Bitcoin Miners Navigate Post-Halving Turbulence

Bitcoin miners adapt to new network dynamics, and a look into the stabilization of mining activities and the evolving role of Layer 2 protocols.

Introduction

In the last 2 months, the Bitcoin ecosystem has experienced significant fluctuations in its fundamentals, while price has stayed relatively close to ATHs. Amidst these market shifts, Bitcoin miners have demonstrated remarkable resilience, outperforming bitcoin itself in several metrics despite facing the challenges posed by the halving event and subsequent market reactions.

This report delves into the performance of public Bitcoin miners, highlighting their adaptability in a rapidly changing economic environment and examining the stabilization of mining activities post-halving. Additionally, it explores recent trends in network traffic, focusing on the normalization of transaction fees and the impact of Layer 2 token protocols. Through detailed investor insights, we provide strategic perspectives on the implications of these developments for the price and the broader market.

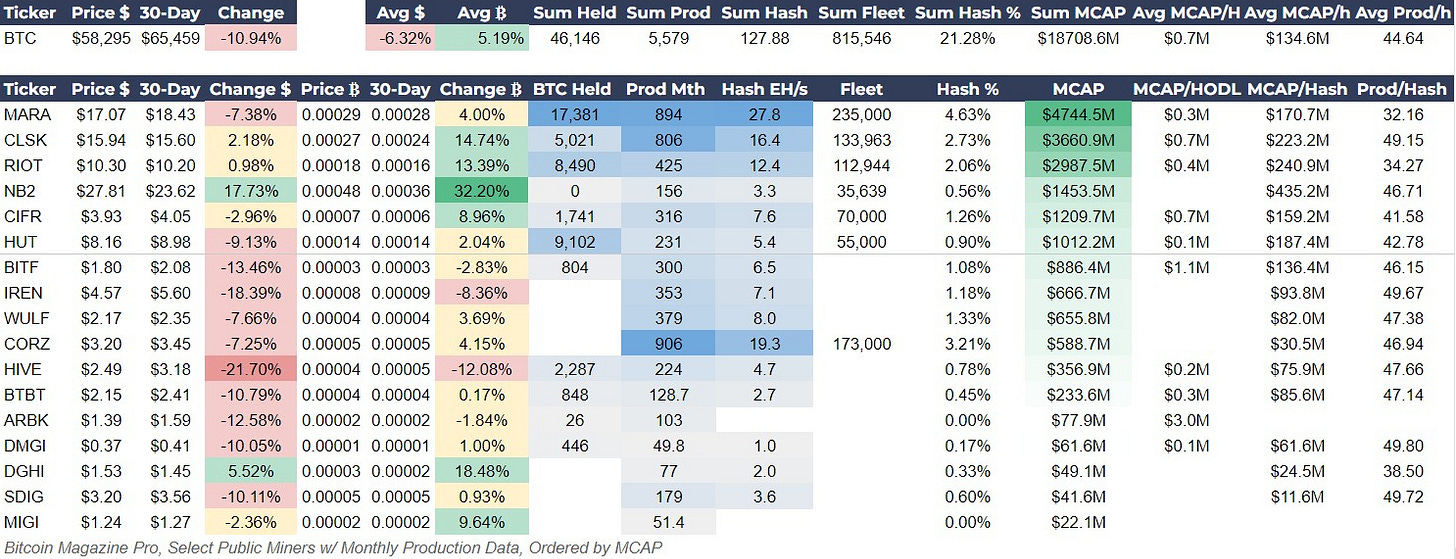

Public Bitcoin Miners' Performance and Resilience

In the past 50 days, Bitcoin went from a new ATH at $73,794 on March 14 to likely finding a bottom at $56,500 on May 1. A total of a 23% drop. Throughout this time, the market also experienced significant outflows from the spot ETFs and the uncertainty about miners around the halving. Despite this, miners weathered the storm fairly well with most outperforming bitcoin since the halving. On average, public miners tracked were down -6.3% in dollar terms, but up 5.1% in BTC terms.

Best and Worst Performers

Best: Northern Data (NB2) led the group with a significant 17.73% increase in USD terms, and a 32.20% increase in Bitcoin terms. They are a surprising standout because they do not hold any bitcoin, at least not publicly on their financial statements.

Worst: HIVE experienced the most considerable decline, down -21.7% and -12.1% in bitcoin terms, despite holding over 2000 bitcoins on their balance sheet. They have recently become more involved in providing compute for AI by moving their old Ethereum miners to that new revenue stream.

Investor Insights

Balance Sheet Bitcoin and Stock Price: While we have not yet seen the largest miners by bitcoin on their balance sheets start to outperform, we expect that to be the case in coming months, as the halving effect really settles in and the bitcoin price recovers to make new highs.

Miner Stocks During Spot Pull Back: During this most recent weakness in the spot price of bitcoin, the miners have held up quite well as seen on the chart above. This could be for many reasons, the main one in my eyes is the ability to hedge downside risk through futures and options. They can ensure their income is much less volatile than the spot price.

