from last week, but are down significantly over 30 days. This is a big signal that speculative interest in bitcoin is at very low levels so far in this bull market.

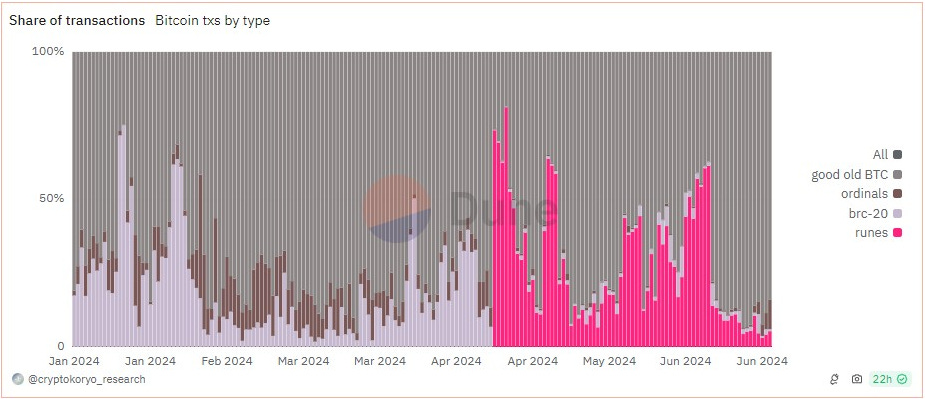

The below graph shows the share of bitcoin transactions by type. As you can see very recently on the right hand side, Runes have trended down or stable at a low lever, while ordinals have surprisingly reemerged. Of course, plain BTC transactions are the vast majority of transactions on a daily basis.

Source: cryptokoryo

Conclusion

In conclusion, despite a challenging period for Bitcoin prices and miner profitability, the broader ecosystem of Bitcoin mining and network activity has showcased significant resilience and adaptability. Public miners have leveraged strategic diversification and operational efficiency to maintain robust performance, while general mining activity remains stable with growing revenues. Additionally, network traffic metrics reveal a stable environment. These insights underscore the strength and potential of the Bitcoin mining sector and network, even in the face of market volatility.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!