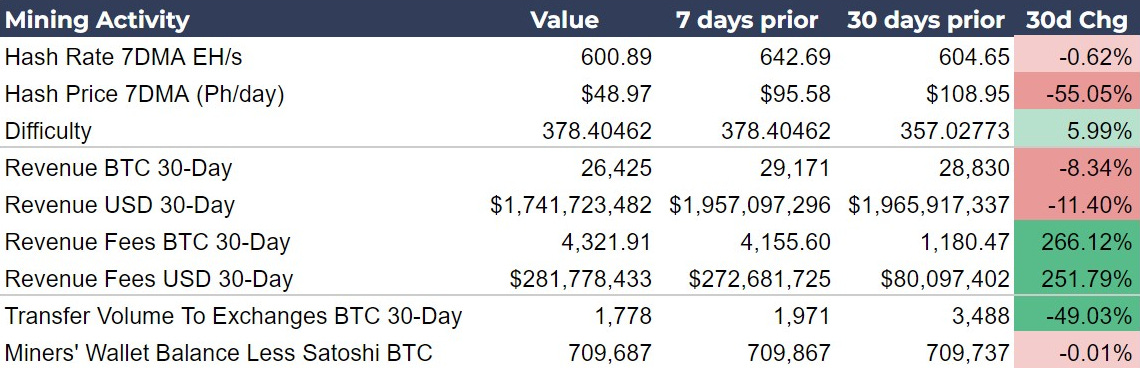

Mining Activity Stabilizes Post-Halving

In the immediate aftermath of the halving, there was a noticeable spike in hash rate, followed four days later by an increase in mining difficulty. This surge in hash rate was primarily driven by the substantial fees generated by Layer 2 token protocols, making it profitable for miners to operate every available machine.

Source: Mempool.space

However, this spike in fees was short-lived. With fees returning to normal levels, miners’ revenues are now feeling the full brunt of the halving's impact. As evident, the hash price has plummeted from $108 to $49. This significant drop has forced miners to reassess their hash rate, leading to the deactivation of less efficient mining rigs. Typically, the least efficient miners are sidelined when the hash price falls below their break-even point.

The forthcoming difficulty adjustment, currently projected to be around -3% in five days, may alter the mining landscape once again. This adjustment could potentially make previously marginal equipment profitable once more.

Investor Insights

Halving Priced-In: When considering the perennial debate of whether or not the halving can be priced in, it is important to consider hash price and miners’ revenue. Once the hash price recovers to roughly $100, can we say the industry is back toward an equilibrium. That can happen by two different routes: 1) Hash from less efficient equipment gets turned off and the difficulty drops. 2) The value of the block reward (3.125 BTC) has to go higher.

Performance in Chaos: With this being an unusually chaotic time for miners, investors can get exceptional insight into the adaptability and health of miners by how they fare over the first couple of months in the new block reward era.

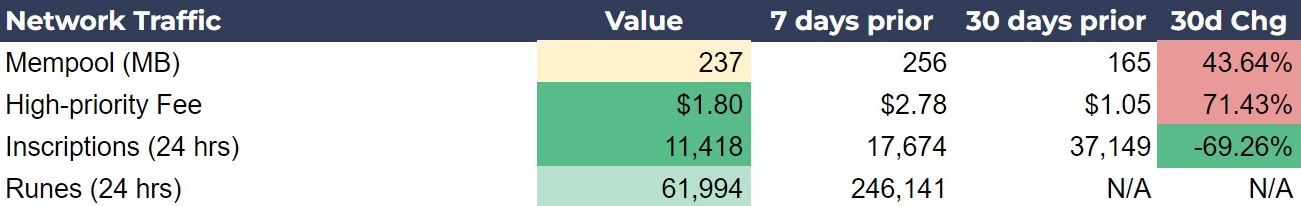

Bitcoin’s Network Traffic and Fee Dynamics

Recently, network fees have normalized much faster than anticipated, a change so rapid that it doesn't even appear in our 7 or 30-day prior fee data. However, the spike in fees that did occur is reflected in the increased Revenue from Fees mentioned earlier.

The surge in Runes-related traffic was transient, as expected. I've updated our tracker to now include both Runes transactions and inscriptions, enabling us to monitor their popularity and adoption more effectively. Despite the normalization of fees, there has not been a noticeable uptick in the number of inscriptions. It seems that most inscribers have transitioned to using the new, more efficient Runes minting function.

Investor Insights

Return to a Normal Fee Regime: Fee spikes generally coincide with price volatility. The recent spike in fees post-halving was unusual as it wasn't accompanied by the typical price volatility, due primarily to the unique surge in Runes transactions. With the subsidence of Runes traffic, we anticipate a resumption of the typical correlation between fees and volatility, which could provide insights into market movements and trader sentiment.

Layer 2 Tokens and Fee Dynamics: Experimentation with Bitcoin, such as through Layer 2 tokens, incurs significant costs due to limited block space and a dynamic fee market. This dynamic provides significant incentive for innovation. Investors should view these spikes as both an indicator of potential price volatility and of the level of experimentation within the Bitcoin network.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!